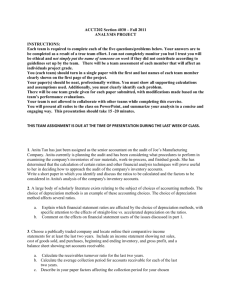

detailed observations and recommendation

advertisement