Simultaneous equation systems in macroeconomic

advertisement

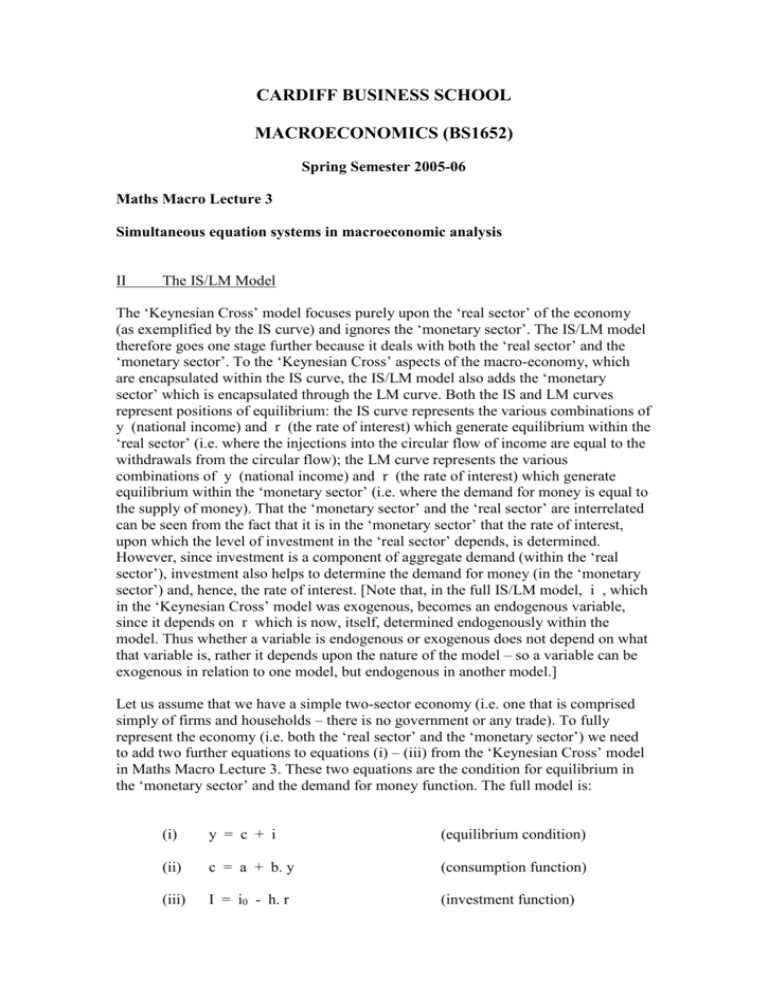

CARDIFF BUSINESS SCHOOL MACROECONOMICS (BS1652) Spring Semester 2005-06 Maths Macro Lecture 3 Simultaneous equation systems in macroeconomic analysis II The IS/LM Model The ‘Keynesian Cross’ model focuses purely upon the ‘real sector’ of the economy (as exemplified by the IS curve) and ignores the ‘monetary sector’. The IS/LM model therefore goes one stage further because it deals with both the ‘real sector’ and the ‘monetary sector’. To the ‘Keynesian Cross’ aspects of the macro-economy, which are encapsulated within the IS curve, the IS/LM model also adds the ‘monetary sector’ which is encapsulated through the LM curve. Both the IS and LM curves represent positions of equilibrium: the IS curve represents the various combinations of y (national income) and r (the rate of interest) which generate equilibrium within the ‘real sector’ (i.e. where the injections into the circular flow of income are equal to the withdrawals from the circular flow); the LM curve represents the various combinations of y (national income) and r (the rate of interest) which generate equilibrium within the ‘monetary sector’ (i.e. where the demand for money is equal to the supply of money). That the ‘monetary sector’ and the ‘real sector’ are interrelated can be seen from the fact that it is in the ‘monetary sector’ that the rate of interest, upon which the level of investment in the ‘real sector’ depends, is determined. However, since investment is a component of aggregate demand (within the ‘real sector’), investment also helps to determine the demand for money (in the ‘monetary sector’) and, hence, the rate of interest. [Note that, in the full IS/LM model, i , which in the ‘Keynesian Cross’ model was exogenous, becomes an endogenous variable, since it depends on r which is now, itself, determined endogenously within the model. Thus whether a variable is endogenous or exogenous does not depend on what that variable is, rather it depends upon the nature of the model – so a variable can be exogenous in relation to one model, but endogenous in another model.] Let us assume that we have a simple two-sector economy (i.e. one that is comprised simply of firms and households – there is no government or any trade). To fully represent the economy (i.e. both the ‘real sector’ and the ‘monetary sector’) we need to add two further equations to equations (i) – (iii) from the ‘Keynesian Cross’ model in Maths Macro Lecture 3. These two equations are the condition for equilibrium in the ‘monetary sector’ and the demand for money function. The full model is: (i) y = c + i (equilibrium condition) (ii) c = a + b. y (consumption function) (iii) I = i0 - h. r (investment function) (iv) Md / P0 = m0 + k. y - l. r (money demand function) (v) Md = M (equilibrium condition) where Md represents the demand for money, P0 is the fixed price level and M is the money supply. To form the LM curve it is necessary to substitute for Md from equation (v) into equation (iv) : M / P0 = m0 + k. y - l. r l. r = [ m0 - M / P0 ] + k. y r = [ ( m0 - M / P0 ) / l ] + ( k / l ). y (B) The relationship (B) between r and y is the LM curve. If we wish to find the solution to the IS/LM model, it is necessary to bring together the IS and the LM curves and solve them simultaneously. In diagrammatic terms we have: r LM r* IS y* y Numerical example Y = C + I (equilibrium condition in the ‘real sector’) C = 50 + 0.75 Y (consumption function) I = 2000 - 100 R (investment function) 2 MD = 70 + 0.5 Y - 200 R (money demand function) MD = MS (equilibrium condition in the ‘monetary sector) where Y is national income, C is consumption, I is investment, R is the rate of interest (measured as a percentage, i.e. R = 5 means the rate of interest is 5 per cent), MD is the demand for money and MS is the money supply. The exogenous variable in this model is: MS . The endogenous variables are: Y , C , I , and R . Since there are four endogenous variables and only one exogenous variable in the IS/LM model above, the reduced form of this model will comprise four equations, expressing each of the endogenous variables in terms of MS and the constant values from the various equations. To solve the model it is necessary to find the equations of the IS and LM curves, and then to solve them simultaneously. The IS curve [This is a relationship between R and Y which represents equilibrium in the ‘real sector’. It is found by substituting for C and I in the equilibrium condition for the ‘real sector’.] Y = 50 + 0.75 Y + 2000 - 100 R Y - 0.75 Y = 2050 - 100 R 0.25 Y = 2050 - 100 R Y = 8200 - 400 R (the IS curve) The LM Curve [This is a relationship between R and Y which represents equilibrium in the ‘monetary sector’. It is found by substituting for MD and MS in the equilibrium condition for the ‘real sector’.] 70 + 0.5 Y - 200 R = MS 0.5 Y = ( MS - 70 ) + 200 R Y = 2 ( MS - 70 ) + 400 R (the LM curve) 3 If MS is known, then the equilibrium values of R and Y can be determined. Let us assume that the money supply is 570. Therefore, our IS and LM curves become: IS: Y = 8200 - 400 R (1) LM: Y = 1000 + 400 R (2) If we add equations (1) and (2) then we get: 2. Y = 9200 Y = 4600 If we subtract equation (2) from equation (1), we get: 0 = 7200 - 800 R 800 R = 7200 R = 9 Hence the equilibrium level of national income is 4600 and the equilibrium rate of interest is 9 per cent. The equilibrium values of the other endogenous variables can be found by using these values in the original equations: C = 50 + 0.75 (4600) = 50 + 3450 = 3500 I = 2000 - 100 (9) = 2000 - 900 = 1100 ) ) ) ) Y = C + I MD = 70 + 0.5 (4600) - 200 (9) = 70 + 2300 - 1800 = 570 ( = MS ) 4