Money Management for a Lifetime

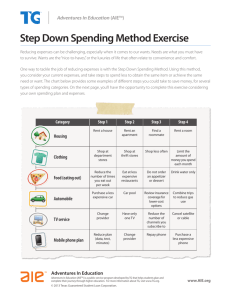

advertisement