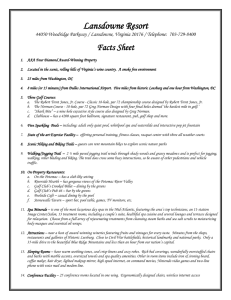

Third Party Event Guidelines - Lansdowne Children's Centre

advertisement

3rd Party Event GUIDELINES THA NK YOU! Thank you for choosing the Lansdowne Children’s Centre (LCC) Foundation as the beneficiary of your fundraising event. We truly appreciate the generous support we receive from the local community. This support is invaluable in assisting us in our efforts to raise the funding so desperately needed to run our many programs and services the Lansdowne Children’s Centre provides for the thousands of children and youth in need in our communities each year. At the Lansdowne Children’s Centre, it is our mission to support children and youth with physical, developmental or communications needs and their families. The support of Third Party Special Events is integral to this success. We are extremely grateful for your commitment to making a difference in the lives of the children and families in need of our services. The Lansdowne Children’s Centre Foundation is a not for profit organization that abides by Federal and Provincial laws for charitable giving. To assist you in the successful planning of your fundraising event in benefit of the Lansdowne Children’s Centre Foundation, please read through our Event Guidelines. The enclosed 3rd Party Event - Agreement must be submitted for approval prior to using the name and/or logo of the LCC and LCCF. Thank you again for considering the Lansdowne Children’s Centre Foundation for your charity benefit. Thank you for your commitment to our community and to the children, youth and families in need of our services. Your generosity truly does make a difference. If you have any questions or would like to discuss your event plans, please contact Erin Helmer, Fund Development Officer at 519.753.3153 ext. 221 or by email at ehelmer@lansdownecc.com. GETTING STARTED Third Party Events are fundraisers created and managed by businesses, organizations or individual volunteers. These fundraisers demonstrate your belief and commitment to the services and programs offered by the Lansdowne Children’s Centre. Third Party Fundraising Events can be as simple as a bake sale or as intricate as a gala evening. The ideas are endless. Some Event Ideas include … Staff BBQ’s Holiday Celebrations Theme Parties Tournaments A-thons i.e. Bike, Spin, Dance Walks/Runs Craft Shows Dress Down Days Book Sales Bake Sales Car Washes Fashion Shows If you are new to the Lansdowne Children’s Centre family please fill out an Event Proposal Form (available upon request from the LCC Foundation office). It may seem a little tedious – but it will help to make sure things run smoothly and allow the LCC Foundation to offer some advice and/or guidance. If this is a second, third or even forth time putting on a charitable event for the LCC Foundation (good for you – it is a great cause!) please fill out the shorter form 3rd Party Event – Agreement. If you are seeking donors of prizes and/or sponsorships please send the Fund Development Officer (Erin Helmer) a list of potentials you are planning on approaching. This allows us the chance to prevent duplication of requests for support from community organizations. Please note that the Foundation is to be advertised as the beneficiary of proceeds, not as a presenter, host or sponsor of the event. What the Lansdowne Children’s Centre Foundation Can Do To Help You … Offer advice and expertise on event planning Provide and approve usage of our logo, tagline and name Assist in promoting the event on our website and through media releases as deemed appropriate Provide a letter of support to validate the authenticity of your event, if requested Provide a written tax receipt for donations of $20 or more to donors who make their cheques payable to the Lansdowne Children’s Centre Foundation Possibly coordinate a cheque presentation with the Lansdowne Children’s Centre Foundation, if scheduling permits Where possible, we may be able to provide staff or volunteers to attend your event What the Lansdowne Children’s Centre Foundation Can Not Do To Help You … Extend our tax exemption to you Provide funding or reimbursement for expenses Solicit sponsorship revenue for your fundraiser Provide mailing lists of donors, volunteers or vendors Issue gift-in-kind receipts Guarantee staff, volunteers or board members at your event KEYS TO SUCCESSFUL T HIRD PA RTY EVENTS 1. Brainstorm Share your event ideas with colleagues, staff, friends and family. Measure how feasible the ideas are and whether or not others will be interested in the event. 2. Enlist Support Planning an event is time consuming. We recommend forming an event committee and dividing it into sub-committees so each of your dedicated and hard-working volunteers can each have a manageable role to play in the project. 3. Know Your Audience Make sure the event will appeal to the audience you are targeting. 4. Establish Your Goals Set a realistic financial goal by creating a budget that includes projected revenue, expenses and net funds. 5. Set a Date Determine an appropriate and convenient time and location when people are available. Remember to take into consideration holidays and other planned events. 6. Marketing and Promotion Promotion is the key to success. After drafting your marketing and promotional materials, please have them reviewed and approved prior to use by the Foundation staff to ensure they are consistent with our branding. 7. Collecting the Proceeds We kindly request that all funds related to your event are submitted to the Lansdowne Children’s Centre Foundation within 90 days of your event. Charitable receipts will be issued on a timely basis. Please note that the final decision to issue official tax receipts rests with the Lansdowne Children’s Centre Foundation and must be agreed upon prior to the commencement of the event. 8. Say Thank You The success of your event should be shared! You can never say thank you enough to your volunteers, sponsors, guests and other supporters. Please ensure that acknowledgement and thanks are generously given to everyone involved to show them how much their contributions were appreciated. 9. Do It Again … Review and evaluate the success of the event and begin strategies for next year! B EFORE YOU OFFER A T A X RECEIPT The Lansdowne Children’s Centre Foundation is a registered charity accountable to its donors and as such adheres to rules and regulations of the Canada Revenue Agency (CRA) to protect its donors and charitable status. The final decision to issue official tax receipts rests with the Lansdowne Children’s Centre Foundation and must be agreed upon prior to the commencement of the event. In order for the Foundation to agree to issue tax receipts, conditions as set by the CRA must be met. A gift is defined as a voluntary transfer of property without valuable consideration. To qualify as a gift, all three of the following conditions must be met: 1. Some property, either in the form of cash or a gift-in-kind is transferred by a donor to a registered charity 2. The property is given voluntarily 3. The donor gives without expecting anything in return. TAX RECEIPT GUIDELINES The Foundation issues charitable tax receipts for donations of $20 or more to individual donors, and business acknowledgment letters to organizations that make a cash donation to your event. Receipts can not be issued to the organizer for proceeds from an event; receipts are only issued for direct donations where the donor receives no benefits from their contribution i.e. no advertising, promotion etc. You must provide documentation to support tax receipting for donations within 90 days of the event. Tax receipts are issued in a timely fashion upon receipt of all required information. For cheques without the contact information of the donor printed on them and for cash donations, the Third Party will provide Lansdowne with a spreadsheet of donor contact information including name and full mailing address. In order to issue tax receipts for 2008, all donor and revenue information must be received within the calendar year. Sale of raffle tickets, admission tickets, green fees, auction items and other goods that provide a benefit to donors are not eligible for a tax receipt. The Foundation does not issue tax receipts for gift-in-kind donations such as ticket sales, auction items or event sponsorships. Receiptable portions can be issued however this must be discussed and agreed to well in advance of your event date. LCC FOUNDATION’S PRI VA CY POLICY The Lansdowne Children’s Centre Foundation (the Foundation) is committed to protecting the privacy of our donors, employees and other stakeholders. We value the trust of those with whom we deal and are accountable to our donors. We adhere to the principles of the Personal Information Protection and Electronic Documents Act (PIPEDA) to ensure the appropriate protection of all personal information shared with us. As a result, we must ensure that all associated Third Party Event Organizers themselves are knowledgeable and compliant with the principles of PIPEDA. As a fundraising event organizer you must also ensure that all associated volunteers or other stakeholders associated with your event or project are aware of and are working in compliance with PIPEDA. The information you share with the Foundation will be held in the strictest of confidence and will only be used for the purposes for which you disclose the information to us. For more information on the Foundation’s Privacy Policy and Practices, please contact our office – we would be happy to discuss further.