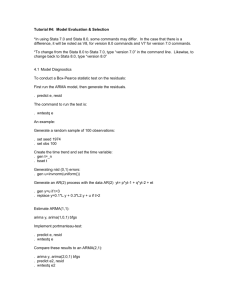

20254ex2 econometrics - School of Economics, Finance and

advertisement

UNIVERSITY OF BRISTOL DEPARTMENT OF ECONOMICS MSc in Economics, Finance and Management Quantitative Methods Exercise 5 NOTE Answers to questions 2*, 4*, 5* and 9* will count towards your final overall assessment. The deadline for handing the completed written work to Jane Pitfield, in room 1C7, is 12 noon on the last day of the Autumn Term, Friday 13th December 2002. Output sheets directly from STATA will not be accepted. Select the material to answer the question from your STATA output and use it in your write up as a table etc. Although you may work together to find solutions the write up MUST be your own work. If there is evidence of work being copied both the original work and the copy will be marked zero. 1. Given the model: Yt o 1X1t 2 X 2 t u t , t 1,...,24 and: y 2 t 152 .283 x t 2 1t 0.4348 t x 1t y t 2.1739 t x 2 2t 0.5217 t x t 2t y t 3.1304 x 1t x 2 t 0.0 t where lower case letters denote deviations from sample means. Test the null hypothesis Ho: 1 2 12 at the 5% significance level. 2*. Given the linear model, Yi o 1X i u i , i 1,..., n , where all the classical assumptions are valid except that the variance of the equation error is not a constant but is given by: E u i2 2 i derive E ˆ 1 and Var ˆ 1 , where ̂1 is the OLS estimator and comment on your results. 3. In the general linear model: Yt o 1X1t ... k X kt u t , t 1,...,T if: u t u t 1 t , with t ~ NIID(0, 2 ) and 1. Derive Var u t and Cov ( u t , u s ), s t. How does this first order serial correlation affect the properties of OLS estimators? 4*. What is meant by the ARCH model? How would you test for an ARCH(1) process in the linear model? 5*. A firm's average variable cost curve (AVC) is given by: AVCt = 1 + 2qt + 3qt2 + ut where qt is output at time t. Use STATA and the data on AVC and q in ASCII format in the file http://www.ecn.bris.ac.uk/www/ecca/avcost.raw to estimate 1, 2 and 3 (i.e. to read the data after invoking STATA type: infile avc q using http://www.ecn.bris.ac.uk/www/ecca/avcost.raw ). Use STATA to plot the data, the estimated AVC curve and the estimated marginal cost curve on the same graph and compute a prediction of the AVC and marginal cost at an output of 10 units. Construct a 95% prediction interval for AVC at the output of 10 units. 6. The STATA datafile “wage” contains 163 observations on a cross section of wages (lnwage, i.e. loge of wages), years of schooling, educ, and a measure of work experience, exper, from a Population Survey conducted by the U.S. Census Bureau. Run a regression of lnwage on educ and exper. Use White’s test to test for heteroskedasticity in the equation error. Run the regression again with “robust” standard errors (in STATA type: regress y x1 x2, robust). What do you conclude? (The datafile is in STATA format and can be read from within STATA by the command: use http://www.ecn.bris.ac.uk/www/ecca/wage). 7. 175 observations on the log of seasonally adjusted real consumption, consum, and personal disposable income, income, are in the datafile “coninc” (The data is stored in an EXCEL, csv (comma-separatedvalue), file which can be read from within STATA by the command: insheet using http://www.ecn.bris.ac.uk/www/ecca/coninc.csv). Use STATA to run a regression of consumption on income. Use the Durbin-Watson test statistic to test for first order serial correlation in the equation error term. Run the regression again using the Cochrane-Orcutt procedure (the command is: prais consum income, corc). Do you think the C-O procedure a satisfactory way of dealing with serial correlation? Explain. Compare your results with the OLS estimates using Newey-West robust standard errors. 8. Using the data in question 7, conduct a Chow test for a structural break from observation number 80, i.e., compare data from 1-79 with the period 80-175, by calculating URSS and RRSS and constructing the Fstatistic for a structural break. What do you conclude? 9*. The datafile “ford” contains observations on the current value of Ford Escorts of various ages (stored as year of manufacture, value, age so type: infile year value age using http://www.ecn.bris.ac.uk/www/ecca/ford.raw ). Use STATA to plot the value against age on a scattergram. You’ll notice that there appears to be a structural break and/or some non-linearity in the series. Use dummy variables and/or transformations of the age variable to model the series and use your final model to predict the value of a 2 year old and a 16 year old Ford Escort. Cliff Attfield November 2002