Corporations-Mini-Review

advertisement

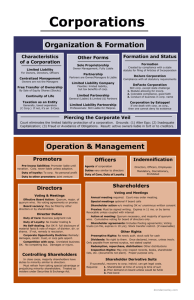

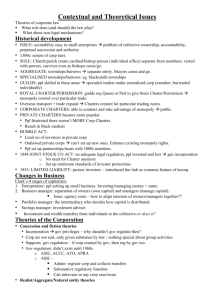

CORPORATIONS MINI REVIEW Page |1 FORMATION I. PROMOTER’S PRE-INCORPORATION CONTRACTS Promoter: Person action on behalf of a corporation NOT YET FORMED - FIDUCIARY of each other and the corp B/c fiduciary they owe a duty of loyalty and can NOT make a secret profit Liability: Corporation NOT liable until ACCEPT (express resolution OR implied through knowledge + accept benefits) Promoter LIABLE until NOVATION (agreement b/w promoter corp, and 3P that corp will replace promoter) Accept Only: If corp merely accepts the promoter is still liable along w/ corp Corp Never Formed: If corp is never formed, promoter will be liable b/c never novate II. WAYS TO FORM A CORPORATION: 1. De Jure Corporation: This is the normal way and only get to other 2 if this way fails Incorporator: natural person + 18 + merely signs/files articles w/ state Articles of Incorporation: Must include (A PAIN) Authorized Shares Max # that can be issued (can’t issue more w/o amending, can issue less) Purpose & Duration Must contain purpose and duration clause General Statement: permissible Specific Statement: If do an ultra vires act (act outside stated purpose) then state can enjoin + corp can sue own directors and officers for losses caused by the UV activity Agent Name + address of agent (official legal rep of corp) who can receive service of process Incorporator Name + address of each incorporator Name of corporation Must include word “corp” “co” “inc” or “limited” to show corporation BYLAWS NOT REQUIRED (shareholders can adopt UNLESS articles gave power to board) 2. De Facto Corp good faith, colorable attempt to comply w/ formalities + NO knowledge of lack of corporate status 3. Corp By Estoppel those who’ve dealt directly with business as a corp are estopped from denying corp status (works both directions = corp and 3rd party both can’t argue not a corporation) Effect of Formation: By De Jure, De Facto, or by Estoppel (all 3 treated the same) Separate Legal Entity: Corporation is a separate legal entity Limited Liability: See below III. LIMITED LIABILITY & PIERCING THE CORPORATE VEIL General Rule: As a rule shareholders are not personally liable for corporate obligations (only liable for price of stock) Exception: Courts will PIERCE THE CORPORATE VEIL to avoid FRAUD OR UNFAIRNESS (and allow creditors of corp to go after shareholders personally) 2 Reasons to Pierce: 1. Alter Ego A controlling shareholder fails to observe sufficient corporate formalities (commingling funds) 2. Undercapitalization Failure to maintain sufficient money (capital) to cover FORESEEABLE liabilities ISSUANCE OF STOCK: Corp Selling its OWN Shares I. SUBSCRIPTIONS: Written offer to buy stock from a corp NOT YET FORMED Revocation: Revocable until ACCEPTED (express board resolution OR implied through knowledge + accept benefits) II. CONSIDERATION – VERY IMPORTANT 3 Kinds of Stock: Par Value MINIMUM issuance price that corporation MUST receive (can NEVER receive less than par) No Par NO minimum issuance price Treasury Stock Stock that was previously issued and has been REACQUIRED by corp can be resold and is deemed just like NO PAR stock Acquiring Property w/ Par Value Stock: If corp buys property by issuing stock board must receive goods worth par (what board values property as worth) Consequences of Issuing for Less than Par: Director PERSONALLY liable for difference b/w sale price and par value Buyer Shareholder Liable to pay full consideration (at least par) for their shares III. PREEMPTIVE RIGHTS: Right of EXISTING shareholder to MAINTAIN THEIR % OWNERSHIP if issuing stock for cash Presumed: If articles are silent then presumed UNLESS articles explicitly take them away Must be for Cash: Does NOT apply if corp issuing stock to acquire goods/property b/c not issuing stocks for cash CORPORATIONS MINI REVIEW Page |2 DIRECTORS & OFFICERS I. BASICS Board: MO corps MUST have a BOARD with 1 or more members - If less than 3, number must be in articles Shareholder Interaction: Elect directors + May remove them with or without cause Meetings: Required A meeting is required UNLESS all directors consent in writing to act w/o a meeting Notice Notice is ALWAYS required Quorum & Voting: Quorum Must have a MAJORITY of ALL directors (quorum) to do business Voting To pass a resolution only need a MAJORITY vote of those PRESENT Proxies NOT allowed to vote for directors Voting Agreements NOT allowed II. LIABILITY OF DIRECTORS/OFFICERS TO SHAREHOLDERS: Duty to Manage + BJR + Fiduciary (care & loyalty) Duty to Manage: Directors have a duty to manage Business Judgment Rule: In managing the corp, the directors are protected from liability by the BJR. BJR A very strong presumption that directors manage in GOOD FAIHT and in corp’s BEST INTERESTS Fiduciaries: Directors, are FIDUCIARIES who owe the corp and SH duties of CARE and LOYALTY Care Director must act w/ the care that a PRUDENT PERSON would use w/ regard to own business Nonfeasance: Failure to act (don’t go to board meetings) ALWAYS liable Misfeasance: Making a mistake NEVER liable so long as innocent Loyalty Director may NOT receive an UNFAIR BENEFIT to the DETRIMENT of the corp or its SH Interested Director Transaction A deal b/w corp and one of its directors (or relative etc) – director can NOT get a financial benefit (can’t sell for more than FMV) Corporate Opportunity Usurping (taking away) an opportunity that corp could have had is breach of duty of loyalty (UNLESS disclose and get some form of independent ratification) III. INDEMNIFICATION Director Lost to Own Corp Corp can NEVER indemnify Director Won against ANY Party Corp MUST ALWAYS indemnify Permissive Indemnification Corp MAY indemnify IF show acted in GOOD FAITH + REASONABLE BELIEF that act was in corp’s best interest Who Determines Eligibility: Only need 1 of 4 - 1) Majority of independent directors approval 2) Committee of at least 2 independent directors approve 3) Majority of shares held by independent shareholders 4) Special legal council’s recommendation RIGHTS OF SHAREHOLDERS I. DERIVATIVE SUIT: Sue to enforce CORPORATIONS’S cause of action Requirements: contemporaneous stock ownership + demand on board rejected/futile II. VOTING: Who Votes: ONLY the RECORD SHAREHOLDER as of the RECORD DATE has the right to vote Record Shareholder = Person shown as the owner on the corporate records Record Date = Voter eligibility cut-off date set by board (no more than 70 days before meeting) Proxies: Shareholders CAN vote by proxies (note directors can not) Elements: written + signed by record SH + sent to sect of corp + authorizing another to vote + valid 11 mo Revocation: ARE revocable UNLSES labeled irrevocable + Coupled w/ an interest Meetings: 2 Kinds Annual Meeting: Every corp MUST have at least an annual meeting at which AT LEAST 1 DIRECTOR POSITION IS OPEN for election Special Meeting: Meeting of shareholders to vote upon a proposal OR a fundamental corporate change Notice: MUST give WRITTEN notice to EVERY SH ENTITLED TO VOTE for every meeting Contents date/place + special purpose for a special meeting (nothing can take place that is not in the notice) Failure if corp fails to give adequate notice any action taken at meeting is VOID UNLESS those not receiving notice WAIVE the notice defect (in writing or by attending) How do SH Vote: Quorum Must be a quorum represented at the meeting (majority of outstanding SHARES not shareholders) Vote If quorum present, action is approved if a majority of shares REPRESENTED AT THE MEETING approve CORPORATIONS MINI REVIEW Page |3 Pooled & Block Voting Methods: Voting Trust written trust agreement + filed with corp + controls how shares voted (legal title to vote to trustee) Voting Agreement written agreement that is binding on all who sign it (do NOT give up legal title to vote) Cumulative Voting: Multiply # of shares * # of open directors positions and top vote getter(s) gets position(s) Presumed UNLESS articles direct otherwise III. RIGHT TO EXAMINE THE BOOKS/RECORDS OF CORP: All SH have right to examine at proper times IV. DIVIDENDS Rule: Declared at BOARD’S DISCRETION – shareholders have NO RIGHT to dividends Priority of Distribution: Common Stock Get paid LAST and EQUALLY Preferred Stock Get paid FIRST and amt of preference Preferred that is Participating Get paid FIRST as preferred and AGAIN as if common shares Preferred that is Cumulative Have right to receive amt that wasn’t paid in prior yrs AND current yr payment Corp Lost $: Corporation CAN award dividends even though lost $ that year but NOT if insolvent or render insolvent Unlawful Dividends: Directors are PERSONALLY LIABLE for unlawful dividends Do have possible defense of good faith reliance on financial officer’s representations LIMITED LIABILITY COMPANIES (LLCs) I. REQUIREMENTS Filings: organizers file Articles of Organization (same as articles of incorp for corps just different name) AND Operating Agreement Liabilities: Members (LLC) = Shareholders (Corp) Managers (LLC) = Directors (Corp) Each have same rights and liabilities Must Have: LIMITED LIABILITY AND (2 of the following 3) Limited Life – art of org must specify some event of dissolution Limited Liquidity – Interest can NOT be transferred UNLESS there is unanimous consent of members Members Retain Management Power FUNDAMENTAL CORPORATE CHANGES I. II. KINDS: Merger, consolidation, dissolution, non-ministerial amendment of articles, SALE of substantially all assets (not purchase) STEPS 1. Resolution by board at VALID meeting recommending the change 2. Notice of special meeting (w/ special notice) 3. Approval By 2/3 of ALL SHARES entitled to vote AND By 2/3 of each CLASS of shares adversely affected by the change 4. Dissenter’s Rights can force corp to buy their shares at fair market value When: Merger, consolidation, SALE of substantially all assets What Have to Do: Before Vote = written objection + intent to demand pmt; During Vote = abstain/vote against AND After Vote = written demand w/in 20 days of vote 5. File Notice w/ the State (i.e. Articles of Merger) FEDERAL SECURITIES LAW I. II. III. ANTI-FRAUD (SEA 10b): Prohibits fraud w/ buying and selling securities Elements: Scienter (intent to deceive) + deception (material misrepresentation/misappropriation of material NON-PUBLIC information) + in connection w/ ACTUAL purchase/sale SHORT SWING TRADING PROFITS (SEA 16b) Who: Applies only to Big Corps and Big Shot D (officer, director, more than 10% shareholder) Prohibited: Can NEVER buy AND sell stock w/in a single 6 month period and make a profit Fraud is NOT required; No requirement of inside information SARBANES-OXLEY: No knowingly false filings + NO profits during false filing or blackout periods (period of 3 days when at least 50% employees can’t trade in retirement pension securities)