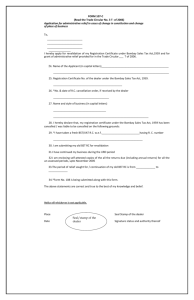

to the PDF File - VAT Acts ( Jharkhand )

advertisement