Homework 2

advertisement

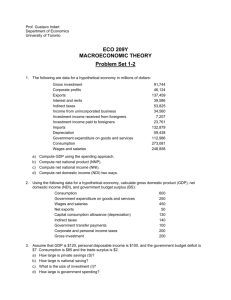

Homework 1 Economics 503 Foundations of Economic Analysis Assigned: Week 1 Due: Week 2 1. You are analyzing the profitability of Hong Kong’s movie industry. You hear that Steven Chao’s Kung Fu Hustle is the top grossing Hong Kong film of all time. You are given a list of local gross box office receipts for a number of Hong Kong movies. N_t in 2004 Prices HK$64,631,007.9 HK$63,993,333.3 HK$63,082,866.1 HK$62,851,511.6 HK$62,109,785.7 HK$61,473,432.2 HK$60,830,000.0 HK$57,580,734.7 HK$57,256,963.5 HK$55,030,000.0 HK$54,604,557.4 HK$47,486,678.6 HK$45,927,507.6 HK$44,805,297.4 HK$40,779,439.4 HK$36,685,334.5 HK$36,056,853.5 Order in Current Dollars Order in Constant Dollars 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 12 7 15 8 6 11 1 2 4 5 3 16 9 13 10 14 17 (Source: www.Asianboxoffice.com) Adjust these for inflation using the Hong Kong CPI. Convert all of these film grosses into 2004 dollars using 2004 as the reference year and rank the films by their grosses in 2004 dollars. 12. All for the Winner 7. Justice My Foot 15. God of Gambers II 8. All's Well, End's Well 6. God of Gamblers Return 11. Fight Back to School 1. Kung Fu Hustle 2. Shaolin Soccer 4. Rumble In The Bronx 5. Infernal Affairs 3. First Strike 16. Flirting Scholar 9. Thunderbolt 13. Drunken Master II 10. Mr. Nice Guy 14. God of Cookery 17. All's Well, End's Well 1997 2. You are given some statistical accounts for the country of Fruitopia which produces two goods, Apples and Oranges. The accounts contain information on the price of apples and the price of oranges for the years 1995 to 2005. You are asked to calculate a CPI, nominal GDP, real GDP and the GDP deflator using 1995 as the base year. Note that there is no investment, government spending, exports or imports in Fruitopia so GDP is equal to consumption. 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 Apples price quantity $1.00 100 $1.10 105 $1.21 110 $1.33 115 $1.46 120 $1.61 125 $1.77 125 $1.95 130 $2.14 135 $2.36 140 $2.59 145 Oranges price quantity $2.00 100 $2.40 105 $2.88 100 $3.46 100 $4.15 100 $4.98 95 $5.97 90 $7.17 90 $8.60 85 $10.32 80 $12.38 75 a. Calculate the CPI. The representative market basket for the Fruitopian consumer is 100 apples and 100 oranges. Calculate the cost of this market basket in 1995. The CPI in subsequent years is the price of this same market basket (100 apples and 100 oranges) relative to price of that basket in the base year (multiplied by 100). b. Calculate the nominal GDP which is the sum of the market value of apples (price × quantity) plus the market value of oranges in each period. c. Calculate real GDP which is the sum of the market value of apples calculated using the 1995 price (1 × quantity of apples) plus the value oranges calculated using the 1995 price (2 × quantity of oranges). d. Calculate the GDP deflator as the ratio of the nominal GDP to the real GDP. e. Calculate the average inflation rate using both price measures. Which price index increases the most over time? Explain. Notice that the market basket has switched toward apples whose price has not risen sharply over time. CPI 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 100 116.6667 136.3333 159.5667 187.0433 219.5717 258.1176 303.836 358.1074 422.5836 499.2405 CPI Inflation 16.67% 16.86% 17.04% 17.22% 17.39% 17.56% 17.71% 17.86% 18.00% 18.14% Nominal Real GDP GDP Deflator GDP GDP Deflator Inflation $300.00 300 100.00 $367.50 315 116.67 16.67% $421.10 310 135.84 16.43% $498.67 315 158.31 16.54% $590.41 320 184.50 16.55% $674.09 315 214.00 15.99% $758.92 305 248.83 16.28% $898.31 310 289.78 16.46% $1,020.35 305 334.54 15.45% Avge $1,155.68 300 385.23 15.15% Avge 17.44% $1,304.85 295 442.32 14.82% 16.03% The apple price rises much more slowly than the orange price. As a result, the consumption basket switches to apples and away from oranges. The GDP deflator measures the cost of the current market basket. The CPI inflation which is measured as if the market basket were fixed at 1995 levels contains more high inflation oranges in it and thus displays higher inflation. 3. It is 2005. You are in charge of deciding compensation for regional managers of an American multi-national firm. In the United States, managers receive a pay package worth US$150,000. Calculate the amount that you would have to pay these managers in local currency that would allow them to have a purchasing power equivalent to what managers get in the United States. Indonesia Japan Korea Malaysia Singapore Thailand US Salary $150,000 $150,000 $150,000 $150,000 $150,000 $150,000 PPP Equivalent Local Currency Salary 590,139,000 19,432,500 118,338,000 259,500 162,000 2,389,500 Cost in US Dollars PPP S 60,809.36 3934.26 9704.74 176,306.48 129.55 110.22 115,550.91 788.92 1024.12 68,469.66 1.73 3.79 97,590.36 1.08 1.66 59,410.74 15.93 40.22 a. Use 2005 PPP conversion factors that can be downloaded from the World Bank, which are available here or as hard copy in class: http://home.ust.hk/~davcook/icp-summary.pdf Use 2005 Purchasing Power Parities to calculate how much providing would cost the parent company in the currency of the relevant country. Convert your answers to US dollars using the exchange rates available at the World Bank site. To derive the convert from US $ to Ref country currency using PPP method use the PPP REF formula US Salary where PPPUS = 1 by definition. Therefore, to get the PPPUS amount of local currency necessary to buy the same living standard that $150K would buy in US just multiply by PPPREF. To calculate how many US dollars this would cost the S US parent company, just use the formula Local Currency Salary REF where again by S US definition S = 1.