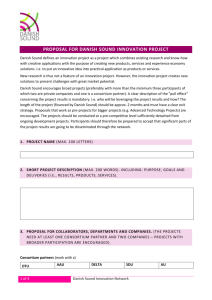

Mapping of the Danish pop music industry

advertisement