TMR2014-8 - John Keells Limited

advertisement

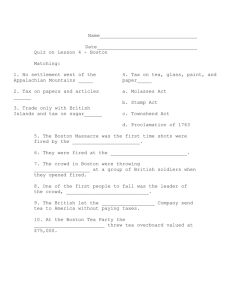

1 www.johnkeellstea.com 2 TEA MARKET REPORT : SALE NO: 08 – 25TH/26TH FEBRUARY 2014 COMMENTS P O BOX 76, COLOMBO. TEL : 2306000 Latest reports from the High Grown regions indicate drought conditions particularly in the Western sector following the sporadic rainfall that was experienced over the weekend. Crop intakes from all regions are showing a downward trend which is normal for the time of the year. Elsewhere around the major tea producing countries crop intakes are moderate. Liquors of Western teas which were produced under ideal conditions, such as low ambient temperatures and high hygrometric differences have shown the normal seasonal quality and brightness. Even though the low temperatures are not experienced in most planting districts at the time of writing, the present dry conditions should prompt the producers to manufacture brighter teas with colour and strength. Ex-Estate offerings comprised of 1.16 M/kgs and met with lower demand. Best Western BOPs were selectively dearer following quality, whilst the corresponding BOPFs were lower by Rs 20 -30 and at times more. Below Best sorts were lower by Rs.10/- to Rs.20/- at the commencement of the sale and eased further towards the latter part. Plainer sorts were irregularly lower. Nuwara Eliya BOPs were fully firm to a little dearer, whilst BOPFs were Rs.10/- easier at times. Uva / Udapussellawa’s were barely steady at the initial stages of the sale, however these prices declined further by Rs.10/- to Rs.20/- as the sale progressed. Select Best Low Grown BP1s were dearer by Rs.10/- to Rs.20/-, whilst the select best PF1s declined substantially by Rs.40/- to Rs.50/-. High and Medium types too were lower by Rs.10/- to Rs.15/- on average. www.johnkeellstea.com 3 Contd. The 3.5 Mkgs of Low Growns that came under the hammer this week, yet again met with less demand particularly for the small leaf and the Tippy varieties. In the Leafy category, select best BOP1/OP1s met with less demand and declined in value, whilst OP/OPAs along with PEKOE/PEKOE1s maintained last levels. Better FBOPs and FBOPF1s shed Rs.20/- to Rs.30/- , below best and poorer types were also lower by a similar margin and at times were neglected due to lack of interest. The Tippy varieties declined sharply with many invoices remaining unsold due to lack of demand. There was less demand from Iran however Russia, Turkey, Syria and Libya lent fair support. www.johnkeellstea.com 4 A few Select best BOPs sold well on special inquiry, other good invoices shed Rs.10/- to Rs.20/-, below best sorts eased Rs.20/-, plainer varieties declined Rs.5/- to Rs.10/-. Select best BOPFs declined Rs.10/- to Rs.20/other good invoices shed by a similar margin and more at times, below best sorts eased Rs.20/- on average and more as the sale progressed, plainer varieties declined Rs.5/- to Rs.10/- on average. Medium BOPs shed Rs.10/- to Rs.20/-. BOPFs eased Rs.10/- and more for the poor leaf sorts. BOPs gained Rs.20/- to Rs.30/- on average. BOPFs were barely steady. BOPs declined Rs.10/- and more at times. BOPFs shed Rs.10/- to Rs.20/- on average. Uda Pussellawa BOPs were irregularly lower. BOPFs eased Rs.20/- on average. Low Grown CTC PF1s declined Rs.30/- to Rs.40/- and more at times with a fair volume remaining unsold. BP1s advanced Rs.10/-. High & Medium PF1s declined Rs.10/- to Rs.20/- on average. BP1s advanced Rs.10/- to Rs.15/-. Fair demand. Select best OP1s eased Rs.20/- to Rs.30/-, however best types were firm to dearer by Rs.5/- to Rs.10/-, below best and poorer sorts were firm. Select best BOP1s shed Rs.15/- to Rs.20/-, best types eased Rs.10/- on average, below best and poorer sorts were firm to lower by Rs.5/- to Rs.10/-. Select best OPs were mainly steady, wiry OPs gained Rs.5/- to Rs.10/-, balance were firm. Select best along with best OPAs maintained last levels, clean below best and poorer sorts were firm to at times dearer by Rs.3/- to Rs.5/-, the balance tended lower. Select best Pekoe1s shed Rs.5/- to Rs.10/-, however best and below best varieties were irregularly dearer by Rs.5/- to Rs.10/-, poorer sorts were firm. Bold Pekoe varieties were fully firm to dearer by Rs.5/- to Rs.10/-, clean flaky types gained Rs.5/- to Rs.10/-, whilst others were firm.Lower demand to last for Tippy/small leaf grades. Select best and best BOP/BOPSPs shed Rs.20/- to Rs.30/-, below best and poorer sorts too were lower by Rs.10/- to Rs.20/-. Select best and best FBOPs were lower by Rs.20/- to Rs.30/-, below best and poorer sorts too declined Rs.20/- and at times were difficult of sale due to lack of demand. Select best and best FBOPF1s shed Rs.20/- to Rs.30/-, below best and poorer sorts too were lower by Rs.20/-. Select best and best Tippy sorts were substantially lower to last, below best and poorer types too declined several rupees below last levels and at times remained difficult of sale due to lack of demand. Select best and best liquoring Fngs1s were firm to last, below best and poorer sorts too were firm. Select best BMs were firm to dearer by Rs.5/- to Rs.10/-, whilst the below best and poorer sorts were lower by Rs.5/- to Rs.10/- and more at times. All Low Grown Fngs were sold at firm levels. All BPs were firm. Select best and best BOP1As were irregularly dearer by Rs.5/- to Rs. 10/-, whilst the balance were firm on last levels. Select best Dust1s declined Rs.20/- to Rs.30/-, whilst best and below best types declined Rs.25/- to Rs.30/and more as the sale progressed. Clean secondaries declined Rs.10/- to Rs.15/-, whilst the below best types were firm, poorer sorts declined Rs.10/- to Rs.15/-. Best Low Grown Dust/Dust1s declined Rs.5/- to Rs.10/- , whilst the balance declined Rs.10/- to Rs.20/- and more at times. www.johnkeellstea.com 5 Parity Rates – SL Rupee spot middle rate - USD : 132.42 GBP : 221.24 EURO : 182.67 BOP BOPF Good Westerns 500 – 650 480 - 600 Average Westerns 445 – 470 440 - 470 Plainer Westerns 415 – 435 420 - 435 Western Mediums 415 – 720 395 - 450 Uva Teas 380 – 440 400 - 510 Nuwara Eliya Teas 560 – 580 520 - 530 Udapussellawa Teas 370 – 450 380 - 450 CTC (BP1 and PF1) 375 – 500 370 - 600 LIQUORING DUST-1 OFF GRADES FGS1 FGS LOW GROWNS FBOP BOP1 BOP BOP.SP BOPF FBOPF/FF.SP/EX SP. FBOPF1 OP1 OP OPA PEKOE PEKOE1 DUST/DUST1 Select Best Best Below Best Others 560.00-670.00 470.00-520.00 420.00-450.00 340.00-380.00 420.00-440.00 380.00-400.00 300.00-360.00 300.00-320.00 360.00-460.00 300.00-330.00 280.00-290.00 250.00-270.00 580.00-620.00 530.00-550.00 450.00-500.00 400.00-430.00 660.00-760.00 590.00-650.00 510.00-580.00 460.00-500.00 570.00-600.00 520.00-540.00 450.00-480.00 400.00-440.00 550.00-600.00 520.00-540.00 450.00-480.00 400.00-425.00 550.00-580.00 520.00-540.00 430.00-460.00 325.00-375.00 800.00-1800.00 600.00-700.00 500.00-550.00 440.00-480.00 570.00-600.00 500.00-540.00 450.00-480.00 420.00-440.00 700.00-810.00 650.00-690.00 540.00-640.00 470.00-530.00 540.00-660.00 490.00-530.00 470.00-480.00 400.00-460.00 530.00-630.00 490.00-520.00 470.00-480.00 400.00-460.00 590.00-700.00 530.00-580.00 480.00-520.00 440.00-470.00 610.00-720.00 560.00-600.00 530.00-550.00 480.00-520.00 430.00-470.00 315.00-335.00 300.00-310.00 250.00-260.00 Approximate price range in Rupees per kg www.johnkeellstea.com 6 BOP BOPSP BOPF/BOPFSP FBOP/FBOP1 PEKOE/PEKOE1 OP1 BOP1 OP/OPA FF/FF1 * * * BOP * BOPF/BOPFSP * FBOP/FBOP1 PEKOE/PEKOE1 OP/OPA * * * BOP BOP.SP BOPF/BOPFSP PEKOE/PEKOE1 OP1 BOP1 OP/OPA FBOPF/FBOPF1 PF1 BP1 OF BPS Lovers Leap Mahagastotte Court Lodge Lovers Leap Mahagastotte Lovers Leap Lovers Leap Lovers Leap Mahagastotte High Forest Luckyland Special Liddesdale High Forest Gordon Mooloya Luckyland Special Mooloya Luckyland Special Gordon Blairlomond FBOP/FBOP1 PF1 BP1 OF BPS Dessford Queensberry Alton Inverness Holyrood Somerset Inverness Inverness St Andrews Inverness * * * * 650.00 550.00 600.00 760.00 590.00 590.00 650.00 880.00 590.00 590.00 PF1 BP1 OF BPS 580.00 580.00 580.00 530.00 530.00 720.00 650.00 640.00 640.00 450.00 460.00 450.00 450.00 590.00 590.00 530.00 530.00 435.00 510.00 510.00 Kalubowitiyana CTC 600.00 Suduwelipothahena CTC 500.00 Suduwelipothahena CTC 460.00 Indigahahena 325.00 Dunsinane CTC Dunsinane CTC Dunsinane BOP BOPSP BOPF/BOPFSP FBOP/FBOP1 PEKOE/PEKOE1 OP1 BOP1 OP/OPA FF/FF1 BOP BOPSP BOPF/BOPFSP FBOP/FBOP1 PEKOE/PEKOE1 OP1 BOP1 OP/OPA FBOPF/FBOPF1 BOP BOP.SP BOPF/BOPFSP FBOP/FBOP1 PEKOE/PEKOE1 OP1 BOP1 OP/OPA FBOPF/FBOPF1 450.00 425.00 450.00 www.johnkeellstea.com * * * * ++ * * * * * * Delta CTC Strathdon Madulkelle 450.00 440.00 Dotel Oya Nayapane Craighead Craighead Craighead Cooroondoowatte Kenilworth Craighead Telford Craighead 720.00 640.00 550.00 960.00 600.00 600.00 690.00 720.00 525.00 700.00 410.00 Bandaraeliya Poonagalla Mahadowa Spring Valley Ampittiakande Craig Craig Templehurst Battawatte Spring Valley Poonagalla 440.00 580.00 445.00 640.00 560.00 560.00 520.00 530.00 590.00 570.00 570.00 Demodera ‘ S’ Halpewatte Uva El Teb Sarnia Plaiderie Sarnia Plaiderie Maratenne Hillmark Uva Tinioya Demodera ‘S’ Adawatte Wewesse 550.00 485.00 510.00 630.00 590.00 590.00 590.00 740.00 860.00 820.00 580.00 7 DUST1 P.DUST FNGS/FNGS1 PFNGS BM BOP1A BP * * * * * * * * BOP BOPSP BOPF BOPFSP OP1 BOP1 OP * OPA PEKOE PEKOE1 FBOP FBOP1 FBOPF1 FBOPF * * St Coombs Hingalgoda CTC Nawalakanda Hingalgoda S.H. Nawalakanda Wewelkandura Halwitigala S.H. Demodera S Telbedde Brombil Mulatiyana Hills Andaradeniya Super Renukanda Nawagamuwahena New J S P Sun Rise Sithaka Woodland Tea Thundola Ella Selna Wijaya Group Karagoda Himara Yalta Nilgiri Nehinigala Super Liyonta Galaboda Group Matuwagala Super Green Flower Nawalakanda Super Sithaka Rotumba Uruwala Sherwood Super 670.00 545.00 460.00 540.00 490.00 490.00 510.00 490.00 490.00 FBOPF SP FFEXSP FFEXSP/SP1 635.00 630.00 630.00 620.00 600.00 625.00 810.00 760.00 660.00 660.00 630.00 630.00 630.00 630.00 630.00 630.00 630.00 630.00 630.00 700.00 700.00 720.00 740.00 700.00 860.00 860.00 * TEAS SOLD BY JOHN KEELLS PLC + ALL TIME RECORD PRICE ++ ALL TIME RECORD PRICE EQUALED www.johnkeellstea.com * Woodland Tea Yalta Magedara 3,000.00 4,050.00 2,650.00 8 Uva High Growns Western High Growns CTC High Growns Summary of High Growns Uva Medium Growns Western Medium Growns CTC Medium Growns Summary of Medium Growns CTC Low Growns Summary of Orthodox Low Growns Summary of Low Growns TOTAL SALE AVERAGE Uva High Growns Western High Growns CTC High Growns Summary of High Growns Uva Medium Growns Western Medium Growns CTC Medium Growns Summary of Medium Growns CTC Low Growns Summary of Orthodox Low Growns Summary of Low Growns TOTAL SALE AVERAGE Sale of 11/02/14 In LKR 400.33 451.20 407.00 439.07 420.52 418.78 415.41 419.38 506.09 Sale of 19/02/14 In LKR 404.70 450.54 407.13 439.24 421.25 412.75 410.79 415.64 478.82 513.77 513.57 484.33 503.25 502.54 476.67 Sale of 11/02/14 In USC 306 345 311 336 317 316 313 316 389 388 387 365 Sale of 19/02/14 In USC 309 344 311 336 318 311 310 314 361 380 379 360 www.johnkeellstea.com Corres. 2013 In LKR 359.70 425.42 397.29 409.45 379.54 375.31 377.71 376.60 424.76 428.73 428.61 417.64 Corres. 2013 In USC 273 322 301 310 288 284 286 285 322 325 325 317 9 From 01 January todate 2014 In Rs. 419.91 454.95 425.13 446.37 Uva High Growns Western High Growns CTC High Growns Summary of High Growns Uva Medium Growns Western Medium Growns CTC Medium Growns Summary of Medium Growns CTC Low Growns 449.95 430.64 425.71 437.34 506.39 529.85 529.12 Summary of Orthodox Low Growns Summary of Low Growns TOTAL SALE AVERAGE 497.74 2013 In Rs. 377.32 443.30 418.26 426.83 376.93 380.70 2014 In USC 317 343 321 337 2013 In USC 286 336 317 324 428.25 339 325 321 330 382 400 399 286 289 296 288 336 324 325 420.82 376 319 390.81 379.48 442.83 427.73 MONTH – FROM 01ST TO 19TH FEBRUARY 2014 2014 In Rs. Uva High Growns Western High Growns 407.00 Summary of High Growns 441.83 Uva Medium Growns 423.70 Western Medium Growns 419.53 Summary of Medium Growns 420.94 Summary of Low Growns 512.04 TOTAL SALE AVERAGE 483.07 453.71 www.johnkeellstea.com 10 CROP FIGURES OF MAJOR PRODUCING AND EXPORTING COUNTRIES (IN MILLON KG) Country Sri Lanka North India South India Kenya Bangladesh Malawi MONTH December December December December January January 2013 * 2014 30.2 39.2 19.8 41.72 2.5 * 8.2 * 2012 * 2013 28.0 39.2 21.1 41.40 2.8 * 4.5 * CUMULATIVE Up Up Up Up Up Up to to to to to to Dec. Dec. Dec. Dec. Jan. Jan. www.johnkeellstea.com 2013 * 2014 340.2 957.5 242.7 432.45 2.5 * 8.2 * 2012 * 2013 328.4 887.0 239.3 369.56 2.8 * 4.5 * CUMULATIVE + INC./DEC. + 11.8 + 70.5 + 3.4 + 62.89 0.3 + 3.7 11 WESTERN’S Western sector experienced bright, cold and dry weather conditions at the commencement of the week. However, scattered afternoon showers were experienced towards the end of the week. NUWARA ELIYA’S Nuwara Eliya’s experienced bright mornings; scattered showers were however witnessed towards the end of the week. UVA’S Uva’s too experienced bright mornings with occasional scattered shower towards the end of the week. LOW GROWN’S Ratnapura, Deniyaya and Galle too experienced occasional showers towards the end of the week. CROPS Crop intakes were moderate at the beginning of the week. A marginal increase in crops has been reported from the Low Grown regions towards the end of the week. ALL BROKERS PRIVATE SALE FIGURES FOR THE PERIOD OF 17TH TO 22ND FEBRUARY 2014 WEEKLY P/SALES BMF DIRECT SALES TO-DATE 55,578.00 488,532.00 ALL BROKERS PRIVATE SALE FOR THE PERIOD OF 22ND TO 27TH OCTOBER 2012 233,498.00 2,165,732.00 5,226.00 317,181.80 www.johnkeellstea.com 12 MOMBASA MARKET SALE NO. 08 - SALE OF 24TH /25TH FEBRUARY 2014 Improved general demand for the 145,870 packages (9,339,518kilos) on offer at irregular rates with 12.34% neglected. Brighter BP1s saw less enquiry easing by USC5 to 14 but a few well made invoices gained upto USC6 while mediums were generally USC2 to 8 easier but a few improved lines were firm; lower mediums were irregular varying between firm to USC5 dearer to easier by similar levels. Plainer sorts were about firm to USC8 below last prices. Brighter PF1s were irregular and ranged between firm to USC6 dearer to easier by upto USC20 with mediums appreciating by USC2 to 16. Lower medium PF1s varied between firm to USC10 dearer to easier by upto USC3 while plainer sorts held firm to USC2 dearer. Brighter PDUSTs saw an irregular enquiry ranging between firm to USC14 dearer to easier by upto USC6 while mediums appreciated by USC2 to 14 to easier by upto USC6. Lower mediums opened firm but closed upto USC16 above last prices with plainer descriptions firm to USC4 above last rates. Brighter DUST1s ranged between USC5 to 10 dearer to easier by upto USC18 while mediums were firm to USC8 dearer to easier by upto USC4 with lower mediums irregular varying between USC6 dearer to easier by similar levels but plainer descriptions were firm to USC8 above last prices. In the secondary catalogues BPs and PFs were heavily discounted. Clean well sorted coloury Fannings and DUSTs were steady. Other Fannings lost value while DUSTs were steady. BMFs were well absorbed but at irregularly lower levels. Pakistan Packers lent very strong support with more activity from Egyptian Packers, Yemen, other Middle Eastern countries and UK. Afghanistan showed less interest but Sudan was active. There were more purchases from Bazaar while Kazakhstan(CIS) and Russia maintained interest. Iran was operating. Somalia showed less activity. QUOTATIONS Best Good Good Medium Medium Lower Medium Plain AUCTION AVERAGE PRICE AUCTION KENYA 2013 6 $ 3.24 7 $ 3.13 8 $ 3.04 BROKENS 370 – 523 365 – 410 346 – 410 317 – 381 238 – 293 182 – 238 FANNINGS 317 - 397 315 - 333 312 - 331 278 - 309 218 - 271 190 - 248 ( SL RUPEES) KENYA 2014 $ 2.31 $ 2.27 $ 2.32 TOTAL 2013 $ 3.04 $ 2.96 $ 2.86 TOTAL 2014 $ 2.20 $ 2.18 $ 2.24 SOURCE : AFRICA TEA BROKERS LTD. www.johnkeellstea.com 13 CHITTAGONG MARKET SALE NO. 40 - SALE OF 25TH FEBRUARY 2014 CTC LEAF: 56,375 packages and 40 packages of old season teas on offer met with a more selective demand with heavier withdrawals. BROKENS/FANNINGS: A handful of clean liquoring varieties were well supported but at slightly easier rates and the best could be quoted between Tk.185/- and Tk.195/-. Other varieties met with very selective demand and where sold recorded a drop of Tk.10/- and more. There were very heavy withdrawals in this category. CTC DUST: 8,803 packages and 35 packages of old season teas on offer met with a fairly good demand with prices closely following quality. Select few lines of good liquoring varieties on offer met with keen competition and were dearer by Tk.10/- and more. Other varieties sold around last levels easing by upto Tk.10/- whilst end of season varieties were again mostly withdrawn. Once again Blenders and Loose tea buyers lent a fair support. COMMENTS: End of season varieties comprised the bulk of the offerings and these met with a more selective demand. Prices declined for all types. There were some enquiry from Pakistan buyers for plain and poor varieties at low levels. Both Blenders and Loose tea buyers were less active this week and as a result of this, withdrawals were heavier. A small quantity of good liquoring Dusts were strongly competed for. Quotations – This Week – (In Taka) Brokens Large Medium Small Plain This Week 140-150 140-160 145-170 60-80 Last Week 170-175 175-185 180-195 120-140 Fannings Best Good Medium Plain This week Last Week 185-195 165-180 140-185 60-80 190-200 175-185 150-160 60-80 Dust PD RD D CD This week Last Week NQTA 130-228 125-228 120-260 NQTA 140-220 135-220 130-266 SOURCE : NATIONAL BROKERS LTD www.johnkeellstea.com 14 SILIGURI FINAL MARKET SALE NO. 08 - SALE OF 21ST FEBRUARY 2014 SOURCE : PARCON INDIA PVT LTD. GUWAHATI FINAL MARKET SALE NO. 19 - SALE OF 19TH FEBRUARY 2014 SOURCE : PARCON INDIA PVT LTD. www.johnkeellstea.com 15 KOLKATA (ORTHODOX/CTC) FINAL MARKET SALE NO.08 – SALE OF 21ST/ 22ND FEBRUARY 2014 2. TOTAL AUCTION WEIGHTED AVERAGE(IN RS) ORTHODOX SALE 08 114.10 2013/2014 SALE 07 120.66 +/-6.56 SALE 08 152.48 2012/2013 SALE 07 +/151.92 0.56 2013-14 200.75 UPTO SALE 08 2012-13 +/197.46 +3.29 SOURCE : PARCON INDIA PVT LTD. www.johnkeellstea.com 16 COCHIN MARKET SALE NO. 09 - SALE OF 25TH/26TH FEBRUARY 2014 DUST (CTC) :- Fair Demand Good liquoring and better mediums were firm to easier by Rs.5/ , while FD’s were sold Irregularly. Medium and Plainer bolders were eased up to Rs.4/ , whilst others were sold Irregularly. AVT and Civil Supplies fairly active on liquoring sorts. Tata Global and HUL lent useful support on good and medium liquorings. Bazar and Local Packers operated selectively. Exporters operated very selectively on liquoring and blacker varieties. CST buyers lent useful support on bolders. DUST (ORTH) :- Fair Demand. Market firm to dearer by Rs.2/ and occasionally more. Exporters and CST buyers operated on these teas. LEAF (CTC) :- Fair Demand. Good liquoring sorts were sold irregularly, whilst Medium and Plainers were firm to easier by Rs.3/ and more on Fngs. Exporters operated on Medium and Plainer sorts. CST buyers selectively operated on all varities. HUL on good liquoring sorts. Bazar operated mainly on brokens. LEAF (ORTH) :- Fair Demand. High Grown :- For Whole leafs, selected lines of wiry sorts were sold at dearer levels, while others were sold around last with some withdrawals. Primary brokens were easier by Rs.5/ to 10/ , while others were steady. Fngs were firm t dearer by Rs2/. Medium Grown :- For Whole leafs, OP’s were dearer by Rs.2/ to 5/ and more, whilst others were eased in value, with some with drawls. For Brokens, Primary sorts were tended lower, while others were sold around last. Fngs steady.CIS buyers selectively operated on Cleaner varieties. Selected continental orders on Nilgiri teas. HUL very selective on whole leafs . Tunis fairly supported on secondary’s. CST buyers lent useful support on wiry sorts. SOURCE : GLOBAL TEA BROKERS www.johnkeellstea.com 17 JAKARTA MARKET SALE NO 08 - 26TH FEBRUARY 2014 Fair demand with lower prices. Java orth. Brokens mainly withdrawn, droppiong 3-10c where sold BOPF lost 2-3c. PF 2-3c down. Dust mainly withdrawn losing upto 9c where sold. PFII 5-13c down where sold. Offgr. Dusts irr.firm. FII firm to 5c. down. Sumatra orth. Most teas withdrawn, prices dropped 6c where sold. CTC BP1 lost 2-9c. PF1 7c down to 17c up. PD firm to 11c down. D1 2c up to 11c down.Fann lost 3-9c. D2 gained 1-6c. SOURCE : ELINK SCHUURMAN CEYLON www.johnkeellstea.com 18 Life without tea is unthinkable for the billions of people who rely on their cherished cuppas to get them through the day. But tea crops the world over are facing multiple threats, from climate change and water shortages to rural de-population and low wages. So serious are these threats, that some of the world's biggest tea companies are joining forces to combat them. Unilever, which owns Lipton, Brook Bond and PG Tips, Twinings, Finlays, and Tata Global Beverages, which owns Tetley, are laying to one side competitive instincts to protect the long-term future of their business and ensure that tea remains as accessible and affordable as it is today. "Unless we manage these issues, we're looking at a very different future for tea," says Sally Uren, chief executive of Forum for the Future, which is co-ordinating the Tea 2030 initiative. Greater competition The threats to tea are many and varied. The world's population is set to grow by a third by 2050, increasing demand for food by up to 70%, according to the United Nations. And much of this population growth will be in rapidly-developing countries such as China and India - precisely those that produce the most tea. Sources: International Tea Committee, UK Tea Council, Somo, Forum for the Future Extreme weather' Climate change is another major threat to tea production. Tea is a relatively delicate plant, sensitive to changes in temperature and rainfall, and is grown in regions particularly vulnerable to extreme weather events. For example, in the past 60 years rainfall has fallen significantly in Assam, the main tea-growing region of India, while forecasts suggest Sri Lanka will experience more intense rain and higher temperatures in the future. Low wages mean the tea industry is struggling to attract pickers In those areas where rain can no longer be relied upon, tea growers have had to turn to irrigation, and with it the very real threat of water shortages. "It is quite possible that more extreme weather could interrupt supply and make tea far more difficult to grow," says Mr Writer. Tea production in some areas, particularly those at higher altitudes, will no longer be possible. The increasing popularity of tea in domestic markets also means there could be less available for export, so any shortfall in supply will be exacerbated in those countries dependent on imports to quench the massive demand for tea. Source: United Nations Food and Agriculture Organization. Production figures for 2012. www.johnkeellstea.com 19 AUCTION NO. 10 09 11TH/12TH March 2014 No. of Lots No. of Kgs Dates Ex Estate Main Sale Total High & Medium Low Growns Leafy Tippy Premium/Flowery Off Grades Dust Grand Total Reprints 08 04TH/05TH March 2014 No. of Lots No. of Kgs 25TH/26TH Feb. 2014 No. of Lots No. of Kgs 930 1,068,256 kg 938 1,096,740 kg 980 1,162,360 kg 11,102 6,116,573 kg 10,994 6,052,979 kg 10,984 6,193,356 kg 1,361 704,161 kg 1,369 713,388 kg 1,048 555,948 kg 3,699 2,636 1,754,690 kg 3,729 2,567 1,755,301 kg 3,828 2,610 1,866,229 kg 1,620,675 kg 1,551,920 kg 539 176,513 kg 520 169,510 kg 677 224,032 kg 2,355 1,367,428 kg 2,241 1,292,850 kg 2,196 1,275,484 kg 512 493,106 kg 568 570,010 kg 625 634,471 kg 12,032 7,184,829 kg 11,932 7,149,719 kg 11,964 7,355,716 kg 728 443,806 kg 648 396,771 kg 864 515,069 kg Scheduled to Close (Ex) Dates (Ms) 20.02.14 21.02.14 13.02.14 13.02.14 06.02.14 07.02.14 Scheduled Closing Dates Auction No.09 : 04th/05th March 2014 Ex Estate : 13.02.2014 Main Sale : 13.02.2014 Auction No.11 : 18h/19h March 2014 Ex Estate : 27.02.2014 Main Sale : 28.02.2014 Auction No.10 : 11th/12th March 2014 Ex Estate : 20.02.2014 Main Sale : 21.02.2014 Auction No. 12 : 24th/26th March 2014 Ex Estate : 06.03.2014 Main Sale : 07.03.2014 ORDER OF SALE ( SALE NO:09 – 04TH/05TH MARCH 2014 ) MAIN SALE ORDER-1 MAIN SALE ORDER-2 (H&M/OFF/DUST) Mercantile Produce Brokers (Pvt) Limited Asia Siyaka Commodities (Pvt) Limited Bartleet Produce Marketing JOHN KEELLS PLC Ceylon Tea Brokers PLC Eastern Brokers Limited Asia Siyaka Commodities (Pvt) Limited Ceylon Tea Brokers PLC Eastern Brokers Limited Lanka Commodity Brokers Limited JOHN KEELLS PLC Bartleet Produce Marketing (Pvt) Limited Lanka Commodity Brokers Limited Forbes & Walker Limited Forbes & Walker Limited Mercantile Produce Brokers (Pvt) Limited EX- ESTATE Asia Siyaka Commodities (Pvt) Limited Forbes & Walker Limited Eastern Brokers Limited Mercantile Produce Brokers (Pvt) Limited Lanka Commodity Brokers Limited JOHN KEELLS PLC Bartleet Produce Marketing Ceylon Tea Brokers PLC SELLING TIMES OF OUR CATALOGUE Ex-Estate High & Medium Leafy Low Tippy/Premium PROMPT DATES : 1,637,192 kg 11.35 08.37 04.16 04.16 am am pm pm Off Grades BOP1A Dust Buyers – 11.03.2014 Sellers - 12.03.2014 www.johnkeellstea.com 12.15 pm 05.22 pm 02.00 pm [ KD: ne ] 20 SRI LANKA TEA EXPORTS QTY (KG) DESCRIPTION VALUE (RS) APPROX.AV.UNIT FOB VALUE PER KG.RS/CTS JANUARY 2014 Instant Tea 149,840.00 170,854,746.00 1,140.25 3,194,197.00 1,919,604,713.00 600.97 436,384.00 623,045,655.00 1,427.75 Tea in Bags 8,899,724.00 6,743,182,093.00 757.68 Tea in Bulk 9,201,316.00 5,720,910,576.00 621.75 21,881,461.00 15,177,597,783.00 693.63 100,871.00 99,356,820.00 984.99 3,440,192.00 1,655,538,676.00 481.23 326,823.00 426,039,672.00 1,303.58 Tea in Bags 8,285,765.00 5,436,679,244.00 656.15 Tea in Bulk 9,918,041.00 5,198,429,223.00 524.14 22,071,692.00 12,816,043,635.00 580.66 Tea in Packets Green Tea Total JANUARY 2013 Instant Tea Tea in Packets Green Tea Total MAJOR IMPORTERS OF SRI LANKA TEA JANUARY 2014 COUNTRY BULK TEA 3,041,986 PACKETED TEA 7,000 TEA BAG 700,702 GREEN TEA 95,905 2,749,150,659.00 TOTAL 2014 3,845,593 TOTAL 2013 3,913,920 287,761 452,790 1,851,881 1,645 1,614,839,362.00 2,594,077 1,742,943 1,229,950 980,966 170,112 249 1,790,603,380.00 2,381,277 3,065,671 413,480 345,160 397,058 56,265 803,396,941.00 1,211,963 1,205,242 IRAQ 17,820 69,650 1,091,590 2,048 617,397,283.00 1,181,108 1,460,324 SYRIA 35,100 559,980 393,888 144 624,657,602.00 989,112 1,359,839 JAPAN 747,274 42,872 99,920 369 645,499,475.00 890,435 569,075 KUWAIT 80,800 580,000 113,563 2,220 325,466,617.00 776,583 706,135 AZBIJAN 563,934 13,935 - - 377,188,075.00 577,869 841,167 JORDAN 8,100 24,250 495,987 2,833 407,717,600.00 531,170 554,841 RUSSIA TURKEY IRAN U.ARB.E TEA OTHER www.johnkeellstea.com 21 NOTICE We congratulate award winners that were recognized at the “Asia Pacific Entrepreneurship Awards 2014” held at the Cinnamon Grand Hotel, Colombo. Outstanding Entrepreneurship Awards Mr Lushantha De Silva Mr Saman Upasena Mr Thushan Upasena - Empire Teas - K.D.U. Group - New Kendagastenne Tea Factory Most Promising Entrepreneurship Awards Mr Pramuditha Chamara Abeyratne – 98 Acres Resort & Spa ----------------------------------------------------------------------------------------------Please note due to stock verification at Akbar Brothers Pvt Ltd warehouses on 03rd/04th March 2014, all ex-estate purchases should be delivered to their warehouses latest by Friday, 28th February 2014. HOLIDAY NOTICE Our Office, Warehouse and Sample Room will be closed on the 16th of March 2014 on account of Medin Full Moon Poya Day. www.johnkeellstea.com