School research of USC

advertisement

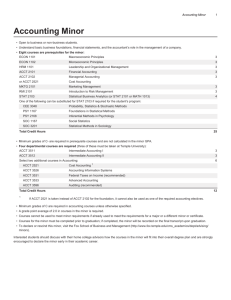

School research of USC Master of Accounting (MAcc) The Leventhal Master of Accounting (MAcc) program is a full-time, one-year program that begins in June for non-accounting undergraduate majors, and August for undergraduate accounting majors. Consistently ranked among the top graduate accounting programs in the country, the MAcc program at the University of Southern California prepares graduates for careers in: Public Accounting Financial Services and Investment Banking Government and non-profit Corporate Finance Students study accounting in greater depth than is typically provided in an undergraduate accounting program or MBA program with a concentration in accounting. The objectives of the program include developing the sound conceptual, technical, analytical and communication skills that are required to succeed in the accounting profession. To accomplish these objectives, the program takes an intensive approach with extensive use of the case study method and teamwork in all courses. The program employs a rigorous case analysis approach which requires students to exercise their analytical abilities and develop effective verbal and written communication skills. The case study method puts the student in the role of management, making decisions about issues now facing the business world. This enables the student to apply accounting and business concepts in various settings to give a broad perspective to the role of accounting rather than a narrow technical viewpoint. Students may apply to the MAcc program after completing a baccalaureate degree from an accredited college or university or during their senior year. An undergraduate accounting or business major is not necessary nor is work experience a requirement. Students typically graduate the MAcc program having fullfilled the educational requirements to sit for the Uniform Certified Public Accountant (CPA) examination and have had exceptional success in passing the exam. COURSE ARRANGEMENT Required Units = 30* To complete the Master of Accounting degree, you will take a minimum of 10, three-unit courses: 3 Required Accounting Courses 9 units 3 Accounting Elective Courses 9 units 1 Required Accounting Information Systems Course 3 units 1 Required Communication Course 3 units 2 Floating Electives Courses 6 units 10 Total Courses (minimum) 30 units +1 Corporate Finance Course +3 units (if needed) 33 units with Finance Course during program * After satisfying accounting prerequisite courses (see Admissions for a list of prerequisite coursework). Accounting prerequisites may be completed through undergraduate education or by completing ACCT 525, our 15-unit Summer Intensive Program. An additional 3-unit Corporate Finance class is required of MAcc students, but this requirement may be fulfilled before entering the program or during the program. See below for a description of these requirements. Required Accounting Courses (3) ACCT 585 Professional Accounting Concepts Spring [Required] 2009 Choose two (or more) courses from the following list: ACCT 537 Management Control Systems Spring 2009 ACCT 546 Auditing/Assurance Services Fall 2008 ACCT 557 Advanced Auditing Topics Spring 2009 ACCT 581 Financial Statement Analysis Spring 2009 Accounting Elective Courses (3) Choose three (or more) courses from the following list. ACCT 537 Management Control Systems Spring 2009 ACCT 548 Enterprise Systems: Design, Implementation Spring 2009 ACCT 549 Advanced Enterprise Systems and Fall 2008 Technologies ACCT 557 Advanced Auditing Topics Spring 2009 ACCT Tax Theory Spring 560T ACCT 574 2009 Accounting in Global Environment Fall 2008 (International) ACCT 581 Financial Statement Analysis Spring 2009 ACCT 582 Mergers and Acquisitions (Acct and Tax Fall 2008 Views) ACCT 583 Accounting for Income Taxes Spring 2009 ACCT 584 Family Wealth Preservation Spring 2009 ACCT 587 Forensic Accounting Spring 2009 ACCT 588 SEC Registration and Reporting Spring 2009 ACCT 599 Special Topic – Strategy & Operations Spring through CFO Lens 2009 Required Accounting Information Systems Course (1) Choose one based on your background and interest. ACCT 547 Enterprise Information Systems Fall 2008 ACCT 548 Enterprise Systems: Design, Spring Implementation, Security 2008 Advanced Enterprise Systems and Fall 2008 ACCT 549 Technologies DETAIL COURSES RECOMMENDATION ACCT 537 Management Control Systems (3, Sm) Study of systems and devices managers use to ensure that strategies are being implemented as intended and that assets are not being stolen or otherwise dissipated. Among the topics covered are planning and budgeting systems, responsibility centers, performance measures and evaluations, incentives, and the roles of controllers and internal auditors. Prerequisite: GSBA 518 or GSBA 536. ACCT 548 Enterprise Systems: Design, Implementation, Security and Audit (3, Sp) Exploration of a number of areas including the role systems play in organizations, the technology that supports these systems and issues relating to technology risk, system/application security and system review/audit. Prerequisite: ACCT 547 or ACCT 371b. ACCT 549 Advanced Enterprise Systems and Technologies (3, FaSp) Design, control and development of advanced enterprise systems, using reengineering, focusing on accounting and financial systems, using a wide range of emerging existing technologies. Recommended preparation: ACCT 547. ACCT 557 Advanced Financial Statement Auditing Topics (3, Sp) Advanced coverage of topics in financial statement auditing including market effects of auditing, auditor litigation and client acceptance, errors and fraud, analytical procedures, and going-concern assessment. Prerequisite: ACCT 525x. ACCT 574 Accounting in the Global Business Environment (3, Fa) Study of national and international accounting and business issues; global capital market changes; international accounting and business topics; cases and studies of specific business entities and countries. Prerequisite: GSBA 510 or GSBA 518 or GSBA 536. ACCT 581 Financial Statement Analysis (3, SpSm) Analysis of corporate financial reports from a decision-maker's perspective. This course is case-and-applications-oriented. Applications include credit analysis, equity valuation, and financial distress. Prerequisite: GSBA 510. ACCT 560T Tax Theory and Its Business Applications (3, FaSp) Taxation and its relationship to business and investment decisions; the effects of taxation on business organization, capital structure, policies, operation, and expansion. Recommended preparation: introductory tax course. ACCT 582 Accounting for Mergers and Acquisitions (3, Fa) Theoretical and practical problems in accounting for business combinations: purchase and pooling-of-interests accounting; consolidated financial statements; income tax considerations; International Accounting Standards. Prerequisite: GSBA 510. ACCT 583 Accounting for Income Taxes (3, Sp) Examination of the roles of auditors, tax professionals and corporate financial personnel in preparing, analyzing and reviewing the accrual of income taxes in financial statements. Open to M.B.T., M.Acc. and M.B.A. students only. Prerequisite: ACCT 544, ACCT 572. ACCT 584 Family Wealth Preservation (3, Sp) Analysis of transfer of property during lifetime or at death from a tax saving perspective. ACCT 587 Forensic Accounting (3) Role of the accountant in litigation matters. Identification and exploration of the analytical and communication tools necessary to be an effective forensic accountant. Prerequisite: ACCT 572x. ACCT 588 Analysis and Implications of SEC Registration and Reporting (3, Sp) Legal, institutional, and economic implications of being a U.S. public company. The Securities and Exchange Commission and its influence on investors, management, underwriters, and accountants. Recommended preparation: ACCT 572. ACCT 599 Special Topics (1, 1.5, 2, or 3, max 6, FaSpSm) Examination of current literature and research techniques in contemporary accounting areas including tax, auditing and international accounting. ACCT 547 Enterprise Information Systems (3, Fa) Focuses on accounting enterprise database models and information technology required to support those systems. Includes analysis and design of interfunctional process flows through reengineering to exploit technology capabilities. Professor profile RUBEN A DAVILA 【 inportant NN】 FORENSIC ACCOUNTANT 213-740-5005 Email:rdavila@marshall.usc.edu [ no paper, no books, perfect working experience] 2007 - Present Board Member AICPA Board of Examiners 2007 - Present Board Member AICPA BOE - Financial Accounting and Reporting Subcommittee 2007 - Present Committee Member NASBA Professional Continuing Education Committee 2006 - Present Faculty Advisor Latino Business Student Association 2004 - Present Committee Member Provost Committee - Oversight Committee for Athletic Academic Affairs 2003 - Present Member National Association of Board of Accountancy (NASBA) 2001 - Present Member California State Bar 2001 - Present Ruben A. Davila, Attorney at Law Ruben A. Davila, Attorney at Law 1987 - Present Ruben A. Davila, CPA, Consultant and Forensic Accountant 1982 - Present Member American Institute of Certified Public Accountants 2006–2007 Committee Member AICPA -Board of Examiners - State Board Committee 2006–2007 Task Force Leader IQAB - Evaluation Committee: Insitituto Mexicano de Contadores Publicos 2005–2007 Committee Member IQAB - Evaluation Committee - Institute CPAs in Ireland 2005–2007 Committee Member IQAB - Substantial Equivalence Criterion Committee 2002–2007 Committee Member LSOA - Graduate Curriculum Committee 2002-04; 2006-07 2003–2007 Board Member International Qualifications Appraisal Board 2006–2007 Committee Member NASBA - Education Committee 2004–2007 Board Member Joint AICPA/NASBA: International Qualfications Appraisal Board (IQAB) 2006–2007 USC Mentor for Transfer Students USC Marshall Cohort 2004–2007 Committee Member CBA - Legislative Commitee 2004–2007 Committee Member CBA - Enforcement Protection Oversight Committee 2003–2007 Board Member California Board of Accountancy 2006 Secretary-Treasurer California Board of Accountancy 2004–2006 Faculty Advisor - USC Student Chapter Assoc. of Latino Professionals in Acctg and Finance (ALPFA) 1998–2006 Committee Review Member LSOA - Annual Performance Review Committee 1998-02; 2006 - Present 2005 Committee Member CBA Committee on Professional Conduct 2004–2005 Committee Member ALPFA - Scholarship Committee 2004–2005 Committee Member ALPFA - Student Outreach Committee Member 2004 Task Force Member CBA - IQEX Task Force 2003–2004 TF Member CBA SOX Cascade Effect Task Force 2002–2004 Academic Advisor Graduate Latino Business Students –2003 Committee Member LSOA - Graduate Admissions 1988-92, 2002-03 –2002 LSOA - Academic Standards Committee 1988-89, 1995-97, 2002-03 –2001 Committee Member LSOA - Curriculum Development Committee 1997-98; 2000-01 1999–2001 Volunteer Law Clerk Los Angeles Center for Law and Justice - Consumer Div. –1999 Volunteer Law Clerk L.A. District Attorney's - Criminal Courts –1999 Volunteer Law Clerk L.A. District Attorney's Office - Major Fraud Unit 1993–1995 Volunteer Teacher Accounting Awarness Program 1986–1994 Faculty Advisor Gamma Phi Beta Sorority 1986–1994 Non Resident Faculty Fellow Office of Student Affairs 1989–1993 Volunteer Teacher L.A. Academy of Finance 1988–1989 Faculty Advisor Lambda Chi Alpha Fraternity 1979–1985 Senior Accountant - Adult Division Deloitte & Touche MARK L DEFOND 213-740-5016 defond@usc.edu research field: corporate governace, auditing, international accounting if I really have interests in auditing, I believe he is the one who deserves to be studied for long.. DeFond, M., Hung, M., Covrig, V. (2007). Home Bias, Foreign Mutual Fund Holdings, and Voluntary Adoption of International Accounting Standards. Journal of Accounting Research, 45, 41-70. DeFond, M., Hung, M. Y., Trezevant, R. H. (2007). Investor Protection and the Information Content of Annual Earnings Announcements: International Evidence. Journal of Accounting and Economics, 43, 37-67. DeFond, M., Hung, M. Y. (2007). Investor Protection and Analysts' Cash Flow Forecasts Around the World. Review of Accounting Studies. DeFond, M., Francis, J. (2005). Auditing Research after Sarbanes-Oxley. Auditing: A Journal of Practice and Theory, 25, 5-30. DeFond, M., Hann, R., Hu, X. (2005). Does the Market Value Financial Expertise on the Audit Committees of Boards of Directors?. Journal of Accounting Research, 43, 154-194. DeFond, M. (2004). Discussion of the Riskiness of Large Audit Firm Client Portfolios and Changes in Audit Liability Regimes: Evidence from the US Audit Market.. Contemporary Accounting Research, 21. DeFond, M., Hung, M. Y. (2004). Investor Protection and Corporate Governance: Evidence from Worldwide CEO Turnover. Journal of Accounting Research, 42, 269-312. DeFond, M., Hung, M. (2003). An Empirical Analysis of Analysts' Cash Flow Forecasts.. Journal of Accounting and Economics, 35, 75-100. DeFond, M. (2002). Discussion of The Balance Sheet as an Earnings management Constraint.. The Accounting Review, 77, 29-33. DeFond, M., Raghunandan, K., Subramanyam, K. R. (2002). Do Non-Audit Service Fees Impair Auditor Independence?. Journal of Accounting Research, 40, 1247-1274. Chen, S., DeFond, M., Park, C. W. (2002). Voluntary Disclosure of Balance Sheet Information in Quarterly Earnings Announcements. Journal of Accounting and Economics, 33, 229-251. DeFond, M., Park, C. (2001). The Reversal of Abnormal Accruals and the Market Valuation of Earnings Surprises. The Accounting Review(76), 375-404. DeFond, M., Francis, J., Wong, T. J. (2000). Auditor Industry Specialization and the Market Segmentation: Evidence from Hong Kong. Auditing: A Journal of Practice and Theory, 19, 49-66. DeFond, M. (2000). Discussion of Differences in Conservatism Between Big Eight and Non-Big Eight Auditors Proceedings of the 15th Illinois Audit Symposium. DeFond, M., Wong, T. J., Li, S. (2000). The Impact of Improved Auditor Independence on Audit Market Concentration in China. Journal of Accounting and Economics, 28, 269-305. DeFond, M., Park, C. (1999). The Effect of Competition on CEO Turnover. Journal of Accounting and Economics, 27, 35-56. DeFond, M., Subramanyam, K. R. (1998). Auditor Changes and Discretionary Accruals. Journal of Accounting an Economics, 25, 35-68. Becker, C., DeFond, M., Jiambalvo, J., Subramanyam, K. R. (1998). The Effects of Audit Quality on Earnings Management. Auditing: A Journal of Practice and Theory, 15, 1-24. DeFond, M., Blacconiere, W. (1997). An Investigation of Audit Opinions and Subsequent Auditor Litigation of Publicly Traded Failed Savings and Loans.. Journal of Accounting and Public Policy, 16, 415-454. DeFond, M., Ettredge, M., Smith, D. (1997). An Investigation of Auditor Resignations.. Research in Accounting Regulation, 11, 25-46. DeFond, M., Park, C. (1997). Smoothing Income in Anticipation of Future Earnings.. Journal of Accounting and Economics, 23, 115-139. DeFond, M., Jiambalvo, J. (1994). Debt Covenant Violation and Manipulation of Accruals.. Journal of Accounting and Economics, 17, 145-176. DeFond, M., Jiambalvo, J. (1993). Factors Related to Auditor-client Disagreements Over Income-Increasing Accounting Methods. Contemporary Accounting Research, 9, 415-31. DeFond, M. (1992). The Association Between Changes in Client Firm Agency Costs and Auditor Switching. Auditing: A Journal of Practice and Theory, 11, 16-31. DeFond, M., Smith, D. B. (1991). Discussion of the Financial and Market Effects of the SEC Accounting and Auditing Enforcement Releases.. Journal of Accounting Research, 29(Supplement). DeFond, M., Jiambalvo, J. (1991). Incidence and Circumstances of Accounting Errors.. The Accounting Review, 66, 643-355. Working Papers DeFond, M., Zhang, J. Stock and bond market s reaction to covenant violations DeFond, M., Zhang, J. The Information Content of Earnings Surprises in the Corporate Bond Market DeFond, M., Hung, M. Y., Karaoglu, E., Zhang, J. Was Sarbanes Oxley Good News for the Bond Market? DeFond, M., Francis, J., Hu, X. Audit Quality, SEC Enforcement and Geography 在读他的 paper~ DR. CECIL. W. JACKSON Research field: signals of Fraudulent financial reporting Phone: 213-740-5020 ceciljac@marshall.usc.edu Books Jackson, C. W. (2006). Business Fairy Tales: Grim Realities of Fictitious Financial Reporting. Thomson -South-Western Publishing. Pincus, K. V., Jackson, C. W. (1999). Core Concepts of Accounting Education: Accounting Issues Involving Economic Resources, Custom Edition. Core Concepts of Accounting Information McGraw-Hill. Refereed publications Jackson, C. W., O'Leary, D., Wallis, J. (1999). A Multiple Criterion Model for the Product Pricing Decision. In , (Ed.), Advances in Mathematical Programming and Financial Planning (pp. 39-46). Jackson, C. W., Dollery, B. E. (1997). A Note on the Methodological Parallels Between Accounting and Economics. The Journal of Interdisciplinary Studies. Jackson, C. W., Lin, T. W., Elnathan, D., Ferreira, L. (1993). Product Costing and Cost Control in the new Manufacturing Environment. The Review of Business Studies. Jackson, C. W., Dollery, B. (1985). The Profit Maximizing Pricing Model. Accountancy SA. MRS. CHRISLYNN FREED Research field: auditing and gender issues Telephone: 213-740-5016 Email: cfreed@marshall.usc.edu Refereed publications Freed, C., Tucker, R. (2006). Auditing Textbook - Solutions to selected chapters YANIV KONCHITCHKI (ASSOCIATE PROF) Research field: financial accounting, asset pricing, financial statement analysis Telephone:213-740-9399 Email: yaniv@marshall.usc.edu Books Aranya, N., Yampuler, E., Konchitchki, Y. (2007). Accounting in Business. Book, Tel Aviv University Press. Book chapters and other Konchitchki, Y. (2007). Inflation and Nominal Financial Reporting. Stanford University, Ph.D. Thesis, 92. Working Papers Konchitchki, Y., Simon, A. Would you Bet Your Savings on Today's Best Analyst?. Barth, M., Konchitchki, Y., Landsman, W. Cost of Capital and Earnings Transparency. Konchitchki, Y. Inflation and Nominal Financial Reporting: Implications for Performance and Stock Prices. International students profile Robin Guo, MAcc2009 Undergrad School:Fudan University |Major:InternationalEconomy & Trade | Hometown:Shanghai, China macc.mbt@marshall.usc.edu After graduating with an International Economics degree from a top-tier university in China, I worked for 3 years at Ernst & Young (Shanghai Office) before entering the MAcc program at USC Leventhal. I chose the University of Southern California because of its prestigious faculty, tight relation with the global business community, and its ideal location. Please free to contact me with any questions, as I would be pleased to share with you all the wonderful experience here. 问题:对于工作了 3 年的人来说为什么会想到要去念 msa?你觉得它对于你未来 的职业发展具有怎样的意义? Crystal Ma, MAcc2009 Undergrad School: Guangdong University of Foreign Studies | Major: International Business Management / English Hometown: Shenzhen, China macc.mbt@marshall.usc.edu I graduated from Guangdong University of Foreign Studies in China with a BA in English for Business. Prior to joining the program, I worked at PricewaterhouseCoopers for 1 year and did internships at Standard Chartered Bank and China Merchants Bank. I chose the MAcc program because of the extremely strong USC alumni network and tremendous job opportunities for MAcc graduates. The best part of the MAcc program is the Summer Intensive Program where non-accounting undergraduates catch up with accounting majors in several weeks and lifetime friends are made. I hope to work in an accounting firm upon graduation. In my spare time I enjoy outdoor sports, yoga, swimming and music. I have also been a Chinese national volleyball player for 12 years. 问题:在刚开始的 2 个月提前学习的过程是否很辛苦?你觉得最困难的点是什么 呢?全英语授课环境,会计的专业知识?还是新环境的寂寞?,空前的压力? Krista Victorio, MAcc 2009 Undergrad School: Ateneo de Manila University | Major: Economics | Hometown: Philippines and US krista.victorio.2009@marshall.usc.edu I recently graduated with a BA in Economics from a premier university in Asia. While my undergraduate major has broadened my horizons and given me a new perspective on things, I feel that a Master of Accounting adds depth and skill to what I already know. As the world we live in becomes an increasingly interconnected world of ideas, people, and events, the realization is that accounting-accountability is primary, especially in business. USC is a top ranked university where you can expect to learn just as much from your peers as from the university's distinguished faculty and staff. Ultimately, USC is not just a school; USC is an experience. I have lived in the US and the Philippines and have traveled extensively. I enjoy playing sports – particularly football (soccer), tennis, and golf – as well as photography, current events, languages, and cross cultural appreciation. At this point, I am considering a future in finance and developmental projects. Is the MAcc program worth your time/money/social life? I like to think it is. Should you need more convincing, let me know! 问题:extensive travel expeience 是否对于申请有明显的帮助,或者对于未 来念 msa 又具有什么样的影响呢? Sunny Lei, MAcc 2009 Undergrad School: University of California, San Diego | Major: Economics | Hometown: Rowland Heights, CA sunny.lei.2009@marshall.usc.edu I graduated with a BA in Economics from UC San Diego in 2007. I became interested in accounting when I took a financial accounting course while studying abroad in Hong Kong. I realized the increasing international scope of the profession was something I wanted to pursue. With an interest in business but lacking the proper foundation, I decided that my best option was to continue my education through a graduate accounting program. I chose the USC MAcc not only because of its outstanding reputation and location, but also because it encouraged people with any undergraduate major to apply. In the short amount of time I've spent here at USC, I'm glad to say I've already encountered a great mix of students with diverse backgrounds. My work experience includes a summer internship with a major commercial real estate firm and with a local accounting firm this past tax season. After graduation, I plan to work in a public accounting firm as an auditor in the financial services or energy industries, and eventually bring my skills overseas. Outside of school, I enjoy photography, ping pong, and watching the Lakers dominate your favorite team! Feel free to ask me any questions you have concerning the program, life as a student, or anything else that comes to mind. Amit Cheela, MBT 2009 Undergrad School: New University | Major: Economics | Hometown: Edison, NJ amit.cheela.2009@marshall.usc.edu York Originally from New York City, I graduated from NYU in 2007 with a BA in Economics. Before joining USC, I held internships in investment banking and the healthcare industry. I chose to get my Master in Business Taxation from the University of Southern California because I was confident that only USC could provide me with an outstanding education, the support of a nationwide alumni network, and excellent career prospects. Moreover, only USC offers students these benefits in a metropolitan city such as Los Angeles. Please feel free to contact me with any questions you have about the program or USC. 问题: nationalwide alumni network 对于未来的工作具有怎么样子的帮助? detail? 为什么认为只有 usc 可以提供好的教学环节,好的人脉关系网,好的职 业 path.为什么这些东西在 chicago, 或者 uiuc 你觉得就不能获得呢? Students profile 总结 1. 学生普遍都是本科毕业于牛校, 学的是和经济有关的 专业(可能不是 accounting) 2. 学生都具有很好的实习经验 比如很多学生都曾工作在 四大或者实习在四大 3. 学生都是很有头脑的。具体体现在他们每个人都知道为 什么要来学 accounting, 为什么选择 usc, usc 能够提供 什么样子的条件使他们将来就业更具有竞争力,将来毕 业后他们打算做什么,有的给出短期目标,有的给出了 长期的终身奋斗的目标。 4. 学生兴趣广泛。眼界开阔。 综上所述: Usc 可能喜欢具有一定专业背景的学生,他们过去的 record 记录良好。但是 usc 并不真的计较本科的专业背景,讲到底 它喜欢拥有这样知识的人!他们不仅喜欢具有这样子知识的 人,他们很看重非常看重实习经历。USC 喜欢具有明确目标 的人。USC 喜欢兴趣广泛,眼界开阔的学生。 我努力的方向: 1. 努力做 field-research, 争取把会计原理和审计原理在暑假前都 吃透,看懂。对这个行业有一个全面的宏观的认识。 2. 我已经找到一份实习啦!是在立信会计事务所~暑假就可以将我学 的我会的在实际中体验运用下。好好参与项目。 3. 在做 school research 和 field research 的同时,对会计越来越了 解的基础上,我要好好理清楚我的 career path,有明确的人生目 标。更要知道我为什么要去学会计,为什么选择审计,为什么选 择我要投的学校,它对于我未来的职业发展有着怎么样的作用和 意义,它又存在着那些问题和不利条件,我具有怎么样的 quality, 为什么我适合这个学校,我的卖点又是什么,会计和审计在国外 和国内的不同发展前景,(回国或者不回) 4. 培养自己用西方人的思维去理解和交流。 5. 努力锻炼身体! ! !! !这是一个需要身体的行业,~~~ 6 个选择 usc 的理由 1. 杰出的教授队伍可以提供你最优最全的知识和信息来面 对未来的全球化格局和激烈的社会竞争 2. 强调 team group 解决问题和 cases, 注重培养 communication skills 3. usc 招收的中国学生比例高,对华人很友好。 4. 教授和学生的关系不仅仅维系在课堂。他们是 partnership 的关系,能更有效的利用教授资源。 5. 国际化大都市的地理条件,方便找工作 6. 强大的学生人脉网,对于未来的求职和工作都有很大的帮 助