i. plan sponsor information

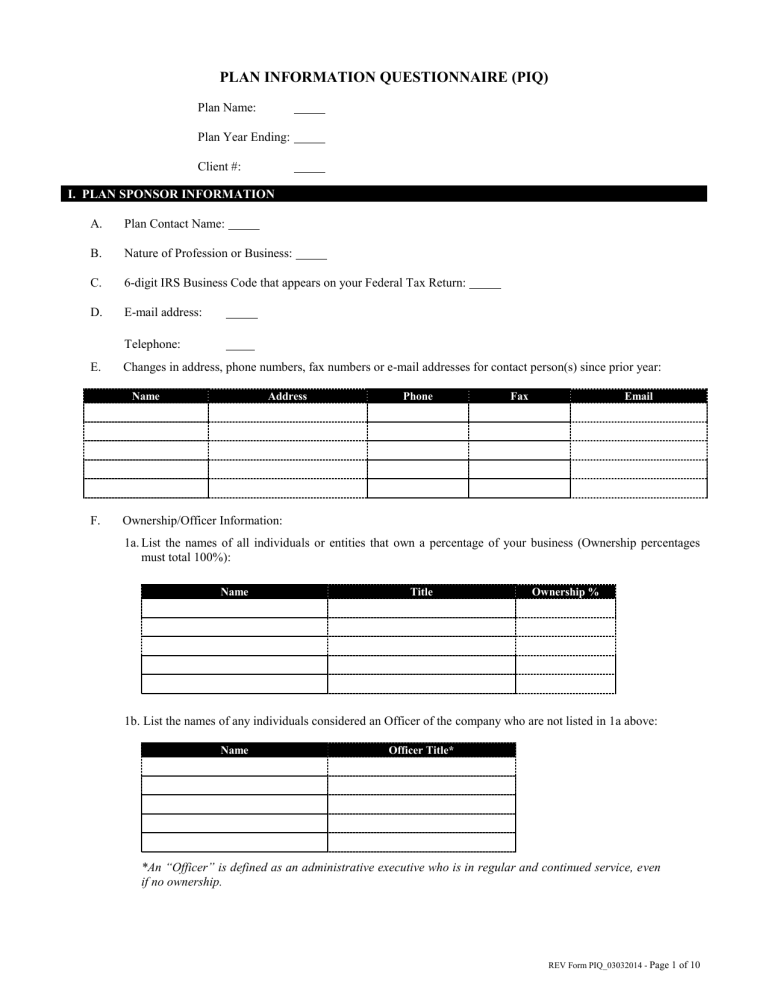

PLAN INFORMATION QUESTIONNAIRE (PIQ)

Plan Name:

Plan Year Ending:

Client #:

I. PLAN SPONSOR INFORMATION

A. Plan Contact Name:

B. Nature of Profession or Business:

C. 6-digit IRS Business Code that appears on your Federal Tax Return:

D. E-mail address:

Telephone:

E. Changes in address, phone numbers, fax numbers or e-mail addresses for contact person(s) since prior year:

Name Address Phone Fax Email

F. Ownership/Officer Information:

1a. List the names of all individuals or entities that own a percentage of your business (Ownership percentages must total 100%):

Name Title Ownership %

1b. List the names of any individuals considered an Officer of the company who are not listed in 1a above:

Name Officer Title*

*An “Officer” is defined as an administrative executive who is in regular and continued service, even if no ownership.

REV Form PIQ_03032014 - Page 1 of 10

1c. If your company is a corporation, do any individuals have an option to acquire stock?

Yes No (If Yes, please complete below; if No, go to Item 2.)

Name Number of

Shares Owned

Number of Options on Already

Outstanding Stock

Number of Options

Directly from

Corporation

2. List the names of any employees who are related to any owner listed in F-1a or F-1c above:

Name Relationship Person Related To

G. Is the Employer a member of a Controlled Group or Affiliated Service Group? (See “Glossary of Terms” for definition.)

Yes No (If Yes, please complete below; if No, go to “H.”)

1. Do any of the individuals, their spouses, or entities listed in Question F-1a have ownership interest in any other company?

Yes No (If Yes, please complete below.)

Name of Company Ownership

%

Approx. # of

Employees

Included in Provided

Census?

Yes No

Yes No

Yes No

2. Does the Plan Sponsor (your Company) have an ownership interest in any other company?

Yes No (If Yes, please complete below.)

Name of Company Ownership

%

Approx. # of

Employees

Included in Provided

Census?

Yes No

Yes No

H. Employer’s Fiscal Year End:

I. Employer’s Entity Type: Click Drop Down and Choose:

Other:

Yes No

*(Partnerships, LLPs, and LLCs taxed as partnerships, attach Form 1065 & K-1)

REV Form PIQ_03032014 - Page 2 of 10

J. List the total number of employees employed during the plan year, include all self-employed individuals and employees of entities aggregated with the employer through a Controlled Group or Affiliated Service Group:

K. Did the Employer have any Union or Leased Employees during the year? If yes, indicate number of employees in each category. Note that employees who are contracted through an employment agency or temporary agency on a long term or full time basis, may be Leased Employees as defined under Code section 414(n).

Yes No ( # of Union # of Leased)

If yes, are these reported on the census information? Yes No

II. CLIENT ADVISORY INFORMATION

A. Were there any changes during the plan year such as an accountant, attorney, financial advisor, or trustee?

Yes No

If yes, please provide the name and address of the person who was replaced and the reason, as well as the name and address of the person’s successor:

Name Address Phone Reason

B. If your plan has over 100 participants and you are required to have an independent audit of the plan, or if under 100 participants and the plan invests in non-qualifying assets and does not have a bond equal to the value of such nonqualifying assets thereby requiring an audit of the plan, please indicate:

Name of Accountant or Accounting Firm:

EIN of Accountant or Accounting Firm:

III. CONTRIBUTION INFORMATION

A. Profit Sharing or 401(k) Plans Only:

1.

Was a profit sharing contribution declared for this plan year?

No, no contribution will be made this year.

To be determined. We will contact you on or near (insert date) .

Yes: a) Exact dollar amount for the Fiscal Year End is $ .

b) % of all eligible compensation. Please calculate this amount.

c) Please calculate OPTIMUM percentage to maximize owners.

d) Please calculate MAXIMUM to all employees.

B. 401(k) Plans Only:

1. Will there be a matching contribution this year? Yes No

If yes, what is the matching formula or amount? $ Formula:

REV Form PIQ_03032014 - Page 3 of 10

If yes, is the match to be determined by the Employer, or to be recommended by NRS

Contributions are remitted Click Drop Down and Choose:

Other:

2.

During the plan year, did you limit the deferral elections of highly compensated participants to a maximum percentage of compensation in order to ensure the passage of the Actual Deferral Percentage (ADP) Test?

Yes No If yes, enter the maximum percentage: %

IV. OTHER PLAN INFORMATION

A. Does the Plan Sponsor maintain any other Qualified Plan(s)? Yes No

If Yes, and the other plan is not administered by NRS, please provide a brief description of the other plan(s):

Plan Type (e.g., Defined

Benefit, ESOP, etc.)

3-Digit Plan Number

(ie: 001, 002)

Plan Year End Contribution Amount

Person(s) Responsible for Testing (combined limits)

B. Does the Employer maintain a Section 125 Plan (Cafeteria, FSA or POP - see “Glossary of Terms” for definitions)?

Yes No

C. Has the Employer ever terminated a Qualified Plan? Yes No

If yes, please provide the following:

Date of Termination Plan Type 3-Digit Plan Number

V. IRS FORM 5500 SERIES INFORMATION

Please be reminded that Form 5500 series with related Schedules must be submitted for processing via the EFAST2 system (which means electronically). All signers of the Form 5500 series must register for filing credentials through the

I-REG application. If you have not already done so, please go to www.efast.dol.gov and click ‘Register’, to register for filing credentials.

A. Please provide the name of the individual that will sign as the Plan Administrator on the Form 5500 series:

Name:

E-Mail Address (to be) used to register:

Completed On-Line Registration with EFAST2: Yes No

B. Please provide the name of the individual that will sign as the Employer/Plan Sponsor on the Form 5500 series

(this is optional; the form only requires the signature of the plan Administrator):

Name:

E-Mail Address (to be) used to register:

Completed On-Line Registration with EFAST2: Yes No

C. Trust Identification Number (this will be different from the Employer Identification Number):

REV Form PIQ_03032014 - Page 4 of 10

D. During the Plan Year, did the Plan receive any non-cash contributions whose value was neither readily determinable on an established market nor set by an independent third party appraiser? (Example: Non-Publicly traded Employer Stock, Real Estate or Limited Partnerships).

Yes No

E. During the Plan Year, did the Plan hold any assets whose current value was neither readily determinable on an established market nor set by an independent third party appraiser?

Yes No

F. Did the employer fail to transmit to the Plan any participant contributions or loan payments within the maximum time period described by the DOL in 29 CFR 2510.3-102?

Yes No

If yes, this may be considered as a Prohibited Transaction. Please consult your tax advisor for a Form 5330 filing

(see Note below).

Pay Date Date of Deposit Amount of Deposit

NOTE : Federal regulations deem employee money withheld from an employee’s paycheck for deposit into the employer’s retirement plan or money paid by the participant as a plan participant loan repayment to be ‘plan assets’, as of the earliest date on which the money can reasonably be segregated from the employer’s general assets (‘earliest date rule’). This Regulation (2510.3-102) is strictly enforced by the Employee Benefits

Security Administration (‘EBSA’) of the United States Department of Labor (‘DOL’).

Retirement plans covering fewer than 100 participants at the beginning of the plan year are given a ‘Safe

Harbor’ equal to seven business days after the payroll date. However, prudent employers normally deposit participant contributions and loan repayments on the same day as the payroll, but no longer than two or three days after the payroll.

For retirement plans with 100 or more participants (at the beginning of the plan year), they have no such safe harbor and must follow the ‘earliest date rule’ described above. Plans of any size are subject to an outside limit equal to the 15th business day of the month following the month in which the participant contributions or loan payment amounts were received by the Employer. This limit is very rarely applied because the ‘earliest date rule’ almost always results in a much earlier limit.

G. Qualified Plans are required to have a Fidelity Bond. List the name and current amount of the Plan’s ERISA fidelity bond:

Surety Company: Amount: $

H. Were any fees or commissions paid to any brokers, agents or other persons by an insurance carrier, insurance service or other organization that provides some or all of the benefits under the plan? (If any benefits under the plan are provided by an insurance company/service or other similar organization, or if the plan has investments with insurance companies such as a GIC, report the total of all insurance fees and commissions paid to agents, brokers and other persons directly or indirectly attributable to the contract(s) place with or retained by the plan.)

Yes No If yes, please state amount: $

I. Has the plan failed to provide any benefit due under the plan? (Were/are there any benefits due under the plan which were not/have not been timely paid or paid in full. Include in this amount the total of any outstanding amounts that were not paid when due in previous years that remain unpaid.)

Yes No If yes, please state amount: $

REV Form PIQ_03032014 - Page 5 of 10

J. Were any loans by the Plan or fixed-income obligations due the Plan in default as of the close of the plan year or classified during the year as uncollectible? (See K. below regarding participant loans secured by the participants’ account balances.)

Yes No If yes, please state amount: $

K. Were any participant loans in default at any time during the year? (A default occurs if any payment(s) that were due were not made and then not made up by the end of the calendar quarter following the quarter in which they were due.) If yes, please indicate below:

SSN Participant Amt of Loan

Outstanding

Date(s) of Missed

Payment(s)

L. Were any leases to which the Plan was a party, in default or classified during the year as uncollectible?

Yes No If yes, please state amount: $

M. Did the plan experience a ‘Blackout Period’ during the plan year?

Yes No (See Glossary of Terms)

If yes, was the required notice provided to participants within 30 days prior to the effective date of the Blackout

Period?

Yes No If not, please list exceptions:

N. Did the Plan engage in any non-exempt transaction with any party-in-interest?

Yes No If yes, please state amount: $

O. Did the Plan have a loss that, whether or not reimbursed by the Plan’s fidelity bond, was caused by fraud or dishonesty?

Yes No If yes, please state amount: $

P. Did the Plan at any time hold 20% or more of its assets in any single security, debt, mortgage, parcel of real estate, or partnership/joint venture interest?

Yes No If yes, please state amount: $

Q. Were any Plan amendments adopted during this plan year? (Answer only if using a plan document that was not prepared by NRS)?

Yes No If yes, please send us a copy of the signed and dated amendment (if not previously provided).

R. Please add any additional comments you may have regarding your Plan:

.

REV Form PIQ_03032014 - Page 6 of 10

I HEREBY CERTIFY that the information provided in this questionnaire and corresponding employee data for preparation of the Annual Plan Valuation is complete and accurate to the best of my knowledge. I further understand that NRS is not responsible for any excise or penalty taxes assessed to my Company’s Plan .

Company:

Signature:

Printed Name:

Title:

Date:

REV Form PIQ_03032014 - Page 7 of 10

RECONCILIATION OF EMPLOYEE CENSUS

Plan Name:

Plan Year Ending:

Client #:

1.

Include all employees who were employed at any time during the plan year. For each employee, enter the requested data. However, if your Plan Document excludes Union Employees (employees covered by a collective bargaining agreement), list only Non-Union Employees and insert the following:

2.

Hours Worked - Input total hours paid or for which payment is due including hours paid for vacation, holiday, sickness, jury duty, leave of absence or back pay awarded.

3.

a.

The compensation supplied under the Gross Compensation Amount column on your census worksheet or EDE file should be the total of the following:

Compensation reportable as taxable wages on Form W-2

Pre-tax 401(k),403(b) and 457 deferrals

125 Cafeteria Plan deferrals

132(f) Qualified Transportation (Commuting) deferrals

Note that on Form W-2:

Box 1 'Wages, Tips, Other compensation' does not include Pre-tax 401(k), 403(b), 457 deferrals, Section

125 Cafeteria deferrals or Section 132 (f) deferrals. Roth 401(k) deferrals are included in box 1, since they are withheld after-tax.

Box 5 'Medicare Wages and Tips' includes Pre-tax 401(k), 403(b), 457 and Roth deferrals but does not include Section 125 Cafeteria deferrals or Section 132(f) deferrals.

In addition, there may be some other differences between Box 1 and Box 5. For example, health insurance premiums for S Corporation 2% or more shareholder-employees are always included in Box 1, but may be subject to an exclusion under Box 5. As a result, Box 5 may not be an appropriate source of compensation for retirement plans. Therefore, you may want to obtain gross compensation figures from a report provided by your payroll company or your in-house payroll software.

For calendar year plans , please validate that your plan census, compensation, and employee information correlates with the IRS Form W-3 (transmittal form for Forms W-2) by completing the following:

Form W-2, Box 1 (Wages, tips and other compensation ) total payroll reported

Plus total Pre-tax 401(k), 403(b) and 457 Deferrals (if any)

Plus total Section 125 Cafeteria Deferrals (if any)

$

$

$

Plus total Qualified Transportation (Commuting) Benefits 132(f) Deferrals (if any)

Should equal total gross compensation reported on employee census

Form W-3 total number of employees

$

$

$ b.

Sole Proprietors/Partnerships: Generally, Sole Proprietors can derive earned income from the IRS Schedule C

(Form 1040). Please provide copies of Schedule C (Form 1040) and Schedule SE (Form 1040). Partners in

Partnerships can derive this figure from the IRS Schedule K-1. Please provide IRS Form 1065 including Schedule

K-1 for each partner.

The definition of net earned income is net earnings (gross earnings minus expenses) from personal services rendered which produced material income. It does not include passive income from invested capital. c.

If your Plan Document excludes certain types of compensation, please indicate below the compensation listed under the 'Excluded Compensation' column.

Bonuses

Overtime

Commissions

Reimbursement or other expense allowances, fringe benefits, moving expenses, welfare benefits

REV Form PIQ_03032014 - Page 8 of 10

d.

If your Plan Document excludes ' Pre-Entry Compensation ', please provide compensation for newly eligible employees paid prior to their entry date. Pre-entry compensation is gross compensation from the first day of the plan year to the date the employee is first eligible to participate in the plan (entry date), regardless of whether or not the participant elected to make 401(k) contributions at that time.

4.

If you are providing census data by hard copy, complete the enclosed Reporting Compensation Paid After

Separation of Service form regarding employees who received compensation after their date of termination. This form is not required if you are providing census data in Excel or EDE format, because the information will be included in your electronic file.

5.

Please complete the Additional Employee Information form regarding: a) employees who terminated employment due to death, disability or retirement; b) employees rehired during the plan year; and c) employees on leave of absence. Please note: Do not report leave of absence dates as termination dates on the employee census.

6.

When transmitting data electronically or via hard copy, please sign and date this form in the space provided below and return along with the Plan Information Questionnaire to your NRS Account Manager as soon as possible.

I hereby certify that the attached information is true and correct.

Company:

Signature:

Printed Name:

Title:

Date:

REV Form PIQ_03032014 - Page 9 of 10

ADDITIONAL EMPLOYEE INFORMATION

Plan Name:

Plan Year Ending:

Client #:

REPORTING TERMINATIONS DUE TO DEATH, DISABILITY OR RETIREMENT

Name Social Security

Date of

Termination

Reason

REPORTING PARTICIPANT REHIRES

Name Social Security

Original Date of Hire

Date(s) of

Termination

Note: If an employee has multiple rehire dates, list all dates of hire and termination.

Rehire

Date(s)

Name

REPORTING PARTICIPANT LEAVES OF ABSENCE

Social Security

Date of

Leave

Date of

Return

Reason

Click Drop Down and Choose:

Click Drop Down and Choose:

Click Drop Down and Choose:

Click Drop Down and Choose:

Click Drop Down and Choose:

Click Drop Down and Choose:

REV Form PIQ_03032014 - Page 10 of 10