Disc. assign.

advertisement

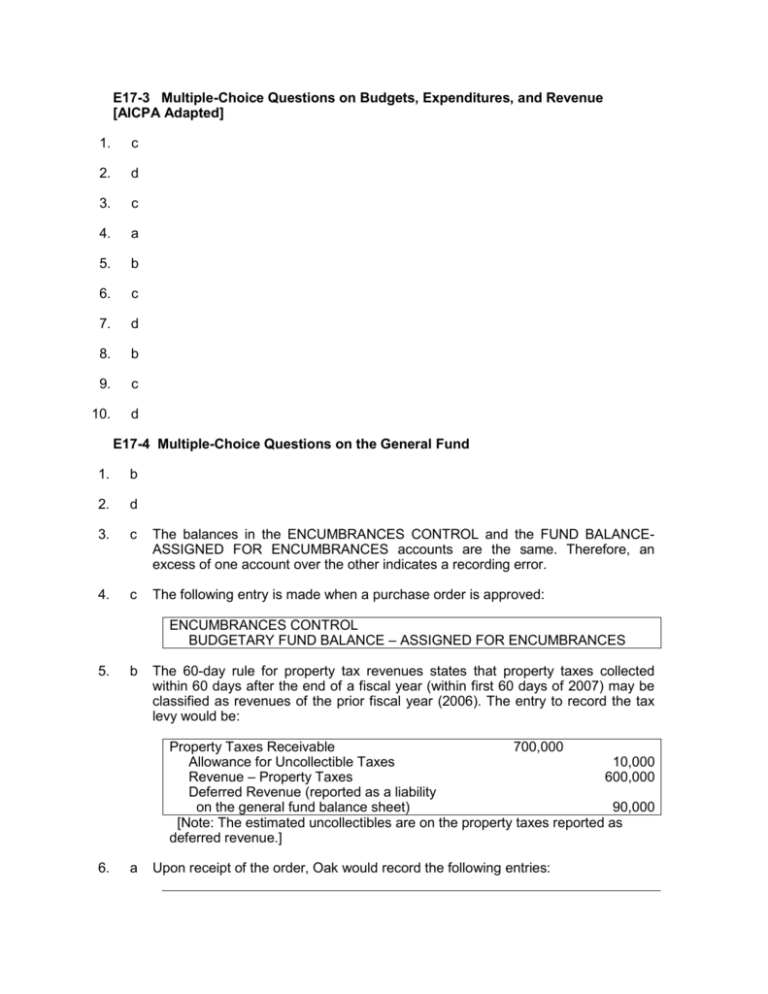

E17-3 Multiple-Choice Questions on Budgets, Expenditures, and Revenue [AICPA Adapted] 1. c 2. d 3. c 4. a 5. b 6. c 7. d 8. b 9. c 10. d E17-4 Multiple-Choice Questions on the General Fund 1. b 2. d 3. c The balances in the ENCUMBRANCES CONTROL and the FUND BALANCEASSIGNED FOR ENCUMBRANCES accounts are the same. Therefore, an excess of one account over the other indicates a recording error. 4. c The following entry is made when a purchase order is approved: ENCUMBRANCES CONTROL BUDGETARY FUND BALANCE – ASSIGNED FOR ENCUMBRANCES 5. b The 60-day rule for property tax revenues states that property taxes collected within 60 days after the end of a fiscal year (within first 60 days of 2007) may be classified as revenues of the prior fiscal year (2006). The entry to record the tax levy would be: Property Taxes Receivable 700,000 Allowance for Uncollectible Taxes 10,000 Revenue – Property Taxes 600,000 Deferred Revenue (reported as a liability on the general fund balance sheet) 90,000 [Note: The estimated uncollectibles are on the property taxes reported as deferred revenue.] 6. a Upon receipt of the order, Oak would record the following entries: BUDGETARY FUND BALANCE – ASSIGNED FOR ENCUMBRANCES ENCUMBRANCES CONTROL Expenditures Control Vouchers Payable 7. a 5,000 5,000 4,950 Johnson would record the following entry: ESTIMATED REVENUES CONTROL 9,000,000 ESTIMATED OTHER FINANCING SOURCE – TRANSFER IN (Internal Service) 1,000,000 ESTIMATED OTHER FINANCING SOURCE – TRANSFER IN (Debt Service) 500,000 APPROPRIATIONS CONTROL BUDGETARY FUND BALANCE – UNASSIGNED 8. c 9. a 10. b 4,950 XXXXXX XXX E17-5 Encumbrances at Year-End a. Outstanding encumbrances lapse at year-end. (1) Order equipment—November 3, 20X2: ENCUMBRANCE BUDGETARY FUND BALANCE--ASSIGNED FOR ENCUMBRANCES Order equipment and record encumbrance. (2) 21,000 21,000 Year-end entries—December 31, 20X3: BUDGETARY FUND BALANCE – ASSIGNED FOR ENCUMBRANCES ENCUMBRANCES Close remaining budgeted encumbrances. 21,000 21,000 Fund Balance – Unassigned 21,000 Fund Balance – Assigned for Encumbrances 21,000 Reserve actual fund balance for outstanding encumbrances at year-end. (3) City Council accepts outstanding encumbrances—January 1, 20X3: Fund Balance – Assigned for Encumbrances Fund Balance – Unassigned Reverse prior-year encumbrance reserve. 21,000 21,000 ENCUMBRANCES 21,000 BUDGETARY FUND BALANCE – ASSIGNED FOR ENCUMBRANCES 21.000 Establish budgetary control over encumbrances renewed from prior year. (4) Equipment received—January 18, 20X3: BUDGETARY FUND BALANCE – ASSIGNED FOR ENCUMBRANCES ENCUMBRANCES Remove budgetary reserve for goods received. 21,000 21,000 Expenditures 21,800 Vouchers Payable Record expenditure for goods received at actual cost of $21,800. (5) 21,800 Year-end entry—December 31, 20X3: Fund Balance—Unassigned Expenditures Close 20X3 expenditures account. 21,800 21,800 E17-5 (continued) b. Outstanding encumbrances are nonlapsing. (1) Order equipment—November 3, 20X2: ENCUMBRANCE BUDGETARY FUND BALANCE--ASSIGNED FOR ENCUMBRANCES Order equipment and record encumbrance. (2) Fund Balance – Unassigned Fund Balance – Assigned for Encumbrances Reserve fund balance for outstanding encumbrances. 21,000 21,000 21,000 21,000 21,000 Equipment received—January 18, 20X3: Expenditures – 20X2 Expenditures (20X3) Vouchers Payable Record actual expenditure for goods received. (5) 21,000 Date the encumbrances from prior year—January1, 20X3:: Fund Balance – Assigned for Encumbrances Fund Balance – Assigned for Encumbrances – 20X2 Reclassify reserve from 2002, prior year. (4) 21,000 Year-end entries—December 31, 20X2: BUDGETARY FUND BALANCE – ASSIGNED FOR ENCUMBRANCES ENCUMBRANCES Close remaining budgetary encumbrances. (3) 21,000 21,000 800 21,800 Closing entries—December 31, 20X3: Fund Balance – Assigned for Encumbrances – 20X2 21,000 Expenditures – 20X2 Close expenditures account for prior year encumbrances. Fund Balance – Unassigned Expenditures (20X3) Close expenditures for current year. 21,000 800 800 E17-5 (continued) (Note: In entry (4), the $800 excess of actual cost over the encumbered amount must be approved as part of 20X3's expenditures. Entry (4) records the City Council’s approval with a debit to Expenditures (20X3) which increases 20X3’s total expenditures. The expenditures for 20X3 are closed in entry (5). If the actual cost was less than the encumbered amount, then the difference should be closed to Fund Balance-Unassigned, although some governmental units have a policy of closing any difference between actual and encumbered amounts for prior year encumbrances to the current year's expenditures.) c. (1) Outstanding encumbrances are nonlapsing; City Council cancels order— January 1, 20X3: Fund Balance—Assigned for Encumbrances Fund Balance—Unassigned City Council cancels 20X2 order for equipment. 21,000 21,000 E17-6 Accounting for Inventories of Office Supplies a. Consumption method of accounting for inventories: (1) Purchase of supplies: August 8, 20X2 Expenditures Vouchers Payable Acquire inventory of supplies. (2) 3,600 3,600 Entries at end of 20X2 fiscal year: September 30, 20X2 Inventory of Supplies Expenditures Recognize ending inventory of supplies. Fund Balance – Unassigned Fund Balance – Assigned for Inventories Establish fund reserve for ending inventory. Fund Balance – Unassigned Expenditures Close expenditures account. 2,800 2,800 2,800 2,800 800 800 E17-6 (continued) (3) Entry at end of 20X3 fiscal year: September 30, 20X3 Expenditures Inventory of Supplies Record expenditures for inventories consumed. b. 2,800 2,800 Fund Balance – Assigned for Inventories Fund Balance – Unassigned Remove fund balance reserve for inventories consumed. 2,800 Fund Balance – Unassigned Expenditures Close expenditures account. 2,800 2,800 2,800 Purchase method of accounting for inventories: (1) Purchase of supplies: August 8, 20X2 Expenditures Vouchers Payable Acquire inventory of supplies. (2) 3,600 Entries at end of 20X2 fiscal year: September 30, 20X2 Inventory of Supplies Fund Balance – Assigned for Inventories Recognize ending inventory of supplies. Fund Balance – Unassigned Expenditures Close expenditures account. (3) 3,600 2,800 2,800 3,600 3,600 Entries at end of 20X3 fiscal year: September 30, 20X3 Fund Balance – Assigned for Inventories Inventory of Supplies Remove fund balance reserve for inventories consumed. 2,800 2,800 P17-14 General Fund Entries [AICPA Adapted] 1. ESTIMATED REVENUES CONTROL APPROPRIATIONS CONTROL BUDGETARY FUND BALANCE – UNASSIGNED Record the budget. 3,000,000 Taxes Receivable Allowance for Uncollectible Taxes Revenue from Taxes Record tax levy. 2,870,000 Cash Taxes Receivable Record tax collection. 2,810,000 Allowance for Uncollectible Taxes Taxes Receivable Record write-off of uncollectible taxes: July 1, 20X1, taxes receivable balance 20X2 tax levy Less: Taxes collected Taxes receivable final balance Taxes written off as uncollectible Cash Miscellaneous Revenue Collect miscellaneous revenue. 2. 2,980,000 20,000 70,000 2,800,000 2,810,000 40,000 40,000 $ 150,000 2,870,000 (2,810,000) (170,000) $ 40,000 130,000 130,000 Fund Balance – Assigned for Encumbrances Fund Balance – Unassigned Reverse prior reserve which has been renewed. 60,000 ENCUMBRANCES BUDGETARY FUND BALANCE – ASSIGNED FOR ENCUMBRANCES Renew encumbrances from prior period. 60,000 ENCUMBRANCES BUDGETARY FUND BALANCE – ASSIGNED FOR ENCUMBRANCES Record encumbrances. 2,700,000 60,000 60,000 2,700,000 P17-14 (continued) 3. 4. Expenditures Due to Other Funds Record liability to other funds for services received. BUDGETARY FUND BALANCE – ASSIGNED FOR ENCUMBRANCES ENCUMBRANCES Reverse encumbrances for items received. Expenditures Vouchers Payable Record expenditures. BUDGETARY FUND BALANCE – ASSIGNED FOR ENCUMBRANCES ENCUMBRANCES Reverse reserve for encumbrances. Expenditures (Prior Period) Vouchers Payable Actual expenditure for goods received. Due to Other Funds Vouchers Payable Record approval for payment to other funds. Vouchers Payable Cash Record voucher payments. 5. ENCUMBRANCES BUDGETARY FUND BALANCE – ASSIGNED FOR ENCUMBRANCES Record May 10 encumbrance. 142,000 142,000 2,700,000 2,700,000 2,700,000 2,700,000 60,000 60,000 58,000 58,000 210,000 210,000 2,640,000 2,640,000 91,000 91,000 P17-15 General Fund Entries and Statements a. Entries for 20X2 budget and transactions: 1. 2. ESTIMATED REVENUES CONTROL APPROPRIATIONS CONTROL ESTIMATED OTHER FINANCIAL USES – TRANSFER OUT Record budget. 1,877,000 1,840,000 37,000 ENCUMBRANCES BUDGETARY FUND BALANCE – ASSIGNED FOR ENCUMBRANCES Renew encumbrances from prior period. 21,000 Fund Balance – Assigned for Encumbrances Fund Balance – Unassigned Reverse reserve for renewed encumbrances. 21,000 21,000 21,000 Property Tax Receivable – Current Allowance for Uncollectibles – Current Property Tax Revenue Record property tax levy. 1,600,000 Cash Property Taxes Receivable – Current Property Taxes Receivable – Delinquent Collect property taxes. 1,590,000 Allowance for Uncollectibles – Delinquent Property Taxes Receivable – Delinquent Property Tax Revenue Write off remaining delinquent property taxes. 16,000 1,584,000 1,507,000 83,000 9,000 7,000 2,000 Property Taxes Receivable – Delinquent 93,000 Allowance for Uncollectibles – Current 16,000 Property Taxes Receivable – Current Allowance for Uncollectibles – Delinquent Reclassify remainder of uncollected 20X2 property taxes. Cash Sales Tax Revenue Miscellaneous Revenue Due to Motor Pool Fund Other cash receipts. 93,000 16,000 333,000 284,000 39,000 10,000 P17-15 (continued) 3. ENCUMBRANCES BUDGETARY FUND BALANCE – ASSIGNED FOR ENCUMBRANCES Record purchase orders. BUDGETARY FUND BALANCE – ASSIGNED FOR ENCUMBRANCES ENCUMBRANCES Reverse reserve for items received. 4. b. 1,800,000 1,800,000 1,773,000 1,773,000 Expenditures Vouchers Payable Actual expenditures for items received. 1,788,000 Vouchers Payable Cash Vouchers paid. 1,793,000 1,788,000 1,793,000 Due from Central Stores Fund Other Financing Uses – Transfer Out Cash Other cash payments and transfer. 13,000 37,000 50,000 Pine Ridge General Fund Preclosing Trial Balance December 31, 20X2 Debit Cash Property Tax Receivable – Delinquent Allowance for Uncollectibles – Delinquent Due from Central Stores Fund Vouchers Payable Due to Motor Pool Fund Fund Balance – Unassigned Property Tax Revenue Sales Tax Revenue Miscellaneous Revenue Expenditures Other Financing Uses – Transfer Out ESTIMATED REVENUES CONTROL APPROPRIATIONS CONTROL ESTIMATED OTHER FINANCING USES– TRANSFER OUT ENCUMBRANCES BUDGETARY FUND BALANCE – ASSIGNED FOR ENCUMBRANCES Credit $ 191,000 93,000 $ 16,000 13,000 26,000 10,000 161,000 1,586,000 284,000 39,000 1,788,000 37,000 1,877,000 1,840,000 37,000 48,000 $4,047,000 48,000 $4,047,000 P17-15 (continued) c. Closing entries: APPROPRIATIONS CONTROL ESTIMATED OTHER FINANCING USES – TRANSFER OUT ESTIMATED REVENUES CONTROL Close budgetary accounts. BUDGETARY FUND BALANCE – ASSIGNED FOR ENCUMBRANCES ENCUMBRANCES Close remaining encumbrances. 1,840,000 37,000 1,877,000 48,000 48,000 Fund Balance – Unassigned 48,000 Fund Balance – Assigned for Encumbrances Reserve fund balance for outstanding purchase orders. Property Tax Revenue Sales Tax Revenue Miscellaneous Revenue Expenditures Other Financing Uses – Transfer Out Fund Balance – Unassigned Close operating statement accounts. d. 48,000 1,586,000 284,000 39,000 1,788,000 37,000 84,000 Pine Ridge General Fund Balance Sheet December 31, 20X2 Assets Cash Property Tax Receivables – Delinquent Less: Allowance for Uncollectibles – Delinquent Due from Central Stores Fund Total Assets Liabilities and Fund Balance Vouchers Payable Due to Motor Pool Fund Fund Balance: Spendable: Assigned to: General Government Services Unassigned Total Liabilities and Fund Balance $191,000 $ 93,000 (16,000) 77,000 13,000 $281,000 $ 26,000 10,000 $ 48,000 197,000 245,000 $281,000 P17-15 (continued) e. Pine Ridge General Fund Statement of Revenues, Expenditures, and Changes in Fund Balance For Fiscal Year Ended December 31, 20X2 Revenue: Property Taxes Sales Taxes Miscellaneous Total Revenue Expenditures: Current Capital Outlay – Furniture Total Expenditures Excess of Revenue over Expenditures Other Financing Sources (Uses): Transfer Out Change in Fund Balance Fund Balance, January 1, 20X2 Fund Balance, December 31, 20X2 $1,586,000 284,000 39,000 $1,909,000 $1,746,000 42,000 $1,788,000 $ 121,000 (37,000) 84,000 161,000 $ 245,000 $ [Note that the $42,000 expenditure for the office furniture capital outlay is reported separately. The theoretical support for this is that the expenditure will also benefit future periods. Some governmental entities report capital outlays made in the general fund with current expenditures because current financial resources were expended. Some governments integrate capital outlay expenditures into the appropriate functional categories (e.g., fire protection, government administration, or streets and highways) rather than separately report the expenditures for capital outlays. The choice of reporting alternative for the general fund is up to the governmental entity because the total expenditures will be the same regardless of how or where the capital outlay is reported.] P17-17 Identification of Governmental Accounting Terms 1. Government-wide financial statements 2. The Governmental Accounting Standards Board (GASB) 3. A fund 4. Interfund services provided or used 5. Internal service and enterprise funds 6. Infrastructure assets 7. Agency and trust funds 8. Modified accrual basis 9. Flow of total economic resources 10. The property tax levy 11. The general, special revenue, capital projects, debt service funds and permanent funds 12. The allowance for uncollectible property taxes 13. Budgetary fund balance – unassigned 14. Encumbrances 15. The consumption method 16. Other financing uses – transfer out 17. Expenditures 18. Fund balance – unassigned 19. Expenditures 20. Appropriations 21. Nonlapsing method