Group Number

advertisement

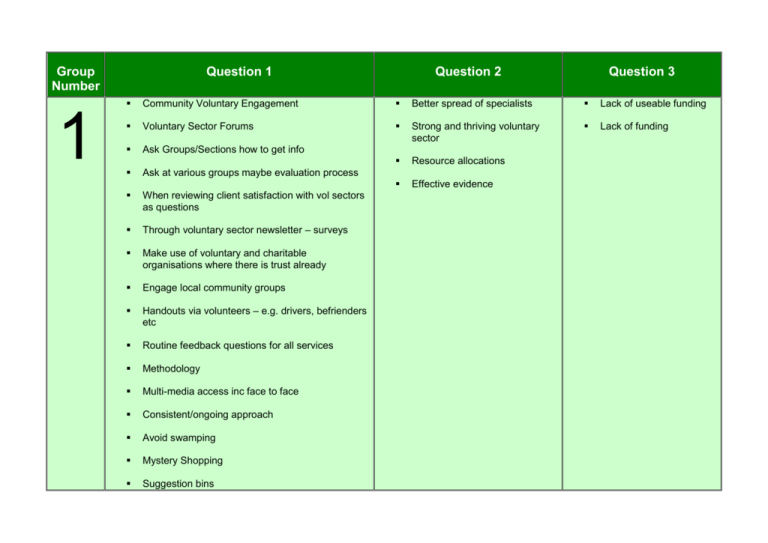

Group Number 1 Question 1 Question 2 Question 3 Community Voluntary Engagement Better spread of specialists Lack of useable funding Voluntary Sector Forums Strong and thriving voluntary sector Lack of funding Ask Groups/Sections how to get info Resource allocations Ask at various groups maybe evaluation process Effective evidence When reviewing client satisfaction with vol sectors as questions Through voluntary sector newsletter – surveys Make use of voluntary and charitable organisations where there is trust already Engage local community groups Handouts via volunteers – e.g. drivers, befrienders etc Routine feedback questions for all services Methodology Multi-media access inc face to face Consistent/ongoing approach Avoid swamping Mystery Shopping Suggestion bins 2 On street questions Accessible formats Talk to ‘captive audience’ – airports, blood donors etc. Random sample telephone questionnaires. Get to people while they are using our service Whilst they wait Need information to be accessible to volomgs and COM groups. Does JSNA data/ localities reflect PL areas? Voting buttons in GP surgeries, CAB etc. A catalogue of what’s on/in the JSNA hub. Understanding PP geographical boundaries Gather feedback from people after attending hospital appointments, including hospital appointments, out patience etc. Access to data & basic training, to do simple analyses Concern over accuracy of data available. Concern that evidence you read isn’t on the hub Limited info available on some conditions which impeach on identifying need Questionnaires and suggestions box at GP surgery convening GP, PET, NHS, Star seines. Training to understand the website & data holds Knowledge/Training/password Care workers- 5 minutes with each person they visit on key topic 3x per year. Information on what JSNA holds Terms of information. Voice pod (videoed in a box??) Like x factor auditions. VOICE EVIDENCE Needs data on adults with disabilities INC. Deaf (not currently available) info only on children Do manages PP have the right training/ Comp to use JSNA data. Differences / similarities links to profiling Stockport Council Examples of people have used the data Volume of data Do as part of others activities and events. Go to were pp people are pp. In outlets which serve public routinely. Use other networks Leisure Comment and disorder Chamber activities Consult at pubs, supermarkets. Targets places people go such as… Pubs, Cinema. Use Internet Likely sights Blogs Tapping into professional and volume sector feedback Second –hand but still valid Make better co-ordinate use of qualities views which all serve gather-common database? Tapping in to and using existing information P.T.A.S to greater effect. Use Volume and community networks Complaints data analyse. User survey over the phone –use local college structure-higher response rate Someone at the end of a phone to query things with. Analysis’s to support interpreting data. intimidating (Where to start) People don’t know that JSNA even exists People “fear” data – how do I use/ understand it? The word DATA is scary for a lot of people Not clear what it is & what/how the data can be used 3 Annual joint city engagement event –genetic opinion though Rip out in local paper-key issues –Plans for future, all sent to central point In sensitize responses- volume feed back Find a mechanism to capture ad hoc comments/ Gut feelings they are often revealing. Get perceptions of service users and non users. All services users be resumed invited to feedback on Training. Knowledge of what works elsewhere Services user individual (questionnaires, focus groups, planning groups) Sharing practice and ideas regionally Objective user led research on polity of services Horizon scanning team Investment of people using services enriches commissioning but training and preparation needed (MH experiences). Consumer Perspective. Carers & families to be invited to comment immediately. More community development comity and infraslauche Recognition that change in health equality / lifestyle takes time and long term investment Help with analysis and application of data. Support to use the JSNA data hub effectively Use existing community gather information. Collect feedback at surgery after GP appointment. Text survey and feedback Economic Modelling Support Interactive website. Good quality data on XXXX Enchanted role for citizen power Investment over longer term Time to think outside the box and beyond day to day service needs. ‘Service based’ thinking (i.e. lack of willingness to investigate). Evidence base for some public health programmes not available (data not collected. Lack of resources - time, staff, expertise. Time and staff resources to collect evidence based (e.g. user Public opinion services (needs and attitudes). Website – accurate at all public locations easy to update survey or qualitative research. Sound procurement procedures. Fear of overspend / of generating demand. Tools for gathering evidence on quality outcomes, not just data. Private follow up survey of services users-row was it for you? Use social marketing approach to service development not just for social messaging Use resources of large services…(Tesco Morrison’s) Support for positive risk taking, think outside the box and act – leadership. Comparative investment info and standards for similar organisations. e.g. across PCTs Identify & pay represent of population to complete survey using technology (like Make Research) Knowledge of ‘market’ Local free-views /channels / radio phone in’s Agreed on what are the priorities (and what has to go) Community competitions Pilthy data and statements of what it means. 4 Strategic Commitment. Using public to do mystery shops. Have an interactive quiz in health centre and local government waiting rooms, on computer screens Informal info to be corrected - at the bust stop and in shops. Visit pubs and ask people drinking there their views (with reward vouchers). Market surveys in public areas – e.g. shops, public events. “Topical Events” - free transport Division of culture xxxx / ASC Need to show quick results e.g. in year change in health status. Time Outcomes are long term Input / outcomes models have rules (culture) Acceptance that it takes time to think about what the data is telling us Mass of evidence – time to be familiar with it and find right bit. The right evidence – e.g. who are the key GP to be targeted . what GPs they want. Lack of evidence of some key things .e.g. what this population want and will respond to. Data rich analysis poor. Skills Better understanding of needs (by locality) Curiosity (is wide spread of interest in best practice xxxx) Benchmarking is about impairment is the outcome Have a message in a bottle postcard for people to send in if they have a suggestion / complaint they want to raise (free post or boxes everywhere to put them in Evidence of what works. More familiarity with what commissioning is in practice. Get out to local markets and collar shoppers for their views (and give a reward e.g. for a free swim). Public (patient / client) understanding and commitment (expectations). Text number / ask questions - get immediate feedback. Tracking approach to identify to identify progress on outcomes Kooth.com Tap into existing forums r.e. school councils PTA. Children’s school councils. Team approaches without automatic dominance by single professions. “Rise Employees volunteered and members to understand” PO closures Analysis complaints / compliments to inform lines of enquiry Select committee Social networking. Online discussion forums. Focus groups. Provider forums to get ideas of what works. Simple Language – avoid professional jargon Qualitative rather than pure number crunching How to combine quantative and qualitative data. Support to interpret / understand data. Help to make best use of data soft and hard by having analysts as pieces of work. More people with time to talk over evidence with. Comparisons to national trends - it is Stockport issue? The interest of in-house providers to maintain the status roles. Needs to be more clarity about role difference / similarities between providers / commissioners. Cross organisational aspects (consistency – Children and Young People Community Safety Adults. Culture – don’t understand data. Lack of impact evidence to join up with ‘needs’ evidence. Lack of cost effectiveness evidence. 5 Avoid research stance Pilot / pre test topics Be clear about purpose / use Keep professionals away Ensure co-ordinated approach Decision making authority Face to face discussion Access to data from Vol. sector Service user feedback questionnaires. Detailed local data. One to one interviews with users. Questionnaires postal Use evaluation more consistently Give qualitative data equal status with static’s Ensure parts of qualitative data in JSNA (not an A00-07) Resources – lack of money Habit – “we’ve always done this”. Increase data analyst resources within PCT. Lack of people with key skills More joint working and joint funding. Limited perspectives of what constitutes evidence. Allowing creativity and risk taking. Lack of clear service specs based on evidence of need. Lack of clear strategy and resources for public consultation. Flexibility in service design and provision Clear and detailed service specifications with evidence base. What’s considered ‘evidence’ Investment One to one doctors surgeries (practice managers) Go to where people are Local meetings Nurse home visits. Go to where people are (community’s workplaces). 6 Use or target supermarkets Street interviews (precinct) Adopt an open attitude. Be interested. Use existing channels and media – local press, radio, school etc. Build data collection into existing programmes and activities. Use technology – web and text messages. Feedback and action. Informal mechanism valuable . Complaining takes energy so capture informal comments Fear of complaining / commenting affecting service. Need anonymous routes. System for staff to report informal feedback for clients. Go behind health issues to ‘real’ issues. Anonymous and independent for honest answers. Use charter for involvement “good practice” Avoid over consulting Test the info. Go back and ask if we got it right. More communication 2 way. Between commission and providers. Providers know clients More help to understand and interpret the numbers – what does it mean. How or when was the data collected – is it up to date? Need to confirm integrity, reliability of data and its analysis. Overall aim to support population to improve over health and wellbeing, More understanding of motivation, engagements. Should be an outcome in itself Numbers – ruling Support to link evidence to practice. What the data is not able to tell us. How reliable is the data over time. Qualitative data recognised as important Outcomes based commissioning should be More engaging – better than blank paper. 7 Independent questioner Not tokenistic Managing expectations. Honest about what may or may not be possible. Ask people what they want, e.g. AOT work. Contacting prospective and second generation users. Co-ordination Share results Use LINKS – it’s new but great potential to develop as VOICE. Links and VOICE., How are these used together. Social service QA annual feedback. Contact centre extra Q’s Understand balance between qualitative and quantitative data. Shared understanding of definitions. Capture individual outcomes – not continue Development of qualitative data ‘Consent’ from public Clear outcome measures experienced in difficult areas. Feedback via GP surgeries hospitals. Customer Care Shadow AOT Board Individual user feedback Reflective logs of processes. a goal – not just evidence. How do you reconcile user, commissioner, provider relationship. How do you reconcile personalisation (individual budgets) with strategic commissioning. Clear definitions Culture – is this ‘day job’ Conflictive priorities – left hand outcomes Not being heard Confidentiality / data protection Too many regulatory More public health research evidence rate what works structures Self assessment of outcomes post access. Contracts / contracting Use existing groups but be careful about I Issue people. User organisation, MIND, Age Concern. Do what co-op does at checkouts – Chip/PIN points (asks questions with Y/N answer) What do people want – pubs, gyms and younger meeting format Carers Journals Surveys Focus Groups Standardised interviews Questionnaires generic about quality / outcomes – Focus groups to unpick issues Online forums Innovative: Pod cast and blogs – over forums Blogs / Websites Vision – what want Clarity – Purpose Objective – what don’t Capacity to engage Contentious relationship. 8 Share hard date form JSNA and public to gauge their views. Understanding / analysis of quantative data. Old / out of date information Pro-active approach to quality assure service, independent of the service provider. Analyst skills to interpret capacity / resource Audit of locality facilities, e.g. involve locality business forums. Understand the data – further analysis. Capacity skills inability in terms of time or knowledge to use / interpret data. Is the analysis right? Resources / investment/ disinvestment Lack of budget The quantity of data ‘only part of the story’ Attitude / behaviours Resources Risk of current of services. Customer care responses to link into general feedback perception resourcing. Support to run focus groups / engage with groups. Better quality info from “mainstream” social and health care services. Links to all voluntary sector organisations standardised perception Q’s. Contracts compliance collation of data from users and workers. Use SP feedback and collate for general feedback (existing info to feed into hub. Collect service user views at review stage, Social worker. Social worker team meetings – Bi-annual agenda item – A4 bullet point summary to be provided Service user / customer satisfaction. Use of clear and standardised processes (make sit easier) Standard template for all satisfaction type Analyst support Good quality data information / comprehensive. Up to date information. Info from non health and social care focused activity (barrier= how). Evaluation of impact of commissioning decisions. Maintain current service delivery whilst working on future changes. Funding surveys Use of clickers / other interactive technology in the community. Use of the council’s website to gather information. Online surveys. Survey on websites Better use of good facilitation exercises. Identify priorities for data needed for JSNA. Ensure good feedback to promote effectiveness of collecting data. Consult with frontline staff as a first step. Ensure routine opportunities for feedback when we provide services / engage the public. Post it note wall – ask for comment on specific issues. Public display thoughts on a postcard. One stop shop / info point – community based. Information – tick box options and pre-paid envelopes. Available throughout shops etc. Understand the resource implications to shifting focus. Follow a cohort of real people and ask them their needs / views experiences along the way. Resources / reinvestment / disinvestment in order to commission in line with the evidence. Link in with leisure services feedback systems – expand. Survey ‘on the street’ e.g. in busy shopping centres. Opinion gathering: shops, GP’s, snap shot Civic review