KohlsAnnualReportAnalysis - Julianne Kueffer Photography

advertisement

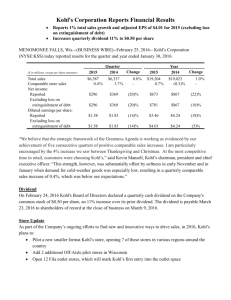

Kohl’s Annual Report What Kohl’s Does Well Kohl’s is one of the leading retailers in the country. It operates 1,022 department stores in 49 states with 39 stores expected to open this Fall. Customers can shop for merchandise online at kohls.com. It offers brands that are private to Kohl’s and has also formed several partnerships with exclusive brands that are recognized nationwide. Its retail consists of a large selection of apparel for men, women, and children in classic to contemporary styles at a scaled range of prices. It also offers footwear, accessories and items for the home. Fortune Magazine recently ranked Kohl’s as one of the top ten for “Best Breakaway Brands.” Prior to the national economic decline, sales were on a steady rise, increasing from $10.3 billion in 2003 to $16.5 billion in 2007. Overall, sales have increased 60 percent from 2003 to 2008. Kohl’s sales declined only .5 percent from fiscal year 2007 to 2008 with an operating income of $1.5 billion, which was up from $9.5million in 2003. From 2004 to 2008, the company’s stock price increased from $2.06 to $2.89 and its ecommerce revenue from $241million in 2007 to $356 million in 2008. Value Proposition Kohl’s mission statement is “To be the leading family-focused, value-oriented specialty department store offering exclusive and national brand merchandise to the customer in an environment that is convenient, friendly, and exciting.” In 2005, the company’s approach to merchandising was redeveloped into a ninebox merchandising grid that defines brands according to consumer lifestyles and price tiers. Kohl’s prides itself in consumer awareness and recognition and conducts extensive research to determine strengths in categories such as price, quality and style of prospective brands as recognized by the consumer. Kohl’s has partnered with internationally recognized brands like Vera Wang, Ralph Lauren, Quicksilver, and Liz Claiborne. Kohl’s Marketing and Distribution Strategies Kohl’s main focus is marketing moderately priced merchandise to consumers. Kohl’s purchases its merchandise from domestic and foreign suppliers. It sells family apparel, jewelry, shoes, accessories and home items. The company distributes its products through its stores and its Internet channel. The company’s annual earnings and cash flows depend largely on how business performs during the last quarter – the holiday season – of each fiscal year. This is a major factor the company takes into consideration when developing marketing strategies. The company employs 121,000 associates, crediting them for their loyalty and dedication to the company. Target Market Kohl’s target market is middle-class Americans. Risk Factors Kohl’s is in a highly competitive market. Its competitors include other department stores, discounters, home stores, specialty retailers, and wholesale clubs. Plans for the Future Kohl’s expects third and fourth quarter sales to range between negative 1 percent and positive one percent, a margin more narrow than its competitors – between negative 5 and 3 percent. Kohl’s plans to open approximately 37 new stores for a total of 56 stores within the fiscal year 2009. By the end of this month, Kohl’s will have remodeled 51 stores, compared with 36 stores last year. Kohl’s Corporation (NYSE:KSS) is in the discount and department store retail industry with corporations based in Wisconsin (Kohl’s Corporation) and Delaware (Kohl’s Department Stores, Inc.). Competitors include but are not limited to: JC Penney, Macy’s, The Gap, Target and Sears. On January 30, 2010, Larry Montgomery, chairman on the board of directors and employee of 21 years, will retire. (lexisnexis.com, SEC Filing from August 28, 2009) (Kohl’s Web site, Investor Relations) Kohl’s Annual Report: Form 8-K The Dictionary of Finance and Investment Terms explains what an analyst does and why he or she is worthy of our attention: “FORM 8-K Securities and Exchange Commission required form that a publicly held company must file, reporting on any material event that might affect its financial situation or the value of its shares, ranging from merger activity to amendment of the corporate charter or bylaws. The SEC considers as material all matters about which an average, prudent investor ought reasonably to be informed before deciding whether to buy, sell or hold a registered security. Form 8-K must be filed within a month of the occurrence of the material event. Timely disclosure rules may require a corporation to issue a press release immediately concerning an event subsequently reported on Form 8-K.” Kohl’s filed an 8-K on September 3, 2009 to report its sales from a four-week period— the month of August. Kohl’s issued a press release on September 3, 2009 through Business Wire. A moderate investor with experience in mutual funds, stocks and bonds, “duanej” posted a blog response to someone looking for buying ideas at Morningstar.com on April 11, 2009. Duanej said that Kohl’s looked like a pretty inexpensive buy. Blogs are an open platform, giving anyone an opportunity to post their opinions and receive direct feedback. Cramer used a graph created by Dan Fitzpatrick from Realmoney.com to support his outlook for the retail market. Cramer provided reasons that defend his and Fitzpatrick’s point of view. Cramer gave reasons for consumer spending market to continue to rise. Kohl’s Back-to-School Season Cramer gave word to the masses that he foresees an increase in retail industry sales. Back-to-school season is usually a most profitable time for the retail industry except that the shaky economy is causing consumer spending to be extremely irregular. Kohl’s and other department stores cut fall spending by 30 percent. (Cathy Horne, The New York Times, Sept 11, 2009) However, Kohl’s profits managed to stay up last month for back-to-school, along with big chains such as Target and Wal-Mart. Kohl’s shares rose .2 percent. Cindy Perman, writer at CNBC.com, covering the stock market, retail sector, and other business news said that Kohl’s shares rose with the help of its cheaply priced, trendy merchandise. Rosalind Wells, chief economist of the National Retail Federation, said that many retailers postponed their back-to-school spending because they were waiting for the state sales tax holiday or hoping to receive additional discounts. Cramer said that he has a positive outlook for retail chains. Kohl’s Management Strategies The corporation promoted someone from within, Kevin Mansell, to become the next CEO. Mansell had been the company’s president since 1999. Boston University management professor, Fred Foulkes credited Kohl's for promoting from within. Foulkes said that it reduces risk and sends the right message to employees moving up the ranks. The current CEO, Larry Montgomery, will step down and fill the company’s HR position. Many retail companies are pulling business execs in to fill HR positions, but Kohl’s is recognized for fulfilling the position from within the company. (Workforce Management 87: Ed Frauenheim, “From CEO to HR Minder”) Analysts recognize Kohl’s for its management team, investments in technology and its marketing strategies. (May 15, 2009, Stephanie Rosenbloom: The New York Times) Risk Factors An article called “Analyst Picks and Pans” said, “Kohl's earned $137 million, or 45 cents per share, in the period ended May 2, down from $153 million, or 49 cents per share, a year earlier. Analysts surveyed by Thomson Reuters expected profit of 43 cents per share. Sales edged up 0.4% to $3.64 billion. Same-store sales slipped 4.2%.” “For the full year, Kohl's raised its EPS forecast to a range of $2.19 to $2.42, up from $2 to $2.30. Analysts are predicting net income of $2.52.” “Kohl's also said it expects to earn 56 cents to 64 cents per share in the second quarter. Analysts expect profit of 61 cents per share. The company expects same-store sales to fall 5% to 8% in the second quarter.” “Kohl's guidance was ‘conservative’," according to analyst Liz Dunn with Thomas Weisel Partners. Dunn wrote to clients that the company's inventory is still declining. It’s down about 0.5 percent in the quarter, and that "continues to result in improved merchandise margins." (BusinessWeek: “Analyst Picks and Pans” May 14, 2009) Kohl’s Annual Report: What does the media say? Strategic Talent Management Kohl’s is one of the leading retailers in the country. Even during an economic recession, the company’s annual sales are holding steady. The corporation is recognized for strategically utilizing their talent from within in order to maintain a successful operation. Kohl’s believes that management strategy is key to the company’s success. The corporation has promoted someone from within, Kevin Mansell, to become the next CEO. Mansell has been the company’s president since 1999. Boston University management professor, Fred Foulkes also credits Kohl's for promoting from within. Foulkes believes that it reduces risk and sends the right message to employees moving up the ranks. The current CEO, Larry Montgomery, will step down and fill the company’s HR position. Many retail companies are pulling business execs in to fill HR positions, but Kohl’s is recognized for fulfilling the position from within the company. Montgomery will manage human resources, legal and real estate departments. Kohl’s had nothing bad to say about their current CEO– Montgomery. They are playing a game of chess, putting their most talented players in positions where they have the most potential. For the 2008 fiscal year, the CEO salary was $2.8 million; the HR director’s salary was $2.3 million. (Workforce Management 87: Ed Frauenheim, “From CEO to HR Minder”) Kohl’s Continues to Acquire New Designers Kohl’s operates 1,022 department stores in 49 states, and customers can shop for merchandise online at kohls.com. The sluggish economy has slowed down consumer spending especially in the apparel industry, and now high-end fashion designers are looking to partner with mass-marketing retailers such as Kohl’s. Kohl’s is one of many mass retailers. Other companies who are partnering with high-end designers include Wal-mart, Old Navy, JCPenney, The Gap, and Target. However, Kohl’s retail selection has always consisted of partnerships with exclusive brands that are recognized nationwide along with brands that are private to Kohl’s. Kohl’s most recent hook-up was with designer Dana Buchman. (Crain’s New York Business 24: Catherine Curan, “Increased designer-retailer hookups defy results”) Kohl’s is forming a partnership with Lauren Conrad, who is a 23-year-old star of MTV’s reality TV series “The Hills”. Beginning in October, the brand will be exclusive to Kohl’s, called LC Lauren Conrad. The line will be California-inspired clothing for women. (April 22, 2009: Stephanie Rosenbloom, The New York Times) Kohl’s Marketing and Distribution Strategies The company’s annual earnings and cash flows depend largely on how business performs during the last quarter – the holiday season – of each fiscal year. This is a major factor the company takes into consideration when developing marketing strategies. Kohl’s took on the 2008 holiday season with full marketing force. While many companies’ spending decreased, Kohl’s pushed a plan that was marked by more spending. The previous year’s holiday marketing plan clocked in at $158 million. Chief marketing officer, Julie Gardner, explained that the messages would be sent in all forms such as direct mail, email, radio and TV. The advertising was to be focused on weekends because families are tending to combine all of their errands into one trip on weekends in order to save gas money. The company created advertisements with Cirque de Soleil in order to provide consumers with “feel good messaging.” The advertisements will support their devotion to value and that the Kohl’s customers can continue to count on exclusive brands. (Advertising Age: Natalie Zmuda, “Kohl’s bulks up as rivals trim; Retailer to blast value message across platforms to lure budget-conscious”) Risk Factors Kohl’s is in a highly competitive market. However, its competitors are trailing behind in success during this economy with the exception of Wal-Mart. Both Kohl’s and Wal-Mart were recognized for their performance in the current economy. Analysts recognize Kohl’s for its management team, investments in technology and its marketing strategies. The new Dana Buchman line accounted for 44 percent of its sales. While Kohl’s earnings results exceeded analysts’ expectations, investors still wince as its shares fall 1.69 percent, to $41.24. (May 15, 2009, Stephanie Rosenbloom: The New York Times) Plans for the Future Kohl’s seems to be more prepared and accommodating for consumers in a struggling economy. While most retailers have to cut spending, Kohl’s chooses to continue buying and remodeling as the other chains close. The Mervyn’s chain went bankrupt, and Kohl’s has remodeled many of them. Kohl’s is remodeling 40 percent more stores than last year. The company is expanding to new places across the country. The company also raises sales by being a go-to destination for gifts during holiday seasons. (May 15, 2009, Stephanie Rosenbloom: The New York Times) Kohl’s Annual Report: What do analysts say? Why Pay Attention to an Analyst? Jim Cramer, host of the TV show “Mad Money” and co-founder, director, chairman and shareholder of TheStreet.com, ranted last year, on his TV show, about the housing market. His predictions advised people not to buy homes. One year later, homes values were dropping 20-50 percent. If only you had cable TV… Anyone can make a prediction; however, analysts’ get more intimate. Their professional careers are devoted to forming analyses and opinions and giving you the financial forecast. The Dictionary of Finance and Investment Terms explains what an analyst does and why he or she is worthy of our attention: “ANALYST person in a brokerage house, bank trust department, or mutual fund group who studies a number of companies and makes buy or sell recommendations on the securities of particular companies and industry groups. Most analysts specialize in a particular industry, but some investigate any company that interests them, regardless of its line of business. Some analysts have considerable influence, and can therefore affect the price of a company’s stock when they issue a buy or sell recommendation.” There are different types of analysts: “CREDIT ANALYST person who (1) analyzes the record and financial affairs of an individual or a corporation to ascertain creditworthiness or (2) determines the credit ratings of corporate and municipal bonds by studying the financial condition and trends of the users.” A moderate investor with experience in mutual funds, stocks and bonds, “duanej” posted a blog response to someone looking for buying ideas at Morningstar.com on April 11, 2009. Duanej said that Kohl’s looked like a pretty inexpensive buy. Blogs are an open platform, giving anyone an opportunity to post their opinions and receive direct feedback. Cramer used a graph created by Dan Fitzpatrick from Realmoney.com to support his outlook for the retail market. Cramer provided reasons that defend his and Fitzpatrick’s point of view. Cramer gave reasons for consumer spending market to continue to rise. Kohl’s Back-to-School Season Cramer gave word to the masses that he foresees an increase in retail industry sales. Back-to-school season is usually a most profitable time for the retail industry except that the shaky economy is causing consumer spending to be extremely irregular. Kohl’s and other department stores cut fall spending by 30 percent. (Cathy Horne, The New York Times, Sept 11, 2009) However, Kohl’s profits managed to stay up last month for back-to-school, along with big chains such as Target and Wal-Mart. Kohl’s shares rose .2 percent. Cindy Perman, writer at CNBC.com, covering the stock market, retail sector, and other business news said that Kohl’s shares rose with the help of its cheaply priced, trendy merchandise. Rosalind Wells, chief economist of the National Retail Federation, said that many retailers postponed their back-to-school spending because they were waiting for the state sales tax holiday or hoping to receive additional discounts. Cramer said that he has a positive outlook for retail chains. Kohl’s Management Strategies The corporation promoted someone from within, Kevin Mansell, to become the next CEO. Mansell had been the company’s president since 1999. Boston University management professor, Fred Foulkes credited Kohl's for promoting from within. Foulkes said that it reduces risk and sends the right message to employees moving up the ranks. The current CEO, Larry Montgomery, will step down and fill the company’s HR position. Many retail companies are pulling business execs in to fill HR positions, but Kohl’s is recognized for fulfilling the position from within the company. (Workforce Management 87: Ed Frauenheim, “From CEO to HR Minder”) Analysts recognize Kohl’s for its management team, investments in technology and its marketing strategies. (May 15, 2009, Stephanie Rosenbloom: The New York Times) Risk Factors An article called “Analyst Picks and Pans” said, “Kohl's earned $137 million, or 45 cents per share, in the period ended May 2, down from $153 million, or 49 cents per share, a year earlier. Analysts surveyed by Thomson Reuters expected profit of 43 cents per share. Sales edged up 0.4% to $3.64 billion. Same-store sales slipped 4.2%.” “For the full year, Kohl's raised its EPS forecast to a range of $2.19 to $2.42, up from $2 to $2.30. Analysts are predicting net income of $2.52.” “Kohl's also said it expects to earn 56 cents to 64 cents per share in the second quarter. Analysts expect profit of 61 cents per share. The company expects same-store sales to fall 5% to 8% in the second quarter.” “Kohl's guidance was ‘conservative’," according to analyst Liz Dunn with Thomas Weisel Partners. Dunn wrote to clients that the company's inventory is still declining. It’s down about 0.5 percent in the quarter, and that "continues to result in improved merchandise margins." (BusinessWeek: “Analyst Picks and Pans” May 14, 2009) Kohl’s Annual Report: Social Media Social Media: Facebook Social media networks such as Facebook have become a way for companies to increase brand awareness. Kohl’s Web site has a link to its Facebook profile on the company’s home page. By clicking the blue link at the company’s site, a customer is taken directly to the Kohl’s Facebook profile where he or she can become a fan, joining more than 700,000 other people who are currently fans of Kohl’s. Fans are able to participate in conversation with other fans, feed their opinions on the main page of the profile, also known as “The Wall.” The company does not censor negative feedback, and right now the latest “buzz” or most frequent topics of conversation on the profile are complaints. The past 12 hours of commentary on Kohl’s Wall has been about the company’s decision to discontinue free shipping for MVC (Most Valuable Customer) cardholders for orders placed online. Customers claim that the free shipping set the company apart from its competitors such as Sears, JcPenney and Macy’s. Most of the posts announce that they will no longer be shopping at Kohl’s, pleading for the revival of free shipping for online orders. In one posting, the customer’s characterization of herself was the same as Kohl’s description of its target market at the Web site: Sharon Carlisle Kohl's have you no women in your organization? We would tell you along with any MBA that when you have a good thing going, "you do not change it". Free shipping for the devoted, everyday shopper, like me, was your calling card. Now YOU are just an ordinary store with no savvy. You had better check with your web experts, if you have any, what this will do to your online shopping profits when there is no free shipping!!! Ask any woman, we ARE the shoppers and we know the best place to shop. There is no substitute when shopping at Kohl's with free shipping!!! Bring it back, we can't wait any longer!!! Don't let Santa Kohl's be stuck in the chimney. The commentary is further interesting because Kohl’s has been confident for holiday sales revenue in the past, and so it will be interesting to see how the lack of free shipping will affect the company’s sales. Other information on Kohl’s Facebook page includes: -The “Info” tab that has the Web address and its mission statement. - The “Style&Savings” tab with links to specific brands at Kohl’s and also ways to save money at Kohl’s. -The “Video” tab with clips from events. -The “Green Scene” tab that goes into depth about the company’s sustainability initiatives. -The “Discussions” tab allows people to write a blog and receive comments or feedback. It also gives figures at the company an idea of the current buzz about the company’s social standing. Other Social Media Platforms Kohl’s has videos streaming on Youtube.com; however, individuals posted the videos, not Kohl’s. The company does not have a profile on Youtube. In 2008, Kohl’s was not utilizing a Twitter account; now, it is. Customers must become a member of Kohl’s on Twitter in order to see its daily statuses, which may be something like deals of the day. One blogger credited Kohl’s for it’s large following on Facebook but was disappointed with the lack of transparency. Apparently, the blogger and others discovered that the “customers” that were constantly making posts about he or she’s best buys at Kohl’s or favorite trends were not really customers. The marketing executive at Kohl’s, Ed Gawronski, and other company stakeholders were identified after continuously posting comments as if he or she were the customer. There are lots of blogs that people can find about Kohl’s, but in order to be heard exclusively by fans of Kohl’s, one must post a discussion on Facebook. Investor Relations The investor relations at Kohl’s have yet to embrace social media. However, blogs on sites such as retailsails.com openly analyze sales data, creating graphs and overviews. Sources: http://www.experiencetheblog.com/2009/06/transparency-or-lack-thereof-on-kohls.html http://www.facebook.com/kohls?v=wall&ref=share http://twitter.com/kohlsdotcom http://www.youtube.com/results?search_query=kohls&search_type=