Literature Review for LDA

advertisement

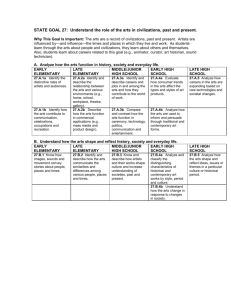

Table of Sources Final Draft October 2005 In partnership with Experian Business Strategies Introduction This report outlines the literature and documents reviewed in order to better understand the visual art sector in England. The documents recorded have been particularly informative in the preparation for the area-based case studies and for this reason documents have been listed under the headings General, North West or London. Table of Sources – General Name of Document Author / Organisation Date Content Summary Type of Document The Market for Art DCMS Committee Mar 2005 Page 6 introduction UK has a 26% share of the global art and antiques market. Select Committee report Page 6 the UK art market Retail sector (art sold by artists privately and by other organisations than public galleries) is rising sharply. On-line sales currently 0.3% but growing. Page 13 Artists resale rights (droit de suite) Will shortly be introduced throughout EU, each time the work is resold the creator will get a %age of the price. A fait accompli, it is strongly opposed by the UK government and the British art market as it may displace the art market to New York or Geneva. Page 17 the public sector Supports artists and contributes directly to the market by Display and exhibition of work, both in temporary exhibitions and Arts Council England Contemporary Visual Arts: Table of Sources 1 permanent collections Direct support via exhibition fees, residencies, fellowships, commission, purchase of work Potential sales outlet Employment of artists as curators, teachers, etc. Indirect support by educating the public and contributing to the subscription process (see Taste Buds report) Page EV6 a-n the Artists Information Company submission to Committee a-n the artist’s trade body artists driven by three approaches Public sector Private/commercial sector Artist-led/self-managing Jobs and opportunities rising rapidly as evidenced by a-n’s own advertising, mainly in commissions and public art. Page EV7 VAGA submission to Committee VAGA Visual Arts Galleries Association, principally concerned with public funded activity that supports and promotes contemporary art. Support of galleries for the art market and artists (as above in main report) Display and exhibition of work, both in temporary exhibitions and permanent collections Direct support via exhibition fees, residencies, fellowships, commission, purchase of work Potential sales outlet Employment of artists as curators, teachers, etc. Arts Council England Contemporary Visual Arts: Table of Sources 2 Indirect support by educating the public and contributing to the subscription process (see Taste Buds report) Few curators have the expertise or resources to promote sales. Public purchase budgets have not kept pace with prices, inflation or public interest. Risk is a key fact or for galleries in supporting emerging artists. The Contemporary Art Society Special Collections Scheme (ACE lottery funding) is the main source of independent funding for contemporary collecting, enabling regional museums and galleries to purchase contemporary work, and providing professional support for curators in CPD, and R&D. Increasing practice for galleries to produce limited editions (e.g. Whitechapel, Serpentine, Tate) Vaga education and outreach ‘VAGA believes that the public sector provides a key entry point into the art world for budding collectors’ Page EV11 Arts Council England submission to Commission Relevant ACE activities ACE collection of British Art, managed by the Hayward Gallery, largest national loan collection of British Art in the world Grants for touring exhibitions 2000-4 £6m British Art Show, every five years Hayward touring exhibition of emerging artists ACE register their concern at the standstill funding of the Spending Arts Council England Contemporary Visual Arts: Table of Sources 3 Fertilising Gerri Morris the Market Director of Morris Hargreaves McIntyre Mar 2005 Review 2004 Impact of National Lottery funding, and are still awaiting confirmation as distributor for this round Grants for Arts funding 2000-4 £6m Capital programme 2000-4 £70m Support for art fairs Contemporary Art Society, Special Collections Scheme initiated 1997 with £2.5m Lottery funding, funded regional acquisitions and development for curators. Completed 2004, no further funding secured Public acquisition capacity of museums and galleries is ‘severely limited by their budgets’: ‘the private sector needs strong regional public collections to develop public confidence and engagement with the work of living artists’ Own Art, launched 2004, making purchase of original contemporary arts and craft affordable to the public via interest free loans. Available through 250 regional galleries and outlets. Studio space – have invested £69m 2000-4 With a-n the Artists Information Company, a Code of Practice for Visual Arts This Article, discusses growing of the Art Market with reference to the findings of ‘Taste Buds – How to Cultivate the Art Market’ for Arts Council England 2004. Article for Arts Professional Magazine Two opposing views which emerged Taste Buds: Art Dealers stated that the market was small and fully developed 5.9 Million people have an unsatisfied desire to buy contemporary art (on top of the 4.9 million who own art) Morris describes the mechanics of the market in terms of: Arts Council England Contemporary Visual Arts: Table of Sources 4 Taste Buds How to cultivate the art market Morris Hargreaves McIntyre Arts Council England Oct 2004 Aspirational Art – Art is symbolic of the buyer, Art is ascribed value based on rarity and endorsement. Dealers manage increases in value controlling who buys it. Conformity – Artists are discouraged from selling work, potential buyers are Discouraged put off by galleries, dealers are conformist and do little market development – then dealers and artists claim the market is too small. Reducing the threat – Encourage buyers at all levels for the market to flourish. Whole eco-system needs to be addressed. Need to help new buyers through interest-free purchase plans, open studio events, affordable art fairs, and new-style outlets. Generating Growth – Holistic view of market as well as bottom-up and top-down cultivation required in order to benefit artist’s seller and buyers. A year long research programme into the market for original contemporary art Research Report for Arts Page 1 summary ‘there is potential to more than double the size of the Council England market for original art’ Page 4 the subscription system a process where artists gain value via dealers, exhibitions and public collections, peer groups and critics. Direct selling circumvents the subscription system. Page 8 production there are 34,000 to 110,000 artists in the UK recognised/avant garde/emerging/most art 43% of artists do not promote their own work (i.e. sell to domestic purchasers)and prefer to wait for the subscription system to recognise their work 60% recognise they do not understand the market and would value training in marketing average incomes: Arts Council England Contemporary Visual Arts: Table of Sources 5 emerging £500-£20,000 mid career £12,000-32,000 established £50,000-60,000 most income is from non-sales sources 50% live in London. Page 10 supply there are 1170 outlets selling, 436 in London: 940 commercial dealers 91 independent (usually artist led) 82 publicly funded (usually local authority) 38 open studio events 13 art fairs. ‘there is virtually no infrastructure outside London for selling critically engaged, innovative, contemporary art’ page 11 public sector usually concerned with subscription rather than selling ‘could play a greater role in championing the development of new markets outside London’ Page 12 art fairs regional, national, international, expensive for artists, tends to sell accessible art, targets domestic market. ‘there is potential for he development of regional art fairs that focus on the sale of innovative, critically engaged work’ page 12 open studios/ direct sales At least 40 events per year, at least 3,000 artists, estimated 434,000 visitors, market worth £1.5 plus. Page 13 dealers operate in subscription system, most high end dealers in London, look to international trade, source most new talent in London ‘dealers could be encouraged to widen their conservative view of the market’ Arts Council England Contemporary Visual Arts: Table of Sources 6 page 14 demand 4.9m have bought visual art, 5.9m aspire to buy but have not yet, total potential market 10.8m (27% of population) Majority would buy work by living artist, contemporary in style, innovative work. Page 2 Inhibiting factors to growth of market: Belief that market is fully developed Inherent conservatism of subscription system Fear of being perceived as interested in selling Market Matters The dynamics of the contempo rary art market Louise Buck Arts Council England Oct 2004 The workings of the art market, both public and private, are discussed in order to: Encourage those that want to buy new contemporary visual art Make suggestions on how ACE and galleries/museums work more closely to establish protocols to support the economy for artists and collectors. Interdependence of arts organisations and commercial sector is highlighted recognising strong public collections stimulate private collecting & vice versa. ‘Snapshot’ evaluation of the current contemporary art market commissioned by Arts Council England Mechanics of the Market p12 Complex fluidity of value and recognition of Contemporary visual art Power of Endorsement of contemporary visual art work Value of the Market p18 Recent expansion – London world’s 2nd largest art market place after NY Building a figure - Difficult – but value of UK’s unregulated primary domestic market is calculated to be £354.5 m (Taste Buds). Market Matters calculates in effect of a global economy and public commissions estimating a market worth in excess of £500 million. Arts Council England Contemporary Visual Arts: Table of Sources 7 Characterising the Market p21 Artists – no definitive number of artists in England, 34 -110,000(Taste Buds). Between 30 -50% of England’s artists and photographers live in London. Career status of artists is assessed according to myriad and compound factors. Artists’ relationship to the Market – Complicated: importance placed on sales, peer group approval, or rejection of both. Significant shift towards wider economy. Artists’ view on dealers Distribution p27 “In England there are around 1,170 outlets (including open studios, auction houses, art fairs and non-profit and public galleries selling art) which describe themselves as selling contemporary art. Out of these, 439 (43%) have a London postcode. However, if this sample is narrowed-down to commercial galleries solely devoted to sales of challenging contemporary art, then London has the virtual monopoly.” Dealers How dealers operate Art fairs Other spaces – Open studios, lottery-funded workspaces, designated exhibition or project space, artist-run and emerging spaces, commissioning agencies, Key open shows. Retailers – retail style outlets (Biscuit Factory in Newcastle and Comme Ca Art in Manchester) can be first rung on ladder for new buyers. Websites – contemporary visual art is either unique or limited in number which does not make it immediately conducive to the bulk sales of an online market-place – also JPEG’s does not do art justice. Eyestorm, Britart.com and Counter Editions are discussed. Potential for primary market sales on Ebay. Arts Council England Contemporary Visual Arts: Table of Sources 8 Buyers p39 Statistics of ‘Taste Buds’ listed which highlight types of buyers and the percentages of buyers willing to buy original art, challenging contemporary art, and art from living artists. Top-level and committed collectors - only approx 100 collecting challenging contemporary art in England. Most are collecting from abroad, and those that are based in England (and thus mostly based in London) are largely not British. However the home market is expanding eg. Outset, a group of London-based supporters of new art raised £100,000 to spend at Frieze Fair in 2003. Reasons for collecting are also discussed. Regular collectors and occasional buyers – described as professionals with surplus income to spend on art, or artists peers, or those who are enthused by the celebrity of contemporary art via media coverage and high profile events such as Frieze Art Fair. A new phenomenon is the small collective of syndicate of buyers who buy work to share on a timelimited basis. Committed and regular collectors: relationship to the market Buyers of art by living artists – timid buyers Buyers of art by living artists: relationship to the market Public Sector p49 Artists, dealers and buyers cannot operate within the contemporary art market without direct or indirect contact with the public sector – subsidised art schools, studios, galleries, events, and support giving organisations and networks. Public sector funding comes from DCMS, local authorities and the Arts Council. Arts Council supporting the market – Developed environment for visual artists in last 10 years. Ambitions for the Arts 2003-2006 ‘higher priority for the arts’. Own Art and At Home with Art. Public galleries and some commercial cross-dressing – historical relationship is beginning to shift. Partnerships between private and public galleries are beneficial as public galleries budgets become less restrictive Arts Council England Contemporary Visual Arts: Table of Sources 9 and commercial galleries receive public endorsement. Dealers and the Public sector – general view is it is the commercial rather than the public sector which leads the field in the showcasing, promoting and developing the latest in contemporary art. There is a strong demand for new protocols to be drawn up with regard to the interaction of dealers, artists and the public sector. Public purchases – Arts Council Collection from 1946, has 7500 work, grows by about 30 works pa, limited budget of £150,000 pa, largest national loan collection of modern and contemporary British art in the world. Generally dealers accuse public purchasers of being unstrategic, conservative, too slow (meaning prices are high) and prefer selling to European Union collections which are more immediate. There is no coherent national strategy for collecting contemporary art. (The Goodison Review: securing the best for Museums: Private giving and government support (2004)). CAS and 1998 Arts Council Lottery award of £2.5 million to develop the contemporary art collections of 15 regional museums and galleries across England. Public galleries as positive role models: national/regional purchasing strategy – drafting of a ‘National Collections Strategy and Regional Purchasing possibilities ‘ would bring together key players in public and private sectors to encourage greater boldness. Training for regional curators Engaging with collectors Developing the market p63 Tax concessions/incentives Trade association More data needed Incentives for collectors Developing a bigger picture Conclusion: the market does matter p69 Arts Council England Contemporary Visual Arts: Table of Sources 10 General consensus is that the public sector should be working with and enhancing existing elements already operating within the contemporary art market rather than trying to intervene directly in or run parallel with the commercial sector – Public sectors role: advocacy; assistance; and education. Artists are the heart of the market – the Arts Council acknowledges this. Collectors have to be actively engaged and nurtured to grow the market. Crafts Review: Towards a National Strategy 2004/5 Martina Margetts Sept2 004 Arts Council England Position Paper The Crafts Council, as a RFO of Arts Council England, London, has sought clarification from the Arts Council England (ACE) on a national strategy for the crafts in order to focus its operation. This paper covers the roles and remits of the ACE national and regional offices in relation to crafts, gaps in provision and priorities for investment, resulting in recommendations towards a brief for a national strategy for the crafts. Position Paper Covering definitions of the crafts, roles and priorities of the ACE national and regional offices, as well as the roles and priorities of the crafts council and partnerships between these organisations the following question is posed: How well is the crafts sector serving ACE priorities? Interesting to note is that there is no clear definition of ‘crafts’. Amongst the recommendations in the final conclusions are: Making it Prof. Andrew Aug Infrastructure: - ACE/CC to work together to achieve adequate venues for the crafts nationwide. Professional Development: impacting curators – impacts presentation. Visibility: better display (read: presentation) interpretation and understanding of crafts – Establish nationwide priorities for big international crafts exhibitions, both contemporary and historical. This study aims to explore the socio-economic situation of craft makers in Independent Arts Council England Contemporary Visual Arts: Table of Sources 11 in the 21st Century – A socioeconomic survey of crafts activity in England and Wales 2002-03 McAuley 2004 England and Wales in 2002- 2003, and contextualise this with information on the wider crafts economy. Objectives: Dr. Ian Fillis Department of Marketing University of Stirling. To establish the numerical and occupational structure of practising makers in England and Wales in relation to the scope of the Crafts Council’s activity and present this in relation to existing structures. To asses the socio-economic conditions of makers, including information about personal circumstances, continuing professional development and training opportunities, work situation, personal fulfilment, difficulties and attitudes. To obtain information on makers’ attitudes to, and the adequacy of, support organisation including the Crafts Council and sectoral infrastructure. To asses the economic value of the sector, through primary research undertaken and desk analysis of existing material in wider cultural industries. 3.3. The Businesses p24 “Most crafts people work very, very hard for very small recompense. More emphasis should be put on opening selling opportunities” report for the Crafts Council, Arts Council England, and The Arts Council of Wales p25 - Table 13 Location of main workshop (as 50.7% of makers marketed ‘Direct to the public from workshop’ – 57.8% of makers marketed ‘Through exhibitions/galleries’ – see Table 28 Use of Marketing Channels page 33) Note from R. Naylor: take Location Quotient into account! p27 - 35.6% of respondents generated all or nearly all of their income from craft activities while 35.2% generated 20% or less of their income from craft activities - see Table 17 p33 - Marketing channels and selling – the most frequently reported channels for selling work were commissions (69.6%), exhibitions/galleries (57.8%) and selling direct to the public from a workshop (50.7%). The combined figure of Arts Council England Contemporary Visual Arts: Table of Sources 12 18.6% using a website indicated a relatively high proportion of makers using this mew media as a marketing channel. See Table 28 and 29 (p34). p34 - Table 30 Use of methods of promotion – 56.6% mentioned exhibitions (second most dominant category after postcards/leaflets/brochures and 42% mentioned use of websites. Demonstrations/stand at exhibitions/crafts fairs and workshops are also listed. p35 – 39 - Markets and Sales – illustrates the use of retail outlets as part of the route to market. Table’s 32, 33, 34, 35, 36, 37, 38, 40 (shows frequency of internet business usage) p44 – Table 47 target market for growing the business p52 – 54: Illustrates contact with various associations and the main purposes for contact (ie. contact with Craft Council for exhibiting opportunities, etc). Appendix 1 – The Questionnaire - Questions of Interest are: p72 Q9: Is the subject or style of your work: Contemporary? Traditional? p77 Q19b: Please tick the different ways in which you sold work during 2002 indicating approximately what percentage of your turnover came from each in the UK and from export sales (results p33 onwards in chapter 3) p79 Q21: Please would you indicate how many craft associations you belong to (results p52 onwards). New Audiences for the Arts Arts Council England June 2004 New Audiences £20m invested across the UK over five years to help arts organisations reach out to new audiences. 1,157 awards made. Work across all art forms was funded as well as research, evaluation, training and development work. Generated over 4million attendances to live arts events. Broadcast, online and promotional partnerships attracted large numbers of new audiences for Art Council England evaluation of the ‘New audiences for the arts’ programme run Arts Council England Contemporary Visual Arts: Table of Sources 13 the arts. Website documented the programme. Audience development was form 1998 to addressed through: 2003 Setting the scene p4 Art in unusual spaces p6 – Addressing placing work where ready-made new audience s might be, NHS waiting rooms (eg. Mandy Sutter), shopping centres or public transport. New Audiences and broadcasting p8 – using broadcasting and promotional campaigns, touring work and festivals eg. Channel 4 Peratunity and BBC English Regions for Roots used popularity of TV and Radio to encourage new talent and audiences. New lifestyles, new audiences p10 – Looking at new social trends (e.g. ‘time poor’ era where the arts must compete for peoples leisure time) to create new types of audiences resulting in projects: ‘Love art Later’, ‘At home with Art’ New Audiences: Encouraging lifelong participation in the arts p12 – young people; 5– late 20s via new means: text messages, programmes – older people; Targeting barriers: Lack of transport; price; having no one to go with. Projects; Silverscreen, Equal Arts, Time Out. New Audience and Families p 16 - 40 projects totalling £1.3m. Family, priority group. Projects included a partnership between the Oakengates Theatre in Telford and the Sure Start scheme in Lawley; and Britains first Bollywood Drive-in in Leicester. New Audiences and Diversity p18– over £4m (1/5) was allocated to projects aiming to develop audiences for culturally diverse work. Funding was spread amongst existing art organisations who felt their audiences were not representative of their communities and new projects and programmes such as ‘Self-Portrait UK’. New Audiences and disability p20 – nearly £2m to projects whose primary focus was disability – encouraging disabled people to engage with the arts and bringing disability art to a wider audience. Rural Change p22 –Close to £1m supporting arts and audiences in rural areas. Funding to the Littoral arts trust in 2001 where artist of all Arts Council England Contemporary Visual Arts: Table of Sources 14 Ambitions into Action Arts Council England Mar 2004 disciplines worked alongside farmers and other affected to create ‘Cultural documents of the foot and mouth crisis. New Audiences – giving people a voice p24 - £1.5m for supporting research and development into projects addressing social inclusion. Many diverse and rural community-based organisations received funding, some for the first time. In their own words p26 – Findings, reports from organisations and from independent researchers, were recognised as an important resource, these were collected and can be found at www.artscouncil.org.uk/newaudiences. New Audiences success factors p28 Training has allowed organisations to develop skills and understanding to that they can continue to build audiences In the long term Research has produced important evidence about who audiences are, what they want, and point to models of good practice New audience development posts funded through the programme are now integrated into organisations Measures and mechanisms are in place to help increase audiences in the loner term e.g. websites will allow organisations to continue to market their activities online. New Audiences for the future – 21st C arts organisations need to understand audiences and the communities in which they reside. Audience development is a key component of an organisations work. Lessons learnt through New Audiences are being built into AC funding programme ‘Grants for the Arts’ and affect the work with organisations and the audience development sector. ‘Ambitions into action’ asserts the progress made with regard to ‘Ambitions for the arts 2003-2006’ (the Arts Council England’s’ manifesto published in February 2003 which identified their six overall ambitions as: Supporting the Artist; Enabling Organisations to Thrive, Not Just Survive; Championing Cultural Diversity; Offering Opportunities for Young People; Encouraging Arts Council England Publication Arts Council England Contemporary Visual Arts: Table of Sources 15 Growth; and Living up to Our Values). From 2003 to 2006 the Arts Council England are investing £2 Billion of public funds in the arts, including funding from the National Lottery. Supporting the artist p3 – Investing £25m in individual artists between 2003/2004 and 2005/2006 – double previous investments. Almost 800 grants given in first 6 months. Developing international opportunities and connections with 61 residencies in 25 countries and 130 artists benefiting. Helping gaining access to premises and equipment – artist workspace was one of the priorities for the 2004 capital programme – 90% of the awards went to projects, which included space for creating art. Supporting creative businesses in many regions through loan schemes and advice on skill and business development. Enabling organisations to thrive, not just survive p7 – ACE indicates that it will invest in ‘Organisations that have the ability to produce work of the highest artistic standards’ - 1300 RFO’s, internationally renowned organisations, and smaller organisations. ACE will support the talent of people working in the arts making sure they have the skills needed to lead the sector e.g. ACE are a major partner in the new Clore Leadership Programme fellowships. Championing cultural diversity p12 – ACE is reviewing portfolio of RFO’s to ensure it reflects England’s cultural diversity. Decibel project and showcase (ended March 2004) inspired showcase planned for 2005. ACE want to see more and better funded Black and minority Ethnic- led arts organisations and artists. Chinese Arts Centre in Manchester and Rich Mix in east London listed as ACE supported. ACE increasing funding to disabled artists and disability-led organisations. ACE’s work with Youth Justice Board gained international recognition. Offering opportunities for young people p15 – Artsmark Scheme 2001, Creative Partnerships, both cited as successful ACE programmes. Young Arts Council England Contemporary Visual Arts: Table of Sources 16 Peoples Arts Award offering 1000 14-19 year olds to take part in a new pilot 2004/2005 paving the way for a new national award. The Contributi on of Culture to Regenerat ion in the UK: a review of Evidence Graeme Evans and Phyllida Shaw Jan 04 Encouraging growth p19 – 2002 ACE Research shows ‘huge unsatisfied demand for the arts’ - important part of economy and can help other areas (health, education, crime, regeneration) achieve objectives. 2000 almost 760,000 people working in cultural sector, an increase of more than 150,000 since 1993. ACE working with national and local partners to generate additional resources, forming new partnerships. New Audiences programme to encourage people to participate – ambassador idea. P5 Identifies three models of culture’s contribution to regeneration: Culture-led Cultural activity the catalyst e.g. Baltic, Sage Cultural regeneration Fully integrated into an area strategy e.g. Birmingham Renaissance, Barcelona Culture and regeneration Often small scale cultural intervention at late stage, add-on Report to DCMS Summarises examples of the impact of culture and methods of measurement, on P9 Environmental regeneration e.g. re-use of buildings, new buildings, better public spaces, safety, increased sense of pride, improved transport, creative clusters p20 economic regeneration e.g. inward investment, visitor spend, job creation, employer retention, publicprivate sector partnerships, increased property values Arts Council England Contemporary Visual Arts: Table of Sources 17 p28 social regeneration e.g. changed perceptions of place and self, increased social activity (social capital), reduced offending behaviour p33 summaries of evidence based studies including Lace Market, Nottingham Hi8Us Ulverston, Cumbria Acme Studios, London Custard factory, Bham P57 gaps in evidence Culture not adequately recognised in social policy and quality of life indicators Short term evaluation does not always capture all benefits Often no single body charged with measurement, so does not happen Cultural regeneration can conflict with economic/environmental Few holistic approaches Inadequate funding for full evaluation Culture at the Heart of Regenerat ion DCMS 2004 P10 Icons, Cities and Beyond Examples given of iconic buildings and projects and their economic impact e.g. Tate Modern, Gateshead Quays, Capital of Culture However the ‘Bilbao effect’ is possible, where the benefits fail to trickle down to the local residents. Sustainability is built by not relying on flagship events and buildings, e.g. as at Barcelona. Value also of regional and rural regeneration. Consultation document (summarises the evidence of the DCMS document above) P20 Sense of Place Examples of the impact on the physical environment and sense of place e.g. Bellenden in Peckham, Bournemouth Library. Arts Council England Contemporary Visual Arts: Table of Sources 18 Changing attitudes to built environment: CABE/MORI poll 2002 found 81% of people were interested in how the built environment looks and feels Value of mixed use developments e.g. Brindleyplace Growing presence of artists on planning design teams Growing public expectation that projects will feature public art. P30 Delivering for Communities, with Communities Role of culture in increasing social cohesion, reduction of crime, building individual capacity E.g. West Yorkshire Playhouse outreach, Bradford Museum of Photography, Film and TV P36 making the Economic case Includes Increased inward investment Higher resident/visitor spend Job creation Employer location/retention Diverse workforce Examples: Manchester Museum of Science and Industry Seaside towns initiative Hoxton Nottingham Lace Market Creating Places speech Peter Hewitt, CEO, ACE 8-Jul03 Artists’ studios can be Workspace Selling space A networking hub A regeneration catalyst But ‘artists should no longer be victims of the renewal process which they help to initiate’ Speech to Creating Places conference, Tate Modern Arts Council England Contemporary Visual Arts: Table of Sources 19 Survey of recent England-wide studio initiatives. Arts Council England Contemporary Visual Arts: Table of Sources 20 Table of Sources – North West Name of Document Author / Organisation Intro Jack Hale ducing Manchester Craft & Design Date Content Summary Type of Document June 2004 The tenants of the Manchester Craft and Design Centre, which provides studio/workshop/retail space and exhibition opportunities for craftspeople and designer makers in central Manchester, devised a 20 year vision (inline with the City Councils promotion of the redevelopment of the Northern Quarter (NQ) as a cultural quarter for the inner city of Manchester). This resulted in a new organisational structure which sees the co-operative model replaced with a not for profit company-limited by guarantee and a new board of directors. MCaD potential aims are to: Background notes for meeting with Manchester City Council Cultural Strategy Group & ACE Attract/support/retain/develop/promote work of high-quality artists, crafts people and designers in Manchester Acquire freehold of the existing building from City Council and improve it Acquire other suitable properties in NQ for existing or relocating individuals Enable provision of suitable/relevant services such as: Marketing and promotion; Facilities management; Information – online info etc; Networking; Business support; Education and continuing professional development; Exhibition and conferencing; Retailing/catering; Financial; Residential provision; Childcare. Media Arts North Initiative (MANI) Karen Gutherie for the Arts Council FebDec 2004 The Arts Council England having recognised the ‘growing reputation’ of media arts in the North East, North West and Yorkshire (The North) commissioned a ‘Lead Advisor’ (Karen Gutherie) to facilitate capitalisation of this growing reputation by the process of inter-regional collaborations. Strategy paper for Media Arts Development across Arts Council England Contemporary Visual Arts: Table of Sources 21 England Consulting key media arts organisations and free-lancers from Yorkshire, the North West and the North East over three meetings the following three areas for capitalisation of growth and inter-regional collaboration emerged: Innovative Distribution; Audience Development and Interpretation; Curatorial Dialogue. Yorkshire the North West and the North East Page 13 – 17 - Innovative Distribution Rationale: based on: current inadequate opportunities to tour the North; acknowledgement of the value of developing the regional audience and regional distribution network; The North’s festivals vital to new work but collaboration co-production and co-commissioning still rare; The North’s RFO’s could develop new technological solutions in partnership with smaller organisations. Projects: Media Lounge Network Page 17 -21 – Audience Development and Interpretation Rationale: based on: The North has particularly active audiences existing research ‘Audience Yorkshire’; Existing interest to develop audiences through creating understanding of media arts; Region has individuals and organisations interested in the contextualisation, interpretation and broadening of access of media arts. Projects: - Media Relations Project; Grow your Own Media Lab Project (GYOML); Page 24 -28 – Curatorial Dialogue Rationale: based on; Lack of resources within media arts organisations for curatorial purposes but The North has a number of organisations with curatorial expertise which could be shared; Effects of this deficit in curatorial dialogue affects both individuals and quality and interpretation of the work in the region. Projects: Curatorial Mentoring Programme; Networking Events/Symposia (3). An MA in Beryl Graham 2004 Proposed by FACT and in association with the Culture Campus this report Research Arts Council England Contemporary Visual Arts: Table of Sources 22 Curating New Media Art for Liverpool For Arts Council England North West reviews the feasibility of a new MA in curating new media art. This report surveys resources, compares with relevant existing MA models, makes initial indications of competition and market as well as potential problems. However while it does make recommendations it does not propose content for any resulting MA course. Report (Interesting is the reference made to a ‘presentation review’ planned by ACE 2004, Marjorie Allthorpe-Guyton, “concerning curating education in general” – the findings of which “are likely to be of interest to those planning this proposed course”.) Interesting also is that The University of Sunderland had in development, during period in which research was conducted, a new MA in curating which could include an optional module in curating new media art – but not a specialist course. Through 5 case studies the relationships between education and arts organisations, as well as different funding structures are reviewed. The Liverpool context is then examined. Existing and possible strands of funding are reviewed as well as possible partnerships. Questionnaires were constructed to obtain indications as to existing patterns of demand for curating qualifications in relation to new media exhibiting. In conclusion the following recommendations were made: Proposed course should take advantage of the current ‘gap in the market’ May be necessary to choose two collaborators to ‘own’ the MA course Liverpool should proceed with proposal, but course must be outward looking and international in scope. High Status course requires regular additional funding of - ACE suggested Research has revealed adequate evidence of demand for the course Manchester Arts Council England North 2004 Identifying a steering group which is led by the Manchester City Council, this document outlines the consultation and discussion process which resulted in Report of Consultation Arts Council England Contemporary Visual Arts: Table of Sources 23 International Centre of Excellence for Fashion and Textiles West making a case for an International Centre of Excellence for Fashion and Textiles based in Manchester. The document outlines 7 options which were proposed and discussed – each relating the re - housing of Manchester City Galleries ’Designated Costume Collection’ to existing strategies in Manchester (NWDA Culture and Tourism, Manchester Knowledge Capital, Urban Regeneration and Economic Policies, Higher Education, and NWDA’s objectives for Textile and Creative Industries). The options discussed range from relocating the collection to the centre, to public and trade showcasing of collection or creating a Centre for Excellence in Conservation by consolidating and exhibiting various collections. process preceding tender Brief for feasibility study. As a result of this consultation process a tender document was created by the Arts Council England North West for a: Feasibility Study for he Establishment of an International Centre of Excellence for Fashion and Textiles in Manchester. Northwest Design Forum Phase 1 Report David Smith and Barney Hare-Duke For Liverpool Design Initiative Nov 2003 Report outlines phase one which consists of two forum workshops held in September 2003 (see workshop 1 as above). In this phase the sector was defined, issues sector was facing were established and the process of mapping interventions started. Report on first Phase Interventions focused on four issue areas: Education; Skills development; Business development; Market development. Conclusions included: More communication and collaboration between and within organisation would have an immediate and positive impact on the awareness, over-lap, take up and sustainability of interventions. There is no regional focal point or BIG idea for (the development and marketing) of the Northwest design sector. The Designer-Maker segment is more mature than the other three design service segments in terms of interventions. Arts Council England Contemporary Visual Arts: Table of Sources 24 Northwest Design Forum Workshop David Smith and Barney Hare-Duke 1 Report For Liverpool Design Initiative Open Studios in Cumbria Andy Mortimer, Arts Educational Services For Arts Council England, North West, and Cumbria County Council, Sept 2003 This report documents the Design Initiative’s objective (to strengthen the supply of and grow the demand for Northwest design) and strategy (3 phases). Northwest Design Forum Workshop 1 Report The workshop introduced the partners and their perspectives, gave a definition of the Design sector, and divided the Design disciplines into: for Manufacture; for Communication; for Physical Environment; for Lifestyle. Issues were listed relating to: Education; talent; prof development; agencies; marketing; funding; supply chain; collaboration; market knowledge; channels to market; business development; knowledge exploitation; JanJune 2003 The report considers the strategic development of open studios in Cumbria, in line with the County’s ‘Cultural Strategy’ and Arts Council England, North West’s ‘Creative Industries Policy’ to propose ideas for beneficial, sustainable and collective action. Research & development report Findings: Arts Council, the County Council and other local and regional agencies have an important role to play, and need to be proactive in supporting the development of open studios Precise form of support requires further negotiation between artists and funding bodies but three key features would seem essential to progress the effectiveness of open studios and arts festivals in Cumbria: Needs to be some form of direct, country-wide support for all the groups in order to foster networking, explore areas of common concern and develop further marketing and publicity opportunities. Needs to be continued identification of the ongoing and changing professional development needs of both individual artists and studio groups and the brokering of training opportunities to address these. Arts Council England Contemporary Visual Arts: Table of Sources 25 There needs to be support for the provision of an arena for critical debate within the wider open studio and visual arts community to encourage a real sense of engagement with not only local issues but regional national and international development. The case is consistently made for the importance of exhibition/presentation via Open Studios for artists. Page 3 – The National Picture: outlines importance of Open Studio’s for sale of work Page 4 – Open Studios in Cumbria: outlines Cumbria’s Open Studio’s and figures Page 7-8 – Conclusions: Concludes that Open Studio’s Need to bring their aspirations inline with key support agencies policies, criteria, targets, etc Need to link into existing programmes Require further research into improved sale of work at and beyond Open Studios Are open to forming a ‘federation’ Page 9 – Recommendations: Recommended that a ‘Federation’ of Cumbrian open studios be formed to network studio groups and to consider strategic issues and other matters. Recommended that funding be sought immediately to appoint an ‘Open Studios Facilitator’ to convene the meetings of the ‘Federation’ and undertake the support functions identified in this research. Graduate Retention Liverpool 2002 Heidi Reitmaier Commissione d by the Liverpool 2002 The research component aims to understand and present detailed reasons for the departure of fine art graduates from Liverpool considering Liverpool’s growing arts and cultural provision and focus. Strategic objectives addressed: Research document and strategic action plan The shape/context of the arts community in the region, UK and Liverpool Possible reasons for graduate migration Arts Council England Contemporary Visual Arts: Table of Sources 26 Biennial of Contemporary Art on Behalf of the Visual Arts Group Build on the creative partnerships between the various arts organisations, institutions and other sectors in the city Programmes and action plan that could stimulate interest and ensure greater access to arts opportunities for graduates in the centre. Page 5-7: Liverpool (along with Manchester) a ‘Hub for culture and the economy in the region’; NWDA’s strategy for the region focuses on culture and skilled people; Liverpool’s City Council looks at new development in ‘key industrial sectors’ which are leisure and culture, as well as talent retention. Page 11-14: SWOT – strengths include many new venues, growing infrastructure, long-term investment and partnerships; weaknesses include lack of resources, lack of long-term strategy and growth, lack of communication, perceptions of artist not in line with contemporary artist, lack of transferable skills, lack of work and living space. Page 24- 33 - Proposals for action – 4 strategic objectives for gradate retention; Ensure future professional development and support opportunities for local graduates Increase commitment, communication and build on the visibility of local, regional, national and international arts projects and artists within Liverpool and to promote local artists elsewhere Increase creative and innovative partnerships amongst the public and private sector Increase long-term commitment and growth through the current plans of regeneration and change. Greater North Curatorial Developm Antonia Payne 1998 Commissioned by what were the Regional Arts Boards (RBA’s) of the Greater North band – North West Arts, Northern Arts, and Yorkshire & Humberside Arts – this document evaluates the Greater North Curatorial Development Programme and puts forward proposals for future programming. An Evaluation of Activity 19951997 and Proposals for Arts Council England Contemporary Visual Arts: Table of Sources 27 ent Programm e Future The Primary aim shared by all three RBA’s was a focus on practising curators Programming to raise standards of the provision of contemporary visual art across the 1998-2001 Greater North. Group travel and research was hailed as successful (highlights include India) while individual travel and research grant applications were assessed as disappointing – however continuation of all travel and research grants was recommended. The requirement of supported collaborations to contain a partner of each of the RAB regions was said to be unviable and advised this be dropped. Reasons curators gave for not responding to travel or research grants are related to the ambiguous processes and demands of applications. Though curators were unenthusiastic about the possibility of mentoring and placements, artistcurators expressed interest, it was recommended that when/if resources became available this occur within RAB regions. Lack of curatorial confidence was seen to be an obstacle to networking and pairing schemes were recommended. The document advised that the programme should consider additional ways in which it can increase curator access to information about events and develop within the regional national and international visual art worlds – suggesting use of the internet and the Regional Arts Pages website. Acting on curator interest in conferences and colloquia was recommended especially as satellite activity could raise the profile of the Greater North venues. It was also recommended that the Greater North RBA’s approach ACE to establish an annual forum for information sharing in the interests of national curatorial development. Arts Council England Contemporary Visual Arts: Table of Sources 28 Other Documents Received – North West Name of Document A Snapshot of the Creative Industries in England’s North West Creative Industries in Cumbira Author / Organisation Date Content Summary Type of Doc Marc Collett and Burns Collett Sept 2004 Document prepared by Culture Northwest for the Department of Culture Media and Sport which describes: the region, the sectors, the impact of the creative industries sector, sub-sectors with potential for growth, NWDA prioritised sub sectors, gaps in research to support creative industry development, strengths/characteristics, constraints, etc. Many Northwest organisations active with the creative industries are cited and discussed. Discussion Document Apr 2004 Part-financed by ACE NW this report was for Cumbria County Council and the County LADAs (Local arts development agencies). It collects and analyses existing economic data, new data illustrating business performance of the sector and qualitative date/info of the needs of the sector. It asses potential areas of growth and intervention within the sector and provides comparisons with other similar/rural areas in the NW. The Final report would hope to serve as an aid to all public server partners in Cumbria, while the process will have developed the existing database of creative businesses in the County. Proposals would be made for future structures for collection and analysis of data. Evaluation of Creative Industries in Cumbria 2004 The Report establishes that the scheme works: it has been tested and provides a growing number of highly motivated graduates; has created a network of stakeholders and partners, and reinforced their strategies; has given undergraduates an understanding of setting up in business; has status as a Crafts Council scheme; is needed and should continue. External Evaluation of Setting-up Scheme For Culture Northwest Positive Solutions Draft Final Report The Next Barney Hare – Move: Duke Jeremy Evaluation Theophilus Report 2004 Arts Council England Contemporary Visual Arts: Table of Sources 29 Northwest Design Opportuni ties to grow and develop the regions design sector David Smith and Barney Hare-Duke Dec 2003 The document sets out the findings as discussed in the workshop 1 and phase 1 reports Presentation document Regional Crafts Council Photostor e Evaluation Report 2003 Document forms part of the Crafts Council’s continuing evaluation of the provision of Photostore and its services. Evaluation Report North Bryan West Arts Edmondson Board – Setting Up Scheme an Evaluation 1999 Evaluates interest in and impacts of the Setting up Scheme in the North West after having been implemented 6 years earlier. Evaluation Report For Liverpool Design Initiative Table of Sources – London Arts Council England Contemporary Visual Arts: Table of Sources 30 Name of Document Author / Organisation The Whitechapel Economic Gallery Impact of the Whitechap el Project Date Content Summary Type of Doc July 2005 The Whitechapel Project involves increasing the size of the galleries and project spaces at the Whitechapel Gallery, improving access and removing the need for closure for installation, installing a street front café and bar, extending opening hours, and increasing facilities for the education programme. The Project is due for completion in 2008. Draft report This report estimates the impact will transform the gallery from a business with £2m turnover to £2.9m, and increase of 45% have an impact on the economy of 60% increase footfall by 30% from 199,000 to 239,000 per year increase floor space by 78% have an annual impact via visitor spend of £10-15m, mostly spent in the locality reinforce the reputation of the Whitechapel Gallery as a major public exhibiting institution Fortify the role of the Whitechapel in drawing visitors into the East End. The potential is currently being explored for public realm enhancements, including the possibility of branding the surrounding Spitalfields area as a Cultural Quarter, and installing public art in front of the Gallery. Arts Council England Contemporary Visual Arts: Table of Sources 31 Energy and Overspill: Artist-led Spaces in London’s East End Peter Suchin July 2005 Development of artist-led gallery or project space over last 15-20 years in east End. Initially confined to Hoxton, now spreading to Hackney, Bethnal Green Rd, and Spitalfields. clustering allows them to draw on established audiences, and to coordinate open nights, share resources and advice ends the distinction between artist and gallerist. required a shift in perceptions from the anti-commercial artist to the ‘artistentrepreneur’ which started in the Thatcherite 80s with YBAs (Young British Artists) capitalise on a new breed of collectors, young businessmen and women Article in Artists Newsletter Characteristics: most do not show their own work (described as ‘vanity galleries’) most are non-commercial use email to keep marketing costs to a minimum often shoe-string finances, some ACE funding often adventurous programming allows newer artists exhibition time and established artists ability to show without commercial pressures Arts Council England Contemporary Visual Arts: Table of Sources 32 The Economic Impact of the Cultural Sector in Hackney: final report BOP for London Borough of Hackney/Hack ney Cultural Forum Feb 2005 The cultural sector in Hackney accounts for roughly 10% of employment in the Borough and almost 13% of businesses. Of these, Research report Page 6 visual arts accounts for 2,200 employees, in 430 enterprises with total turnover of £92.5m (including design). This represents 28% of the whole Hackney cultural sector (slightly higher proportion than London as a whole.) Page 9 visual arts (excluding design) accounts for 9.7% of cultural sector employees (460), 4.8% of enterprises (150) and 2.1% of the sector’s turnover (£12.5m). Page 11 the sector is dominated by micro-enterprises (86% of enterprises) reflecting Hackney employment patterns generally). Page 13 geographic patterns: cultural enterprises most heavily concentrated in the southern tip of the borough, in Shoreditch, in postcodes EC2 A3, NI 6, NI 7, E2 8 (again reflecting Hackney employment patterns generally). Maps illustrating this pp21-2. Page 24 business support includes Geffrye Museum training and nurturing freelance artists (predominantly BME background); inIVA offering workspace and business support, predominantly for women and those from BME background. Arts Council England Contemporary Visual Arts: Table of Sources 33 The Economic Impact of the Cultural Sector in Hackney: final report BOP for London Borough of Hackney/Hack ney Cultural Forum Feb 2005 The cultural sector in Hackney accounts for roughly 10% of employment in the Borough and almost 13% of businesses. Of these, Research report Page 6 visual arts accounts for 2,200 employees, in 430 enterprises with total turnover of £92.5m (including design). This represents 28% of the whole Hackney cultural sector (slightly higher proportion than London as a whole.) Page 9 visual arts (excluding design) accounts for 9.7% of cultural sector employees (460), 4.8% of enterprises (150) and 2.1% of the sector’s turnover (£12.5m). Page 11 the sector is dominated by micro-enterprises (86% of enterprises) reflecting Hackney employment patterns generally). Page 13 geographic patterns: cultural enterprises most heavily concentrated in the southern tip of the borough, in Shoreditch, in postcodes EC2 A3, NI 6, NI 7, E2 8 (again reflecting Hackney employment patterns generally). Maps illustrating this pp21-2. Page 24 business support includes Geffrye Museum training and nurturing freelance artists (predominantly BME background); inIVA offering workspace and business support, predominantly for women and those from BME background. Arts Council England Contemporary Visual Arts: Table of Sources 34 Energy and Overspill: Artist-led Spaces in London’s East End Peter Suchin July 2005 Development of artist-led gallery or project space over last 15-20 years in east End. Initially confined to Hoxton, now spreading to Hackney, Bethnal Green Rd, and Spitalfields. clustering allows them to draw on established audiences, and to coordinate open nights, share resources and advice ends the distinction between artist and gallerist. required a shift in perceptions from the anti-commercial artist to the ‘artistentrepreneur’ which started in the Thatcherite 80s with YBAs (Young British Artists) capitalise on a new breed of collectors, young businessmen and women Article in Artists Newsletter Characteristics: most do not show their own work (described as ‘vanity galleries’) most are non-commercial use email to keep marketing costs to a minimum often shoe-string finances, some ACE funding often adventurous programming allows newer artists exhibition time and established artists ability to show without commercial pressures Arts Council England Contemporary Visual Arts: Table of Sources 35 London Creative Industries Snapshot Key Questions on Regional Impact BOP for DCMS Dec 2004 Overall Creative industries contributed £21b to London’s GDP in 2000, greater than any other sector except business services. The UK’s creative industries are concentrated in London: London’s creative industries represent 25% of the sector across the UK. Data summary The sector has faster growth than any other sector in London at 8.5% pa. Advertising, architecture, art and antiques, film and photography, software and computer games all showed particularly strong growth rates. Employment Creative industries directly employ 468,700 in London and a further 182,000 are employed in other industries in creative jobs. Creative industries are the third largest employment sector in London and contributed one in five of London’s new jobs from 1995-2000. The sector is characterised by a high number of SMEs (employing fewer than 50) and micro-enterprises (employing fewer than 5). Regeneration There is evidence that creative industries contribute to the regeneration of specific areas such as Hoxton, with little public sector intervention. There will be creative industries initiatives in all new major LDA initiatives including the Thames Gateway, City Fringe, Stratford, and Lower Lee Valley. Social inclusion and diversity The proportion of workers of BME origin working in the sector is, at 11.6%, roughly half that of the London workforce as a whole. Women are also underrepresented at 36% of the creative industries workforce, compared to 45% of the overall London workforce. Potential for growth Growth 4.5%ofover the medium term is thought to be sustainable. Much Arts Council England Contemporary Visual Arts:ofTable Sources potential growth lies in specific sectors, particularly computer software, film and video, music, interactive leisure software, design and designer fashion. 36 Creative hubs leaflet Creative London - Creative Hubs are an initiative of Creative London, providing A space for work, participation and consumption of creative products Nurturing for emerging talent and support for businesses Introductory leaflet They have 4 main areas of focus: Talent: enabling, nurturing and training emerging talent, leading to employment and enterprise opportunities Enterprise: Business support, investment readiness, access to finance Property: Access to appropriate and affordable workspace across the creative business lifecycle Showcasing: Promoting London’s creative businesses, from the local to international level, and supporting export activities And they often invest in and boost the work of existing community bodies that have the necessary track record and ambition. London’s Creative Sector: 2004 Update GLA Economics/LD A 2004 Page 1 summary London has 40% of creative industries jobs, growing faster Research report than any other industry except financial and business services. Data is not broken down sufficiently to identify visual arts. Arts Council England Contemporary Visual Arts: Table of Sources 37 Oranges and Lemons and Oranges and Bananas http://www. artistsineastl ondon.org/e ssay/index.h tm ACME 2001 History of artists in the east of London 1960-2000 Essay Charts the need for artists in the 1960s to get new studio space because of 1 rising rents in central areas of London 2 Changing practice leading to the need for larger spaces leading to SPACE applying for funding in 1968 for money to develop St Katherine Dock as artist space, followed closely by ACME who developed cheap short life housing and studio space for artists in east London. Whitechapel Open numbers applying grew 1960-70s showing growing number of artists in east, and following that growing amounts of exhibition as well as production. Importance of Whitechapel Art Gallery as focus for local artist activity especially under Nicolas Serota 1976-88. Development of galleries directly linked to studio organisations such as Matt’s gallery (at ACME). Chisenhale established by artists. Role of Freeze exhibition 1988 which launched Brit Art and numbers of that generation of artists living /exhibiting in the east of London. Arts Council England Contemporary Visual Arts: Table of Sources 38 Creative and Cultural Industries in Newham Newham Council June 2000 Now somewhat out of date. Research report P6 Visual arts/crafts/design – 225 artists and companies identified, mainly centred around Stratford in artists’ studios and Stratford Workshops. Key issue is finding low cost supportive premises with other creative individuals. P8 Stratford town centre identified as a key location and ‘vibrant cultural and urban quarter’ with theatre as well as visual arts. 2 large studios: Waterhouse Studios and Stratford Workshops. P12 SWOT analysis identifies weaknesses as the perception of Newham as far from central London lack of affordable studio and workspace perception of an unpleasant and unsafe environment opportunities include potential for artists moving east for cheaper premises appendix 1 survey of artists and designers most located in Newham for cheap accommodation poor image of borough nearly half saw development of Stratford as a strength Arts Council England Contemporary Visual Arts: Table of Sources 39 Arts Council England Contemporary Visual Arts: Table of Sources 1