TAX - Beatrez & Company CPAs

advertisement

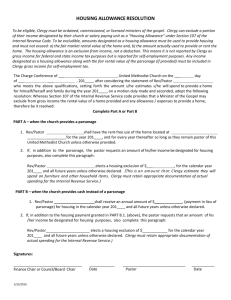

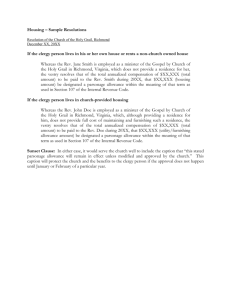

1 TAX Unique tax rules apply to members of the clergy. Tax Planning for Servants of God BY FRANCES E. McNAIR, EDWARD E. MILAM AND DEBORAH SEIFERT EXECUTIVE SUMMARY FOR CLERICS, GROSS INCOME does not include housing allowances paid as part of compensation to the extent the allowance is used to rent or provide a home and does not exceed the fair rental value of the home plus the cost of utilities. However, housing allowances are included in income for self-employment tax purposes. TO QUALIFY FOR SPECIAL TAX TREATMENT, clergy must perform services in the exercise of their profession and be duly ordained, commissioned or licensed. THE DETERMINATION OF WHETHER A CLERIC is an employee or selfemployed for federal income tax purposes primarily is based on fact. BUSINESS EXPENSES FOR TRAVEL to visit hospitals and nursing homes or to attend religious conferences and meetings are allowable, but deductions for a home office rarely are allowed. FEES PAID DIRECTLY TO THE CLERGY FOR BAPTISMS, bar mitzvahs, weddings and funerals are includable in income on schedule C as self-employment income even if the cleric is considered an employee. MINISTERS ARE SELF-EMPLOYED FOR SOCIAL SECURITY purposes even if they are treated as employees for federal income taxes. COMMON TYPES OF RETIREMENT PLANS AVAILABLE for employee http://www.aicpa.org/pubs/jofa/oct2004/mcnair.htm downloaded 3/5/05 2 clergy include IRAs, tax-sheltered annuities, qualified pension plans, 401(k) plans, SEPs and Rabbi trusts. FRANCES E. McNAIR, CPA, PhD, is a professor of accounting at Mississippi State University. Her e-mail address is fmcnair@cobilan.msstate.edu. EDWARD E. MILAM, CPA, PhD, is a professor of accounting at Mississippi State University in Starkville. His e-mail address is emilam@cobilan.msstate.edu. DEBORAH SEIFERT, CPA, is a doctoral student at Washington State University in Pullman. Her e-mail address is dseifert@mail.wsu.edu. ith today’s complex and ever-changing rules, annual tax planning is increasingly important for all taxpayers. However, it’s especially important for members of the clergy because of three unique rules that apply to the income and Social Security taxes they pay: the housing exemption allowance, the treatment of employee clergy as self-employed for Social Security tax purposes and the exemption from withholding income tax from wages (but not from paying income tax on wages). This article discusses tax-planning opportunities for clergy that CPAs in public practice need to know to best counsel this special group of clients. HOUSING EXEMPTION ALLOWANCE A housing allowance is an important tax benefit for clergy because it can be excluded, within limits, from gross income for federal tax purposes. It provides a way for many religions to supplement, tax-free, the usually low salaries they pay their clergy. Continuing this tax-free status has strong bipartisan support, and in 2002 Congress passed legislation aimed at settling the issue of what amount can be excluded from gross income. IRC section 107, as amended by The Clergy Housing Allowance Clarification Act of 2002, states that “in the case of ministers…, gross income does not include the rental allowance paid to him as part of compensation to the extent used by him to rent or provide a home and to the extent such allowance does not exceed the fair rental value of the home, including furnishings and http://www.aicpa.org/pubs/jofa/oct2004/mcnair.htm downloaded 3/5/05 3 appurtenances such as a garage, plus the cost of utilities.” The housing allowance must actually be used to maintain or provide a furnished home and cannot be used for other purposes. Housing Allowance for Clergy Without the housing allowance they currently receive, America’s clergy face a devastating tax increase of $2.3 billion over the next five years. Source: Rep. Jim Ramstad (R, Minnesota), 148 Congressional Record H1300, April 16, 2002. In addition IRS Publication 17, Your Federal Income Tax, states that clerics who own their homes can exclude the lesser of the following: The amount actually used to provide a home. The amount designated as a rental allowance. The annual rental value of the home, including furnishings. For clerics who own their own homes, actual expenses include mortgage interest payments, down payments, real property taxes, insurance, utilities, furnishings, repairs and improvements. The limitation on the excludability of the clergy housing allowance generally is effective for taxable years after December 31, 2001. A cleric can receive a housing allowance for only one home, and the cleric’s church, temple or mosque must actually designate, in advance, payments made for housing or utilities as housing allowances so there is no question these payments are excludable from gross income. Ministers living in churchprovided parsonages, for example, do not have to include the fair rental value of their homes in their gross income and may exclude a designated allowance for utilities and upkeep to the extent of actual expenses. According http://www.aicpa.org/pubs/jofa/oct2004/mcnair.htm downloaded 3/5/05 4 to revenue ruling 87-32, those who receive a housing allowance still are allowed to deduct mortgage interest and property taxes on their federal tax returns as itemized deductions. The Clergy Housing Allowance Clarification Act applies only to housing allowances and parsonage allowances for federal income tax purposes. Housing and parsonage allowances have always been, and continue to be, included in income for self-employment taxes. In addition, since the housing allowance is a part of total compensation, religious organizations must be careful to avoid paying their clerics “unreasonable compensation,” which could jeopardize their tax-exempt status. While there is little guidance on what is considered reasonable, CPAs should recommend that compensation packages above $125,000 be reviewed by the board or documentation for support be provided. DETERMINING FAIR RENTAL VALUE Since clergy housing allowances are excludable only up to the maximum of fair rental value, the determination of what that constitutes is of utmost importance. Figuring the fair rental value of a property would be simple if there were fixed formulas, rules or methods. Usually, there is no single formula that applies when determining fair rental value. The fair rental value usually is figured by examining the facts and circumstances of each instance, but in all cases should be based on a furnished property plus utilities. The fair rental value of a furnished property as a whole should be used, not the fair rental value of a property plus the fair rental value of the furniture. The courts have allowed two methods for figuring fair rental value. Both assume that fair rental value is determined at arm’s length, that is, objectively and between unrelated parties. The primary method has been comparable fair rental value based on the testimony of an expert who compares the property in question with other similar properties. CPAs can regard reliable http://www.aicpa.org/pubs/jofa/oct2004/mcnair.htm downloaded 3/5/05 5 real estate agents as experts, able to quote rental values based upon the location, size and condition of the dwelling. The second valuation method allowed by the courts is the comparable sales method. This technique requires the determination of two amounts: the fair market value of the subject property and the rate of return on investment that an unrelated lessor of comparable property would require. The two numbers are multiplied to determine the fair rental value amount. The first amount, fair market value, should be readily available from real estate sales records. The second figure, the required rate of return, is more subjective. The Tax Court used 13% in the 1999 Hunt & Sons (66 TCM 853) case, but a higher rate of return may be justified. A required rate of 15% probably would not be unreasonable. WHO QUALIFIES? It is common to think that all members of the clergy are eligible for special tax treatment, but this is not true. IRS Publication 1828, Tax Guide for Churches, broadly defines ministers as “members of clergy of all religions and denominations and includes priests, rabbis, imams and similar members of clergy.” But, according to Treasury regulations section 1.1402(c)-5, in order to qualify for special tax treatment as clergy, an individual must be a “minister” performing services “in the exercise of his ministry” and a “duly ordained, commissioned or licensed minister of a church.” The services performed by a minister in the exercise of the ministry include the “ministration of sacerdotal functions,” the “conduct of religious worship” and the “control, conduct and maintenance of religious organizations (including religious boards, societies and other church or church denomination).” In each case the facts determine whether an individual is duly ordained, commissioned or licensed, since religious disciplines vary in their formal procedures in these areas. For example, the Tax Court in Salkov (57 TC 727) http://www.aicpa.org/pubs/jofa/oct2004/mcnair.htm downloaded 3/5/05 6 found that a Jewish cantor who wasn’t ordained but who had a bona fide commission and who was employed by a congregation on a full-time basis was a minister for tax purposes because he performed the religious worship, sacerdotal, training and educational function as specified by Jewish religious tenets. However, in Lawrence (50 TC 494) the Tax Court found that a minister of education in a Baptist church didn’t qualify for special tax treatment because he was commissioned but not ordained and wasn’t able to officiate at baptisms or the Lord’s Supper or to preside over or preach at worship services. Youth ministers, ministers of education or other special-function ministers may find themselves in this same situation. CPAs must take into account the duties of clerics with regard to sacraments and worship when making the determination of whether they qualify as “ministers of the gospel.” EMPLOYEES OR SELF-EMPLOYED? The determination of whether a cleric is an employee or self-employed for federal income tax purposes is based primarily on fact. Most probably are employees under the current tests used by the IRS and the courts. From a tax-planning standpoint, they generally are better off being classified as employees than as self-employed persons for several reasons. First, classification as an employee allows the value of various fringe benefits available to employees—such as employer-paid health insurance premiums, life insurance premiums and contributions to retirement plans—to be excluded from income. Second, as employees, most clerics can be reimbursed by their organization for business expenses without any income tax consequences as long as the reimbursement is through an “accountable plan.” Reimbursements under an accountable plan are especially beneficial to clerics subject to the alternative minimum tax (AMT). The amount of the reimbursement is not included in income and there is no AMT adjustment for the related expenses since they are not deducted as miscellaneous itemized http://www.aicpa.org/pubs/jofa/oct2004/mcnair.htm downloaded 3/5/05 7 deductions. Finally, clerics are less likely to trigger an IRS audit with employee status. According to a GAO report in 2001, audit risk is much higher for self-employed persons than for employees. The downside of being considered an employee for federal income tax purposes is that unreimbursed employee business expenses are subject to a 2% of adjusted gross income (AGI) floor and must be reported on schedule A. Clerics who do not itemize thus will lose any deduction for unreimbursed employee business expenses. Generally, someone is an employee if the employer has the legal right to control both what the individual does and how the work is performed. However, there are a few situations in which a cleric is more likely to be classified as self-employed rather than as an employee for federal income tax purposes. For example, itinerant evangelists usually conduct services in several different churches during the course of a year and ordinarily are selfemployed. Guest speakers also are usually self-employed as are ministers on temporary assignment to a church. Clerics who are employees may be selfemployed for certain services such as baptisms, bar mitzvahs, weddings and funerals. These services usually are performed directly for church or temple members who pay a fee to the cleric. Members of the clergy who work without direct control and supervision may think they are self-employed. However, the Tax Court in James (25 TC 1296) stated that “despite this absence of direct control over the manner in which professional men and women shall conduct their professional activities, it cannot be doubted that many professional men and women are employees.” Whether they are classified as employees or as self-employed for federal income tax purposes, clerics are exempt from federal tax withholding. However, those who are classified as employees can request that their http://www.aicpa.org/pubs/jofa/oct2004/mcnair.htm downloaded 3/5/05 8 income taxes and self-employment taxes be withheld from their salary payments, and CPAs should advise them to do so. If they don’t, members of the clergy must make quarterly estimated payments for federal income taxes and self-employment taxes to avoid penalties for underpayment of taxes. RESOURCES Church & Clergy Tax Guide by R. Hammer, 2004 edition, Christian Ministry Resources, Matthews, North Carolina, 2003. www.clergysupport.com provides some free useful information. IRS Audit Guide, Ministers: Market Segment Specialization Program. IRS Publication 533, Self-Employment Tax. IRS Publication 517, Social Security and Other Information for Members of the Clergy and Other Religious Workers. IRS Publication 1828, Tax Guide for Churches. IRS Publication 17, Your Federal Income Tax. All IRS publications can be found at www.irs.gov. CLERGY BUSINESS EXPENSES Clerics who are classified as employees may be reimbursed for business expenses such as meals, travel, office supplies, and robes and vestments. However, for the reimbursement to be excluded from income, it must be made under an accountable plan, that is, an arrangement that requires a business purpose for all reimbursements, substantiation within a reasonable period of time and reimbursement of any payments in excess of substantiated business expenses to the employer within a reasonable period of time. Business expenses that are not reimbursed under an accountable plan or http://www.aicpa.org/pubs/jofa/oct2004/mcnair.htm downloaded 3/5/05 9 that are in excess of the amounts allowed under such plans are deductible on form 2106 for employees and on schedule C for self-employed taxpayers. A common business expense for clergy is travel; deductions can be taken for trips to hospitals or nursing homes, conferences and meetings in town or out of town, and any other business-related travel. Clergy face the same deductibility limitations on travel, meals, entertainment and lodging as do other taxpayers. Travel to and from their houses of worship, for example, is considered a commuting expense and is nondeductible. Clergy also may have other deductible business expenses related to their profession. Purchasing supplies or paying renewal fees for maintaining credentials are valid deductible business expenses, as are telephone expenses for business purposes and deductions for special robes or vestments. If a cleric is an employee, reimbursements under nonaccountable plans must be reported as income. Business expenses then are deductible as miscellaneous itemized deductions subject to the 2% of AGI floor. These expenses generally are reported on form 2106, or for self-employed ministers, on schedule C. Regardless of whether a cleric is an employee and deducting business expenses on form 2106 or self-employed and deducting business expenses on schedule C, some percentage of business expenses will not be deductible in most cases. If a cleric’s compensation includes a parsonage or housing allowance, which is excludable from gross income, the nondeductible business expense percentage is based on the ratio of the clergy’s nontaxable to taxable income. CPAs can find detailed examples and worksheets in IRS Publication 517, Social Security and Other Information for Members of the Clergy and Other Religious Workers. Not all expenses are deductible, though. Deductions for a home office rarely are allowed since churches and temples usually provide an office, and http://www.aicpa.org/pubs/jofa/oct2004/mcnair.htm downloaded 3/5/05 10 parsonage allowances already are excluded from income. Contributions made by clerics to their congregations also are not classified as business expenses but are deductible as itemized charitable deductions on schedule A. Business suits aren’t deductible since they can be worn outside of work, and dry-cleaning expenses also can’t be deducted. GIFTS AND COMPENSATION Many clerics mistakenly believe that special offerings or bonuses they receive are gifts when in fact the IRS views these as compensation for services rendered. The definition of a gift for tax purposes is “proceeding from a detached and disinterested generosity…out of affection, respect, admiration, charity or like impulses. The most critical consideration…is the transferor’s intention.” Therefore, gross income for clergy includes compensation, bonuses and “special gifts” that have been made out to the church, temple or mosque and then given to the cleric, or for which a parishioner or member is taking a charitable deduction. It also includes expense allowances for travel, transportation or other business expenses received under a nonaccountable plan and amounts paid to cover a cleric’s self-employment or income taxes. Payments made for spousal travel are taxable as income unless the spouse was required to travel for religious business purposes. Fees paid directly to the cleric for performing ceremonies such as weddings, bar mitzvahs, funerals, baptisms and masses all are includable in income on schedule C as self-employment income even if the cleric is an employee. Fees given directly to the congregation rather than to the cleric aren’t considered compensation to the cleric unless the congregation then writes a check out to him or her. Contributions made to or for the support of individual missionaries are includable as gross income to the missionaries. SELF-EMPLOYMENT TAXES FOR CLERGY Members of the clergy always are self-employed for Social Security purposes even if they are treated as employees for federal income tax purposes. Thus, http://www.aicpa.org/pubs/jofa/oct2004/mcnair.htm downloaded 3/5/05 11 a cleric pays 12.4% for Social Security on income up to $87,900 for 2004 and 2.9% for Medicare on all self-employment income just like everyone else. Earnings for self-employment taxes include the total compensation such as salary and any parsonage or housing allowance reduced by business expenses, whether unreimbursed or reimbursed under a nonaccountable plan. In addition, one-half of the self-employment tax (computed without regard to this deduction) can be deducted in computing net earnings from self-employment. Also, half of an individual’s self-employment tax is deductible in arriving at adjusted gross income when computing federal income taxes. Clerics may file for an exemption from self-employment tax under certain circumstances. For example, those who conscientiously object to, or whose religious principles oppose, the acceptance of public insurance (for example, benefits established by the Social Security Act) may file for an exemption under section 1402(e)(1). However, the exemption is valid only if approved by the IRS. CPAs can find the requirements for the exemption in IRS Publication 517. PRACTICAL TIPS TO REMEMBER When advising members of the clergy, CPAs should Recommend that compensation packages above $125,000 be reviewed by the board and that documentation be reviewed to make sure compensation is reasonable. Check out revised IRS Publication 1828, Tax Guide for Churches, for some limited guidance on who is a minister. While the issue is critical, the IRS has provided little other advice on the subject. Consider classifying clergy as employees rather than self-employed to http://www.aicpa.org/pubs/jofa/oct2004/mcnair.htm downloaded 3/5/05 12 take advantage of nontaxable fringe benefits such as health insurance, life insurance, employer-provided retirement plans and a lower IRS audit risk. Advise the church, temple or mosque to adopt an accountable reimbursement arrangement if an accountable plan is used for business expenses. Be sure the cleric has sufficient evidence to substantiate the amount, date, place and business purpose of the expense. Remind clerics that “love offerings,” bonuses and other gifts are taxable income. Encourage organizations that offer “denominational plans” to designate that a part of the benefit be used as housing allowance, which will be excluded from both income tax and self-employment taxes of the cleric in retirement. CLERGY RETIREMENT PLANS A number of tax-favored retirement plans available to clergy include the same types that are available to all employees, as well as some unique plans and features. Common types of retirement plans include individual retirement accounts (both Roth and regular), tax-sheltered annuities (403(b) plans), qualified pension plans, 401(k) plans, simplified employee plans (SEPs) and “Rabbi trusts.” Self-employed clergy also may establish Keogh plans. One unique plan for clergy whose features CPAs should be aware of is the “Rabbi trust” arrangement, which allows a religious organization to transfer assets into a trust whose income and principal will be paid to the clergy upon retirement. IRS letter ruling 8113107 concluded that the transfer of the assets into such a trust didn’t cause a taxable transaction for the beneficiary. If the guidance provided in revenue procedure 92-64 is followed, this is an effective way for CPAs to defer the taxation on the transfer of assets until they actually are paid to the beneficiary. http://www.aicpa.org/pubs/jofa/oct2004/mcnair.htm downloaded 3/5/05 13 Denominational plans or retirement plans such as 403(b)s or SEPs established by religious denominations for their clerics also offer significant opportunities. These plans can be funded by the employing organization, but even if they are completely funded by the cleric, they provide attractive benefits that aren’t available with other retirement plans. The significant benefit of such plans is that taxpayers can declare that a part of the benefit is for a housing allowance for the retired cleric, thereby sheltering a portion of the retirement benefits from taxation. In addition Congress in 1996 excluded the parsonage allowance from self-employment taxes after the cleric retires, making denominational plans especially attractive. CLERGY’S UNIQUE TAX ISSUES Members of the clergy face a wide variety of tax complexities and can benefit greatly from expert tax advice in the areas of housing exemption allowance, employee vs. self-employed status, business expenses, self-employment taxes, gifts and compensation and retirement plan options. Sound tax planning advice can help them reap the tax benefits afforded their profession under the Internal Revenue Code. http://www.aicpa.org/pubs/jofa/oct2004/mcnair.htm downloaded 3/5/05