The Price of Oil: Is History Repeating Itself?

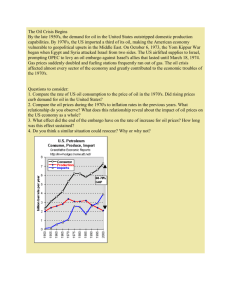

advertisement

The Price of Oil: Is History Repeating Itself? The price of oil has broken through $55 and continues to hit new highs. In fact, oil prices have increased over 70% this year for three main reasons: there have been few new discoveries of oil in recent years; there is greater demand for oil, especially from China, who is now the world’s largest importer of oil following the United States; and there is uncertainty over oil supplies because of war and terrorism. In the past 30 years, higher oil prices were followed by recessions in 1973, 1981, 1990 and 2000. Higher oil prices have historically led to recessions because they act as a tax on spending by absorbing consumer dollars that would be spent elsewhere, by reducing corporate profits through increased costs and lower demand, and by causing higher inflation which in turn causes higher interest rates. Higher oil prices cause a supply shock that reduces GDP while simultaneously raising inflation. This is what happened in the 1970s when the world was hit by stagflation, and when accommodative policies by central banks pushed inflation and interest rates even higher. The oil shocks of the 1970s and 1980s had a devastating impact on investors. 10year US Bond yields rose from around 6% to 15% imposing losses on fixed-income investors. Stock market investors also lost money. For example, the Dow Jones Industrial Average lost nearly 75% of its value, after adjusting for inflation, between 1966 and 1982, its worse decline since the Great Depression. Depositors suffered because interest rate controls prevented them from getting adequate returns on their deposits. During the 1970s, there was no place to hide. Whether investors had their money invested in stocks or bonds, they lost money. Should investors today have the same concerns? Why 2004 Is Different From 1973 and 1981 The impact of higher oil prices on the economy and on investors is more complex that it would first appear. That is why taking a full global and historical perspective on the price of oil is important. By looking at historic oil prices, stock prices, interest rates, inflation rates and other financial and economic data in the Global Financial Database, we can provide some analysis to help investors. Increases in oil prices impact some economic sectors more than others. Investors need to change their sector allocations in response to higher oil prices. Oil stocks, for example, have been breaking out to new highs for the past two years. This also happened in the 1970s when oil prices increased previously. Oil stocks outperformed the rest of the market between 1973 and 1980 when the price of oil was rising, but underperformed the rest of the market between 1980 and 2000 when oil prices declined. A continuation of strong performance in the oil stocks will depend upon whether the price of oil continues on this uptrend. Additionally, investors should consider the impact of higher oil prices on other sectors. The airline and auto industries, which are heavily dependent on oil, have faltered during the past two years, just as they did in the 1970s. Internet retailers, such as Amazon, should benefit from higher oil prices because consumers won’t drive as much as they used to. The impact of higher oil prices on the stock market is smaller than in the 1970s. Energy costs’ share of GDP has fallen from 8% in 1973 to only 2% today. The global economy relies more on services today than in 1973 and higher oil prices have made the world more energy efficient. Increased demand from China has contributed to the rise in commodity prices, including oil, during the past five years. China needs more oil to produce the vast amount of goods it is exporting to the rest of the world. Though oil prices are higher, Chinese exports have reduced the price of manufactured goods benefiting consumers throughout the world. Every change in the global economy has costs and benefits and the key to successful investing is to determine where those costs and benefits occur. To measure the overall impact of China’s entry into the world economy, you have to look at the impact on both commodities and manufactured goods. China has moved the terms of trade in favor of countries exporting commodities and importing manufactured goods, such as Australia, while moving the terms of trade against countries importing commodities and exporting manufactured goods, such as Bangladesh. This trend is likely to continue. Therefore, investors should be aware of the impact this will have on the price of equities. Investors should increase investments in countries, such as Australia, that benefit from higher commodity prices and lower prices for manufactured goods while reducing investments in developing countries that must import oil and compete with Chinese exports. One surprising difference between 2004 and the 1970s is that despite higher oil prices, interest rates have not increased. Typically, a supply shock both raises prices and reduces output; however, this time inflation has not risen significantly, and long-term interest rates have actually fallen. Lower interest rates signify that the inflationary impact of higher oil prices will be minimal. The bond markets do not expect the higher oil prices to trigger an inflationary spiral similar to the 1970s. The good news is that fixed-income investors need not fear the impact of higher oil prices on bonds as much. The smaller role of energy costs in GDP, the larger role of services, and the deflationary impact of greater manufactured exports from China along with less accommodative monetary policy have reduced the inflationary impact of higher oil prices. The supply and demand for oil are both inelastic in the short run causing the price of oil to be volatile. This explains why the price of oil can increase by 70% since December 2003. Changes in the supply or demand for oil can cause dramatic shifts in the price of oil, either higher or lower. Higher oil prices spur more exploration for oil, increase the demand for oil substitutes, and encourage oil conservation. Historically, oil prices have increased sharply, and gradually declined as supply caught up with demand. Oil prices increased rapidly in the 1860s, the 1910s and 1970s only to be followed by declining prices in the decade that followed these periods. This is because the supply and demand for oil are more elastic in the long run, making the price of oil more stable in the long run. Oil prices have been rising since 1999, but the impact has been quite different from the 1970s. For the reasons given above, the impact of higher oil prices on investors is likely to be less severe than in the 1970s. Also considering the behavior of inflation and exchange rates in the past, we will see that history reinforces this conclusion. Adjusting for Inflation At $55, the current price of oil is at an all-time high, but what happens if you adjust for inflation? Or what happens if you look at the cost of oil in Euros or in Yen? To adjust for inflation we converted the historic price of oil into 2004 prices. We found that the average price of oil during the 20th Century, as measured in 2004 prices, was $23. The real price of oil fluctuated between $10 and $20 until the 1970s when the first oil crisis hit. Since 1973, the average real price of oil has been $38. After 1972, the price of oil increased more than five fold, rising from $15.50 in 1973 to over $83 in 1981 as measured in 2004 prices. The price of oil slid for the next 17 years, bottoming out at $13 per barrel in November 1998. Adjusting for inflation, this was the lowest the price oil had been since the 1940s. Since November 1998 the price of oil has risen steadily from $11 in 1998 to $56 per barrel today. There was an initial increase in price between November 1998 and June 2000 when oil rose to $35 per barrel, and a second increase from November 2001 when oil rose from $20 a barrel to $55 today. Although the current price of oil is at an all-time high, after adjusting for inflation, oil is still cheaper than it was in 1981. In fact, the price of oil would have to increase by 50% from its current price of $55 to return to the equivalent of its 1981 levels. Given the psychology of markets, if the price of oil were to increase to $83 a barrel, what would keep it from going to $100? Nevertheless, at $55 the current price of oil is 50% higher than the average price of oil since the oil shocks of 1973. Oil prices have been rising for six years now, which is above its long-term average. Although the price of oil could still rise further, in the longer term the price of oil is more likely to retrace to the $30 range. Looking at the historical behavior of the price of oil, it would appear that most of the increase in the price of oil has already occurred, and probabilities favor that five years from now the price of oil is more likely to be below today’s price than above it. Oil Price $/Barrel Year 1900 1910 1920 1930 1940 1950 1960 1970 1975 1980 1985 1990 1995 2000 2004 Nominal 0.45 0.53 3.5 0.95 1.02 2.57 2.97 3.41 13.37 35.53 26.53 28.44 19.54 26.72 56.37 2004 Prices 11.35 10.85 34.19 11.18 13.71 19.48 18.89 16.24 45.65 78.02 46.00 40.28 24.12 29.10 56.37 The Price of Oil in Europe and Japan Although the price of oil is set in US Dollars, the cost of oil in Europe and Japan also depends on exchange rate movements. We calculated the price of oil in two currencies, the Euro (using the European Currency Unit before 1999) and the Yen. The results are quite interesting. European currencies appreciated relative to the US Dollar in the 1970s, reducing the economic impact of higher oil prices. The price of a barrel of oil rose from around 3 Euros at the beginning of 1973 to 25 Euros by the summer of 1980. Although the US price for oil peaked in February 1981 at $38, the decline in the value of European currencies meant that the cost of oil continued to rise until 1984. Oil rose from 32 Euros in February 1981 to 40 Euros in September 1984. The price of oil increased by 20% in Euros during those three years, but fell by 30% in US Dollars. The price declined to around 11 Euros per barrel by March 1986 and remained under 20 Euros until 1999. The strength of the Euro in the past few years has meant that the rise in the Euro price of oil hasn’t been as severe as in the United States. A barrel of oil hit 38.50 Euros ($33.60) in November 2000, and rose to 44.20 Euros ($56.37) in October 2004. Oil has risen 70% since November 2000 in Dollar terms, but only 15% in Euro terms. The price for oil may be at all-time highs in Europe and the United States, but not in Japan. A barrel of oil cost around 1000 yen in 1972 and rose to over 9000 yen by October 1982. As the Yen strengthened after October 1982, the price of oil in Japan fell. By July 1986 oil had fallen to around 1750 yen, only 75% above its level in 1972. This fact can partly explain why Japanese manufacturing was so strong relative to the rest of the world in the 1980s. The price of oil increased 400% in the US and Europe between 1973 and 1986, but it increased only 150% in Japan because of the strength of the Yen. Further strength in the Yen meant that by the end of 1998, a barrel of oil cost only 1400 Yen, only 40% higher than the price in 1972! Today, the price of oil is about 6000 yen, which is still lower than the yen price in 1982. The important point to note from this review is that only looking at the Dollar price of oil can be misleading. As the table below shows, changes in the price of oil look quite different when viewed in Euros or Yen rather than in US Dollars. This is another reason why the impact of higher oil prices on the world economy is likely to be weaker now than it was in the 1970s and 1980s. Month Dec. 1972 Feb. 1981 Oct. 1982 Sept. 1984 Jul. 1986 Sept. 1990 Nov. 1998 Nov. 2000 Oct. 2004 Conclusions Dollar 3.51 38.34 33.01 29.65 11.38 39.58 11.37 33.61 56.37 Euro 3.19 32.12 35.97 40.22 11.26 30.09 9.8 38.53 44.20 Yen 1060 8040 9150 7320 1750 5480 1400 3700 6020 Investors are concerned about the daily increases in the price of oil to new highs. Yet the impact of higher oil prices on the prices of financial assets in 2004 has been surprisingly weak compared to the 1970s. Let’s summarize some of these reasons. First, proven oil reserves are actually greater today than they were in 1973 when the first oil crisis hit. Despite higher oil prices, there are no unrealistic fears that the world is running out of oil as in the 1970s. Long-term interest rates have not risen this year indicating that the bond market considers the rise in the price of oil to be short lived. The biggest problem for oil is the concentration of reserves in the Middle East. Although proven oil reserves are greater than they were 30 years ago, reserves remain heavily concentrated in the Middle East and disruptions to oil supplies resulting from conflict in the Middle East are the primary concern for traders. This is the so-called “terrorism premium” that is built into the price of oil. Second, the current rise in the price of oil has not been accompanied by increases in the prices of other commodities as in the 1970s. Inflation in the price of food, metals and other commodities remains subdued, so the overall inflationary impact on the economy is smaller. This helps to explain why we have not suffered as much inflation as in the 1970s and why interest rates have remained low. Third, oil now represents 2% of global GDP, not the 8% it represented in 1973. Higher oil prices give people an incentive to make more efficient use of oil. Moreover, the global economy has moved toward more services and information technology and away from manufacturing. Fourth, prices are relative. Even at $55 a barrel, after adjusting for inflation, the price of oil is still 30% below its price in 1982. The price of oil would have to rise to $83 to match the 1982 price. The real price of oil is above its historical average giving businesses an incentive to search for oil substitutes. This also gives businesses an incentive to search for new oil reserves. As this occurs, the price of oil will fall. Fifth, in nominal terms, the Euro price for oil has only increased by 15% in the past four years while the US Dollar price has increased by almost 70%. The Yen price of oil is still below its level 20 years ago. The strength and weakness in the price of the US Dollar also influences the cost of oil. Sixth, one reason for the increase in the price of oil is greater demand from China. At the same time, exports from China have a deflationary effect on manufactured goods, which offset the inflationary effect on commodities such as oil. Countries that import manufactured goods and export commodities will strongly benefit from this effect. Developed countries that import oil and export manufactured goods will suffer the most from these changes. By studying the historical behavior of financial assets we now have a better understanding of what the future is likely to hold. The evidence we have presented and reviewed leads us to believe that the impact of higher oil prices on stocks and bonds should be limited, barring a severe disruption of oil supplies from the Middle East. Although the price of oil could still rise in the short run, the price of oil is more likely to decline during the next few years than to rise.

![Midterm1: StudyGuide[Schaeffer]](http://s3.studylib.net/store/data/007091072_1-c0613f2c3bd55f3b4ea56190b4a7d5fa-300x300.png)