March 20, PM - indu . events

advertisement

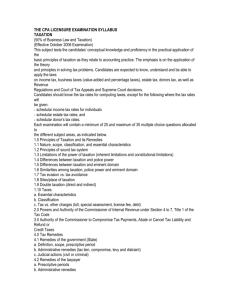

1 Day 1 – November 26 *Note that all delegates may attend both plenary sessions. A book is included as a reference for the Tax Incentives lecture in Day 1. Plenary Session 1: Problems, Issues, and Solutions in Tax Audit and Investigations Dr. Ruperto P. Somera November 26, 8:00-12:00 NN Statutory Basis of Assessment Priority Target in Taxpayers’ Audit Industry Benchmarking Revenue Memorandum No. 3-2010 Revenue Memorandum Order No. 22-2011 Exclusions from Audit And Investigation By The Rdo’s Requirements of LA Tax Verification Notices Revenue Memorandum Circular No. 62-2010 Power of the Commissioner to Obtain Information Revenue Regulation No. 10-2010 Revenue Merandum Order No. 45-2010 Remedies During Audit Revenue Memorandum Order No. 38-88 Guidelines on Revalidation of Letter of Authority Notice of Informal Conference Preliminary Assessment Notice Revenue Regulations No. 12-99 Preliminary Assessment Notice (Pan) Formal Letter of Demand And Assessment Notice Assessment of Income Tax Authority to Make Assessments Effect of Assessments Revenue Regulations No. 12-99 Formal Letter of Demand And Assessment Notice Summary of Assessment Cycle Guidelines As to Finality Of Assessments Revenue Regulations No. 12-99 Disputed Assessment Effect of Failure to Appeal on Time Definition and Nature of Surcharge Definition of Delinquency Effect of Partial Protest Requisites for a Valid Waiver Under Rmo 20-90 Civil Remedies Remedies Available to the Taxpayer Under the Tax Code in Connection with the Collection of Taxes Remedies Available to the Government 2 Remedies for the Collection of Delinquent Taxes Definition of Distraint Definition of Levy (on Real Property) How Levy is Effected Definition of Forfeiture Definition of Tax Alien Distraint of Personal Property Levy on Real Property Garnishment Suspension of Running of Statute of Limitations (Collection) Authority of the Commissioner to Compromise, Abate and Refund or Credit Taxes Minimum Compromise Settlement Tax Credit or Refund of Taxes Forfeiture Of Cash Refund Power of the Commissioner to Make Assessments Failure to Submit Required Returns, Statements, Reports and Other Documents Amendment of Return Fraudulent Return Failure to File Certain Information Returns Exceptions as to Period of Limitation of Assessment and Collection of Taxes Oplan Kandado Power of the Commissioner to Suspend the Business Operations of a Taxpayer Tax Amnesty Plenary Session 2: Tax Incentives Mr. Danilo A. Duncano November 26, 2012, 1:00 – 5:00 PM 1. Anti-Red Tape Act of 2007 B. Tax Differentials and Tax Incentives (Special Laws and Relevant BIR Issuances) Cooperatives Mircrofinance services of NGOs Barangay Micro Business Enterprise Senior Citizens Magna Carta for Persons with Disabilities Jewelry Industry Tax Incentives under the Labor Code PERA Adopting a Public School Philippine Normal University Philippine Overseas Shipping PAGCOR Tourism Industry Bases Conversion and Development Act of 1992 (BCDA) Special Economic Zones (Freeport Zones) 3 Cagayan and Zamboanga Special Economic Zone Aurora Special Economic Zone Board of Investments Related Laws/Issuances Philippine Deposit Insurance Corporation National Commission for Culture and Arts Home Development Mutual Fund Law of 2009 Socialized Housing Real Estate Investment Trust (REIT) Special Purpose Vehicle (SPV) Power Sector Assets and Management Corporation (PSALM) 2. Relevant Tax Code Provisions Marginal Income Earners/Employees/Self-Employment Educational Institutions 40% OSD VAT Zero Rating & Exemptions 3. a. Recap of Pinoytax eClinic Wellness Strategy b. Recap of Main Pinoytax References I kNOw TAX?! Exemptions, Exclusions and Reductions Handbook Pinoytax website - kNOw TAX?! Exemptions, Exclusions and Reductions eBook 4. Closure Day 2 – November 27 *Note that a delegate may attend only 1 morning and 1 afternoon breakout session of their choice. Break-out Session 1 (Morning): Managing Tax Risk Dr. Ruperto P. Somera November 27, 2012, 8:00 – 12:00 NN Introduction to Risk Management Tax Risk Problems Solutions to Tax Risk Problems Managing Tax Risks Preventive Measures in Tax Risk Problems Control Year End Tax Risk Strategies Managing Tax Risk in Tax Compliance Basic Tax Compliance Tax Management in the Filing of Returns Withholding Tax Requirements VAT Requirements Tax Risks in Tax Audit or Tax Investigations Managing Tax Rights in the Collection of Delinquent Accounts 4 Break-out Session 2 (Morning): Updates on Taxpayers’ Rights and Remedies Atty. Victorino C. Mamalateo November 27, 2012, 8:00 – 12:00 NN What a Taxpayer Need to Know About the BIR Organizational Structure and its Audit Jurisdiction Understanding the BIR Tax Audit Program Relevant Information About Audit Notices to Examine Books What the BIR Looks for in an Audit & Common Pitfalls of Taxpayers Understanding BIR's Bases of Assessment Assessment Processes BIR's Collection Enforcement Remedies of the Taxpayer Recent Developments Break-out Session 3 (Morning): Tax Planning, Strategies, and Techniques for Yearend Tax Closing Atty. Froilyn D. Pagayatan November 27, 2012, 8:00 – 12:00 NN I. Year End Tax Planning and Strategies 1) Objectives of Year – End Tax Planning General Approach and Strategies in Tax Planning Specific Year End Tax Planning Options And Strategies 2) Avoiding Improperly Accumulated Earnings Tax 3) Relief from Minimum Corporate Income Tax Minimum Income Tax on Domestic Corporations Minimum Corporate Income Tax (MCIT) on Resident Foreign Corporations 4) Year End Strategies on Net Operating Loss Carry Over 5) Optimized Tax Deductions Revenue Regulations Persons Covered 5 Determination of the Amount of Optional Standard Deductions for Individuals Determination of the Amount of Optional Standard Deduction for Corporations Determination of the Optional Standard Deduction for General Professional Partnership (GPPs) and Partners of GPPs Other Implications of the Optional Standard Deduction Itemized Deduction Maximized Deductible Expenses Allocation of Expenses Revenue Related Transactions Method of Recording Requirements for Deductability Reporting Requisites for Deductability of Interest Expense Taxes Losses Bad Debts Depreciation Research and Development Expenditures Charitable and Other Contributions Retirement Benefit/Separation Pay 6) Tax Strategies of Fringe Benefits Special Treatment of Fringe Benefit Computation of Grossed-Up Monetary Value 7) Withholding Tax Strategies Types of Withholding Taxes Tax Due = Tax Withheld Withholding Tax Returns Pertinent Revenue Regulations and Memoranda 8) Value Added Tax Strategies Requirements on Input Tax Substantiation Requirements on Input Tax Allocation of Input Taxes Between VAT Taxable and VAT Non-Taxable Operations Procedures for Claiming Refunds or Tax Credits 9) Compliance in Bookeeping Rules and Regulations 10) Strategies on Civil Remedies 11) Handling Tax Audit and Taxpayers’ Rights and Remedies 11.1) Statutory Basis of Assessment Letters of Authority (L.A.’S) Priority Target in Taxpayers’ Audit Industry Benchmarking 6 Pertinent Revenue Memoranda Excluded from Audit and Investigation by the RDO’s Power of the Commissioner to Obtain Information, Etc. 11. 2) Remedies During Audit Guidelines on Revalidation of Letter of Authority Informal Conference Preliminary Assessment Notice Formal Letter of Demand and Assessment Notice Assessment of Income Tax Formal Letter of Demand and Assessment Notice Guidelines as to Finality of Assessments Pertinent Memoranda and Revenue Regulations Disputed Assessment The Prescriptive Periods 11. 3) Civil Remedies Remedies Available to the Taxpayer under the Tax Code in Connection with the Collection of Taxes Remedies Available to the Government Remedies for the Collection of Delinquent Taxes Suspension of Running of Statute of Limitations (Collection) Authority of the Commissioner to Compromise, Abate and Refund or Credit Taxes “Oplan Kandado”: Revenue Memorandum Order No. 3-2009 11. 4) Tax Amnesty Break-out Session 1 (Afternoon): Tax Exclusions and Reductions Mr. Danilo Duncano November 27, 2012, 1:00 – 5:00 PM *Outline to follow Break-out Session 2 (Afternoon): The Latest on Expanded Withholding Taxes and Allowable Deductions Mr. Enrico Pizarro November 27, 2012, 1:00 – 5:00 PM Expanded Withholding Tax Underlying Law and Regulations 7 Nature and Basic Principles of EWT Withholding Agents Exemptions from Withholding Timing of Withholding Effects of Failure to Withhold EWT Remedies EWT Base Tax Credit Mechanism Payments Subject to EWT Administrative Requirements Allowable Deductions Expenses – General Requirements Requisites for Deductibility, Limitations and Substantiation Requirements Entertainment, Amusement and Recreation Expenses Interest Taxes Bad Debts Depreciation Charitable and Other Contributions Research and Development Pension Allocated Expenses by Head Office Senior Citizen Discount Standard Input Tax Non-Deductible Expenses Expenses – Remedies If Disallowed Net Operating Loss Carry-Over (NOLCO) Optional Standard Deduction (OSD) Latest Issuances Break-out Session 3 (Afternoon): Estate Planning and Wealth Management in Relation to Taxation Dr. Ruperto P. Somera November 27, 2012, 1:00 – 5:00 PM The Importance of Estate Planning Types of Assets and Their Value Transfer of Properties of an Individual Estate Taxation Objectives of Estate Planning Is it a Need? Determining Taxable Net Estate Composition of Gross Estate Estates Classification Deductions Allowed to the Estate 8 Considerations to Determine Whether Transfer was in Contemplation of Death Judicial Expenses Attachments to Estate Tax Return Penalties Devices of Estate Planning Consequences of a Person Dies without a Will Trusts The Importance of Life Insurance Insurance Exclusions from the Gross Estate Donations Computation on Taxable Gifts Allowable Deductions from Gross Gifts Tax-free Reorganizations Exchange of Real Property to Shares of Stock Wealth Management ***NOTHING FOLLOWS***