Business News - LeCornu Lewis Hancock

advertisement

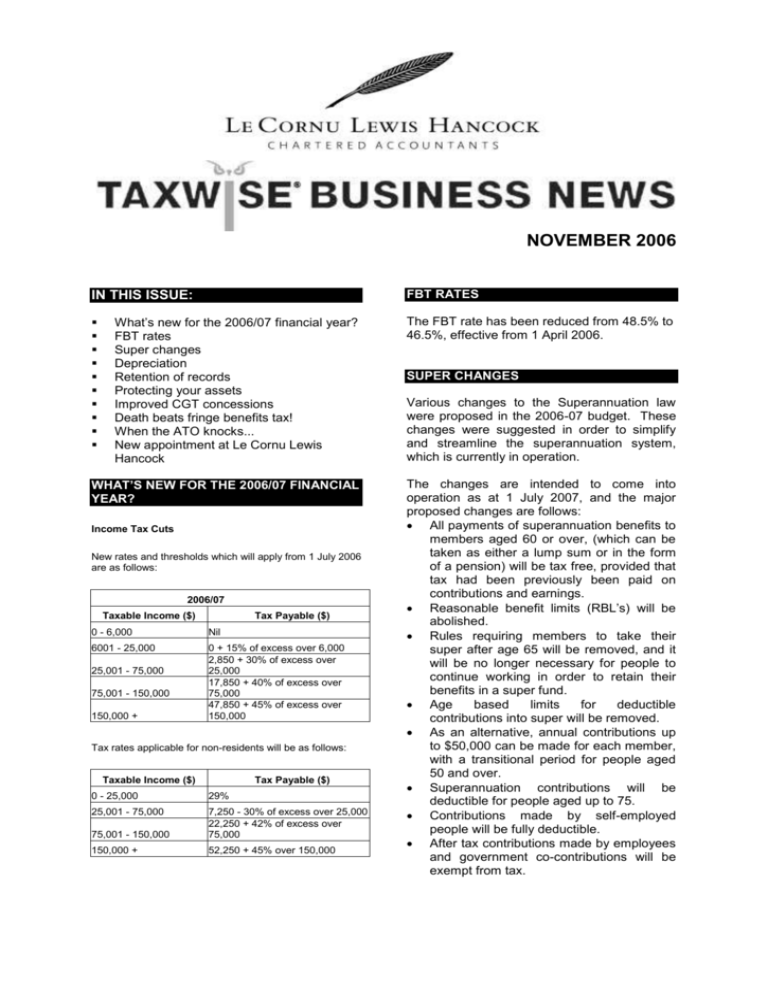

NOVEMBER 2006 FBT RATES IN THIS ISSUE: What’s new for the 2006/07 financial year? FBT rates Super changes Depreciation Retention of records Protecting your assets Improved CGT concessions Death beats fringe benefits tax! When the ATO knocks... New appointment at Le Cornu Lewis Hancock The FBT rate has been reduced from 48.5% to 46.5%, effective from 1 April 2006. WHAT’S NEW FOR THE 2006/07 FINANCIAL YEAR? The changes are intended to come into operation as at 1 July 2007, and the major proposed changes are follows: All payments of superannuation benefits to members aged 60 or over, (which can be taken as either a lump sum or in the form of a pension) will be tax free, provided that tax had been previously been paid on contributions and earnings. Reasonable benefit limits (RBL’s) will be abolished. Rules requiring members to take their super after age 65 will be removed, and it will be no longer necessary for people to continue working in order to retain their benefits in a super fund. Age based limits for deductible contributions into super will be removed. As an alternative, annual contributions up to $50,000 can be made for each member, with a transitional period for people aged 50 and over. Superannuation contributions will be deductible for people aged up to 75. Contributions made by self-employed people will be fully deductible. After tax contributions made by employees and government co-contributions will be exempt from tax. Income Tax Cuts New rates and thresholds which will apply from 1 July 2006 are as follows: 2006/07 Taxable Income ($) Tax Payable ($) 0 - 6,000 Nil 6001 - 25,000 0 + 15% of excess over 6,000 2,850 + 30% of excess over 25,000 17,850 + 40% of excess over 75,000 47,850 + 45% of excess over 150,000 25,001 - 75,000 75,001 - 150,000 150,000 + Tax rates applicable for non-residents will be as follows: Taxable Income ($) Tax Payable ($) 0 - 25,000 29% 25,001 - 75,000 75,001 - 150,000 7,250 - 30% of excess over 25,000 22,250 + 42% of excess over 75,000 150,000 + 52,250 + 45% over 150,000 SUPER CHANGES Various changes to the Superannuation law were proposed in the 2006-07 budget. These changes were suggested in order to simplify and streamline the superannuation system, which is currently in operation. The co-contribution scheme will be extended to after tax contributions made by the self-employed. After tax contributions limited to $150,000 per year. People aged less than 65 will be able to bring forward two years of contributions, enabling $450,000 to be contributed in one year, provided that no further contributions are made in the two years following. o In addition to the annual cap, people can contribute a lifetime limit of $1 million from the sale of a small business which has been held for 15 years; and settlements for injuries which resulted in permanent disablement. The SIS levy will be increased from $45 to $150 in order to provide additional funding to the ATO for compliance activities, steam lining reporting requirements and other measures. Records relating to capital gains and losses must be kept for at least five years after the last relevant capital gains tax event, ie sale. Records relating to deductions, which relate to your work as an employee must be kept for five years from the date of lodgment of your income tax return. For depreciating assets, you must keep records for the entire period over which you claim deductions for decline in value of those assets. You must also retain these records for a further period of five years from the date of your last claim. If you have a particular situation, which is not covered above and you are uncertain of your responsibilities, please contact us to discuss the relevant record keeping requirements. PROTECTING YOUR ASSETS For further information about the proposed changes to the superannuation system, please contact us. We introduced you to succession planning in our November 2005 newsletter - the need to plan ahead for the handing over or sale of your business, as well as protecting your assets. DEPRECIATION Under previous legislation, if you depreciated assets on a prime cost basis to arrive at a depreciation rate, you would divide 100 by the effective life of the asset, and if depreciating on a diminishing value basis you would divide 150 by the effective life. Under the new legislation, for assets acquired on or after 10 May 2006 you can use 200 divided by the effective life of the asset to calculate depreciation on the diminishing value basis, This will substantially increase the level of depreciation claimed on assets in the early years of ownership. For example if a motor vehicle is purchased after 10 May 2006, under the new rules the diminishing value depreciation rate on motor vehicles will increase from 18.75% to 25% p.a. RETENTION OF RECORDS Please note that original documentation forwarded to Le Cornu Lewis Hancock to aid in preparation of income tax returns and financial statements will be returned to clients. It is the client’s responsibility to retain these records for the period prescribed by the tax and other legislation. Some of the basic rules are as follows: DID YOU KNOW? Recent reports indicate more than 65% of businesses will face a major succession issue in the next 10 years, and on current figures barely 25% have done anything about it yet. Picking up on the theme of protecting your assets, from an estate planning perspective, we’re going to have a brief look at how it may also be possible to use your will to set up a trust (called a ‘testamentary trust’) to hold and protect your assets for future generations. It’s a complex topic to cover in a small space, so we’re only outlining the bare bones of some of what’s involved. Whilst it does have some distinct tax advantages, it’s not just about tax. LOOK BEFORE YOU LEAP As always, it’s best to get appropriate legal, tax and financial advice about whether setting up a testamentary trust is right for you. What’s a testamentary trust? You use your will to set up a testamentary trust. As it is part of your will, the testamentary trust comes into existence when you die. At the risk of oversimplification, when this happens, the assets in this trust are ‘owned’ by the trustee(s) and the ‘benefit’ of the income and capital belongs to your beneficiaries – this effectively shifts control over the assets from the beneficiaries to an independent trustee(s). A testamentary trust is usually a discretionary trust, so this separation of ‘ownership’ and ‘benefit’ enables your trustee(s) to determine who benefits, when and to what extent. PLANNING TIP A testamentary trust can be used to ensure your beneficiaries receive some form of regular income after you die and, when they become adults, the assets of the trust. Why set up a testamentary trust? A properly set up testamentary trust may be a useful planning tool to help you plan for your family’s income and asset protection needs. There are also potential tax advantages. In addition, there’s another potential tax saving. The use of a testamentary trust allows any of your beneficiaries who are under 18 years old to have the benefit of adult income tax marginal rate scales. This is instead of the usual penalty rates that apply to certain types of income earned by minors. A SIMPLE EXAMPLE When you die, $700,000 in funds are vested in your testamentary trust and invested by the trustee. The trustee distributes $40,000 in trust investment income equally to your two surviving children, who are 12 and 14 years of age ($20,000 each). The distributions to each of your children are taxed at adult income tax marginal rates, with a total tax of $4,800 (at rates applicable from 1 July 2006). Re-cap on succession planning Your asset protection needs Here’s a re-cap on some of the key steps in formulating your own succession plan: You may want to control where your income and assets go from beyond the grave for any number of reasons. Most people want to ensure their assets remain within the family and are used for the benefit of family members. For example, people sometimes use a testamentary trust to: provide for children who need ongoing medical care and community support; protect their assets where the assets may otherwise be at risk in the hands of the beneficiary (e.g., where a beneficiary becomes bankrupt, is spendthrift, or becomes divorced and their assets are split on divorce). Tax advantages Tax may be saved by splitting income across one or more minor beneficiaries rather than adults taxed at the top marginal tax rate. For instance, your trustee can direct income to the lowest income-earning beneficiaries. If your surviving spouse is a high-income earner, then instead of distributing income to him or her, the income could be distributed to your children at their lower tax rates. identify someone to take over your business and whether you plan to be involved in the business in some way after the hand-over or sale and, if so, how you want to do this; identify and maintain key relationships, including suppliers, financiers, employees, external advisers, and so on – it’s important to have strategies in place to ensure these relationships are maintained after you go; ensure funds are available for life’s events like retirement, resignation, bankruptcy, total and permanent disablement, death and other trauma related events; and consider all tax consequences, such as income tax, capital gains tax (CGT) and stamp duty on asset transfers. IMPROVED CGT CONCESSIONS Given the anticipated level of business handovers in the next 10 years, it’s encouraging that steps were take in the recent Federal Budget to make the small business capital gains tax (CGT) concessions more accessible and hopefully less difficult to comply with. Before looking at some of the proposed changes, we’ll take a look at the current state of the small business CGT concessions. As you can see, exactly how any of these concessions relate to your business and which concessions are appropriate may depend very much on your particular circumstances. OK, what are these concessions? What’s the problem? Provided you meet the qualifying conditions, there are 4 small business CGT concessions: 15-year exemption: you can disregard a capital gain you make on an eligible asset you have owned for at least 15 years; active asset reduction: you’re entitled to a 50% reduction of the capital gain; retirement exemption: allows you an exemption from capital gains up to a lifetime limit of $500,000; and small business rollover: this allows you to defer the making of a capital gain if you acquire eligible replacement business assets. ADDITIONAL BONUS You may also be able to factor in the general 50% CGT discount to reduce any capital gain. How do the concessions apply? The order in which you can apply these concessions can be a bit tricky. As a general guide: If you qualify for the 15 year exemption, you can disregard the capital gain entirely and there’s no need to apply any further exemptions. If you don’t qualify for the 15 year exemption, then the next step is to reduce the capital gain by any capital losses you may have. Once you’ve done that, before applying any of the remaining concessions, you then see if you can also apply the general 50% CGT discount to reduce any remaining capital gain. That done you can then work out if you’re eligible to apply the 50% active asset reduction to any remaining capital gain. If you still find that there is some capital gain left over after doing this, you would then see if you are eligible to apply the retirement or rollover exemptions to the remaining part of any gain – you can in fact choose both these concessions for different parts of the remaining gain if eligible. One of the main problems with the small business CGT concessions is that they are difficult to access. IT’S ALL TOO DIFFICULT! Many small businesses make mistakes in trying to work out whether they satisfy a number of entry conditions, and then the concessions themselves have extra conditions attached that are often hard to apply. The end result is small businesses find it difficult to get around the entry hurdles and are denied access in the first place. Tax Office feedback also shows that if you get over the entry hurdles, the concession claims themselves are frequently wrongly calculated. Given the potential tax savings involved, this is a disaster! What will the changes do for you? The Government intends implementing all but one of the recommendations of the Board of Taxation’s post implementation review of the small business CGT concessions. The Government’s plan is to increase the availability of these concessions and also hopefully reduce your compliance costs. As there are a number of proposed changes, some of which are quite technical, we have picked a couple of the more significant improvements that are on the drawing board. The maximum net asset value test This is one of the main general entry tests and perhaps the most significant stumbling block to accessing these concessions. Currently if you, together with persons associated with you (e.g., your spouse), own business or investment assets with a total net value of more than $5 million, you’re not entitled to access the concessions at all. There are two main problems with this test: calculating the $5 million net assets is riddled with difficulties. To make the calculation easier, from 1 July 2006, a range of legitimate liabilities (e.g., provisions for annual leave and long service, unearned income, and future tax liabilities) can be taken into account in calculating the $5 million; and the $5 million cap is too low. From 1 July 2007, total net value of assets will be increased to $6 million. The active asset test The small business CGT concessions only apply to active assets. Essentially these are assets used or held by you in the course of carrying on your business, e.g, plant and equipment. One of the big problems with this test is that you have to “use” the asset in your business right up to the point in time just before sale. This is in addition to a requirement that you also have held the active asset for a particular length of time. Prior to the proposed changes, by vacating the old shop Margie would not have been able to access the small business CGT concessions in relation to the sale of the shop. Her old shop was not used or “held ready for use” in the course of carrying out her hat business immediately before she sold it – failing the active asset test. To get around this problem, Margie may have been advised to store stock and other business related bits and pieces in the old shop in order to maintain its active asset status prior to its sale. This type of advice should no longer be necessary under the proposed changes for Margie to satisfy the active asset test. Under the proposed changes, as Margie has held the business premises for the required time, she’s at least got over the active asset hurdle. DEATH BEATS FBT! There are a number of traps for the unwary in Australia’s fringe benefits tax (FBT) regime. From 1 July 2006, the test will be simplified so that the active assets must now only be active assets for the lesser of half of your ownership period or 7 ½ years, regardless of whether your business has actually ceased. One that catches out many employers is that you can still be exposed to a potential FBT liability if you provide a taxable benefit to a former employee (e.g., someone who has retired or simply changed employers). IT’S NOW EASIER TO COMPLY It will no longer be necessary to show that the active asset was used or ‘held ready for use” by your business just before sale. However, you might be interested to know that if you foot the bill for the funeral expenses of one of your employees, your business will not have a fringe benefits tax (FBT) liability. Where’s the benefit for me? The above change is best illustrated with the following simple example. Margie runs a successful hat shop near the race course. She has owned the strata title to the shop for over 10 years and has carried on this business in her shop for all that time. She purchases a bigger shop nearby and vacates the old shop, moving her business to her new premises. The old shop is left vacant and after 3 months, luckily for her, she is able to sell it at a handsome profit. According to a recent Interpretative Decision from the Tax Office, the ATO has conceded that the concept of ‘employee’ for FBT purposes requires the continuing existence of the individual concerned! So it looks like FBT stops at death’s door for the ATO! Is there a planning opportunity here? In the wake of the above decision by the Tax Office, there is some speculation as to whether the ATO’s reasoning has broader application. For instance, if you allowed the deceased employee’s family to keep the company car or you agreed to continue to pay school fees for the deceased employee’s children, would you have an FBT liability? In light of the ATO’s Interpretative Decision, some would argue ‘no’. NEW APPOINTMENT AT LE CORNU LEWIS HANCOCK EXERCISE CAUTION The matter is far from clear or settled so it’s important to get advice about what to do if you’re looking at benefits in this area. Finally, we would like to congratulate Renae Bolt who has recently been promoted to our management team. Renae has been with the firm since July 2000 and has numerous qualifications including a Bachelor of Laws (hons), a Bachelor of Commerce, and membership with the Institute of Chartered Accountants. Renae is also a Fellow of the Taxation Institute of Australia. WHEN THE ATO KNOCKS… With the incidence of tax audits on the rise, it’s a good idea to know in advance what to expect if you find an ATO auditor on your doorstep. Always follow this plan of action! Set out below are series of key steps to follow should you find the ATO on your doorstep. If the ATO calls, advise them that you have an adviser and contact us immediately – we need to determine as soon as possible whether you have anything in fact to be concerned about and how to manage the ATO. It’s best not to deal with the ATO alone – in particular, if the ATO wants a meeting, we can advise the ATO that we will also be with you and try to meet the ATO on neutral ground, like our office. Designate one person in your business to deal with an ATO officer so the ATO doesn’t get different views from talking to different people – it’s best to take a cooperative approach and try to avoid unnecessary conflicts. Generally don’t volunteer information unless asked – only provide information in response to a particular request. If the ATO makes an oral request for particular information, ask for the request to be put in writing to avoid any misunderstanding. If a request seems unreasonable and you have to reallocate resources to meet the demand, you may need to consider offering to provide the information at a more convenient time. If an ATO auditor is on site, don’t let them sit anywhere where they can access your files at will or wander around your office. Disclaimer Taxwise® News is distributed quarterly by professional tax practitioners to provide information of general interest to their clients. The content of this newsletter does not constitute specific advice. Readers are encouraged to consult their tax adviser for advice on specific matters.