Incentive Chart - RBAP-MABS

advertisement

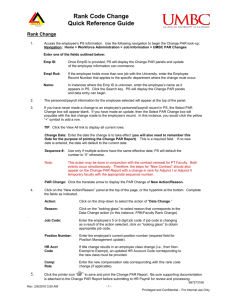

Name of bank 1. Santo Tomas*2 Type of Minimum Program MFU requirement MABSBranch Par affiliate (over 7 days) IS <= 5% Minimum AO requirements Who is entitled? Some Other bonuses Major revisions1 Portfolio: 500,000 pesos AO – 60 6-month; yearly pay raise; consist of AO training to upgrade skills Within the last year, increased IS quotas from P350,000 portfolio and 60 active clients. Overtime pay, sports fests, bonus withheld instead of lost, until PAR <= 1.5% From 2000-2002, used a MABS approach but after cases of AO fraud, management changed to bankwide scheme. PAR: <= 2% # of active clients: >= 80 # of loans disbursed each month: >= 25 2. One Network Bank wide program Branch must reach HO’s monthly quota and MFU PAR <= 1.5% Portfolio: 600,000 pesos PAR: <= 1.5% # of active clients: N/A # of loans disbursed each month: 10 1 2 MF Supervisor – 25% In-house staff – 15% 10% of net income for IS – distributed to all 46 branches – equal % of IS for all staff based on branch income Research was conducted in May of 2004. Therefore, many of these revisions have already been implemented or are planned for the next quarter or by the end of the year. * - uses break even analysis 3.Kabayan * 4. Macro * Profitsharing; Bank / branch wide program Branch must reach HO’s yearly targets Areawide program focusing on PAR and # of clients Area (2 branches) must have PAR <= 5% Portfolio: N/A PAR: < 3% # of active clients: about 120 clients by 1st year # of loans disbursed each month: N/A Portfolio: N/A PAR: <= 5% # of active clients: > 50 # of loans disbursed each month: N/A 5-7% of net income used for profit-sharing amongst all staff if yearly targets for each unit of the bank are met. Seasonal outings; 3-4 months of bonus salary a year; life insurance; hosp- ital insurance No majors have been made or have been planned. Mngment: 20% Field staff: 80% (75% to AOs; 25% to sprvsr). 70% based on PAR; 30% on # of active clients. Quarterly bonus, motorcycle provided by management, client apprecia-tion fiestas. Management is planning to change to fully AO independent IS, so AO performance is not tied to MFU Name of bank Type of Minimum Program MFU requirement Minimum AO requirements Who is entitled? Other bonuses Major revisions3 5. Green*4 MABSaffiliate IS Portfolio: 1 million pesos AO: 50% Supervisor: 15% Head Offc: 5% In-house Staff: 30% 5% Head office IS used for end-of-theyear awards IS Plans – extend portfolio to 2.5 million; Reward qualifying AOs 50% of IS if branch does not reach requirements AO: 60% Supervisor: 15% Product Head: 5% Loan Section Head: 3% Branch Share: 17% Branch share is used for merienda for all staff the entire month IS Plans – extend portfolio to 2 million; lower AO and branch PAR 1 day + to 3%; increase portfolio to 600,000 (AO far from branch) and 700,000 (AO close to branch) 6 Cantilan* MABSaffiliate IS Weekly branch PAR: <=5%; Monthly branch PAR: <=3% Monthly MFU PAR for 7 days + <= 5% PAR: <= 3% for 7 days + # of active clients: >= 100 # of loans disbursed each month: >= 25 Portfolio: 400,000 pesos PAR: < 5% # of active clients: 80 # of loans disbursed each month: 20 3 4 Research was conducted in May of 2004. Therefore, many of these revisions have already been implemented or are planned for the next quarter or by the end of the year. * - uses break even analysis 7. Talisayan 8. Coop MABSaffiliate MABSaffiliate No minimum MFU requirements. AO’s performance not tied to branch No minimum MFU requirements. AO’s performance not tied to branch Portfolio: 400,000 pesos PAR: <= 5% # of active clients: 60 # of loans disbursed each month: 25 Portfolio: 400,000 pesos PAR: <= 5% # of active clients: 60 # of loans disbursed each month: 20 AO: 100% Supervisor: 25% Head ofc: 20% In-house staff: 40% Brach Mngr: 15% CAP health; In-house staff divide IS at the end of the year. IS plans: increase portfolio to 1 million; increase # of accounts to 150; lower PAR minimum to 2% AO: 100% Supervisor: 15% Branch Mngr: 20% CAP health; monthly outings and weekly sports fests. No changes to individual program; but group-lending minimum active clients was 100, and now is 125.