White Paper Outline

advertisement

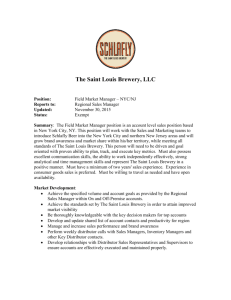

Depository Trust and Clearing Corporation Fund Transfers Business Advisory Group Industry Recommendation Paper DTCC Fund Transfers Industry Recommendation Paper V23 February 2007 Depository Trust and Clearing Corporation Table of Contents i) Acknowledgements.................................................................... 3 II. Business Considerations and Recommendations .................. 5 A. B. C. D. E. F. Contract Snapshot .......................................................................................................................... 5 Carrier Rules for Fund Transfers ................................................................................................ 7 Distributor Requirements and Expectations ............................................................................... 8 Regulatory Considerations ............................................................................................................ 9 Real-time vs. Batch Processing.....................................................................................................11 Decision to use XML .....................................................................................................................12 III. Prerequisites For Using Fund Transfers via NSCC........ 12 a) b) c) ACORD Product Profile for Annuities (PPfA) (or similar mechanism). .................................12 NSCC Positions and Values (POV) ..............................................................................................13 Financial Activity Reporting (FAR) ............................................................................................13 IV. Proposed Fund Transfer Process....................................... 14 Product Profile (PPfA) (highlighted in orange in the Workflow Diagram)........................................14 Positions and Valuations (POV) (highlighted in blue in the Workflow Diagram) .............................14 Fund Transfer Process ............................................................................................................................15 V. Next Steps ............................................................................ 17 Appendix A - Assumptions and Notes ....................................... 18 Appendix B – Glossary of Terms ............................................... 19 DTCC Fund Transfers Industry Recommendation Paper V23 February 2007 Depository Trust and Clearing Corporation i) Acknowledgements This paper was a collaborative effort by members of the Fund Transfers Business Advisory Group. Below are the firms that contributed to this paper. COMPANY NAME ACORD Allstate BlueFrog Solutions DTCC Edward Jones Finetre The Hartford ING John Hancock Lincoln Merrill Lynch Met Life Morgan Stanley Nationwide NAVA Pacific Life PCA Raymond James Piper Jaffray Sun Life Financial Vertex Consulting Wells Fargo Investments DTCC Fund Transfers Industry Recommendation Paper V23 February 2007 Depository Trust and Clearing Corporation I. Executive Summary The purpose of this document is to provide a summary of the Fund Transfers Business Advisory Group’s (BAG) analysis and recommendations to the industry on how the proposed NSCC Fund Transfers service will operate. This paper will discuss the business issues considered, the proposed process, complimentary features of the service and next steps. Development and implementation of the Fund Transfers process is the second phase in automating and standardizing a broad range of inforce policy transactions, which started in 2005 with ACATS for Insurance, internal rep changes (REP) and brokerage account number changes (BIN). Fund Transfers is in line with the insurance industries straight through processing objectives and consistent with the continued efforts to mainstream insurance products with other financial products. Scope: The scope of this initiative is confined to the following: One-time fund transfer and/or reallocation of the underlying securities within a variable contract initiated by a registered representative (Rep). In addition, within the actual fund transfer transaction, broker/dealers may update service feature that were impacted by the fund transfer. These Service Features include: o Standing Allocations o Dollar Cost Averaging / Special DCA o Systematic Withdrawals o Automatic Investments o Interest Crediting o Asset Allocation o Asset Rebalancing Real-time Contract Snapshot transaction (aka Values Inquiry Message). This transaction will occur prior to the fund transfer. Broker/Dealers can request updated contract information rep has the most current information possible prior to submitting a fund transfer transaction. The scope of this project does not include: customer-initiated requests directly to the carrier. The new service is intended to replace current processes used by reps today to request a one-time fund transfer of assets, including online carrier website requests, telephone, fax, email, and other independent transactions. Background: This initiative began as a result of several regulatory findings that enforced distributor responsibility for the actions of their reps with regard to unethical business practices. These findings prompted the Securities Industry Association (SIA) Insurance Panel to request that DTCC, through one of its subsidiary operating companies, create an efficient and cost effective way to automate the fund transfer process enabling distributors to better monitor the actions of their reps, and reduce the risk of unethical business practices. Concerns over client suitability, market timing, and late day trading were factors that led to the proposed fund transfer process outlined in this paper. NSCC is a wholly owned subsidiary of DTCC and a clearing agency registered with the Securities and Exchange Commission. Its membership includes broker/dealers, banks and insurance carriers. It operates as an industry utility for various sectors of the financial services industry, including mutual funds and insurance services. Proposed Process: The BAG proposal for fund transfer processing is based on an interactive request and response service via NSCC’s Insurance Processing Service (IPS). DTCC Fund Transfers Industry Recommendation Paper V23 February 2007 Depository Trust and Clearing Corporation Distributors will provide the ability; either from their own internal system or solution provider service, for reps to receive updated contract snapshots, enters fund transfer transactions and receives immediate confirmation. As a best practice, distributors will utilize several complimentary services to provide upfront checks and balances to ensure both product rules and suitability rules are being followed. Distributors will be responsible for “Time Stamping” of transaction to ensure that “No Late Trading” is permitted; subject to SEC approval of proposed NSCC rule changes. NSCC will play the role of centralized, secure processing source, which will receive, edit and transmit transactions to all parties involved. Carriers will receive fund transfer requests from the distributors and respond with responses that convey the request status back to the distributor. Fund Transfer Objectives: Automate and centralize the fund transfer process by creating real-time request and response transactions, which will increase efficiency and lower operational costs. Create an efficient way for distributors to monitor and track rep-initiated fund transfer transactions to comply with regulatory requirements. Increase the number of In Good Order (IGO) fund transfer transactions sent to the carriers. Improve the overall user experience for reps by mainstreaming the process, which will hopefully lead to increased annuity sales. Business Recommendations: Distributors and carriers will incorporate NSCC’s Positions and Valuation file (POV) and ACORD’s Product Profile for Annuity (PPfA) as complimentary services to provide current contract detail and carrier product rule information. This information can be used to ensure that the rep is using the most current contract information on which to base the fund transfer and the proper carrier product rules are being enforced on the front end. Distributors and Carriers will develop a contract snapshot real-time inquiry message to provide the most updated contract information available. This will include, but not limited to, contract values, fund restriction information, service feature information such as target and source funds. A selling agreement addendum will be created that allows the carrier to accept the distributor’s time stamp as the end of the day control. This differs from the current process, where the Carrier controls the end of the day time stamp. The Fund Transfers service will be built using the ACORD XML data model Next Steps: Establish Pilot participants and systems development in 2Q07 Pilot testing in 3Q07. SEC review and approval of NSCC proposed funds transfer service Subject to SEC approval, production rollout in 4Q07. Fund Transfers Documentation, including working group minutes, business flows and implementation procedures are available at http://insurance.dtcc.com. II. Business Considerations and Recommendations A. Contract Snapshot Distributors within the Business Advisory Group (BAG) expressed the need to access current annuity contract information at the onset of a fund transfer request to be used to determine the good order status of a request. A contract snapshot will provide pertinent annuity contract information for the distributor to determine if a fund transfer request meets carrier business rules. The snapshot will include information related to the contract, such as contract values, DTCC Fund Transfers Industry Recommendation Paper V23 February 2007 Depository Trust and Clearing Corporation current fund allocations, fund restrictions and active service features. This information will allow the distributor to supply its financial advisor or agent with a current portfolio picture so that the agent may make a valid fund transfer request. The BAG considered two options to obtain the necessary snapshot information – NSCC’s Positions and Valuations (POV) and an ACORD XML real-time query. The BAG recommended that both NSCC’s POV service and a real-time inquiry message would be the ideal solution. Each option considered by the BAG and reasons for its recommendation is outlined below. Option 1 – NSCC Positions and Values (POV) Based on the current POV standard usage, position data would be sent on a daily basis in batch mode to the distributor. The distributor would store and use the POV data to create a contract snapshot for their agents’ review, and apply both carrier and distributor business rules to this data as the fund transfer is requested. This option would allow both carriers and distributors to use a process that is already in place in most firms. Option 2 – Real-time XML Query A real-time XML query would require the distributor to send an XML message to the carrier requesting contract snapshot information at the time the agent is initiating the fund transfer request. The carrier would be expected to respond to this request within a few seconds (returned data would be consistent with POV file information). The distributor would use the real-time XML response to create a contract snapshot for their agents’ review, and apply both carrier and distributor rules to this data as the fund transfer is requested. To respond to the query, carriers would use either stored or real-time data. This option would require most carriers and distributors to develop a new process, but it would ensure the most up to date information and provide additional information that is not on the POV. POV Enhancements Required In order for POV to support contract snapshot information, several enhancements will need to be made. The following enhancements are proposed: o Fund Transfer Agent Authorization Information The owner of an annuity contract must authorize the carrier to accept transaction requests from an agent on their behalf, and may be asked to authorize specific types of transactions and modes in which those requests can be made by the agent. Within the proposed NSCC Fund Transfer process, the carrier will need to provide client authorization information to distributors within the contract snapshot to allow them to verify that the agent is authorized to submit an electronic fund transfer request. New POV fields would include authorization type and authorization mode. These fields would be added to the contract level within all POV record formats. o Fund Transfer Restriction Information Carriers have the ability to restrict fund transfers on a contract for various reasons. Examples include maximum annual transfer limits exceeded and reallocation program already in place. A contract restriction indicator and reason field will be added to all POV record formats. Frequency Standard of POV As a best practice recommendation, the Advisory Group agreed that distributors would need to receive the POV data no later than the 6:00 AM output cycle in order to most effectively utilize the contract snapshot. In order for the carriers to deliver the position data to the distributors in the 6:00 AM output cycle, it will be necessary for firms to adopt the suggested usage for POV, which includes receiving PFF and PNF daily and PVF weekly or monthly. DTCC Fund Transfers Industry Recommendation Paper V23 February 2007 Depository Trust and Clearing Corporation Real-time Inquiry Required In order to support a contract snapshot, firms will need to develop an inquiry message using ACORD XML that will be used in conjunction with the fund transfer process. B. Carrier Rules for Fund Transfers The BAG analyzed various carrier rules that may be required by distributor platforms in order to support in-good-order fund transfers. A list of rules categories was identified. Please note that these rules may differ by carrier and/or product and are not inclusive of all possible rules and scenarios. 1. Product rules requiring neither position nor transaction history These are rules that are basic to the product and do not require any knowledge of the specific contract. Examples include: funds available to the product; transfer options available (i.e. dollar to dollar, dollar to percent, interest to percent); minimum transfer amounts allowed. 2. Product rules requiring position information but not transaction history These are rules that depend on the product and may also require position information on the contract. Examples include: funds available to the contract depending on issue date; funds available to contract depending on active riders; and current allocation amounts. 3. Product rules requiring position information as well as transaction history These are rules that depend on the product and involve the transaction history of the contract and possibly position information. Examples include: no more than one “round trip” exchange for a fund per year; no more than a predefined number of transfers per year. 4. Special circumstance contract restrictions These are non-systematic restrictions. Examples include: contract has violated frequent transfer rules; divorce proceedings in progress (all transfers restricted unless agreed to by both parties in writing). 5. Agent Authorization checks Verifications are done to ensure that the agent has the appropriate credentials to perform the request. Examples include: requesting agent is agent-of-record on contract; agent is licensed and/or appointed in contract owner’s state of residence; client has authorized agent initiated fund transfers. The BAG recommends that carrier rules and supporting contract information be provided to the distributor via the following methods: Product level rules - ACORD’s Product Profile for Annuities (PPfA) Contract positions – NSCC’s POV Transaction history - Distributors will rely on the carrier to indicate when applicable restrictions apply to a particular contract through the new restriction fields to be added to the POV snapshot Special circumstance contract restrictions – Distributors should rely on the carrier to indicate when special restrictions apply to a particular contract, either through the new restriction fields to be added to the POV snapshot, or through manual methods Agent Authorizations – Distributors should use NSCC’s POV to verify contract-related agent authorizations such as client authorization and agent-of-record, and may use NSCC’s Licensing & Appointments (L&A) service to validate license and appointment authorization. DTCC Fund Transfers Industry Recommendation Paper V23 February 2007 Depository Trust and Clearing Corporation C. Distributor Requirements and Expectations The need to overlay distributor rules with the carrier rules is important as we move forward in automating Fund Transfers for several reasons: Ensure transaction is “in good order” from a distributor perspective Ensure the Advisor is the appropriate individual to initiate the transaction (from the distributor’s perspective) Eliminate the need for Advisors to initiate transactions through alternative methods (for example, telephone, carrier websites, etc.) The distributor will be responsible for the following edits: Ensure the contract is linked to a valid broker dealer account Ensure both the contract and the broker dealer account are active without any distributor restrictions Ensure the agent is the broker dealer’s agent of record for the insurance contract Ensure the agent is not prohibited from initiating such transactions, either electronically or holistically Below is a high level flow that outlines the edits the broker dealer will be responsible for: User Enters Application User Enters/Selects Broker Dealer Account Number User Enters/Selects Contract User Enters Fund Transfer Information (existing process will continue from here) System will determine if user role (i.e. Advisor, Associate, Branch Manager) allows entry of inforce transactions System will only allow accounts to be chosen or entered that are associated to the Advisor System will only allow contracts to be chosen or entered that are associated to the account System will ensure the contract is active and without restrictions Finally, distributors will be able to provide suitability review to determine if the transaction is suitable for the client. Information that will be used to complete the suitability review will include all information required pursuant to the NASD Rules of Conduct. Funds deemed unavailable by a distributor for a specific product are not displayed to the user. Prohibiting Advisor initiated transactions through other means, such as calling the carrier directly or utilizing a carrier website, is at the discretion of the broker dealer. Cooperation from insurance carriers may be requested to assist in the restriction of agents requesting transactions through unapproved means. DTCC Fund Transfers Industry Recommendation Paper V23 February 2007 Depository Trust and Clearing Corporation D. Regulatory Considerations Overview Over recent years, sales of variable annuities have grown tremendously as has interest in the sales practices, suitability and supervision of these sales by the NASD, SEC, and states and, most recently, the NYSE. Various notices and rulings, including NASD Notice to Members (NTM) 9686, NASD NTM 99-35, NASD NTM 04-45 and SEC Rule 2310 have made it very clear that regulatory agencies governing the securities business are adamant about ensuring sound suitability practices within member firms. More specifically, recent federal and state regulatory actions, including penalties and large fines to firms, have provided a loud and clear message that firms are responsible for monitoring broker-initiated fund transfers within variable annuities and preventing unethical practices including late-day trading and market timing. A number of new rules and requirements are under consideration by the various regulatory agencies and it is anticipated that specific rules concerning variable annuities will be issued in the coming months. We expect that these rules will continue to reinforce member firm responsibility for determining the suitability of the sale as well as monitoring variable annuity sub accounts on an on-going basis. Market Cut-Off / Time Stamping The BAG has identified a very real concern that the processing rule differences between annuity fund transfers and other financial product trades, particularly in regard to time-stamping and market close, may disadvantage the insurance consumer by reducing the time in which valid market annuity trades can be made. Fund transfer transactions are tied to the market pricing of the underlying funds within the annuity product. As such these transactions may only be initiated before market close on any given day. Currently, the cut off time for these transactions is set by the carrier. No matter what the initiating medium is, the carrier is responsible for regulating the receipt time of the transaction and processing with the appropriate pricing date. As a rule, carriers do not process fund transfer transactions same day if they themselves do not receive the request before market close, regardless of whether an intermediary working on their behalf, such as the broker-dealer or clearing agency, effectively accepts a request from the consumer prior to market close. For funds traded outside of insurance products, the distributor maintains the responsibility for trade cut off time. Back office distributor systems allow for trading all the way up to market close with the transaction being administratively processed after market close. The distributor effectively acts as an authorized intermediary, and is thus able to legally accept trade requests up to market close as an agent of the fund manufacturer. For the NSCC Fund Transfer process, the distributor community sought to align annuity products with other financial instruments in terms of ownership of the cut-off time for the transaction. Ideally the distributor back office system would be available until market close and transactions would be transmitted to the carrier for processing directly following system cut off. Each transaction would be “time stamped” by the distributor to indicate the time the transaction took place on the distributor system. Carriers would evaluate the distributor time stamp for each transaction request received to determine whether a request should be processed same-day or held over for next business-day processing. The concept of not having ownership of the transaction cut off time is new to the carrier community and has presented its share of concerns. DTCC Fund Transfers Industry Recommendation Paper V23 February 2007 Depository Trust and Clearing Corporation Several options were discussed as possible solutions to this issue: Distributor would control transaction cut off time and would be the owner of the time stamp. The carrier would process based on the time that the distributors inputs for each transaction. NSCC will place a time stamp on each transaction when it passes through its system and the carrier would process based on the NSCC time stamp. NSCC would implement a hard system shut down for Fund Transfer processing at market close – transactions received after market close, or with a time stamp after market close would be rejected. Rejected transactions would need to be resubmitted the next business day Carrier would retain control of transaction cut off time and would reject transactions received after market close from NSCC Concerns with these options: Distributor ownership of the time stamp posed concern that the carrier would be responsible for identifying that each distributor had the proper controls in place to provide the time stamp. The NSCC time stamp would still pose a competitive disadvantage to insurance products over other financial products such as mutual funds, as the distributor would still need to cut their systems off sometime before market close to ensure receipt at NSCC by market close. NSCC cut-off for processing as well as carrier rejection of transactions would impose additional expense in the process due to reject and resubmission charges, and would restrict those trading relationships that are able to effectively handle time-stamping at the distributor. Carriers were not entirely comfortable with the proposed processes that remove the carrier ownership of the cut off time. Carriers and distributors looked to determine what the carrier would need in order to allow for processing transactions received after market close. Two points were identified: Mutual Fund Companies and distributors currently have a Matrix Level and/or FundServ distributor agreement to address intermediary responsibilities and expectations. Based on the agreement, Mutual Fund Companies assume that, regardless of when they receive a trade request, any trade they receive was requested by the consumer before market close and the distributor did its due diligence to assure that the trade request was completed before market close. Including this type of language in the Selling Agreement Addendum for this process was proposed. Proposed “Hard 4pm close” regulation is pending with the SEC/NASD which may eventually provide more detailed guidance, but there is no established timing for this decision or ruling. A regulatory decision outlining specific requirements for intermediary acceptance of transactions on behalf of the carrier would ultimately address the carriers’ concerns. However, the BAG feels alternative solutions are required due to the uncertainty of the timing and outcome of these decisions. The recommended solution is the option in which the distributor would control the market cut off time and would be the owner of the time stamp. The carrier would process based on the time of the distributor’s time stamp for each transaction. A selling agreement addendum would be created to account for this process. This recommendation is subject to NSCC’s filing a proposed rule change with the SEC regarding the fund transfer service and SEC approval of the proposed rule change. DTCC Fund Transfers Industry Recommendation Paper V23 February 2007 Depository Trust and Clearing Corporation E. Real-time vs. Batch Processing The decision on whether to transmit fund transfer transactions in real-time or in a batch cycle mode was discussed at length by the Advisory Group. The BAG identified and considered the pros/cons for 3 potential options of processing identified below. The group is recommending Option 3: Real Time Processing for this process. Option 1: One Time Batch Processing The concept of one time batch processing consists of distributors submitting one transmission a day via NSCC (most likely at the end of the day) to be processed by the carrier. Carriers would in turn submit a transmission the same day to the distributor via NSCC, indicating if the transactions have been ‘pended’ or ‘failed’. Pros: Ensures same day processing. Cons: Does not provide a real time response for distributors. Does not allow adequate time for distributors to respond to NSCC ‘rejects’ for same day processing. Distributors would not have time to react to carriers ‘failure’ status for same day processing. Option 2: Multi-Batch Processing This option is the current method for IPS processing. Multi-batch processing for Fund Transfers would consist of distributors submitting multiple batches throughout the day via NSCC for carrier processing. Carriers would in turn submit multi-batch transmissions throughout each day to the distributor via NSCC, indicating if the transactions have been ‘pended’ or ‘failed’. Pros: By allowing multi batches throughout the day, distributors have time to react to NSCC ‘rejects’ and carrier ‘failures’ status. Cons: Does not provide a real time response for distributors. For transactions that are submitted later in the day, does not allow adequate time for distributors to respond to NSCC ‘rejects’ for same day processing. Distributors would not have time to react to carriers ‘failure’ status if transactions are submitted later in the day. Option 3: Real-Time Processing This option allows distributors to submit real time requests to the carriers and receive real-time responses to indicate if the transaction is ‘rejected’ by NSCC, ‘failed’ by the carrier or ‘pended’ by the carrier for processing. Note: Actual fund transfer will occur at next available pricing cycle. Pros: Enables distributors to react to ‘rejects’ and ‘failures’ as they occur. The utilization of request-response messaging enables all parties to reap the full benefits of real time XML processing. Cons: Due to the various hand shakes, editing and processing, we need to ensure that the response time is within a reasonable amount of time. This is a first venture into real-time submissions for insurance via NSCC which creates some processing uncertainty. Why Real-time? Real-time was selected as the best means of processing because of its efficiencies and ability to best meet distributor’s expectations. Financial Advisors can currently utilize a number of existing means to process a fund transfer “real time” (e.g. via phone or carrier website), therefore it was DTCC Fund Transfers Industry Recommendation Paper V23 February 2007 Depository Trust and Clearing Corporation important to select a process that would provide a similar agent experience and be beneficial for the distributors as well as the carriers. Some distributors may still choose to batch their transaction in the real-time process. Regardless of the transport frequency, the expectation will be that most of the rule vetting will be done upfront by the distributor to minimize rejects, and that carriers will immediately perform up-front rule vetting as they receive transactions and provide real time “pended” or “failed” messages back to the distributor. F. Decision to use XML NSCC Insurance Services has determined, in partnership with industry members, that the use of ACORD XML standard messaging is the best approach for fund transfer transactions. NSCC has considered the needs of the insurance industry, both short and long-term, and has evaluated the challenges and benefits involved with utilizing XML vs. the traditional flat file formats which support current IPS services. This decision was in part driven by regulatory and budget considerations. In these times of regulatory driven initiatives, greater development and operational dollars are available for products that enable compliance oversight. In particular, distribution firms believe they have a better opportunity to allocate budget dollars to new XML technology solutions due to the regulatory climate, even though the start up costs to put this new technology in place may be higher than for flat file development. The use of ACORD XML was heavily favored by insurance carriers and solution providers whom have developed internal systems architecture based on the ACORD XML model. The required messages to support Fund Transfers were already documented and supported by ACORD, therefore NSCC users can leverage existing technology and processing to support this function. As with any XML language, there are several significant benefits: XML is an extensible language. Fields may be added to the message without interrupting the integrity of the current information. XML is best suited for request-response messaging. XML is best suited for complex messages that are not extremely high volume. XML is best suited to support attachments. Users can continuously leverage previous implementations of the ACORD XML model with each new messaging solution going forward. There is no additional security risk by using XML messaging. NSCC will implement all messages with the same level of security regardless of file format. The new transactions will be transmitted over current communication lines using the NSCC secure protocols. Documentation will be provided which will define the process and procedures. For more detailed information regarding NSCC’s position, see the XML Position Document available at: http://insurance.dtcc.com. III. Prerequisites For Using Fund Transfers via NSCC a) ACORD Product Profile for Annuities (PPfA) (or similar mechanism). A major concern of processing in real-time was the amount of time it would take for carriers to process a Fund Transfer request and in turn return the appropriate response message back to the distributor. To reduce the amount of time it takes for carrier responses, it is suggested that distributors build within their process the ability to do as many upfront checks on each fund transfer to prevent transactions which are “Not in Good Order” (NIGO’s). DTCC Fund Transfers Industry Recommendation Paper V23 February 2007 Depository Trust and Clearing Corporation PPfA is a highly suggested prerequisite of the fund transfer process to enable good-order processing, but is not required to utilize the service. Details regarding the transfer of profile information will be determined by trading partners and may include alternative methods for communicating profile data. The BAG recommends that carriers and distributors use ACORD’s PPfA as the vehicle for product profile communications. As a best practice, the carrier will send PPfA information to the distributor to provide product rules and allowable context for fund transfer transactions. This data file will be shared directly between the carrier and distributor, outside of the NSCC IPS services. b) NSCC Positions and Values (POV) POV is also a highly suggested prerequisite of the fund transfer process which will further enable good-order processing. As with PPfA, POV is not required to utilize the fund transfer service. Details regarding the transfer of positions information will be determined by trading partners and may include alternative methods for communicating positions data. Traditional NSCC editing cycles and reject processing will apply. The BAG recommends that Participants use POV files to obtain the contract and position information required by the distributor to effectively determine if requests are in-good-order. Either a daily PNF or PFF may be used within the Fund Transfer process since fund positions (amount, units, fund numbers, etc) are present in both files. Together with product profile information, the POV files will be used by the distributor to create and validate fund transfer requests. c) Financial Activity Reporting (FAR) The carrier’s fund transfer response back to the distributors will have confirmed the transaction status and status reasoning where appropriate, but will not contain transaction details of the fund transfer, such as confirmation of post-processing fund positions. Therefore, it is strongly recommended that distributors utilize FAR to obtain the details of the fund transfer for reconciliation purposes. DTCC Fund Transfers Industry Recommendation Paper V23 February 2007 Depository Trust and Clearing Corporation IV. Proposed Fund Transfer Process This diagram is intended to illustrate the IFT Fund Transfer process. DTCC INS FundTransfer Workflow Distributor Product Profiles for Annuities DTCC Yes PPF/PVF Carrier No Pass DTCC edits? Returned to Carrier for Correction DTCC Provides Reject Reason(s) Product Profiles for Annuities PPF/PVF Sent to DTCC Rep decides to transfer funds Create Cancel Message w/ GUID. Send to DTCC Rep Decided to Cancel a Transfer (Previously sent to the carrier the same day) No Yes Rep Initiates Fund Transfer Evaluate against Product Rules, Suitability Review Pass? Create Message Send to DTCC w/ GUID Carrier Receives Message Request Go To * Pass Day Time rules? Yes Pass DTCC edits? No Carrier Cancels Pending Transfer (If not processed & received on time) Yes Pass DTCC edits? Response Created : (Pass or Fail w/ reason code), GUID Yes NO Update Distributor System/status, notify rep as needed Successful Transfers with No errors: DTCC Provides Reject Reason(s) Yes Day 1: 102/212 Request Day 1: 102/212 Response Pending Day 2 : 102/107 Response Success No * Pass DTCC edits? Response with GUID rejected reasons w/info. Reasons. B) Create Response :Pending with GUID Carrier sends to DTCC ** No Successful transfer with carrier determined pre batch errors: Returned to Carrier for Correction DTCC Provides Reject Reason(s) Day 1: 102/212 Request Day 1: 102/212 Response Failure Successful transfer with Post processing (batch) errors: Yes A) Transfer Pending Saved Carrier Process Nightly Cycle Day 2 A)Response with Pass or (Fail w reason codes) GUID B) If Transfer Processed Successfully, Create FAR File Pass DTCC Batch edits? Day 1: 102/107 Request Day 1: 102/107 Response Pending Day 2 : 102/107 Response Failure No Returned to Carrier for Correction Product Profile (PPfA) (highlighted in orange in the Workflow Diagram) Positions and Valuations (POV) (highlighted in blue in the Workflow Diagram) DTCC Fund Transfers Industry Recommendation Paper V23 February 2007 Go To ** Depository Trust and Clearing Corporation Fund Transfer Process The Fund Transfer workflow begins within the environment of the distributor. The distributor will integrate product profile, position information and the real-time contract inquiry into its application system based on its own implementation requirements. Distributors may implement solutions that differ in areas including levels of automation timing requirements, and limitations for data updates. When the Rep initiates a request, they will enter the fund transfer information and any applicable service feature changes into the distributor’s application. Recognizing that different distributors will support different levels of automation in their application system with regard to allowable and required information, at least the information required in the Fund Transfer Request per the NSCC Fund Transfer Implementation Guide is expected to be included. Since this initiative results from distributor suitability and compliance requirements, each distributor may require additional information to be provided by the Rep. The distributor’s system is expected to validate the Rep’s data entry in accordance with carrier and distributor transaction requirements. This process may include validation of data in accordance with product rules, generic transfer rules (such as amount transferred from the source must equal the amount transferred into the destination funds) and distributor requirements. Once the Rep has submitted the transaction, the distributor may evaluate the fund transfer for suitability and compliance or forward the transaction immediately to the carrier, as required by NASD Rules of Conduct. If the distributor determines the fund transfer should not be sent to the carrier, the distributor will perform the required actions (such as notifying the Rep). o The carrier will never know of the proposed transaction that was rejected by the distributor. For those messages that the distributor decides should be sent to the carrier, the distributor will create the Fund Transfer Request message. o Some distributors may send the fund transfer to the carrier in “real time” (i.e. immediately) and some may “batch” transfers together and send them periodically. For those that choose to batch internally, they will still only be allowed to send one transaction at a time to DTCC. NSCC will perform industry defined edits and assuming the transaction(s) passes NSCC edits, they will be sent to the carrier. Once the Fund Transfer request is sent to the carrier, the carrier will perform immediate or “real time” validation on the content of the request. This validation involves consideration of transaction integrity that can be evaluated before fund prices are available and the actual transaction is processed by the carrier’s administration system in overnight batch cycle. The validation that may occur includes edits such as: the policy exists, the Rep was pre-authorized by the owner for electronic transfers, the value being removed from the source fund(s) can be removed, the destination funds are valid, etc. The level of validation that is performed during the day will be determined by each carrier and possibly “trading partner agreement.” Regardless of the complexity of validation, after receiving the original request, the carrier will create a response message which indicates the results of the validation: If the transaction meets initial validation requirements and the carrier accepts the request, the carrier will queue the transaction for processing on their administration system and create a response indicating that the transaction is pending processing. If the transaction does not meet initial validation requirements, the carrier will create a response indicating that they have rejected the transaction for reasons included in the response message. It is likely but not required that the carrier will save the transaction for archival and research purposes, but it will not be queued for processing. Distributors will be expected to submit a new in-good-order request to correct the problem if so desired. DTCC Fund Transfers Industry Recommendation Paper V23 February 2007 Depository Trust and Clearing Corporation After the response is created, the carrier will immediately send it to the NSCC. The response will include the control number from the original request so the distributor can match the original request to the carrier’s response. Presuming the response passes NSCC edits, it will be passed to the distributor. If the fund transfer was pended by the carrier, it will be queued and processed in overnight batch cycle. As the carrier’s administration system attempts to process the fund transfer, one of two situations will result: the fund transfer processed successfully OR there was a problem with the transfer and it could not be processed. After the transaction is processed, the carrier will send a second response to the message indicating whether the fund transfer processing was successful or that it failed. The response message will include the original control number so the distributor can match the original request to both responses. If the transaction was successful, an “accepted’ status will be returned. Transaction details and resulting fund values/units will not be provided in the Fund Transfer response since this information is expected to be provided within daily Financial Activity Reporting (FAR) files if so desired. If the transaction was not successful, a “Failure” status will be returned with the reason(s) why the transaction failed. Note that the transaction will NOT be reprocessed by the carrier. Distributors will be expected to submit a new in-good-order Fund Transfer request (with a new control number) to correct the problem if so desired. Cancel Fund Transfer (highlighted in yellow in the Workflow Diagram) After a fund transfer is initiated by the Rep, he or she may decide to cancel the fund transfer within the same market day. If the distributor has not yet sent the original fund transfer request to the carrier, they will not send the original request to the carrier. If the original request has been sent to the carrier earlier that day and market is still open, the distributor will create a cancellation request. Assuming the cancellation request passes the NSCC edits, the transaction will be sent on to the carrier. When the carrier receives the request to cancel the original transaction, the carrier will evaluate the original request and determine if it can be processed. The carrier will either: Remove the fund transfer from the queue to be processed and create a response message indicating the cancellation transaction was successful, OR Create a response message to indicate the transaction could not be cancelled with corresponding reason code(s). The Response transaction will be sent by the carrier to the NSCC. Assuming the transaction passes NSCC edits, the transaction will be sent to the distributor. DTCC Fund Transfers Industry Recommendation Paper V23 February 2007 Depository Trust and Clearing Corporation V. Next Steps The pilot implementation of Fund Transfers is scheduled for 3rd quarter 2007. Production is scheduled for 4th quarter 2007. Next Steps include: Establish a group of firms to pilot test the initiative. Complete a Customer Implementation Guide, which will include, but not limited to, the following: o NSCC Connectivity procedures o Record Layouts and Messaging edit rules o Data Element Definition o Message Samples o Standard Usage Construct the NSCC Fund Transfer Fee Schedule File for and obtain SEC approval of funds transfer service and fees. DTCC Fund Transfers Industry Recommendation Paper V23 February 2007 Depository Trust and Clearing Corporation Appendix A - Assumptions and Notes The word “may” is used in this Section IV instead of “must” or “should” to acknowledge different levels of electronic support and automation capabilities of the carriers and distributors who plan to utilize the NSCC IFT Fund Transfer service. It is recognized that distributors or carriers may utilize a solution provider to assist with all or some system components of this NSCC Fund Transfer service. The terms “Carrier” and “Distributor” are used in this document to illustrate the responsibilities of each regardless of whether a function is performed by that entity or if it is performed by another party on behalf of that entity. The term “rep” is used to refer to the agent, representative or financial consultant that initiates or cancels the fund transfer. The fund transfer message will not include an effective date on submission. It is assumed that the fund transfer is requested to be processed on the current business day (i.e. no forward-dated or back-dated requests will be sent). During the initial phase, the Fund Transfer service will not include the expectation for carriers to support the immediate processing of a fund transfer that is not dependent on market close (such as transfers involving only fixed funds which could be processed before waiting for fund prices and a batch cycle). No requirements or expectations are established within this recommendation paper regarding whether carriers must prevent or continue to allow access to existing fund transfer servicing functionality (phone, fax, web portal) for a distributor’s Reps. Such expectations will be established through trading partner agreements and will be outside of the NSCC process. Required enhancements to the Positions and Valuations (POV) files (new fields, new/revised edits) are briefly described within section II.A of this white paper and will be fully defined through the existing IPS enhancement request process. The list of edits which the NSCC will perform against the Fund Transfer messages are fully defined within NSCC Fund Transfer Implementation Guide, and will not be replicated in this recommendation paper. DTCC Fund Transfers Industry Recommendation Paper V23 February 2007 Depository Trust and Clearing Corporation Appendix B – Glossary of Terms ACORD ACORD (Association for Cooperative Operations Research and Development) is a global, nonprofit insurance association whose mission is to facilitate the development and use of standards for the insurance, reinsurance and related financial services industries. http://www.acord.org Batch Process in which transactions are bundled and transmitted at certain times of the day. Carrier Reference to Insurance Company, which is the manufacturer of the insurance products. DTCC The Depository Trust & Clearing Corporation (DTCC), through its subsidiaries, provides clearance, settlement and information services for equities, corporate and municipal bonds, government and mortgage-backed securities, overthe-counter derivatives, emerging market debt, insurance products and mutual funds. Distributor Firms responsible for distributing/selling insurance products. Distributors encompasses all terms for distribution which can include Broker/Dealers, Banks, Independent Broker/Dealers and Agencies. Financial Activity Reporting (FAR) Financial Activity Reporting (FAR) enables insurance carriers to provide their distributors with the annuity and life insurance financial transaction information they need in order to comply with the anti-money laundering provisions of the USA PATRIOT Act and general suitability regulations. Fund/Serv NSCC’s Fund/SERV is a highly automated system that brings standardization to mutual fund transaction processing. Fund/SERV centralizes order entry, confirmation, registration and settlement of mutual fund transactions for mutual fund companies and distributors. Licensing & Appointments (L&A) Licensing & Appointments (L&A) automates the two-way flow of information needed to manage producer information between carriers and distributors. It also provides for money settlement between parties. National Securities Clearing Corporation (NSCC) National Securities Clearing Corporation, a wholly-owned subsidiary of DTCC and a clearing agency registered with the Securities and Exchange Commission. It operates as an industry utility for its members, offering services to various DTCC Fund Transfers Industry Recommendation Paper V23 February 2007 Depository Trust and Clearing Corporation sectors of the financial services industry, including insurance and mutual fund services. Positions and Values (POV) Positions and Valuations (POV) enables carriers to send annuity and life insurance contract details to its distributors on a daily, weekly, monthly or other custom basis. Product Profile for Annuity (PPfA) Product Profile for an Annuity (PPfA) provides a standardized definition of the attributes, features and business rules of an annuity product, including fixed and variable, deferred and immediate annuities, for product analysis, new business submission (IGO) and related business acquisition processes. Real-time Process in which transactions are sent individually or bundled and transmitted at any time of the day. Trading Relationship For this paper, a trading relationship is a business exchange between a carrier and distributor XML XML (Extensible Markup Language) is a markup language for documents containing structured information. DTCC Fund Transfers Industry Recommendation Paper V23 February 2007