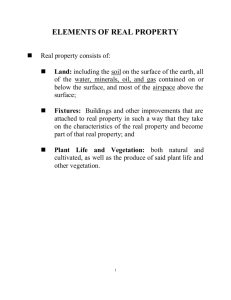

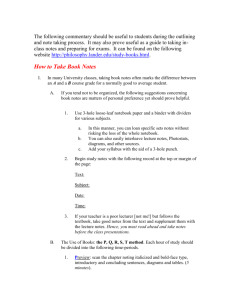

property outline - Ihatelawschool.com

advertisement