Course Title: Infrastructure and Project Finance - IIM Kolkata

advertisement

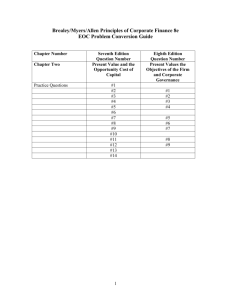

Course Title: Infrastructure and Project Finance - IIM Bangalore No. of Sessions: 10 Instructor: Halady Satish Rao [Former Director General, Asian Development Bank, Manila, Philippines; IIT Kharagpur (1970) and IIM Calcutta (1976)]. Presently, Consultant to the African Development Bank, Tunis, Tunisia. Introduction Infrastructure is vital for sustained economic development and improving the living standards of the population. Yet, there is an “infrastructure deficit” in many developing countries in Asia that is holding back these countries from realizing their full economic potential. Why this deficit in infrastructure, whether it be in roads, transport, electricity, safe drinking water, proper sanitation or communication facilities? One reason for this is that infrastructure presents unique challenges: highly capital intensive, with large initial costs; often of public interest nature thereby requiring greater interface with regulators and government agencies; social returns often exceed private returns, thereby necessitating subsidies/government guarantees or viability gap funding to attract the private sector; and, significant environmental and social impacts that need to be taken care of. Also, construction periods are long, revenue build up is gradual and project economic life is long, thereby requiring long-term funding with loan repayment and equity returns to be spread over longer periods of time. In the early stages of economic development in Asia, governments were the sole providers of infrastructure, often with assistance from Multilateral Development Banks (MDBs) that provide policy assistance and long-term funding on relatively concessional terms. Such development assistance, however, came with requirements that go beyond mere “commercial” considerations, namely economic viability, environmental sustainability and social acceptability and these have become integral part of project design and evaluation. With the growing infrastructure needs of a rapidly developing Asia, governments are finding it increasingly difficult to finance these needs. Hence, governments are reaching out to also the private corporate sector to partner in infrastructure development. Thus, “project finance” based on non-recourse (or limited recourse) lending is being increasingly applied in Asia (and elsewhere), namely lending that relies on debt service payments from the project cash flows and has only the project assets as collateral for the loan. Such project finance structure also enables promoters of a project to address the afore noted challenges in infrastructure projects by creating legally independent project entities and shifting debt burden, operating risks and accounting liabilities to third parties (debt holders and other parties in a vertical chain from input supplier to output purchaser) that are united through a series of legal contracts. Project finance is still in its early stages in developing Asia and its role in infrastructure development is expected to become progressively more important in the coming years. Learning Objectives The course will provide an understanding of the unique features and issues in infrastructure development and how project finance is applied to infrastructure development. The focus will be on underlying concepts (the why) and the operationalization (the how) of these concepts, supported by “hands-on” exercises for project evaluation in all its aspects (technical, market, financial, economic and social). The last session of the course will take the student through a typical PPP structure for an infrastructure project. Evaluation Evaluation will be as follows: Mid-term Examination Group Presentations (based on class exercise/home assignments) End-term Examination Class Participation : 20% : 30% : 30% : 20% Course Content Session Session Theme Topics 1 Introduction to Infrastructure and Project Finance Unique features of infrastructure Why project finance for infrastructure What is Project Finance Project Finance vs. Corporate Finance Advantages & Disadvantages of Project Finance Finnerty-Chap.1, 2 Yescombe-Chap.2 Reading 2 Infrastructure in Asia Overview of infrastructure in developing Asia and the role of Multilateral Development Banks (MDBs). “Developing Physical Infrastructure: A comparative perspective on the experience of China and India” by Rajiv Lall, Ritu Anand and Anupam Rastogi Infrastructure development in India, its Financing and Issues therein. Credit appraisal for financing of a public sector hydropower project with government as the single owner/borrower Class Exercise for a hydro power project (Kali Gandaki) Typical financial instruments used – Senior Debt, Subordinated Debt, Equity, Mezzanine Debt, Asset Backed Securities Structured finance (Infrastructure Funds & Securitization) Cash flow metrics and financial ratios used in project finance Concession agreements, supply agreements, purchase agreements, EPC contracts, O&M contracts Model Inputs & Outputs, Macroeconomic Assumptions, Project Costs and Funding, Loan Drawings and Debt Service, Cash Flow Projections, Projected Financial Statements, Rates of Return and Sensitivity Analysis “Infrastructure in India” by Ritu Anand & “Financing Infrastructure” Rajiv Lall and Ritu Anand 145 MW Kali Gandaki Hydro Electric Project in Nepal funded by the Asian Development Bank (ADB) [Case Study-cum-exercise] and India 3 “Conventional” infrastructure financing (1)public sector infrastructure project 4 Project Finance(1) -Project Financing Plan and Financial Instruments 5 Project Finance(2) – Project Contracts 6 Project Finance(3)– Financial Modeling Evaluation and Finnerty – Ch 8 Yescombe-Ch. 3 Finnerty- Chap.6 Yescombe-Chap.6 & 7 Finnerty-Chap.9-10 Yescombe- Chap.12 7 Project Economic Analysis Class Exercise for a Sugar Project in Viet Nam (1) Guidelines for the Economic Analysis of Projects. Asian Development Bank. http://beta.adb.org/documents/guidelineseconomic-analysis-projects Pages 1-51. (2) Lyn Squire and Herman G. van der Tak, Economic Analysis of Projects . Published for the World Bank by The Johns Hopkins University Press, Baltimore and London. Pages 15-46. 8 Project Environmental and Social Safeguard Compliance International compliance requirements, Environmental Impact Assessment (EIA) and Resettlement Plan (RP) Case: EIA and RP for an Infrastructure Project Safeguard Policy Statement. Asian Development Bank. http://beta.adb.org/documents/safeguardpolicy-statement Pages 14-22. 9 Project Analysis Mitigation Finnerty- Chap. 13 Yescombe-Chap. 8-11 10 Public Private Partnerships Commercial, Macroeconomic and Political Risks Guarantees and Insurance for Risk Mitigation Roles of government and private sector in infrastructure development Public-Private-Partnership (PPP) in infrastructure Advantages & disadvantages of PPP projects Types of PPP – BOT, BOO, BOOT, ROT, etc. Who are the different participants (Government, Project Sponsor, Lenders, EPC & O&M Contractors, Suppliers, Off-takers, Public, Environmental Agencies, Insurers, etc.)? Case: PPP Structure for an Infrastructure Project Risk and Public-Private Partnership Handbook. Asian Development Bank. http://beta.adb.org/documents/public-privatepartnership-ppp-handbook Pages 1-5. Reference Text Books: (1) Project Financing: Asset-Based Financial Engineering, John D. Finnerty, Wiley Finance, 2nd Ed, May 2007 (2) Principles of Project Finance, E R Yescombe, Academic Press, 2002 Readings: As above.