the prediction was

advertisement

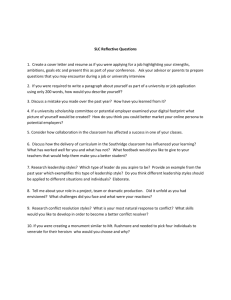

TAKING CARE OF YOU ISSUE#: One Hundred-Twelve November, 2005 INSIDE THIS ISSUE: 1. Active Investment Management = Diversify Manager Styles 2. Markets = Year End/2006 Market Expectations; ROI Benchmark 3. Current Best Funds = Issue# 112 Fund Changes/Why? 4. Comprehensive Financial Planning = Kdis’/Grandkids’ Goals 1. ACTIVE INVESTMENT MANAGEMENT DIVERSIFY MANAGER STYLES What are "Management Styles"? Each Mutual Fund Manager has his own Style, i.e., a philosophy, approach, methodology, and/or belief system, that he feels will result in the best performance for his Fund's Investment Objective. Styles are divided into two broad Categories, each Category ACTIVE has 2 Parts consisting of 3 Factors: INVESTMENT MANAGEMENT Categories Stock OBJECTIVE •Participate In Up Markets •Control In Down Markets ALLOCATIONS •Asset Allocations (Secular/Cyclical Markets) •Opposite Categories •Different Classes •Independent Classes FILL ALLOCATIONS •Use Best Funds •Monitor Choices CONTROL SWINGS •Diversify Manager Styles• •Control Sector Concentration •Allow Fund Managers To Make S/T Decisions •Rebalance •Fine Tuning Strategies ADVISOR/CLIENT •Motivate Advisor •No Conflicts •% Of Assets Basis •Help Build Business Part 1 Quality Bond Term Factor 1 Value Short Factor 2 Blend Medium Factor 3 Growth Long (Equate: (1) "Value" to bargain priced stocks, "Growth" to high flying stocks, and "Blend" to a mix of both Value and Growth stocks; (2) "Short" to <3 year terms, "Long" to >10 year terms, and "Medium" between 3-10 year terms.) Part 2 Size Quality Factor 1 Large High Factor 2 Medium Medium Factor 3 Small Low (Equate: (1) "Large" to big, famous companies; "Small" to small, less known, new companies; and, "Medium" to everything else; (2) "High" to AAA grade corporate and US government bonds; "Low" to bonds of corporations and government entities that are having economic challenges; and, "Medium" to everything else.) The result is 9 Styles for each broad Category: Categories Stock Large/Value Large/Blend Large/Growth Medium/Value Medium/Blend Medium/Growth Bond High Quality/Short Term High Quality/Medium Term High Quality/Long Term Med. Quality/Short Term Med. Quality/Medium Term Med. Quality/Long Term “TAKING CARE OF YOU”, Page 2 (Continued) Categories Stock Bond Small/Value Low Quality/Short Term Small/Blend Low Quality/Medium Term Small/Growth Low Quality/Long Term As you go from the top to the bottom of each Category's list of 9 Styles, the Management Style generally becomes more volatile, meaning there are greater potentials for Upswing Growth and Downswing Decline. Some Managers are devoted to their Style while others are uncommitted. These Styles fall in and out of favor with constant irregularity, i.e., nobody knows the next winner or looser. Many factors influence Styles' current success, e.g., rising interest rates help High Quality/Short Term Bonds sore but cause High Quality/Long Term Bonds to crash, or, a stable, unheated economy pushes Small/Growth Stocks and Low Quality/Long Term Bonds up while suppressing High Quality/Short Term Bonds. Style has such a great influence on a Manager's success that years ago Morningstar changed its Fund rating system to reflect Styles. Because Managers can be compared with other Managers using similar Styles, it is now easier to tell whether a Manager's success is due to his skills or because his Style is in favor. Style has such a large impact on performance and volatility, it is critical to be "in" the right Style to participate in Upswings and to be "out" of the wrong Style to limit participation in Downswings. However, as mentioned above, Styles fall in and out of favor with "constant irregularity" (or "unpredictable regularity"?), and since Timing Styles equates to Timing Markets (which is widely discredited because of its unlikely long term success), the best and most feasible solution is to DIVERSIFY MANAGEMENT STYLES. This way you don't miss Upswings, yet you don't entirely participate in Downswings kind of a very (un)technical theory called "Pigs Get Fed But Hogs Get Slaughtered" (but one that works well over the long term!). 2. MARKETS YEAR END & 2006 MARKET EXPECTATIONS YEAR END: “There are exceptions to every general rule, including this one.” Don’t think too much about this statement, or you will get dizzy – but there is some truth here. One of the general rules of investing, that very seldom has an exception, is that the year-end (October through December, and often into January) will be an upswing. In 2004 there was a huge year-end upswing because of the Presidential Elections. However, this year there is no “sure bet” for an upswing, e.g., “on one side of the ledger” the economy is doing well (many companies are showing substantial profits) which should influence US stocks to go up, but “on the other side of the ledger” there will probably continue to be at least a couple of more Fed interest rate increases because of high oil prices and a healthy economy that is pushing up the inflation rate which should influence US stocks to go down. Which influence is going to win out -- the healthy economy, or increasing interest/inflation rates and high oil prices? And, will the winner be enough to affect the general rule that the year end will be an upswing? ROI started making some small “Fine Tuning” bets in October and continued this trend into November, that there will be a year-end upswing, but we have tried to leave our portfolios in a position to respond to a big upswing or a “general rule” breaking downswing, by increasing our cash position. 2006 MARKET EXPECTATIONS: Generally speaking, return expectations: for 2003 were high (we did great, about 30%); for 2004 were good depending upon election results (we did well, about 11%); for 2005 “TAKING CARE OF YOU”, Page 3 were o.k. depending upon interest rate increases, inflation and oil prices (we have done very well, about 7%+ to date); and, for 2006 are flat depending again on interest rate increases, inflation, oil prices, and the strength of the economy. Even though we have had certain yearly expectations and accordingly made general allocations, the important thing was how we responded each month to what was actually happening in “real time”. In early 2006 we will probably make some conservative allocations to portfolios early in 2006 because of expectations, but we will definitely try to appropriately respond each month to what actually happens – this approach just seems to work for us year after year so we will continue to follow this course. BEATING YOUR BENCHMARK R.O.I., begrudgingly, often refers to popular indexes such as the DJIA, the S&P 500, Nasdaq, and the Russell 2000, because these are indexes that most clients are familiar with -- especially the DJIA and the S&P 500, which in the minds of most people, are supposed to represent the US stock market. Unfortunately, the DJIA and the S&P 500 are often not very good representations of the US stock market, and clients sometimes think these are indexes that our portfolios are trying to beat. R.O.I. has in fact beaten the S&P 500 every year from 1999 through 2005, but we want clients to understand that this is not our objective, because someday we are going to have another “1998” where a popular index will outperform our portfolios. As stated in the left hand column, on the front page of every newsletter, are R.O.I.’s objectives to: (1) Participate In Up Markets; and, (2) Control Participation In Down Markets. If we successfully accomplish these two objectives over a long period of time, a significant, favorable gap is created in what our clients’ investment performance has actually been compared to what most people have experienced – this is a great accomplishment, and we have done a very good job of meeting these objectives. R.O.I. has a benchmark it is trying to beat – it is always found in the first part of the next section (i.e., 3. CURRENT BEST FUNDS) of this newsletter and is called “ROI’S MPT INDEX” (see the * in section 3 that contains a description of ROI’s MPT INDEX). A good index should be difficult for a portfolio to regularly beat, for example Morningstar has an index for its “Wealth Maker” portfolio (an allocation that is usually closest to R.O.I.’s Moderate Allocation) where the portfolio/index has returned: YTD = 1.53%/2.09%; Since 11/2001 Inception = 6.06%/6.99% (see section 3 for how ROI’s “Best Funds” have performed vs. its index). R.O.I. has fared much better against its index, but the last couple of years it has become more difficult for R.O.I. to beat its index, e.g., this year the Moderate portfolio has done +5.1% vs. the index doing +4.7% not a great deal of difference (though a lot better than any of the popular indexes or Morningstar’s comparable portfolio, mentioned above). We are not sure why it has become a greater challenge -- it may because: (1) The last two years have not had significant up or down trends for more than a couple of months at a time; (2) The limitations that did not previously exist on our active management because we now judiciously try to avoid ERFs; (3) We are now comparing a client’s actual portfolio performance rather than a Morningstar model portfolio; or, (4) Some combinations of the previous three reasons, and possibly other reasons. So, a better way to tell how R.O.I. investment management strategies are really doing is to compare R.O.I.’s monthly, Year To Date (YTD) and accumulative performance with the “ROI’S MPT INDEX” for the same periods – you can always find that, fully disclosed, at beginning of section 3 of each newsletter. 3. CURRENT BEST FUNDS “TAKING CARE OF YOU”, Page 4 LAST MONTH -2.4% ROI’S MPT INDEX* -2.7% ROI’S “BEST FUNDS”** ’05 YEAR TO DATE +4.7% +5.1% 1/1/97 THROUGH ‘05 + 63.6 % +116.7 % * ROI’s MPT INDEX = An index based solely upon one Modern Portfolio Theory type of Asset Allocation to each of the following 12 Asset Classes, assuming from: (1) 1/1/97, an 11% Target Return (i.e., 70% in Stocks; 15% in Bonds; 15% in Anti-Inflation); and, (2) 3/1/03, a Moderate allocation (i.e., 50% in Stocks; 25% in Bonds; 25% in Anti-Inflation); using the average returns of all mutual funds in each Asset Class, Rebalanced on a monthly basis (data supplied by Morningstar). ** ROI’s “BEST FUNDS” = Using the returns of an actual client’s account that uses the same Moderate Asset allocation as in ROI’s MPT INDEX, but includs all of ROI’s other strategies. Prior to 6/1/4, ROI used Morningstar’s data, which wasn’t as accurate. ISSUE# ONE HUNDRED-TWELVE BEST FUND CHANGES & WHY? (Funds or % in < > are new funds and allocations replacing prior choices. Current through Newsletter date.) STOCKS Aggressive Growth Janus Orion <125%> Growth Van Kampen Md Cp Gth A <150%> Third Avenue Value (150%) Small Cap <Neuberger Berm Mill Tst> (131.25%) WF Advisor SC Vlu <131.25%> Equity Income Amana Income (109.38%) Stock Index Fidelity Spartan Market Index <150%> Overseas: Int’l, World, SC, EM <Driehus Intl Disc> (107.14%) Oppenheimer Intl SC (107.14%) Delaware Emerging Markets (64.29%) BONDS US/LT, ST, Mtg, Convertible Franklin Cnvrtble Sec (25%) <Pimco S-T D> <167%> < > <0%> Junk Scudder High Yield (50%) Global Pimco Foreign Bd <50%> Payden EM Bond <75%) ANTI-INFLATION Asset Manager Ivy Asset Strategy A (75%) Ntrl Res, Utilities & Metals JennDry Utilities A (50%) Excelsior Energy NR (85%) Real Estate Van Kampen RE <89%> THE “WHYS” 1. Increased Allocations: US Stock Aggressive Growth, Growth/Growth, Small Cap/Value and Stock Index; and Cash; and, Reduced Allocations: US Bond Short Term and Long Term; Global Bond Diversified and Emerging Markets; and Real Estate – A significant effort to increase participation in some asset classes that may participate in a year end US rally and reduce participation in some asset classes that may be continually effected by Fed interest rate increases, but leave us with more cash to adjust to what actually happens through the year end (e.g., US stocks up buy more?, US stocks down short US stocks?, etc.); 2. Neuberger Berman Millennial Trust for Fidelity Advisor Small Cap – Fidelity has continually declined until it dropped out of the top 25% of its asset class, while Neuberger has been performing well in its asset class; 3. Driehus International Discovery for Neuberger Berman International – Neuberger continually declined until it dropped out of the top 25% of its asset class, while Driehus has been performing well in its asset class; “TAKING CARE OF YOU”, Page 5 4. Pimco Short Term D for Parnassus Fixed Income – Parnassus has actually evolved to a mid term bond fund (which has hurt its recent, and probably future, performance) while Pimco has a very short term which should help it perform better if the Fed continues to raise interest rates; 5. Closed Positions in American Century Inflation-Adjusted Bonds – This was our long term bond position, but because it continued to decline even with its inflation adjusted aspect, and was such a small position, we decided to just put it in cash for now; 6. ROI Wanted To Update Additional Funds to Best Funds – ROI wanted to update Amana Income and Delaware Emerging Markets to other funds but decided against doing so because of Fidelity ERFs that would be generated. This is a case where, at times, ROI must operate “with one hand tied behind our back” because of ERF rules that are imposed by “Big Brothers”, e.g., the Fidelity network and/or a mutual fund family. [ROI tracks each month’s consensus predictions for the Dow Jones Industrial Average (DJIA) for the upcoming six months, by the panel of “experts” in the Investment Advisor Magazine.] THE PREDICTION WAS OFF BY: THE PREDICTION WAS: THE DJIA WAS: POINTS PERCENT MADE FOR DJIA ACTUALLY 7/04 12/04 10587 10661 - 74 - 1% 8/04 1/05 10641 10489 + 152 + 1% 9/04 2/05 10713 10835 - 122 - 1% 10/04 3/05 10697 10565 + 132 + 1% 11/04 4/05 10595 10012 + 583 + 6% 12/04 5/05 10554 10331 + 223 + 2% 1/05 6/05 10985 10579 + 406 + 4% 2/05 7/05 11097 10626 + 471 + 4% 3/05 No Investment Advisor Magazine prediction for 8/05 – March issue prediction for 9/5. 4/05 9/05 11127 10378 + 749 + 7% 5/05 10/05 11120 10281 + 839 + 8% 6/05 11/05 10871 11081 - 210 - 2% TWELVE MONTH ERROR RANGE = 839/-210 +8%/-2% !!ROI believes it is impossible to predict the short-term future. If the “experts” can’t reliably do so what chance do you or I have? Should we make large bets on short-term predictions? 4. COMPREHENSIVE FINANCIAL PLANNING (CFP) KIDS’/GRANDKIDS’ MISSIONS, EDUCATION, MARRIAGES AND HOME DOWN PAYMENTS We read and hear a great deal in the media about “529” plans for accumulating money for kids’ and grandkids’ educations. The tax benefits of these plans are striking, e.g., you may get all three of the possible investment tax benefits, i.e.: (1) Tax deductible contributions; (2) Tax deferred growth; and, (3) Tax free withdrawals. We have not been eager to encourage clients to use these heavily for the following three reasons: 1. Most of our clients need to help children with more than education costs, but a 529 plan can only be used for qualified education costs. One could use a 529 plan for education costs and some other plan for “TAKING CARE OF YOU”, Page 6 everything else, but this adds complexity and accessibility issues (you can’t rob Peter to pay Paul, and if higher education never really materializes or scholarships, loans and/or grants pay most of the costs, it is more difficult to unravel what you have put together if you are using a 529 plan); COMPREHENSIVE 2. One of the most important things we can do for our children and FINANCIAL grandchildren is “teach them to fish”, i.e., learn to work, save and manage PLANNING their own financial future (see the prior issue of “Taking Care of You”), but INCOME & EXPENSE 529 plans do not easily lend themselves to teaching these very important, life•Emergency Planning •Budgeting long benefiting concepts; and, •Taxes KIDS/GRANDKIDS’ GOALS •”Teach Them To Fish” •Missions, Education, Marriages, and Home Down Payments RETIREMENT LONG TERM CARE 3. Most people probably will not be happy with the investment results of 529 plans because they have very limited investment choices, the choices are mediocre in quality, and often have limited times/year one can change the investment allocations, and thus they do not lend themselves to be actively managed. The returns might be mediocre in up markets, but irreparable harm may result in down markets. DEATH & DISABILITY IDENTITY THEFT PROTECTION ESTATE PLANNING BUSINESS & ASSET PROTECTION PLANNING We prefer investment programs that can be used at anytime for what ever the planned for, or surprise needs, might be, that lend themselves to creating the impression in the kids’ and/or grandkids’ minds that they are “taking care of their own future”, and, which are much more likely to result in happy investment results because they can be actively managed to accomplish Participation In Upswings and Controlling Participation In Downswings. For example, three suggestions: 1. If a client is in a high income tax bracket, has a large estate, is concerned about asset protection, and/or will be accumulating large sums of money to help kids/grandkids with missions, education, marriages and/or down payments on homes (and maybe for charitable and non-charitable purposes), and/or, wants to retain control but teach kids/grandkids “how to fish”, we might suggest a “Family Bank” (i.e., use of a Family Limited Partnership (FLP) or probably a Limited Liability Company, with kids/grandkids owning growing % depending upon their own and parents’/grandparents’ contributions); or, 2. If a client isn’t really ready for a “Family Bank”, and can’t maximize their contributions to Roth accounts for both the husband and wife, we may suggest using Roth accounts but with some of the funding coming from kids/grandkids’ contributions; or, 3. If a client isn’t ready for a “Family Bank” but is maximizing their contributions to Roth accounts for the husband and wife, we my simply suggest a taxable account in their individual, joint or trust’s name. Admittedly the above three suggestions don’t accomplish all the possible tax benefits of a 529 plan, but they are much more likely to achieve the three reasons stated above – and what do we want most, the “tax tail” that waved the whole dog to death, or the whole healthy and happy dog with at least some “tax tail”. “I THOUGHT YOU WOULD WANT TO KNOW” is a publication of Ronald Olson, Inc. (R.O.I.), an Investment Advisor (I.A.), and is produced for the sole benefit of R.O.I.’s clients. Editors: Ronald H. Olson, President, and Grant Olson, Assistant. 351 East 140 North, Lindon, Utah 84042-2004, 801-785-3254, 801-7853244 (Fax), 801-580-7672 (Mobile), ronolson@itsnet.com (e-mail), www.roionweb.com (Web Site).