Blair, Theory of Firm

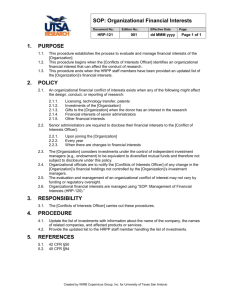

advertisement