The Markets In no particular order, the odds and ends plus Q&A for

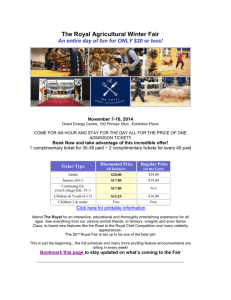

advertisement

www.iaamllc.com 137 North 2nd Street Easton, PA 18042 Tel: 610-258-3269 Fax: 610-258-5841 Issue #104 November 2015 MULTI-ASSET STRATEGYSM A SUMMARY FOR OUR CLIENTS ODDS AND ENDS PLUS Q&A The Markets In no particular order, the odds and ends plus Q&A for this month’s newsletter are as follows: 1. An interesting quote from Ron Baron, a top notch mutual fund manager: “Decades of high oil prices led to a boom in exploration and discovery of new sources of crude around the world. Therefore, we have great reserves that will be tapped if prices go up thereby forcing them back down again.” This is a very interesting long term perspective that I believe could prove accurate. If so, and we have lower oil prices as far as the eye can see, it is only a matter of time before the public realizes this and it could lead to accelerated consumer spending. That would help the economy for years to come. Consumer spending is almost 70% of the total economy. 2. The Dow Jones Industrial Average is currently near 18,000. The economy is a total of $18 trillion (don’t ask how many zeros that is!). In 2007, the Dow Jones Industrial Average was 14,000 and the economy was $14 trillion. In 1960, the Dow Jones Industrial Average was approximately 500 and the economy was about $500 billion. They always seem to go together in this intersecting ratio. 3. The six reasons I have found that people fail to manage wealth successfully over the long run: (1) (2) (3) (4) (5) (6) Failure to develop a sound long-term strategy Bearing too much or too little risk Inappropriate asset allocation Inadequate diversification Poor investment selection Failure to control emotions (greed and fear) Securities offered through Royal Alliance Associates, Inc., member FINRA, SIPC. Advisory services offered through Investment Advisors Asset Management, LLC, a registered investment advisor. Entities listed are not affiliated with Royal Alliance Associates, Inc. It is number six that I have experienced to be the most difficult for people. Unfortunately, I believe it is the one that can be most damaging. I have also found that some people experience both greed and fear many times. They seem to “ping pong” themselves back and forth based on external events in the financial markets. Conversely, if one is truly able to find a stabilizing level between greed and fear, they seem to have the best start to producing the best results. 4. If the Dow Jones Industrial Average continues to perform as it has over the past century what will it be in 20 years? Answer: Approximately 70,000 – The power of compound interest! 5. The Detriments of Portfolio Performance (according to Ibbotson Associates) are as follows: a. Asset Allocation 91.5% b. Security Selection 5.6% c. Market Timing 1.8% It is this last part that illustrates the fact that market timing need not be part of any investment strategy. That’s a good finding because I have found it too difficult to do and not with any appreciable contribution to success. In fact, over a 65 year period (1925-1990) one dollar in the S&P 500 Index became $727, yet $1 dollar missing just 30 of the best months became only $11. 6. Lately, one of the most asked questions of me is “When would you advise investing in the World Leaders Model versus the Multi-Asset Strategy Model?” As hopefully everyone knows, the Multi-Asset Strategy is a risk management process and consists of 3 portfolios – Conservative, Moderate and Growth. They are very well diversified as we try to achieve maximum protection during downturns. The financial crisis of 2007-2009 would be a prime example. The World Leaders Model is much higher “octane” and tries to maximize returns by being only in up to 20 individual stocks. It has a much higher volatility factor. This answer to the question is one of customization for each person. It may be, for instance, that the best mix for someone would be 3 parts Multi-Asset Strategy Moderate Model to one part World Leaders. For some the best ratio is lower, for others higher. Age, income and natural risk tolerance play important parts in getting to the right answer. Therefore, if anyone has questions on this very important topic whether we have discussed it and implemented it or not, please contact us. That’s it for now. We want you to know we are following all events closely and doing all we can to be good long-term stewards of your money. As always, feel free to call us as needed. We are always delighted to hear from you. All calls will be returned promptly as you know (usually within 24 hours). We are eagerly looking forward to working with you in the quarters and years ahead and thank you for all your referrals to date. Also, as always, should the markets dictate an interim newsletter, we will do so. Securities offered through Royal Alliance Associates, Inc., member FINRA, SIPC. Advisory services offered through Investment Advisors Asset Management, LLC, a registered investment advisor. Entities listed are not affiliated with Royal Alliance Associates, Inc. OUR PHILOSOPHY Successful investing is a marathon, not a sprint. Sometimes investing is like watching paint dry, marking time, boring and with not much movement. Sometimes it is chaotic and fear based. Greed and fear are often present. We are long-term investors. We believe four to five years is the appropriate time frame to assess risk and reward. At the end of that time, another four to five year time frame takes place. This keeps happening until one is in the distribution phase of life and needs to live off their assets. Therefore, of course, it is where we are at the end of the race that counts. Although no guarantees can be given, our goal with all our clients is to get to the end of the race in as good a position as possible given their particular life circumstance. Disclosure Statements Standard & Poor’s 500 A market capitalization-weighted index of 500 widely held stocks is often used as a proxy for the stock market. Indexes cannot be invested in directly, are unmanaged and do not incur management fees, costs and expenses. Dow Jones Industrial Average A price-weighted average of 30 actively traded blue-chip stocks, primarily industrials including stocks that trade on the New York Stock Exchange. The Dow, as it is called, is a barometer of how shares of the largest U.S. companies are performing. Risk and Return The views expressed are not necessarily the opinion of Royal Alliance Associates, Inc. Investing involves risk, including the potential loss of principal. No investment strategy can guarantee a profit or protect against loss in periods of declining values. Past performance is no guarantee of future results. This newsletter contains general information that is not suitable for everyone. The information contained herein should not be construed as personalized investment advice. There is no guarantee that the views and opinions expressed in this newsletter will come to pass. Although the information has been gathered from sources believed to be reliable, it cannot be guaranteed. Investors should be aware of additional risks associated with international investing due to factors such as greater economic and political instability, increased volatility, currency fluctuation, and differences in auditing and other financial standards and that these risks can be accentuated in emerging markets. Important Consumer Disclosure This newsletter contains general information that is not suitable for everyone. The information contained herein should not be construed as personalized investment advice. References made herein to the market indices are for illustrative purposes only. An investor cannot invest directly in an index. Different types of investments involve varying degrees of risk and there can be no assurance that any specific investment will be profitable. Certain information contained herein has been derived from third party sources. Although believed to be reliable, we make no representations as to the accuracy or completeness of any such information prepared by any unaffiliated third party incorporated herein, and take no responsibility therefore. Additionally, certain statements that indicate future possibilities are forward looking statements. Due to known and unknown risks, other uncertainties and factors, actual results may vary materially from those portrayed in such forward looking statements. As such, there is no guarantee that the views and opinions expressed in this newsletter will come to pass. Investing in the stock market involves gains and losses and may not Securities offered through Royal Alliance Associates, Inc., member FINRA, SIPC. Advisory services offered through Investment Advisors Asset Management, LLC, a registered investment advisor. Entities listed are not affiliated with Royal Alliance Associates, Inc. be suitable for all investors. Information presented herein is subject to change without notice and should not be considered as a solicitation to buy or sell any security. Investment Advisors Asset Management, LLC (“IAAM:”) is an SEC registered investment adviser with its principal place of business in the Commonwealth of Pennsylvania. IAAM and its representatives are in compliance with the current registration and notice filing requirements imposed upon registered investment advisers by those states in which IAAM maintains clients. IAAM may only transact business in those states in which it is notice filed, or qualifies for an exemption or exclusion from/notice filing requirements. This newsletter is limited to the dissemination of general information pertaining to its investment advisory services. Any subsequent, direct communication by IAAM with a prospective client shall be conducted by a representative that is either registered or qualifies for an exemption or exclusion from registration in the state where the prospective client resides. For information pertaining to the registration status of IAAM, please contact IAAM or refer to the Investment Adviser Public Disclosure web site (www.adviserinfo.sec.gov). For additional information about IAAM, including fees and services, send for our disclosure statement as set forth on Form ADV from IAAM using the contact information herein. Please read the disclosure statement carefully before you invest or send money. Securities offered through Royal Alliance Associates, Inc., member FINRA, SIPC. Advisory services offered through Investment Advisors Asset Management, LLC, a registered investment advisor. Entities listed are not affiliated with Royal Alliance Associates, Inc.