Financial Accounting Standard for

advertisement

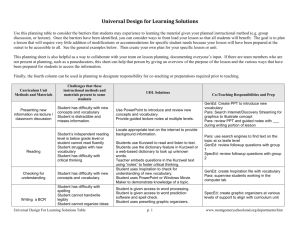

Financial Accounting Standard for General Presentation and Disclosure 1 Financial Accounting Standard for General presentation and Disclosure Content Topic 1. Scope of the standard 2. Objective of the standard 3. The standard text 4. Illustrative forms and general guidelines for the preparation of financial statements. 2 Page 2 2 2 21 Financial Accounting Standard for General Presentation and Disclosure 1. Introduction: This standard determines the requirements of general presentation and disclosure of the financial statements of profit seeking enterprises, consolidated financial statements, and financial statements of enterprises under formation. It also determines the treatment of accounting changes and contingent gains and losses. Furthermore, it defines disclosure requirements regarding the definition of an accounting entity, the nature of its activities, the nature of each of the financial statements, accounting policies, commitments, and events subsequent to the preparation of the financial statements. (Para. 578) This standard has been divided into four main parts: the first part is concerned with the standard of general presentation; the second part is concerned with the standard of general disclosure; the third part is concerned with the requirements of general presentation and disclosure of consolidated financial statements; and the fourth part is concerned with the requirements of general presentation and disclosure of financial statements of enterprises under formation. (Para. 579) This standard should be studied in light of the illustrative introduction, the proposed statement of financial accounting objectives in the kingdom, and the proposed statement of financial accounting concepts. (Para. 580) 2. Scope of the Standard: This standard applies to financial statements of profit-seeking enterprises, regardless of their legal form or the nature of their activities. Furthermore, this standard contains specific considerations regarding the materiality that should be taken into account in deciding whether individual accounts should be disclosed separately or can be combined with other accounts for financial statement presentation purpose. These considerations are not applicable to the other subjects addressed by the standard of general presentation and disclosure. (Para. 581) 3. Text of the Standard: The following is the text of the standard of the general presentation and disclosure: 3.1 General Presentation: The Standard of General Presentation defines the requirements of information presentation in the financial statements as a whole and in each statement. The following are the details of these requirements. (Para.582) 3.1.1 General Requirements: 1. The complete set of financial statements The complete set of financial statements consists of the following: Statement of Financial Position. Income Statement. Statement of Cash Flows. Statement of Changes in Owners’ Equity, or alternatively, a Statement of Retained Earnings. These statements and related disclosure represent the minimum requirement for presenting the financial position, results of operations, and cash flows. (Para. 583) 3 2. Sequence of the Financial Statements Presentation The financial statements should be presented in the following order: The Statement of Financial Position. The Income statement. The statement of Cash Flows. The Statement of Retained Earnings or the Statement of Changes in Owners’ equity. Notes to the Financial Statements. (Para. 584) 3. Materiality Considerations An individual account or group of accounts is considered to be material if its omission, non-disclosure, or improper presentation causes deviation or distortion to the information presented in the financial statements, or this information is inadequate to evaluate the performance of the entity. In deciding whether an item is material for presentation purposes, its type and relative amount should be taken into consideration. Ordinarily, these two factors should be evaluated together. In some circumstances, however, either one of them may be the decisive factor. (Para. 585) In studying the type of an account or group of accounts for financial statements disclosure purposes, the following should be taken into consideration: 1. The nature of the account or group of accounts (e.g. cash, merchandise inventory, accounts receivable, notes receivable, investment by owners, distributed profits, sales, revenue from real estate investments, revenue from investments in other companies, gains from fixed assets sales, losses, salaries and wages, advertising expenses, rentals, cost of goods sold, etc.) 2. The basis of accounting measurement or recognition of the account or group of accounts (e.g. realizable value, historical cost after depreciation, first-in-first-out (FIFO), moving average cost, date of the exchange transaction which generated revenue, etc.) 3. The reliability of the accounting measurement (e.g. estimated liabilities, actual liabilities, estimated revenues, actual revenues, estimated expenses, actual expenses, etc.) 4. The ability of an enterprise’s management to determine the magnitude of an account or group of accounts (e.g. variable expenses, fixed expenses, semi-fixed expenses, expenses subject to management’s judgment such as research and development and advertising expenses, unexpected expenses, etc.) 5. The significance of an account or group of accounts to the users of the financial statements. (Para. 586) A. When considering the relative value of an item, class or component, it should be compared against an appropriate base value. The following base values should be used: 1. Each item, class or component of the Income Statement should be compared with the net income for the current year or the average net income for the last five years (including the current year), whichever is the more relevant measure of net income, taking into consideration the business trend during that period. 4 2. Each item, class or component of the Statement of Financial Position should be compared against the lower of: a. Total owners’ equity (net assets), or b. The appropriate total of the class to which the item belongs, for example, total current assets, total non-current assets, total current liabilities, or total non-current liabilities. Where an item is subject to comparison against the base values described in (a) and (b) above, the more stringent test should prevail. 3. Each item of one of the Statement of Cash Flows sections should be compared against the total of that section, such as net cash flows from (or used in) operating activities, investing activities, or financing activities. (Para. 7) B. The following guidelines should be applied when considering the materiality of an item, class or component: 1. An item, class or component is considered material if its value is greater than or equal 10 percent of the appropriate base value, unless an evidence exists to the contrary. 2. An item, class or component is considered immaterial if its value is less than or equal 5 percent of the appropriate base value, unless an evidence exists to the contrary. 3. When the value of an item, class or component is between 5 and 10 percent of the base value, deciding its materiality will be subject to professional judgment, depending on the circumstances. Although the above guidelines are somehow arbitrary, their application helps reduce the possibility of wide discrepancy in materiality judgments. (Para 8) General Bases for Financial Statements Presentation: 1. Financial statements should be prepared in such a form and use of terminology and classification of items that significant information is readily understandable. Items not significant in themselves should be grouped with such other items as most closely approximate their nature. To eliminate unnecessary details, it is preferable to express all of the amounts in the financial statements to the nearest one thousand monetary units depending on the magnitude of the amounts involved. (Para. 9) 2. Financial statements are generally more useful when they are presented in comparative form with those of the preceding accounting period (or periods). When comparative statements are presented, the notes to the financial statements should contain information for all the periods presented to the extent currently relevant. If changes have occurred in the manner or the basis of presenting the financial statements items from one period to another, such changes should be disclosed and explained in accordance with the requirements of this standard. (Para. 10) 3. Each financial statement must have a title that describes its content and presents the name of the accounting entity and its legal form (corporation, limited liability 5 company, partnership, etc.) and the accounting period (s) for which the financial statement is presented. (Para. 11) 4. Notes to the financial statements should be captioned in such a manner that each caption should adequately describe the information contained. Notes should be numbered and the financial statements should contain specific references thereto. In addition, each financial statement should include a reference stating that the accompanying notes are an integral part of the financial statements. (Para.12) Presentation requirements in the Statement of Financial Position: 1. The Statement of Financial Position should include and properly describe all assets, liabilities and elements of owners’ equity. Assets and liabilities should not be offset unless a legal right of setoff exists. (Para. 13) 2. Assets should be presented in the Statement of Financial Position in accordance with the following order: a. Current assets. b. Investments and financial assets. c. Fixed assets. d. Intangible assets. e. Other assets. (Para. 14) 3. Liabilities should be presented in the Statement of Financial Position in the following order: a. Current liabilities. b. Non-current liabilities. (Para. 15) 4. Owners’ equity should be presented in the Statement of Financial Position in the following order: a. Paid-in capital. b. Additional-paid-in capital, unless the corporate law requires such an item be presented differently. c. Donated capital. d. Reserves (appropriated retained earnings). e. Un-appropriated return earnings. (Para. 16) 5. Assets and liabilities should be classified into current and non-current. Current assets should include cash and those assets ordinarily realizable in cash or sold or consumed within one year from the date of the Statement of Financial Position, or during the course of operating cycle whichever is longer. (Para. 17) 6. Current assets should be segregated between the main classes in the Statement of Financial Position based on their nature, e.g., cash, temporary investments, accounts and notes receivables, inventories and prepaid expenses. Material items within each class should be segregated as between monetary and non-monetary 6 on the face of the Statement of Financial Position or in the related notes. In addition, material items within a class that are subject to different measurement basis should be segregated. (Para. 18) 7. The total of the current assets should be shown on the face of the Statement of Financial Position. (Para. 19) 8. Non-current assets should be displayed on the face of the Statement of Financial Position based on their general nature under the following captions: a. Investments and financial assets. b. Fixed assets. c. Intangible assets. d. Other assets. (Para. 20) 9. Non-current assets displayed under each caption should be segregated as between the main classes based on their specific nature, e.g., land, building, office furniture and equipment under the fixed assets caption. Within each class, material monetary assets should be segregated from non-monetary assets and assets subject to different measurement bases. Segregation between the items of non-current assets displayed under each separate caption is made either on the face of the Statement of Financial Position or in the related notes. (Para. 21) 10. Asset valuation allowances (e.g., Accumulated depreciation and Allowance for doubtful accounts) should be deducted from the assets to which they relate. (Para. 22) 11. Current liabilities should include amounts payable within one year from the date of the Statement of Financial Position or during the operating cycle, whichever is longer. (Para. 23) 12. Obligations, otherwise classified as current liabilities, should be excluded from the current liabilities classification to the extent that contractual agreements have been made for settlements from other than current assets before the issuance of financial statements. Examples include: a. A maturing short-term loan where contractual arrangements have been made for long-term refinancing. b. Trade accounts where contractual arrangements have been made for settlement by the issue of shares of capital stock. (Para. 24) 13. Current liabilities should be segregated as between the main classes, on the face of the Statement of Financial Position under separate captions according to their type, e.g., bank loans, suppliers and accrued expenses payable, loans payable, dividends payable, deferred revenues, and current payment on long-term debt. (Para 25) 14. The total of the current liabilities should be shown on the face of the Statement of Financial Position. (Para 26) 7 15. Non-current liabilities should be segregated as between the main classes, e.g., long-term loans and other non-current liabilities. (Para 27) 16. Each of the following liabilities should be shown separately on the face of the Statement of Financial Position or in the related notes: a. Amounts due to the members of the board of directors, top officers, shareholders or owners of the firms. b. Amounts due to non-consolidated subsidiaries, whether as a result of a loan or otherwise. c. Amounts due to parent and other affiliated companies, whether as a result of a loan or otherwise. (Para 28) 17. Liabilities that are secured by a mortgage should be stated separately on the face of the Statement of Financial Position or in the related notes and the assets used as a mortgage or security for these liabilities should be disclosed. (Para 29) 18. Owners equity should be segregated as between the following main classes: a. Paid-in capital; Paid-in capital includes investments by the owners for which equity interests have been granted by the reporting entity and are outstanding (shares in the case of corporations). Items included in this class of owners’ equity should be displayed separately based on the different rights associated with different equity interests. b. Donated capital: Donated capital include capital contributions received by the reporting entity from non-owners. c. Reserves or appropriated retained earnings: Reserves or appropriated retained earnings should include accumulated earnings of the reporting entity that have been set a side because of the requirements of the companies law or the company statute or otherwise. Items included in this class of owners’ equity should be displayed separately based on the reasons for which the appropriation of retained earnings was made. d. Additional-paid-in capital, unless required by the companies law to be presented otherwise. e. Un-appropriated retained earnings: Un-appropriated retained earnings should include accumulated retained earnings of the reporting entity that are available without any restriction for distribution to its owners. (Para 30) Presentation requirements for Income Statement: 1. The results of operations of the reporting entity should be presented in the Income Statement in a multiple-step format showing appropriate intermediate components of net income. Specifically, the Income Statement should display the following components of net income where applicable: a. The results of continuing operations. b. The results of discontinued operations including any related gains or losses from the disposal of a segment of a business. 8 c. Extraordinary items, that is, gains or losses resulting from casualties or involuntary expiration of usage period of assets for reasons not related to the operations of the accounting entity. (Para 31) 2. The results of continuing operations should separately display the following: a. The results of the ongoing major operations of the reporting entity for which financial statements are prepared. b. The results of the peripheral or incidental transactions of the entity with other entities and other events and circumstances affecting it other than: 1. Results of discontinued operations. 2. Extraordinary gains and losses. The ongoing major operations of the reporting entity refer to its main line(s) of business that is (are) the major source(s) of its revenues as opposed to its peripheral or incidental transactions with other entities and other events and circumstances affecting it. Examples of the results of peripheral transactions with other entities include: 1. Income from rental operations of a steel manufacturer. 2. Dividends received on shares owned by a dairy producer. Examples of the results of incidental transactions with other entities include: 1. Gains and losses on the sale of assets not held for sale in the normal course of business, 2. Revenues from the sale of by-products, e.g., sale of animal feed by a dairy producer and sale of scrap material by a construction company. Examples of the results of other events and circumstances that affect the accounting entity include: 1. Loss resulting from the impairment of value of inventories. 2. Fines imposed by the government as a result of delay in the completion of a project. 3. Loss due to a judgment against the accounting entity because of breach of an agreement with a customer or supplier. 4. A loss contingency resulting from an uninsured claim regarding product liability. (Para 32) 3. The results of operations of a discontinued segment of a business should be displayed separately on the face of the Income Statement and any recognizable gain or loss from the disposal of a segment of a business should be reported in conjunction with the related results of discontinued operations. For purpose of applying this standard, a segment of a business is defined as a component of the reporting entity whose activities represent a separate major line of business. A segment may be in the form of a subsidiary, a division, or a department or in some cases a joint venture or other no subsidy investee, provided that its assets, results of operations, and activities can be clearly distinguishable, physically and operationally and for financial reporting purposes, from the other assets, results of operations, and activities of the entity. A segment of a business should be considered discontinued, for purpose of presentation of the results of operations, when it has been sold, abandoned, spun off, or otherwise disposed of, or when it is still operating but is the subject of a formal plan to dispose of it. 9 (Para. 33) 4. Extraordinary items refer to material gains or losses due to casualties and involuntary expiration of assets that is not related to operations and do not represent the disposal of a segment of a business. Extraordinary items should be displayed as a separate component of net income on the face of the Income Statement following the display of the results of continuing operations and, where applicable, the results of discontinued operations. Casualties refer to sudden, unanticipated expiration of the entity’s assets not caused by the other entities. Examples are fires, floods, earthquakes and other similar events usually termed acts of God. An involuntary expiration of assets that is not related to operations is the sudden, unanticipated damage, destruction or disappearance of assets caused by other entities. Examples are theft and expropriation. (Para. 34) 5. Any governmental operating subsidy should be displayed separately on the face of the Income Statement following the presentation of the results of operations before the operating subsidy. (Para. 35) 6. The following items, where applicable, should be presented separately in the following order on the face of the Income Statement as part of the results of continuing operations: a. Net sales (or revenues) from major operations. b. Cost of goods sold (or cost of revenues). c. Gross income (i.e., the difference between net sales and the cost of goods sold). d. Operating expenses related to major operations including selling, general and administrative expenses displayed separately. e. Income from major continuing operations (i.e., the difference between gross income and operating expenses). f. Individual material elements of other income or gains and loses (or in the aggregate if individual elements are not material) resulting from the peripheral or incidental transactions of the entity and other events and circumstances affecting it other than extraordinary items. g. Income (loss) from continuing operations (i.e., the total of all of the above items or components). (Para. 36) 7. Income (loss) from continuing operations should be followed, where applicable, by a presentation of discontinued operations. (Para. 37) 8. Income before extraordinary items should be followed, where applicable, by individually material elements of gains or losses from casualties and/or involuntary expiration of assets. 10 (Para. 38) 9. The last caption on the Income Statement should always be Net Income (Net Loss). (Para. 39) 10. Earnings per share should be presented on the face of the Income Statement immediately after Net Income (Net Loss). The basis of its computation should be disclosed in the related notes. (Para. 40) Presentation requirement for the Statement of Cash Flows: 1. A firm should prepare a Statement of Cash Flows for each accounting period for which financial statements are prepared. That statement should provide explanation of changes in cash and cash equivalents, and it should show all cash flows from operating, investing and financing activities and their net effect on cash and cash equivalents during the accounting period. The total of cash and cash equivalents shown on the face of the Statement of Cash Flows at the beginning and end of the period must be equal to the amounts shown under similar description in the Statement of Financial Position prepared on the same date. Cash equivalents refer to highly liquid short-term investments that readily convertible to known amounts of cash, and so near their maturity that they present insignificant risk of change in their return rates. Examples are government bonds and commercial papers. (Para. 41) 2. Although information types contained in this statement might be different from an economic activity to another and from one accounting period to another depending on the materiality of that information, curtain cash flows are meaningful to the users of the financial statements. Hence, in all cases, information related to these cash flows must be presented clearly in the Statement of Cash Flows. (Para. 42) 3. Cash flows related to the operating, investing, and financing activities should be presented in the Statement of Cash Flows as follows: (Para. 43) First: Cash flows from operating activities: 3.1.5.3.1 Cash flows from operating activities should show cash received from, and used in, operating activities, including cash received from (or paid for) continuing and discontinued operations, and extraordinary items that are otherwise be categorized as investing or financing. Generally speaking, cash flows from operating activities is the resultant of transactions and events affecting income from operations. (Para. 44) 3.1.5.3.2 A firm that uses the direct method (the preferred method) in presenting cash flows from operating activities, should display, among cash flows from operating activities, the main elements of 11 total cash received and total cash paid and the amount of net cash flows from operating activities. At minimum, The following items of cash receipts and cash payments related to operating activities should be separately presented a. Cash collections from customers, including sales of goods and services. b. Received revenues and return on investments. c. Cash collections from other operating activities. d. Cash payments to suppliers of goods and services including insurance and advertising companies and others. e. Cash paid to employees. f. Interest paid. g. Income taxes and Zakat paid (charged to income). (Para. 45) 3.1.5.3.3 It is preferred that a firm present more details about cash receipts and payments from operating activities according to the most relevant method. (Para. 46) 3.1.5.3.4 3.1.5.3.5 When a Statement of Cash Flows is prepared using the direct method, a reconciliation of net income to cash flows from operating activities should be disclosed in the related notes. (Para. 47) Firms which elect not to use the direct method (the preferred method) in presenting cash flows from operating activities, should display indirectly the same amount of cash flows from operating activities through a reconciliation between net income (net loss) as presented in the Income Statement and net cash flows from operating activities. Reconciliation would eliminate the effect of the following items on net income (net loss): a. Cash receipts and payments related to operating activities that were deferred in previous periods. Examples are changes in inventories and deferred revenue. b. Cash receipts and payments resulting from operating activities and due in future periods. Examples are changes in the balances of accounts receivable and accounts payable. c. Revenues, expenses, gains or losses related to cash flows from investing and financing activities such as depreciation of fixed assets, amortization of intangible assets, and gains and losses on the sale of land, building and equipment. (Para. 48) Second: Cash flows from investing activities: 3.1.5.3.6 Cash flows from investing activities should be presented separately in the Statement of Cash Flows showing the main sources of cash received and main uses of cash paid. Cash flows from investing activities include cash flows related to granting and collecting loans to others, selling and purchase of fixed and intangible assets, investments and other productive assets used in 12 producing goods and services other than material considered as part of inventory. (Para. 49) Third: Cash flows from financing activities: 3.1.5.3.7 3.1.5.3.8 3.1.5.3.9 Cash flows from financing activities should be presented separately in the Statement of cash flows showing the main sources of total cash received and main uses of cash paid. Cash flows from financing activities include cash collected from the owners of the firm, cash dividends, cash subsidies, and short and long-term loans and cash used to repay these loans. (Para. 50) The effect of changes in the exchange rates of foreign currency on cash should be presented separately in the Statement of Cash Flows to reconcile the balances at the beginning and the end of the period. (Para. 51) Cash flows from operating, investing and financing activities should be presented in a manner that is most appropriate to the nature of the firm’s activity, taking into consideration that it should allow the users of financial statements the opportunity to evaluate the effect of these activities on the financial position of the firm, the results of its operations, changes in owners’ equity, and the amounts of cash and cash equivalents, and to use this information for evaluating the relations among these activities. (Para. 52) 3.1.5.3.10 Complex transactions (related to more than one activity) should be analyzed to show cash flows from each activity separately. In case of inability to segregate the activities related to these transactions, separate disclosure to that extent should be added for each item. (Para. 53) 3.1.5.3.11 Cash flows resulting from extraordinary items should be presented according to the nature of the related activity. They should be classified separately in order to appropriately disclose their effects. (Para. 54) 3.1.5.3.12 Net cash flows resulting from acquisition and sale of subsidiaries or other firms should be presented separately, and for each type of investment, in the investing activity section (Para. 55) 4. The reconciliation between net income and net cash flows from operating activities should display all main items subject to reconciliation independently regardless of whether the direct or the indirect method is used. Examples of items that should be displayed separately are the main cash receipts and payments resulting from operating activities and were deferred in previous period, and cash receipts and payments related to operating activities and due in future periods. 13 When appropriate, it is preferred that each firm provides more detailed information. (Para. 56) 5. The financial statements should disclose the following: a. The components of cash on hand and at the banks and cash equivalents, and the amount and nature of cash that is not currently available for use. b. Accounting policy used by the firm for cash equivalents. c. Investing and financing transactions that do not involve collection or payments of cash during the accounting period. d. The following information should be disclosed for each individual investment when a subsidiary or other firms are acquired or sold: 1. Total purchase or sale value. 2. Cash paid (received) as part of the total purchase (sale) value. 3. Cash and cash equivalent balance at the acquired (or disposed of) firm. 4. Total non-monetary assets and liabilities and non cash equivalents classified into their main components. (Para. 57) 6. When accounting for investment in an affiliated or a subsidiary company is based on the equity method or the cost method, only cash flows between the investor and investee should be presented in the investor’s Statement of cash Flows. Examples are cash dividends and loans. (Para. 58) 7. A firm that displays its interest in a partially owned firm should present in its consolidated Statement of Cash Flows only its share in cash flows of the investee company. When a firm accounts for such investment using the equity method, it should present in its Statement of Cash Flows only its share of the investee company’s cash flows and dividends, and other payments and receipts between the firm and the investee company. (Para. 59) 8. Total cash flows resulting from the purchase or sale of subsidiaries and other business firms should be presented separately and classified as investment activities. (Para. 60) 9. A firm should disclose the following for each purchase or sale transaction of a subsidiary or other business firms during the period: a. Total purchase or sale value. b. Cash or cash equivalent paid (received) as part of the purchase (sale) value. c. The amount of cash or cash equivalent in the subsidiary or other investee firms purchased or sold. d. The amount of non-monetary assets and liabilities in the subsidiary or other business firms purchased or sold summarized in main classes. (Para.61) 14 10. Separate presentation of the effects of cash flows resulting from the purchase or sale of subsidiaries or other business firms, and the separate disclosure of the amount of assets and liabilities purchased or sold, helps in segregating these cash flows from those resulting from other operating, investing and financing activities. The effects of cash flows resulting from selling subsidiaries and other firms should not offset against those resulting from purchase of subsidiaries and other firms. (Para. 62) 11. Investing and financing transactions that do not require the use of cash or cash equivalents should be excluded from the Statement of Cash Flows. Such transactions should be disclosed in another part of the financial statements such that all information related to these activities is provided. (Para. 63) 12. A firm should disclose the components of cash and cash equivalent and it should present reconciliation between the amounts in the Statement of Cash Flows and those related items in the Statement of Financial Position. (Para.64) Presentation requirements for the Statement of Retained Earnings: 1. The Statement of retained Earnings should separately report the changes in appropriated (reserves) and un-appropriated retained earnings during the period. (Para. 65) 2. The Statement of Retained Earnings should separately display the beginning balances of appropriated (i.e., the balances of legal, general and other reserves) and un-appropriated retained earnings before and after any prior period adjustments. (Para. 66) 3. Additions to and deductions from the beginning balances of appropriated and unappropriated retained earnings during the period should be separately displayed on the face of the Statement of Retained Earnings. (Para. 67) Presentation requirements for the Statement of Change in Owners’ Equity: 1. The Statement of Changes in Owners’ Equity should report separately the changes in paid-in capital; where applicable, donated capital; reserves and/or appropriated retained earnings; and un-appropriated retained earnings. (Para. 68) 2. The Statement of Changes in Owners’ Equity should separately display the beginning balances of paid-in capital; where applicable, donated capital; reserves and/or appropriated retained earnings; and un-appropriated retained earnings before and after any prior period adjustments. (Para. 69) 15 3. Additions to and deduction from the beginning balances of paid-in capital; where applicable, donated capital; reserves and/or appropriated retained earnings; and un-appropriated retained earnings should be separately displayed on the face of the Statement of Changes in Owners’ Equity with a description of the nature of each addition or deduction. (Para. 70) 3.2 GENERAL DISCLOSURE: 3.2.1 The standard of general disclosure defines disclosure requirements in the financial statements with respect to the following: a. Nature of business. b. Significant accounting policies. c. Accounting changes including: 1. Changes in accounting policies. 2. Changes in accounting estimates. d. Corrections of errors in financial statements. e. Contingencies and their treatments. f. Commitments. g. Subsequent events. (Para. 71) 3.2.2 Notes to the financial statements should include a brief description of the nature of an entity business. (Para. 72) 3.2.3. Disclosure of significant accounting policies: 3.2.3.1 A clear and concise description of the significant accounting policies of an enterprise should be included as an integral part of the financial statements. As a minimum, disclosure of information on accounting policies should be provided in the following situations: a. When a selection has been made from alternative acceptable accounting standards and methods. b. When there are accounting standards and methods used which are peculiar to an industry in which an enterprise operates, even if such accounting standards and methods are predominantly followed in the industry. c. When the financial statements are prepared on a basis not in conformity with one or more of the fundamental concepts described in the Conceptual Framework of Financial Accounting. (Para. 73) 3.2.3.2 In order to provide an overview of the accounting policies of an entity these policies must be disclosed together in the form of a summary rather than in individual notes to the financial statements. Therefore, it is preferable for the disclosure of accounting policies to be provided as either: a. The first note to the financial statements; or b. A separate summary, to which the financial statements are crossreferenced. 16 Suitable titles would be “Summary of Significant Accounting Policies” or “Significant Accounting Policies.” (Para. 74) 3.2.3.3 Wrong or inappropriate treatment of items in the financial statements is not rectified either by disclosure of accounting policies or by notes or explanatory material. (Para. 75) 3.2.4 Change in an accounting policy: 3.2.4.1 A change in an accounting policy should only be made if required by a law or regulation or an accounting standard, or if the change in an accounting policy provides better information in the entity’s financial statements. (Para. 76) 3.2.4.2 When there is a change in an accounting policy of the reporting entity the new accounting policy should be applied retroactively by restating the financial statements of all prior periods presented, except in those circumstances when the necessary financial data is not reasonably determinable. (Para. 77) 3.2.4.3 When a change in an accounting policy is applied retroactively, the financial statements of all prior periods presented for comparative purposes should be restated to give effect to the new accounting policy, except in those circumstances when the effect of the new accounting policy is not reasonably determinable for individual prior periods. In such circumstances, an adjustment should be made to the opening balance of retained earnings of the current period, or such earlier period as is appropriate, to reflect the cumulative effect of the change on prior periods. (Para. 78) 3.2.4.4 For each change in an accounting policy in the current period, the following information should be disclosed: a. A description of the change; b. Justification of the change; and c. The effect of the change on the financial statements of the current period. (Para. 79) 3.2.4.5 When a change in an accounting policy has been applied retroactively and prior periods have been restated, the fact that the financial statements of prior periods that are presented have been restated and the effect of the change on those prior periods should be disclosed. (Para. 80) 3.2.4.6 When a change in an accounting policy has been applied retroactively but prior periods have not been restated, the fact that the financial statements of prior periods that are presented have not been restated should be disclosed. The cumulative adjustment to the opening balance of the retained earnings of the current period should also be disclosed. 17 (Para. 81) 3.2.4.7 The disclosure of particulars, including monetary amounts applies to each change in an accounting policy; it is not appropriate to net items when considering materiality of the effect of changes in accounting policies for disclosure purposes. (Para. 82) 3.2.4.8 A change in an accounting policy that does not have a material effect in the current period but is likely to have a material effect in future periods should be disclosed. (Para. 83) 3.2.5 Change in accounting estimates: 3.2.5.1 A change in accounting estimate refers to any change the entity makes on estimates used in the past as a basis for measurement as a result of new information that did not exist at the date of original estimate. The effect of a change in an accounting estimate should be accounted for in: a. The period of change, if the change affects the financial results of that period only; or b. The period of change and applicable future periods, if the change affects the financial results of both current and future periods. (Para. 84) 3.2.5.2 Disclosure of the nature and effect on net income before extraordinary items and net income of the current period for a change in an accounting estimate that is rare or unusual or that may affect the results of both current and future periods, such as a change in the estimated useful life of a fixed asset, should be made in the Notes to the Financial Statements. (Para. 85) 3.2.5.3 Disclosure is not necessary for a change in an estimate each period in the course of accounting for normal business activities, such as allowances for uncollectible accounts. (Para. 86) 3.2.6 Corrections of errors in prior period financial statement: 3.2.6.1 Errors in prior period financial statements might result from arithmetical mistakes, errors in applying accounting standards or methods, oversight, or misuse of available information and data and affect accounting estimates in the financial statements. All financial statements for the period(s) affected by the error should be restated. (Para. 87) 3.2.6.2 When there has been a correction in the current period of an error in prior period financial statements, the following information should be disclosed: a. A description of the error; b. The effect of the correction of the error on the financial statements of the current and prior periods; and 18 c. The fact that the financial statements of prior periods that are presented have been restated. (Para. 88) 3.2.7 Contingencies: 3.2.7.1 The amount of contingent loss should be accrued in the financial statements by a charge to income when both the following conditions are met: a. It is likely that a future event will confirm that an asset had been impaired or a liability incurred at the date of the financial statements; and b. The amount of the loss can be reasonably estimated. (Para. 89) 3.2.7.2 Disclosure of the nature of an accrual and the amount accrued is preferable. (Para 90) 3.2.7.3 The existence of a contingent loss at the date of the financial statements should be disclosed in Notes to the Financial Statements when: a. The occurrence of the confirming future event is likely but the amount of the loss cannot be reasonably estimated; or b. The occurrence of the confirming future event is likely and an accrual has been made but there exists an exposure to loss in excess of the amount accrued; or c. The occurrence of the confirming future event is not determinable. (Para. 91) 3.2.7.4 Contingent gains should not be accrued in financial statements. (Para. 92) 3.2.7.5 When it is likely that a future event will confirm that an asset had been acquired or a liability reduced at the date of the financial statements, the existence of a contingent gain should be disclosed in Notes to the Financial Statements. (Para. 93) 3.2.7.6 When the existence of a contingent gain, or a contingent loss which has not been accrued, is disclosed in a note to the financial statements, the information should include: a. The nature of the contingency; and b. An estimate of the amount of the contingent gain or loss or a statement that such an estimate cannot be made. (Para. 94) 3.2.7.7 When the existence of a contingent gain or loss is disclosed in a note to the financial statements, it is preferable to include a reference to contingencies on the Statement of Financial Position. (Para. 95) 3.2.7.8 Even though the possibility of loss may be remote, certain loss contingencies should be disclosed nonetheless. The common characteristics of these contingencies “guarantee.” This includes: a. Guarantees (both direct and indirect) or indebtedness of others; b. Guarantees of lease payments of others; and 19 c. Guarantees to repurchase receivables or the related property. (Para. 96) 3.2.7.9 Disclosure of the above and other guarantees should include: a. The nature of the guarantee; b. The amount of the guarantee; c. The value of any recovery that can be expected to result (as in the case of the entity’s right to proceed against an outside party). (Para. 97) 3.2.8 Commitments: 3.2.8.1 Unusual or large commitments of the reporting entity should me disclosed in Notes to the Financial Statements. (Para. 98) 3.2.8.2 The following information about unusual or large commitments should be disclosed: a. A description of the commitment; b. The terms of the commitments; and c. The amount of the commitment. (Para. 99) 3.2.8.3 When a commitment is disclosed in a note to the financial statement, it is desirable to include a reference to commitment on the Statement of Financial Position. (Para. 100) 3.2.9 Subsequent events: 3.2.9.1 Financial statements should not be adjusted for, but disclosure should be made of those events occurring between the date of the financial statements and the date of their issuance that do not relate to conditions that existed at the date of the financial statements but: a. Cause significant changes to assets or liabilities in the subsequent period; or b. Will or may, have a significant effect on the future operations of the entity. (Para. 101) 3.2.9.2 Disclosure of a subsequent event that does not require adjustment of the financial statements would be made by way of a note to the financial statements. (Para.102) 3.2.9.3 Disclosure of a subsequent event that does not require adjustment of the financial statements should include: a. A description of the nature of the event; and b. An estimate of the financial effect, when practicable, or a statement that such an estimate cannot be made. (Para. 103) 3.2.10 Change in the reporting entity: 3.2.10.1 Accounting changes that result in financial statements that are in effect the statements of a different reporting entity should be reported by restating the financial statements of all prior periods presented in order to show financial information for the new reporting entity for all periods. (Para. 104) 20 3.3 3.3.1 3.3.2 3.3.3 3.3.4 3.2.10.2 The financial statements of the period of a change in the reporting entity should describe the nature of the change and the reason for it. (Para. 105) 3.2.10.3 The effect of the change on income before extraordinary items and on net income should be described for all periods presented. Financial statements of subsequent periods need not repeat the disclosure. (Para. 106) PRESENTATION AND DISCLOSURE REQUIREMENTS FOR FIRMS IN THE DEVELOPMENT STAGE: Firms in the development stage should adhere to the general disclosure and presentation requirements for all financial statements. There are also certain general disclosure and presentation requirements which are peculiar to the financial statements of firms in the development stage. (Para. 107) The financial statements of the firms in the development stage should disclose the following: a. Identification of the financial statements as those of a firm in the development stage. b. A description of the development stage activities in which the firm is engaged. (Para. 108) In issuing the same basic financial statements as an established operating firm, a firm in the development stage should present therein certain additional information. The basic financial statements to be presented and the additional information should include the following: a. A Statement of Financial Position, including any cumulative net losses reported with a descriptive caption, such as “deficit accumulated during the development stage”, in the owners’ equity section. b. An Income Statement, showing amounts of revenues, expenses, gains and losses for each period covered by the Income Statement and, in addition, cumulative amounts since the inception of the firm. c. A Statement of Cash Flows, showing cash flows during each accounting period for which an Income Statement is prepared and, in addition, cumulative amounts since the inception of the firm. d. A Statement of Change in Owners’ Equity, showing from the firm’s inception: 1. For each issuance, the date and number of shares of stock, or equity interests issued for cash and for other consideration. 2. For each issuance, the amounts (per share or other equity unit and in total) assigned to the consideration received for shares of stock or equity interests. An amount is assigned also to any non-cash consideration received. 3. For each issuance involving no-cash consideration, the nature of the non-cash consideration and the basis for assigning amounts. (Para. 109) In the first year in which the firm is considered an operating firm. Notes to the Financial Statements should disclose that in prior years the firm had been in the development stage. If comparative statements include periods in which the firm was first in the development stage and later an operating firm, the cumulative mounts and other development stage disclosures are not required for the periods in which the firm was in the development stage. (Para. 110) 21 4. ILLUSTRATIVE FINANCIAL STATEMENTS AND GENERAL GUIDELINES FOR THEIR PREPARATION: This section contains illustrative financial statements. The following should be noted: 1) The methods of presentation used are illustrative only and in no way mandatory. Other methods of presentation may equally with the General Presentation and Disclosure Standard. 2) The material contained in this section is organized as follows: First: Illustrative statements of financial position: a. Vertical classified comparative statement. b. Horizontal classified comparative statement. c. Horizontal unclassified comparative statement. Second: Illustrative income statements. Third: Illustrative statement of retained earnings. Fourth: Illustrative statement of change in owners’ equity. Fifth: Illustrative statement of cash flows. ILLUSTRATIVE STATEMENTS OF FINANCIAL POSITION The following pages contain three illustrative forms of the statement of financial position for a corporation. These forms are: a. Form (A) represents a vertical classified comparative statement of financial position. b. Form (B) represents a horizontal classified comparative statement of financial position. c. Form (C) represents a horizontal unclassified comparative statement of financial position. Reference to notes to financial statements is not intended to illustrate minimum number of note references on a Statement of Financial Position. Rather, they are intended to illustrate format. It should be emphasized that whichever form is used, the classification, grouping and description of items must be carefully considered. The samples provided on the following pages are intended to illustrate general situations. The format used by a reporting entity should be selected with a view of presenting clearly the nature and amount of the entity’s assets, liabilities and owners’ equity. 22 SAMPLE (A): STATEMENT OF FINANCIAL POSITION (COMPARATIVE AND CLASSIFIED) GULF CORPORATION STATEMENT OF FINANCIAL POSITION AS AT / / 20X3 20X2 xx xx xx xx xx xx xx xx xx xx xx xx xx xx xx (xx) xx xx xx xx xx (xx) xx xx xx Notes CURRENT ASSETS Cash Accounts receivable Inventories Prepaid expenses --------------------------------------Total Current Assets ( ( ( ( ( ( ) ) ) ) ) ) 20X3 xx xx xx xx xx xx xx CURRENT LIABILITIES Notes payable Accounts payable Accrued expenses Dividends payable Current maturities of long-term debt Tax payable --------------------------------------------Total Current Liabilities Working Capital FIXED ASSETS, at cost (Note) Land Building Machinery and equipment Office furniture and equipment Less: Accumulated depreciation --------------------------------------------Total Fixed Assets 23 ( ( ( ( ( ( ( ( ) ) ) ) ) ) ) ) xx xx xx xx xx xx xx xx (xx) ( ( ( ( ( ( ( ) ) ) ) ) ) ) xx xx xx xx (xx) xx xx xx xx xx xx xx xx xx xx xx (xx) xx xx (xx) xx xx xx xx xx xx xx INTANGIBLE ASSETS Patent Goodwill ------------------------------------------------Total Intangible Assets ( ( ( ( ) ) ) ) xx xx xx xx xx NON-CURRENT LIABILITIES Long-term loans End-of-service indemnity ----------------------Total Non-current Liabilities Net Assets SHAREHOLDERS EQUITY Authorized share capital ------shares, par value---per share Less: Un-issued share capital ------shares Paid-up share capital Donated capital Reserves or appropriated retained earnings Retained earnings Total Shareholders’ Equity Contingent Liabilities Notes numbers ( ) to ( ) are an integral part of the financial statements. 24 ( ) ( ) ( ) xx xx xx (xx) xx ( ) ( ( ( ( ( ) ) ) ) ) ( ) xx (xx) xx xx xx xx xx xx xx SAMPLE (B): STATEMENT OF FINANCIAL POSITION (COMPARATIVE AND HORIZONTAL) GULF CORPORATION STATEMENT OF FINANCIAL POSITION AS AT / / 20X3 Not e CURRENT ASSETS Cash Account receivable Inventories Prepaid expenses --------------------------------------Total Current Assets FIXED ASSETS, at cost (Note ) Land Building Machinery &equipment Office furniture &equipment Less: Accumulated depreciation ----------------------------------------- Total Fixed Assets 20X3 20X2 Note s 20X3 20X2 ( ) ( ) xx xx xx xx CURRENT LIABILITIES Notes payable Accounts Payable ( ) ( ) xx xx xx xx Accrued expenses Dividends payable ( ) ( ) xx xx xx xx ( ) xx xx ( ) xx xx ( ) xx xx Current maturities of long-term debt Tax payable ( ) xx xx ---------------------Total Current Liabilities ( ) xx xx x x x x ( ) xx xx ( ) ( ) xx xx xx xx ( ) xx xx ( ) (xx ) (xx 0 xx xx xx xx x x NON-CURRENT LIABILITIES Long-term loans End-of-service indemnity Total Non-current liabilities x x SHAREHOLDER S’ EQUITY Authorized share capital ---shares, par value --- per share Less: Un-issued share capital--shares Paid-up share capital 25 ( ) ( ) xx xx xx xx x x ( ) ( ) xx xx x x xx xx x x x x ( ) xx xx ( ) (xx ) (xx ) ( ) xx xx INTANGIBLE ASSETS Patent ( ) xx xx Goodwill ( ) xx xx --------------------- ( ) xx xx Total Intangible Assets x x Total Assets Donated capital ( ) xx xx Reserves or appropriated retained earnings Un-appropriated retained earnings Total Shareholders’ Equity ( ) xx xx Contingent Liabilities Total Liabilities and Shareholders’ Equity ( ) ( ) xx xx x x x x x x x x x x x x x x x x x x The attached Notes No. ( ) to No. ( ) form an integral part of these financial statements. SAMPLE (C): STATEMENT OF FINANCIAL POSITION (UNCLASSIFIED AND HORIZONTAL) GULF CORPORATION STATEMENT OF FINANCIAL POSITION AS AT / / 20X3 Not e Cash Account receivable Inventories Prepaid expenses 20X3 20X2 Note s ( ) ( ) xx xx CURRENT LIABILITIES xx Notes payable xx Accounts Payable ( ) ( ) xx xx xx Accrued expenses xx Land ( ) xx xx Building ( ) xx xx SHAREHOLDERS ’ EQUITY Authorized share capital ---shares, par value --- per share Less: Un-issued 26 20X3 ( ) ( ) xx xx ( ) xx 20X2 xx xx xx xx xx ( ) xx xx ( ) (xx) (xx) Office furniture Less: Accumulate d depreciation ( ) xx xx ( ) (xx ) (xx) xx Goodwill ( ) xx Patent ( ) xx xx ( ) xx xx ( ) xx xx xx Reserves or appropriated retained earnings Un-appropriated retained earnings ( ) xx xx ( ) xx xx xx Contingent Liabilities xx Total Liabilities and Shareholders’ Equity ( ) xx xx Total Assets share capital--shares Paid-up share capital Donated capital xx xx xx xx xx xx xx The attached Notes No. ( ) to No. ( ) form an integral part of these financial statements. DISPLAYING MINORITY INTEREST IN THE CONSOLIDATED STATEMENT OF FINANCIAL POSITION If there is any minority interest in any of the consolidated subsidiaries, the consolidated statement of financial position should have a main caption between “Long-term Debt” and “Shareholders Equity” showing the amount of the minority interest as of the date of each statement of financial position (whether classified or not classified) presented as follows in case of the classified vertical statement of financial position of a corporation: 27 20X2 xx xx xx xx xx Long-term loans Provision for terminal benefits Notes ( ) ( ) Minority interest in subsidiaries ( ) SHAREHOLDERS’ EQUITY Authorized share capital ---shares, par value --per share. Less: Un-issued share capital ---shares Paid-up capital Donated capital Reserves or appropriated retained earnings Un-appropriated retained earnings xx xx xx xx xx xx xx Contingent Liabilities 20X3 xx xx xx xx xx ( ) xx ( ) (xx) xx xx xx xx ( ) ( ) ( ) ( ) xx xx xx ILLUSTRATIVE INCOME STATEMENT Three illustrative Income Statements are presented on the following pages as follows: 1. 2. 3. Income statement showing income from continuing operations and extraordinary items (Sample A). Income statement showing income from continuing operations, discontinued operations and extraordinary items (Sample B). Income statement for a company that receives a subsidy from the government equal to its net losses plus 15% of paid-in capital as secured profit for shareholders (Sample C). Reference to Notes to Financial Statements is not intended to illustrate minimum number of notes references on an Income Statement. Rather, they are intended to illustrate format. 28 The format used by the reporting entity should be selected with vies of presenting clearly the components of net income. SAMPLE (A): INCOME STATEMENT (INCOME FROM CONTINUING OPERATIONS AND EXTRAORDINARY ITEMS) GULF CORPORATION INCOME STATEMENT FOR THE YEAR ENDED / / 20X3 20X2 Notes xx (xx) xxx xx xx xxx xxx Net sales Cost of goods sold Gross Income ( ) ( ) 20X3 xx (xx) xxx Operating Expenses: Selling Expenses General and administrative expenses Income from major operations 29 ( ) ( ) xx xx xxx xxx xx xx (xx) Other Operating Income: Rental income, net Investment income Loss on sale of fixed assets ( ) ( ) ( ) xx xx (xx) xxx xxx Income before extraordinary items xxx xxx xxx xxx Extraordinary gains (losses) Net Income xxx xxx The attached Notes No. ( ) to No. ( ) are an integral part of the financial statements. SAMPLE (B): INCOME STATEMENT (INCOME FROM CONTINUING OPERATIONS, DISCONTINUED OPERATIONS AND EXTRAORDINARY ITEMS) GULF CORPORATION INCOME STATEMENT FOR THE YEAR ENDED / / 20X3 20X2 Notes xx (xx) xxx xx xx Net sales Cost of goods sold Gross Income ( ) ( ) xx (xx) xxx Operating Expenses: Selling Expenses General and administrative expenses xxx xxx Income from major operations xxx Other Operating Income: Rental income, net Investment income Loss on sale of fixed assets Income from continuing operations xx xx (xx) 20X3 30 ( ) ( ) xx xx xxx xxx ( ) ( ) ( ) xx xx (xx) xxx xx xx xxx xxx xxx xxx Discontinued Operations: Income (loss) from discontinued operations of Division X Gain (loss) on sale of discontinued operations assets ( ) xx ( ) xx xxx xxx xxx xxx Income before extraordinary items Extraordinary gains (losses) Net Income The attached Notes No. ( ) to No. ( ) are an integral part of the financial statements. SAMPLE (c): INCOME STATEMENT (INCOME FROM CONTINUING OPERATIONS AND OPERATING SUBSIDY) GULF CORPORATION INCOME STATEMENT FOR THE YEAR ENDED / / 20X3 20X2 Notes xx (xx) xxx xx xx xxx xxx ( ) ( ) xx (xx) xxx Operating Expenses: Selling Expenses General and administrative expenses ( ) ( ) xx xx xxx xxx Income from major operations xx xx (xx) (xxx) (xxx) xxx xxx Net sales Cost of goods sold Gross Income 20X3 Other Operating Income: Rental income, net Investment income Loss on sale of fixed assets ( ) ( ) ( ) xx xx (xx) Loss before operating subsidy Operating subsidy Net Income The attached Notes No. ( ) to No. ( ) are an integral part of the financial statements. 31 (xxx) (xxx) xxx xxx MINORITY INTEREST IN THE CONSOLIDATED INCOME STATEMENT If there is any minority interest in any of the consolidated subsidiaries, the consolidated income statements should have a main caption between “Income (loss) before minority interest in net income of consolidated subsidiaries” and “Net Income” as follows: 20X2 xx Income before extraordinary items Notes (xx) xx (xx) xx Extraordinary Loss: Disaster loss Income before minority interest Minority interest in subsidiaries Net Income xx ( ) ( ) 32 20X3 (xx) xx (xx) xx ILLUSTRATIVE STATEMENT OF RETAINED EARNINGS One illustrative Statement of Retained Earnings is presented below. The format used by the reporting entity should be selected with a view of presenting clearly the changes in appropriated and un-appropriated retained earnings during the periods of presentation. SAMPLE STATEMENT OF RETAINED EARNINGS GULF CORPORATION STATEMENT OF RETAINED EARNINGS FOR THE YEAR ENDED / / 20X3 Notes Balance, 1/1/20X3 (unadjusted) Adjustments applicable to the year ended 31/12/20X2 Balance 31/12/20X3 as restated Net Income for the year ended 31/12/20X3 ( ) Transfer to reserves Dividends Balance, 31/12/20X3 Statutory Reserve General Reserve Unappropriated Retained Earnings xx xx xx xx xx xx xx -- xx -- xx xx xx xx -xx xx xx -xx xx (xx) (xx) xx The attached Notes No. ( ) to No. ( ) are an integral part of the financial statements. 33 ILLUSTRATIVE STATEMENT OF CHANGES IN OWNERS’EQUITY One illustrative Statement of Changes in Owners’ Equity is presented below. The format used by the reporting entity should be selected with a vies of presenting clearly the changes in all owners’ equity accounts during the period(s) of presentation. SAMPLE STATEMENT OF CHANGES IN OWNERS’ EQUITY GULF CORPORATION STATEMENT OF CHANGES IN OWNERS’ EQUITY YEARS ENDED 31/12/ 20x2 & 20x3 Notes Balance, 1/1/20X2 (unadjusted) Adjustments applicable to year 20X1 Balance, 1/1/20X2 as restated Sale of 1000 shares of capital Net income, 20X2 Transfer to reserves Donation of land for plant facilities Dividends Balance, 31/12/20X2 Net Income, year 20X3 Transfer to reserves Dividends Balance, 31/12/20X3 ( ) ( ) ( ) ( ) ( ) ( ) ( ) Paid-in Capital Donated Capital Statutory Reserve General Reserve xx xx xx xx Unappropriated Retained Earnings xx -- -- (xx) (xx) (xx) xx xx ---- xx ---xx xx --xx -- xx --xx -- xx -xx (xx) -- -xx ---xx -xx ---xx -xx -xx -xx -xx -xx -xx (xx) xx xx (xx) (xx) xx The attached notes No. ( ) to ( ) form an integral part of these financial statements. 34 ILLUSTRATIVE STATEMENT OF CASH FLOWS (SAMPLE A) GULF CORPORATION STATEMENT OF CASH FLOWS (DIRECT METHOD) FOR THE YEAR ENDAD 31/12/20X3 20X2 xx xx (xx) (xx) xx (xx) (xx) xx xx xx xx (xx) xx xx xx xx Notes CASH FLOWS FROM OPERATING ACTIVITIES: Collections from customers Dividends received on investment in stock Payments to suppliers and employees Interest paid Cash Flows from Operating Activities ( ( ( ( CASH FLOWS FROM INVESTING ACTIVITIES: Acquisition of a subsidiary (after deducting cash) Acquisition of plant assets Proceeds from sale of plant assets Net Cash Used for Investing activities ( ) ( ) ( ) CASH FLOWS FROM FINANCING ACTIVITIES: Proceeds from issuance of common stock Proceeds from issuance of long-term debt Cash dividends paid Net Cash Flows from Financing Activities Net Increase (decrease) in Cash Cash Balance, 31/12/20X2 Cash Balance, 31/12/20X3 ) ) ) ) xx xx (xx) (xx) xx (xx) (xx) xx xx ( ) ( ) ( ) The attached Notes No. ( ) to ( ) form an integral part of the financial statements. 35 20X3 xx xx (xx) xx xx xx xx ILLUSTRATIVE STATEMENT OF CASH FLOWS (SAMPLE B) GULF CORPORATION STATEMENT OF CASH FLOWS (INDIRECT METHOD) FOR THE YEAR ENDAD 31/12/20X3 20X2 xx xx (xx) xx xx xx (xx) (xx) xx xx xx xx (xx) xx xx xx xx Notes CASH FLOWS FROM OPERATING ACTIVITIES: Net Income Adjustments for non-cash items: Depreciation Gain on sale of plant assets Decrease (increase) in inventory Increase (decrease) in accounts payable Cash Flows from Operating Activities ( ) ( ) CASH FLOWS FROM INVESTING ACTIVITIES: Acquisition of a subsidiary (after deducting cash) Acquisition of plant assets Proceeds from sale of plant assets Net Cash Used for Investing activities ( ) ( ) ( ) CASH FLOWS FROM FINANCING ACTIVITIES: Proceeds from issuance of common stock Proceeds from issuance of long-term debt Cash dividends paid Net Cash Flows from Financing Activities Net Increase (decrease) in Cash Cash Balance, 31/12/20X2 Cash Balance, 31/12/20X3 xx xx (xx) xx xx xx (xx) (xx) xx xx ( ) ( ) ( ) The attached Notes No. ( ) to ( ) form an integral part of the financial statements. 36 20X3 xx xx (xx) xx xx xx xx