File

advertisement

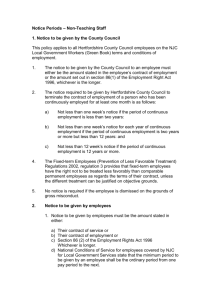

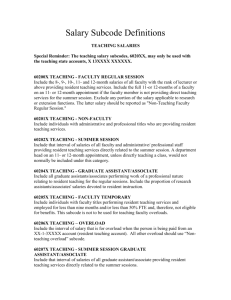

EMPLOYMENT INSURANCE INFORMATION Are occasional teachers eligible for pregnancy and parental leave? Occasional teachers are entitled to a leave of absence from work for the birth and adoption of a child if the board has employed him or her for at least 13 weeks. In many cases, they may also be eligible to receive Employment Insurance benefits if he or she worked 600 hours in the 52 weeks prior to his or her last claim. Maternity leave benefits and occasional teachers The Memorandum of Understanding between OECTA and the government of Ontario extended maternity leave provisions to occasional teachers on long-term assignments. Occasional teachers assigned to a long-term occasional teacher position are entitled to maternity benefits with the length of the benefit limited to the term of the long-term assignment. Occasional teachers on daily casual assignments are not entitled to maternity benefits. Effective May 1, 2013, maternity benefits for occasional teachers assigned to a long-term occasional teacher position were guaranteed at 100 per cent of salary for a total of not less than eight (8) weeks, provided the eight (8) weeks occur during the term of the long-term assignment. Where part of the eight (8) weeks falls during a period of time that is not paid (for example, summer, March break), the balance of the eight-weeks entitlement resumes after that period providing it is within the period of the term of the long-term assignment. Statutory maternity leave and occasional teachers Statutory maternity leave of up to 17 weeks is available to mothers for the birth of a child. A mother may begin maternity leave up to eight (8) weeks prior to the expected date of birth but no later than the week following the birth of the child. This period may be extended or suspended if the child is hospitalized. When applying for Employment Insurance benefits for a maternity leave, a Record of Employment, as well as a signed declaration of the expected or actual date of birth, are required. OECTA's "Essential Information for Occasional Teachers" states: Occasional teachers are eligible for regular employment insurance benefits during non-teaching periods: Christmas break, March break and the summer. This is due to the fact that occasional teachers are hired on a casual or substitute basis and are not “contracted to teach” during the non-teaching periods like regular day-school teachers. Statutory holidays are not considered to be non-teaching periods unless they fall within a non-teaching period. Long-term occasional teachers who sign consecutive 10 contracts and teach the entire school year may not be eligible for regular benefits unless the employment contract is actually terminated between assignments. The basis of eligibility is that the occasional teacher must work from 400 to 700 hours during the 52-week period prior to the non-teaching period applied for, based on where the occasional teacher lives. For individuals who have entered the work force for the first time, or have returned to the work force after a two-year absence, there may be the requirement for 910 hours of insurable work in the prior 52-week period. This would not apply where pregnancy/parental leave benefits were collected 5 years prior to the 52-week qualifying period. The basic regular benefit rate is 55 percent of average insured earnings up to a maximum of $413 per week. Earnings from Employment Insurance are taxable. Benefits are paid after a two-week waiting period. The waiting period applies only once per claim. Your employer should issue a Record of Employment (RoE) at the end of the employment period. Many school boards will issue the RoE to occasional teachers automatically at the end of each year while others will issue it on request. Information regarding Employment Insurance benefits as well as all application information can be found on the Human Resources and Social Development Canada website at www.hrsdc.gc.ca. Specifically, occasional teachers should refer to “Employment Insurance (EI) and Teachers.” You should realize that, as an employee of the Durham Catholic District School Board: You are credited with 7 hours for each "casual" day of work; work done as an LTO counts as 8 hours per day Your ROE (Record of Employment) will automatically be uploaded from the DCDSB to HRSDC. To speed up the process, call or email Carole Boucher at extension 2231 or Carole.Boucher@dcdsb.ca. A special code is required by Service Canada to establish a claim. The current code is posted on our OTBU website (www.dotbu.org). Service Canada states: You will require approximately 910 hours for a new claim. You will require from 550-650 hours for a repeat claim. (In June of 2010, you needed 560 hours according to Service Canada.) Your ROEs from all other employment do count. If you are going from one LTO ending in June and beginning another LTO in September, you will probably be disqualified. You must keep up a job search – and looking for ‘teaching’ jobs doesn’t cut it when you’re facing disqualification. You must report yourself as not being available for work if you take a course during the day. Go to www.servicecanada.gc.ca and carefully read all of the information there. Specifically, occasional teachers should refer to “Employment Insurance (EI) and Teachers.” The basic regular benefit rate is 55 percent of average insured earnings up to a maximum of $457 per week (as of June, 2010). Earnings from Employment Insurance are taxable. Benefits are paid after a two-week waiting period. The waiting period applies only once per claim. EMPLOYMENT INSURANCE (EI) and TEACHERS (Source: Service Canada, June, 2010) What you should know... If you are in the occupation of teaching you may be paid EI benefits. However, because of contractual arrangements in the teaching profession there are some variations to the EI rules. This means that: If you are a teacher under a continuing contract in preelementary, elementary, intermediate, secondary, including technical and vocational schools, you cannot be paid regular benefits during non-teaching periods, even though you are unemployed, unless your contract ends. However, you may be paid maternity, parental; or compassionate care benefits; If you are a teacher above the secondary school level—at universities, community colleges and CEGEPs—the same rules for regular benefits will apply as other claimants; If you are a casual or substitute teacher you can be paid regular benefits during non-teaching periods. Non-teaching periods Non-teaching periods are periods during which no work is performed by people engaged in teaching. They generally include the summer break, Christmas and the midwinter or spring break. A statutory holiday is not considered a non-teaching period, unless it falls within a non-teaching period. The non-teaching periods may vary among provinces and even from one school to another within a region. What about exceptions When any or all the insurable hours that falls within the qualifying period have been accumulated while a person was employed in teaching, no regular benefits can be paid for any week of unemployment that falls in a non-teaching period. However, 3 exceptions to that rule allow a teacher to be paid regular benefits. These exceptions are: the contract of employment for teaching has terminated; the employment in teaching was on a casual or substitute basis; or the teacher qualifies for benefits with an occupation other than teaching. 1st exception - Teaching contract terminated A contract is considered as no longer in effect on the day following the last day of the contract, as long it is not renewed or no other contract exists. Consequently, regular benefits are payable for any part of a non-teaching period until a new contract is signed or effective. Teacher in a repetitive 10-month contract is considered to have a termination of contract at the end of the teaching period. However, if a contract for the next teaching period is signed or agreed with the same school board prior to the termination, regular benefits cannot be paid for the nonteaching period. If during the non-teaching period a contract for the next teaching period is signed, regular benefits cannot be paid as of the date of the signature of the new contract. There is no contract termination when a teacher is either suspended or on an approved leave of absence with or without pay. Teachers who do not meet the 1st exception need to satisfy the 2nd or 3rd exception to be paid regular benefits during a non-teaching period. 2nd exception - Teaching employment on casual or substitute basis If the nature of the teaching employment in the qualifying period is on a casual or substitute basis, regular benefits are payable for any part of a non-teaching period, in certain situations. Casual teaching means irregular, occasional or incidental teaching. If the employment involves filling an unexpected or temporary absence for a short period and, if the employment can be cancelled at any time, it is of a casual nature. Substitute teaching means the replacement of another teacher for part or all of a school year. However, when teachers sign repetitive 10-month contracts for substitute positions with the same school board and work the full school year, regular benefits cannot be paid unless their contract is actually terminated. Teachers employed in teaching on a casual or a substitute basis, for any part of the qualifying period, and who, since the beginning of, or prior to, the non-teaching period have signed or agreed to a regular teaching contract for the following school year, may not be entitled to benefits during any non-teaching periods that fall within their current benefit period. A teacher whose employment in teaching was both regular and casual or on a substitute basis in the qualifying period may qualify for benefits even if there was full-time teaching in the qualifying period. For example, a teacher under a contract to work full-time from September to January of each year, worked as a substitute teacher from January to March, and on a casual and substitute basis from March to June may be paid regular benefits for a non-teaching period. 3rd exception - Qualify for benefits with an occupation other than teaching A teacher who has accumulated sufficient insurable hours in the qualifying period with employment other than teaching, can be paid regular benefits during a non-teaching period. The benefit rate during the non-teaching period is calculated using the earnings from the other employment. However, if you become unemployed after a non-teaching period and if you are entitled to be paid benefits, your benefit rate will be adjusted to take into account your insurable earnings from the employment in teaching. A teacher employed in an occupation other than teaching, during part of the qualifying period, who then signs a contract to teach on a regular part-time or full-time basis for the following school year, can still be paid regular benefits during the non-teaching periods that fall within their benefit period. You need to prove that you are available for work Like any other person who claims regular benefits, to be paid benefits you must prove that you are capable of and available for work and unable to find suitable employment for any working day that falls within your benefit period, including any non-teaching period. As a teacher, you need to show that, during a non-teaching period, you are willing and able to accept immediately any offer of suitable employment and that no restrictions exist that would limit your employment opportunities. As few teaching opportunities exist during a non-teaching period, you must be willing to consider non-teaching jobs. This means that you must show that you are actually seeking a type of work which you can reasonably hope to obtain, particularly when some non-teaching periods are spread over many weeks. Maternity and parental benefits Teachers can be paid maternity and parental benefits during both the teaching and nonteaching periods, as long as the requirements conditions to receive maternity or parental benefits are met. To know more on maternity and parental benefits... Sickness benefits Sickness benefits can be paid during the teaching period only, including situations where the illness during the teaching period extends over to the non-teaching period, or where the illness during the non-teaching period extends over to the teaching period. Sickness benefits are not paid to teachers during non-teaching periods unless one of the 3 exceptions is met. To know more on sickness benefits... Compassionate care benefits Compassionate care benefits can be paid during both the teaching and non-teaching period, as long as the requirements conditions to receive compassionate care benefits are met. To know more on compassionate care benefits... Updated December 24, 2013