Institutions Overview - HBS People Space

advertisement

MIGRATION OF PRODUCTS

C. Y. BALDWIN, C. HIENERTH AND E. VON HIPPEL

SEPTEMBER 5, 2005

The migration of products from lead user-innovators

to manufacturers

T

i

t

l

e

:

Carliss Baldwin*, Christoph Hienerth** and Eric von Hippel***

September, 2005

(

P

ABSTRACT

D

F

In this paper we model the pathways commonly traversed as user innovations are

M

transformed

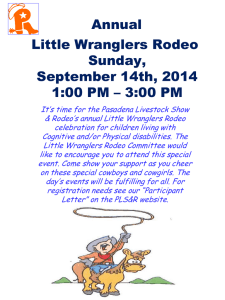

A into commercial products. We test the model against the evolution of the rodeo

kayak industry,

K and find it supported. Our model indicates that industries built upon user

innovationEwill evolve as follows. First, one or more users of some good recognize a new set of

design possibilities–

a so-called “design space” –and begin to explore it. At the start, userR

innovators.may search in isolation. Soon, however, user-innovators interested in the same design

space find E

each other and join into communities. They freely share their innovations, motivated

P

by the increased

efficiency of collective search for better solutions within the design space they

S

share. User-purchasers

then emerge, interested in buying copies of user innovations rather than

) for themselves. In response, user-manufacturers emerge, using high variable cost /

making them

low-capital methods to satisfy the well-understood product needs of fellow community

members. P

r

e

Later, the no-longer-new design space begins to be “mined out” as a result of extensive

v

user search.

i Better solutions become harder to find, and the rate of user innovation slows. As a

result, investments

in manufacturing methods involving higher capital costs and lower variable

e

costs become

feasible.

User-manufacturers or others respond by making such investments and

w

lower-cost :products create a larger market for products of reasonable quality. User-innovators

that require the very best performance continue to innovate, and continue to sell smaller numbers

T

of higher-performance

products to like-minded user purchasers. Successive rounds of

innovationhgive rise to new entrants. Progressive mining out of the design space leads to steadily

lower ratesi of user innovation, less entry, and eventually to the collapse of the experimental

s industry.

sector of the

E model and case have theoretical implications for the “dominant design” literature on

The

P

industry evolution. They also offer managerial guidance to both user-manufacturers and

S

established manufacturers trying to profit from markets strongly affected by user innovation.

p

i

c

t

u

r

* Harvard Business

School, Boston, MA, cbaldwin@hbs.edu

e of Entrepreneurship and Innovation, Vienna University of Economics and

** Department

Business Administration, Christoph.Hienerth@wu-wien.ac.at

w School of Management, Cambridge, MA, evhippel@mit.edu

*** MIT Sloan

a

s

n

o

t

s

a

v

e

1

MIGRATION OF PRODUCTS

C. Y. BALDWIN, C. HIENERTH AND E. VON HIPPEL

SEPTEMBER 5, 2005

The migration of products from lead user-innovators to manufacturers

1. Introduction and Overview

It has been shown that many users – both individuals and firms - develop new products

to serve their own needs. It has also been shown that innovations by so-called “lead users” are

often later adopted by manufacturers and sold as commercial products. Thus user innovation can

greatly influence the rate and direction of product innovation in some industries. We are

interested in how such industries are structured and how they evolve. There is an extensive

literature on how changes in product design and production technology affect the organization of

industry. This paper brings user innovation into that line of research.

In this paper we explore the pathways commonly traversed as user innovations are

transformed into commercial products. We construct a model, based on design search theory and

economics, that explains first, how user innovation is organized and evolves over time, and

second, how user-generated innovations become products and affect the evolution of product

markets. In our analysis, users innovate independently of manufacturers, but manufacturers are

affected by the content and pace of user innovation. We seek to understand (1) how the effort of

innovation can be best organized to meet the goals of users; and (2) how manufacturers can

manage their investments and profitability when faced with a stream of user-generated

innovations, which they do not control.

According to the theory developed in this paper, user innovation begins when one or

more users of some good recognize a new set of design possibilities– a so-called “design space” –

and begin to explore it. In general, one or more communities of user-innovators will soon coalesce

and begin to exchange innovation-related information. We use the formal theory of design search

to model the behavior of user-innovators and the benefits they obtain by forming communities.

Some time after user innovation begins, the first user-purchasers appear – these are users

who want to buy the goods that embody the lead user innovations rather than building them for

themselves. Manufacturers emerge in response to this demand. We show that, under quite

general conditions, the first manufacturers to enter the market are likely to be user-innovators

who use the same flexible, high-variable-cost, low-capital production technologies they use to

build their own prototypes. The relatively high variable costs of these user-manufacturer

production technologies will tend to limit the size of the market.

Then, as information about product designs becomes codified, and as market volumes

grow, manufacturers—both existing user-manufacturers and established manufacturers from

other fields—can justify investing in higher-volume production processes involving higher

capital investments. These processes have lower variable costs, hence their use will tend to drive

prices lower and so expand the market. User-purchasers then have a choice between lower-cost

standardized goods and higher-cost, more advanced models that user-innovators continue to

develop. We predict that the market will segment along the lines of consumer preferences: we

model that segmentation as a function of design quality, usability, and cost.

Finally, as a design space matures, the rate of user innovation within that space tends to

decline because the expected returns from further design improvements decrease. We model the

effects of this “mining out” of the design space on the manufacturers’ choice of technology and

capital investment.

We begin this paper with a literature review (section 2), followed by a case history of

rodeo kayaking (section 3). Rodeo kayaking is a sport and an industry that has been dramatically

affected by user innovations over a period of thirty years. This case history serves as the “test

case” in the development of our theory: the theory’s first challenge is to explain innovative

behavior and industry evolution in this setting. In section 4, we define the basic concepts and

terms of our model. In section 5, we explore the decision-making and organization of user-

2

MIGRATION OF PRODUCTS

C. Y. BALDWIN, C. HIENERTH AND E. VON HIPPEL

SEPTEMBER 5, 2005

innovators. Next, we consider the economics of manufacturing as user innovation and investment

in production technologies change the nature of products and demand (section 6). Section 7

concludes by discussing what we can learn from the model, the managerial implications of our

findings, and the likely differences in commercialization pathways for information products and

physical products.

2. Literature review

In this section, we first review what is known about innovation by users and within user

innovation communities. Next, we describe what is known about the role of user-innovators in

commercializing the innovations they have developed. Finally, we review prior work on how

industry structures change in response to changes in underlying product designs and production

technologies.

Innovation by users

Research has shown that some of the most important and novel products and processes

have been developed by users - both user firms and individual end users. Thus, Enos (1962)

reported that nearly all the most important innovations in oil refining were developed by user

firms (oil refineries). Freeman (1968) found that the most widely licensed chemical production

processes were developed by user firms. Von Hippel (1988) found that users were the developers

of about 80 percent of the most important scientific instrument innovations, and also the

developers of most of the major innovations in semiconductor processing. Pavitt (1984) found

that many inventions by British firms were for in-house use. Shah (2000) found that the most

commercially important equipment innovations in four sporting fields tended to be developed by

individual users.

Several studies have shown that many users engage in developing or modifying

products. In studies of five types of industrial products, the fraction of users reporting

developing or modifying products for their own use ranged from 19% to 36% (Urban and von

Hippel 1988, Herstatt and von Hippel 1992, Morrison et al. 2000, Franke and von Hippel 2003,

Lüthje 2003a). Three studies of user innovation in consumer products found from 10% to 38% of

sampled users reporting that they had developed or modified products for their own use (Lüthje

2003b, Franke and Shah 2003, Lüthje et al. 2003). When taken as a whole, these findings make it

very clear that users are doing a lot of product modification and product development in many

fields.

A user with unique needs derives no benefit from membership in a community.

However, when multiple users want the same or similar things, innovation communities in

which innovators freely reveal their innovations are common. Franke and Shah (2002) have

shown that all innovating users in a sample of four sports innovation communities had assistance

from other community members during their work of innovation development. In the rodeo

kayaking sports community, Hienerth (2004) has shown that commercialization begins when

innovating users first start selling prototypes to community members. Later such

commercialization leads to changes in the overall community system, particularly patterns of free

revealing.

So-called lead users are ahead of the majority of users with respect to important market

trends. Their desires predict the future desires of many other users. Studies of innovating users

(both individuals and firms) show them to have the characteristics of lead users. (The correlations

found between innovation by users and lead user status are highly significant, and the effects are

very large.) Thus many of the novelties developed by user-innovators are likely to appeal to

other users and so be the basis for commercial products. In fact a number of studies have shown

that innovations originating with users are often judged to be commercially attractive and/or

3

MIGRATION OF PRODUCTS

C. Y. BALDWIN, C. HIENERTH AND E. VON HIPPEL

SEPTEMBER 5, 2005

have actually been commercialized by manufacturers (Urban and von Hippel 1988, Morrison et

al. 2002, Franke, von Hippel and Schreier 2005, Olson and Bakke 2001).

Entrepreneurship by users

While it is clear that many users innovate and that user-innovation communities are

common, the evidence on the role of user-innovators in the commercialization of their innovations is

mixed. On the one hand, von Hippel (1988) found that individual scientists who had developed

important scientific instrument innovations seldom founded firms to exploit these. He also found that

user firms that had developed new process equipment seldom went into the commercial production

of this equipment. In contrast, Shah (2000) found that, in the field of sporting equipment, lead users

who developed significant equipment innovations often did become user-manufacturers, producing

small volumes of their innovative equipment for purchasers. Some of these small-scale “lifestyle”

firms faded away as larger firms entered the market. Others, however, grew into major

manufacturers their own right. (For example, Burton Snowboards, founded by an innovating user,

has become a major manufacturer of snowboarding equipment).

Shah and Tripsas (2004) explore when user-innovators are likely to start firms, and

compare the competitive advantages of user-startups with established manufacturers. They point

out that the likelihood that users will start companies is affected by their opportunity costs.

Specifically, the (generally jobless) sports participants who started “lifestyle firms” in Shah’s

study had less to lose by starting a company than did the scientists studied by von Hippel. In

terms of competitive advantage, users have natural information advantages with respect to

knowledge about user needs and desires. They also often have access to free assistance from

members of their communities. For their part, established manufacturers generally have

complementary assets in place such as distribution channels, established brands, and existing

manufacturing capabilities.

The shift to larger-scale manufacturing

To this point, we are not aware of any modeling or quantitative research that has

specifically looked at the migration of products from innovation by users, to initial small-scale

production by firms, and then to large-scale manufacture. However, as was mentioned earlier,

there is an extensive literature on how changes in product design and production technology

affect the organization of industry. This paper brings user innovation into that line of research.

Modern studies of industry evolution were initiated by Utterback and Abernathy (1975).

They put forward the idea that innovation in an “industry segment” begins with product

innovation. Many manufacturers, they said, enter the new segment and compete by offering

different product alternatives. Eventually, a “dominant product design” is selected by

competition in the marketplace. At that point, product innovation declines and process

innovation specific to the dominant design becomes a more worthwhile investment for

manufacturers. Increasing returns to scale in manufacturing then drive a shift towards increasing

industry concentration, and eventually only a few manufacturers with large market shares

survive.

The “dominant design” conjecture has spawned a significant body of empirical research:

see Murmann and Frenken (2005) for an analytic overview of this literature. Despite its

fruitfulness, the dominant design construct has been criticized for its ambiguity and its

dependence on post hoc appraisals (one cannot know a design is “dominant” until it succeeds). In

addition, Klepper (1996) has pointed out that the emergence of a dominant design is not required

for a shift from product to process innovation to occur in an industry over time. As unit

production volumes for specific models increase, investments in process innovation will become

steadily more attractive whether or not a dominant design for a product type has emerged.

More recently, using evidence from the computer industry, Baldwin and Clark (2000)

have argued that changes in the modular structure of both product and process designs can cause

4

MIGRATION OF PRODUCTS

C. Y. BALDWIN, C. HIENERTH AND E. VON HIPPEL

SEPTEMBER 5, 2005

changes in industry structure via two mechanisms. First, modularizations, or “splittings” of

design structure create new “technologically separable interfaces” where transactions between

firms can be located economically.1 Thus modularizations create conditions favorable to vertical

disintegration and the formation of so-called “modular clusters.” Second, modularizations split

up “design spaces” in ways that increase their underlying “technical potential” and option value.

Higher option value justifies more design searches, which in turn create conditions favorable to

entry by new firms.

In complementary work based on the mortgage banking industry, Jacobides and Winter

(2005) have argued that, once technologically separable interfaces exist in a supply chain,

heterogeneous capabilities across firms in each layer will create “gains from trade.” Over time,

exploiting the gains from trade leads to vertical disintegration of the supply chain. However, as

this process unfolds, the knowledge relevant to production may become too compartmentalized.

This in turn creates incentives for firms to reintegrate their operations.

It should be noted that these theories are not mutually contradictory. The main difference

between Abernathy and Utterback’s and Klepper’s theories on the one hand, and the theories of

Baldwin and Clark and Jacobides and Winter on the other, is that the latter focus on the

determinants of vertical as well as horizontal industry structure. In the latter cases, as long as the

overall product and process architecture is stable, in each subindustry of a modular cluster or

stage of a supply chain, the dynamics posited by Abernathy and Utterback and Klepper can take

place. There will initially be a lot of experimentation with new designs, leading to entry by new

firms. Over time, the option value of new designs will decline and search efforts will decrease

commensurately. Then, if there are increasing returns in production, process design, or demand

(ie, network externalities), a few firms will pull ahead of the pack. The others will exit or be

acquired, and the subindustry will become more concentrated.

In this paper, we take a Baldwin and Clark design theory perspective, but leave out the

possibility of architectural change and modularization. Instead we posit that a new “design

space” can be opened up and initially explored by users. (The concept of a design space is

explained in section 5 below.)

Our focus on users as the primary innovators in turn raises two subsidiary sets of

questions related to industrial organization and industry evolution. First, how will the userinnovators organize themselves? Specifically, what social configurations will allow them to

pursue and diffuse innovations efficiently? Second and more classically, how will the industry

evolve over time? Will an industry emerge at all? What types of firms will enter, and when? Is the

concept of “dominant design” useful in these settings? And finally, will there be a switch to

process innovation, and “evolution toward concentration” as Abernathy and Utterback and

Klepper suggest?

The theory of user innovation and product migration developed below seeks to address

these questions. But before proceeding to the theory, we must explain how and why we are using

rodeo kayaking as a test case for our theory. We turn to this task in the next section.

3. Rodeo kayaking—a sport and industry driven by user innovation

The Role of a Test Case

When building a theory about complex and inter-related phenomena like innovation and

industry evolution, the first task is to construct a model of cause and effect that can explain one

set of events in a satisfactory manner. Those events—a case history—serve as the first true test of

The term “technologically separable interface” is due to Williamson (1985). Arora et al. (2001) make a

similar argument.

1

5

MIGRATION OF PRODUCTS

C. Y. BALDWIN, C. HIENERTH AND E. VON HIPPEL

SEPTEMBER 5, 2005

the theory. A theory that cannot explain its test case has been refuted ab initio, and is not worthy

of consideration in a more general context. In contrast, a theory that can explain its test case has

cleared one hurdle, and merits further testing and refinement.

The test case of a theory in turn needs to be selected carefully, with an eye to the

phenomena being investigated. In general, complex phenomena cannot be replicated, but certain

patterns may be repeated as variations on a theme. In the test case it is helpful if the essential

patterns stand out and are not obscured by other, potentially conflicting data. Thus in a “good”

test case, the phenomena of interest should appear in a realistic, but somewhat isolated setting.

Then by representing the test case with fidelity, the theory-under-construction can mirror the

essential structure of the phenomena in valid and robust ways.

In this paper, the phenomena of interest are user innovation and product migration from

user-innovators to commercial manufacturers. Accordingly, it is desirable to have a test case in

which user innovation and product migration have been of first-order importance for a relatively

long span of time. It is also necessary for key events and trends to be well-documented. Finally it

helps if primary sources are accessible and if the data are amenable to new forms of analysis.

Rodeo kayaking—which is both a sport and an industry—satisfies these three criteria. Its

history has been dominated by user innovation for thirty years. During this time period, many

innovations by users have become commercial products. Key events in the sport and trends in

the industry are well-documented. Finally, many of the main actors are alive and available for

follow-on interviews, consultations and fact-checking.

Below we briefly describe the evolution of rodeo kayaking from 1970 to the present. We

first summarize key events and transitions and then provide an overview of the innovations that

have occured in both techniques and equipment.

Innovation in Rodeo Kayaking from 1970 to 2002

Rodeo kayaking involves using specialized kayaks to perform acrobatic “moves” or

“tricks” such as spins and flips in rough whitewater. Interest in the sport has grown significantly

over the years. In the mid-1970’s whitewater kayaking “enthusiasts” (frequent participants) in the

U.S. numbered about 5,000 individuals (Taft 2001). By 2002, about 435,000 enthusiasts in the U.S.

took more than five trips per year (Outdoor Industry Association 2004). A similar, but uncounted

number of enthusiasts live outside of the U.S., primarily in Europe. Approximately 50,000 rodeo

kayaks were purchased in 2002. Industry revenue is currently about $100 million per year

including necessary accessories specifically designed for the sport such as paddles and helmets. 2

Hienerth (2004) describes the evolution of the sport and the industry from inception in

the 1970’s to 2002. We summarize the critical developments in this history below.

Origins

The origins of rodeo kayaking can be traced to an avid kayaker named Walt Blackader,

who was the first to focus in a sustained and serious way on developing methods to “play” in

really big whitewater in a kayak. Blackader began evolving his techniques between 1968 and

1970 on the North Fork of the Payette River, the Jarbridge, the Middlefork of the Salmon, and in

the Grand Canyon. Playing at that time meant entering waves sideways or backwards. Blackader

began developing these novel techniques using standard fiberglass alpine kayaks produced

commercially by local manufacturers.

Later, other “extreme paddlers” joined Blackader and formed a small community.

Colman (1998) contains quotes from Corran Addison, Savage Designs and Riot Kayaks, and Chan

Zwanzig, Wave Sport, about the market size as of that date. Telephone interviews with Eric Jackson of

Jackson Kayak (April 2005) and Robert Sommer of Mega Sports GmbH (October 2004) were used to update

the figures.

2

6

MIGRATION OF PRODUCTS

C. Y. BALDWIN, C. HIENERTH AND E. VON HIPPEL

SEPTEMBER 5, 2005

Community members began to build their own specialized kayaks and related gear and safety

equipment in order to have products more suited to the demands of their emerging sport. These

user-innovators built their rodeo kayak prototypes from fiberglass using hand lay-up techniques

– a method also used by the manufacturers of commercial alpine kayaks at that time. The

method was labor intensive but required very little capital.

The 1970s

The manufacturing of rodeo kayaks began in the early 1970’s when some user-innovators

began to respond to requests from potential purchasers who asked, “can you make me a kayak of

the same design as the one you built for yourself?” These first “user-manufacturers” used the

same hand lay-up techniques to produce boats for sale that they used to build boats for their own

use. Thus they went into business with very low levels of capital investment.

In the mid-1970’s two established manufacturers, Uniroyal and Hollowform, entered the

rodeo kayaking market. Both of these firms were already in the plastics forming business, and

identified plastic-hull rodeo kayaks as a potentially profitable market opportunity. Accordingly,

they introduced boats based on user designs of that time, but made entirely of plastic (Taft 2001,

telephone interview, 2005). Production of these required relatively expensive, design-specific

molds. Some of the original user-manufacturers later switched to plastic boat manufacturing, but

others stayed focused on the production of fiberglass boats for specific market segments (e.g.,

slalom, competition).

The introduction of plastic rodeo kayaks was associated with a great expansion of the

market: plastic kayaks were less expensive and much more durable. Fiberglass kayaks were

fragile and often broke under whitewater use. The new plastic boats proved to be nearly

indestructible. Many customers who had not started whitewater kayaking because they did not

want to spend their leisure time repairing kayaks now bought plastic boats. Also, paddlers could

run steeper and more dangerous rivers than before (Taft 2001). However, plastic boats did not

become a platform for user-innovators, because their hulls could not be easily modified.

The 1980s

User innovations in the early and mid 1980’s focused on the development of “squirt

boat” kayak hull designs. Squirt boats were designed to have only 51% buoyancy – e.g. if one

added more than 1% additional weight, the boats would sink rather than float. Each boat

therefore had to be tailored to the body-weight of the paddler. The advantage of low buoyancy

was that a kayaker could simply lean forward or backwards to push the bow or stern of the boat

under the surface of the water. As a result, kayakers were able to do existing tricks much better

and more quickly, and were also able to do new tricks such as cartwheeling for the first time. As

the kayak designs and kayakers’ experience evolved, user-innovators introduced hulls with

flatter bottoms, and with rather sharp edges that improved the boats’ maneuverability still

further.

Although the additional tricks that could be done with a squirt boat were very appealing

to highly skilled paddlers, the squirt boat’s low buoyancy and tight dimensions made it

dangerous and uncomfortable for most kayakers. Accordingly, the mass market stayed with the

1970’s plastic hulls. Only a few thousand squirt boats were made. They were produced by users

for themselves or by user-manufacturers using low-capital fiberglass hand lay-up techniques.

Modern Rodeo Kayaks

In the late 1980’s, user-innovators discovered how to have the “best of both worlds,” in

the form of reasonable buoyancy plus the high maneuverability of the squirt boat. Their

fundamental innovation was to reduce buoyancy at the ends of the boat while increasing it in the

middle. The net effect was a buoyant boat with a bow and stern that could still be easily pushed

7

MIGRATION OF PRODUCTS

C. Y. BALDWIN, C. HIENERTH AND E. VON HIPPEL

SEPTEMBER 5, 2005

under the water during execution of a trick. In addition, user-innovators discovered that by

building a very flat hull, a planing hull, they could easily spin the boat on waves and maneuver in

“holes” in whitewater.

User-innovator communities quickly focused on this new type of boat. Hull designs and

new tricks and techniques developed very rapidly, each responding to the other. Flashier tricks

on steeper and more dangerous runs brought media attention to the sport and a growing number

of people tried out rodeo kayaking.

The new, high-buoyancy, planing hull designs evoked enough demand to justify new

rounds of investment in the molds for plastic boats. Indeed, a number of new manufacturers

entered the industry in the late 1980s and the 1990s in order to satisfy this demand. And while

large-scale manufacturers had traditionally changed their designs only every four to five years, in

the late 1990s, companies started to change designs on a one or two-year cycle.

Around 2000 a fairly standard rodeo kayak design emerged, and the rate of new model

introduction by manufacturers decreased. However, the new standard design greatly increased

the market for rodeo kayaks among both competitive and amateur paddlers.

Rodeo Kayak Innovations by Type and Source

Table 1 lists the sources of innovation in kayaking techniques. The first column indicates

major tricks. These are tricks never before done with kayaks in the water. Related innovations in

technique are shown in column 2. Column 3 shows the approximate date of introduction of each

trick; column 4 indicates the source (all tricks were invented by users, coded as “U”). Over time, a

point system was developed by the International Freestyle Committee (IFC) to measure

performance in rodeo competitions: points allocated to each trick are shown in the last column.

The point system measures vertical and horizontal rotations and also includes multiplication

points for technical variation. The possible points scored at rodeo competitions are a proxy for

the improvement of rodeo techniques over the years.

Table 2 lists innovations in kayaking equipment. Major improvements, which changed

the way in which people used and paddled kayaks are shown in the first column. The source of

these innovations is indicated in the second column: “U” indicates a user innovation; “M”

indicates a manufacturer’s innovation; and “UM” indicates an innovation by a “usermanufacturer,” as defined below. Minor improvements, which were used to facilitate new

functionality after major improvements or to make paddling more efficient and comfortable are

shown in column 3. Approximate dates of the innovations are shown in column 4. The sources of

the minor innovations are shown in column 5. Finally the points allocated to the techniques

enabled by these hardware innovations are shown in column 6. (Note that the “Timeline” and

“Points” columns are the same in Tables 1 and 2, because the technique and equipment

innovations evolved in tandem.)

Table 3 summarizes the innovations by source. Notably users developed 100% of all new

techniques, as well as 62% of the major and 83% of the minor equipment innovations that

improved kayak performance.

8

MIGRATION OF PRODUCTS

© C. Y. BALDWIN, C. HIENERTH AND E. VON HIPPEL

SEPTEMBER 5, 2005

Table 1: Sources of innovation in rodeo kayaking techniques

Major Tricks

Related important innovations in technique

Big water riding

- Entering waves sideways or backwards

Timeline Source

Points

1970

U

0

1975

U

0

1980

U

1

1985

U

5

- Ferrying across the river (moving sideways in the river parallel to the current,

upriver)

- Rolling the kayak without a paddle (hand roll)

- Rolling the kayak with a screw like rotation of the paddle starting at the bow

(screw roll)

Hole riding, dropping

into a hole (entry and

washout of holes and

waves)

- Entering holes on purpose (entering holes in the middle)

- Balancing the kayak in a hole by bracing the paddle on the side (bracing in holes)

- Moving sideways in holes

- Running waterfalls

Ends, Pirouettes

- Using downriver currents to pull one end of the kayak down

- Balancing the kayak with one end in the water, standing vertical

- Standing on the foot brace, to be able to lean the body backwards in a vertical

position of the kayak

- Turning the kayak around in a vertical position with one end in the water, using

the paddle to initiate the rotation

Linking ends,

- Using sub-currents and features below the surface to pull bow and stern down

First

Cartwheels(rotating the

kayak vertically, on the

side edges)

- Catching the downriver current with the edge to spin around (Squirt)

- Balancing in the hole (upriver or downriver, like surfing the hole)

- Balancing on the wave, trying to keep the kayak in a fixed position

9

MIGRATION OF PRODUCTS

© C. Y. BALDWIN, C. HIENERTH AND E. VON HIPPEL

SEPTEMBER 5, 2005

Table 1 (cont): Sources of innovation in rodeo kayaking techniques (cont.)

Major Tricks

Surfing and spinning

on waves

Related important innovations in technique

Timeline Source Points

- Controlled surf and spin on the wave

1990-1995

U

10-50

1995-2000

U

100-300

2000-

U

500

- Using the eddy line to transfer to the green water of the wave

(finding the right angle to transfer)

- Surfing upriver in multiple positions (frontside, backside, sideways)

- Using the paddle as steering blade

- Using the gradient of the wave to increase speed and release the hull

of the boat and spin

- Using the paddle to initiate a spin of the kayak

- Using body weight and edges to initiate a spin of the kayak

- Bracing with the paddle sideways, very low (low bracing)

Multiple Cartwheels,

fast cartwheeling,

Splitwheels, Clean

Cartwheels

- Using downriver and upriver currents to increase the speed of the trick

- Balancing on the edge to link cartwheels

- Double pump (technique used to initiate the first end of a cartwheel)

- Transferring the body weight from one side to another to change the direction of

the cartwheel (Splitwheel)

- Balancing on the edge without using the paddle as a brace and rotate (Clean

Cartwheel)

Loops, aerial moves

- Doing sharp turns on the wave to release the boat from the surface (Blunt)

- Bouncing on the wave to release the boat from the surface (Blunt)

- Using the upper body to surf on the wave upside down (Helix)

- Pushing the end of the boat (either bow or stern) aggressively in the downriver

current of the hole to get pushed out and rotate (Loop)

10

MIGRATION OF PRODUCTS

© C. Y. BALDWIN, C. HIENERTH AND E. VON HIPPEL

SEPTEMBER 5, 2005

Table 2: Sources of innovation in rodeo kayaking hardware

Major improvements

Source

- Early adaptations

- Use of plastic

M

for kayak hulls

-Reduced length of

U

Related minor improvements

Timeline

- Improved floatation for kayaks

1960-1970

Source

U

- Aluminum/Fiberglass paddle

U

- Spooned paddle blade

U

- Neoprene spray cover

U

- Rescue handle (T-grip)

U

- Grand Canyon type life-vest

U

(33pounds of floatation, instead of 10-15 pounds)

- Adjustable foot brace

1975

U

- Asymmetrical paddle blade

U

- Rescue rope throw bag

U

- Large Cockpits (keyhole)

1980

U

the kayak

- Spray-skirts for large cockpits

U

(Rotational-molding)

- Paddle jacket

U

- Latex wrist gasket for dry paddle jackets

U

- Safety life vest (with rescue rope)

U

- Kayak helmet

U

- Reduced volume of

U

the kayak

- Flattened kayak ends

1985

U

- Locking hull for kayak stabilization

U

- Wing design in the hull-deck shape for kayak stabilization

U

- Foot bumps to increase bow space

U

- Helmet ‘fireman style’

U

- Flat planing hull

U

- “Divot” indentations in hull to reduce water friction

- Chine on the side of the

hull above water surface

U

- Foam Fittings to improve fit of paddler to boat

U

- Adapted life vest (rodeo cut: smaller and lighter)

U

- Release chine (on the side

of the hull beneath the

water surface)

U

- Lightweight paddle (Carbon – Kevlar composite)

U

- Thigh braces to improve fit of paddler to boat

U

- Neoprene socks

U

11

1990-1995

UM

Points

0

0

1

5

10-50

MIGRATION OF PRODUCTS

© C. Y. BALDWIN, C. HIENERTH AND E. VON HIPPEL

SEPTEMBER 5, 2005

Table 2 (cont): Sources of innovation in rodeo kayaking hardware

Major improvements

- Design change of the hull

(volume distribution

- centralized air volume)

Source

UM

Related minor improvements

Timeline

- Bent shaft paddle for improved grip

1995-2000

U

- 45 feather degree paddle (and custom feather degree 0 to 90)

U

- Protection gear (for elbows, head and back)

U

Points

100-300

U

- Combination of spray skirt and paddle jacket

UM

- Adaptable backrest for better fit of the seat

UM

U

- Rodeo style blade (increased blade size at the end)

- Helmet ‘baseball style’

-Design change of the

Source

- Bottom Fins

U

2000-

U

hull (reduced length,

- Sidewall Fins

slightly increased bow

UM

and stern volume,

- Spin groove (a number of specially structured grooves to reduce the friction of the

bottom hull)

U

increased bending)

- Release louvers (to release water from the top side of the kayak)

UM

- Seat fittings

U

- Air hip pads for better fit of the seat

M

- Scoops in bow and stern to increase the working surface of the kayak for certain moves

U

- Air volume tank to adapt the kayak for different play spots

UM

- Adaptable bow and Stern to adapt the kayak for different play spots

UM

- Formable footbrace for more comfort

U

- Double tunnel neoprene spray skirt to reduce the intrusion of water

UM

- Kevlar reinforced spray skirt for more durability

U

- Overthruster, a plastic reinforcement for the spray skirt which is mounted inside the

hull to increase air volume of the kayak

U

12

500

MIGRATION OF PRODUCTS

© C. Y. BALDWIN, C. HIENERTH AND E. VON HIPPEL

SEPTEMBER 5, 2005

Table 3: Summary of Sources of Rodeo Kayaking Innovations

Innovation Type

Technique Innovations

Major

Minor

Hardware Innovations

Major

Minor

Source of Innovations

User-innovator User-manufacturer

Manufacturer

Manufacturer Number

100%

100%

-

-

6

33

63%

83%

13%

2%

25%

15%

8

46

4. Set-up for the model

Our goal in modeling is to explore and characterize the process by which innovations

initiated by user-innovators become commercial products. The primary actors in our model are

therefore user-innovators, user-purchasers, user-manufacturers and established manufacturers

(from other industries).

We assume that all innovations come from users. User-innovators seek to change designs

(innovate) for their own personal benefit.3 They specify requirements, build prototypes, and test

their designs by using them. Designing and testing by use are the essential characteristics of userinnovators in our model. They can hire others to build their prototypes and buy components

from third parties and still qualify as user-innovators under our definition. 4

User-purchasers are satisfied to use an existing design, although they may wish to use an

innovative or advanced model. They do not want to innovate or produce the good themselves,

but they will pay money to acquire it. As we will see, user-purchasers trade off design quality

and costs to purchase and use the good in different ways, hence they differ in their willingnessto-pay for a given design.

User-manufacturers are user-innovators who also make copies of their designs and sell

them as products to others. In our field observations and those of Shah (2003), usermanufacturers are often the first to enter a new marketplace with an new product. In our model,

we assume that user-manufacturers have separable motives: that is, they innovate for personal

satisfaction, but they produce and sell goods for money. 5 Because they are startups, usermanufacturers generally have limited access to capital. 6

In some cases, “users” may be corporations, and the benefits of a user-generated innovation may accrue to

a corporation (von Hippel 2005). The model still applies, although the benefits then take the form of

increased corporate profits.

3

In other words, under our definition, user-innovators can subcontract production and parts supply. They

cannot subcontract design of the whole or testing by use.

4

By this assumption, we exclude two types of behavior: (1) a manufacturer who produces for personal

satisfaction (love of the work); and (2) a user-innovator who designs for money.

5

Even venture-backed startups generally have limited access to capital. Note that our list of actors does not

include “pure” entrepreneurs, that is, non-users who innovate and start new firms. This is consistent with

our focus on users as the driving force of innovation in some industries. In other industries, for example,

drug discovery, non-users may be the source of most innovations, but this is not our concern here.

6

13

MIGRATION OF PRODUCTS

© C. Y. BALDWIN, C. HIENERTH AND E. VON HIPPEL

SEPTEMBER 5, 2005

Established manufacturers are already in business in some other arena. As a result, they

may have complementary assets such as manufacturing capacity, distribution channels and

brands. They can acquire designs from user-innovators by purchasing them, licensing them or

simply copying them. Critically, we assume that established manufacturers have enough capital

to invest in any production technology, as long as the opportunity is financially attractive.

In the next two sections (5 and 6), we will develop our model along two “tracks.” Section

5 deals with the decisions and actions of user-innovators, while section 6 deals with the decisions

and actions of manufacturers as user-generated innovations arrive.

5. The Search for New Designs by User-Innovators

Characteristics of New Designs

Every innovation involves a new design. Designs in turn have certain essential properties

(Baldwin and Clark 2000, in press). In the first place, designing requires effort, hence new designs

are costly. Second, design outcomes are uncertain in several ways. The behavior of a newly

designed good is not perfectly predictable, and the reactions of users to that behavior are also not

perfectly predictable.

The costliness and uncertainty of new designs can be formalized by modeling the process

of design as a search in an unknown territory. (Simon 1981, Nelson and Winter 1977, Levinthal

1997, Baldwin and Clark 2000, Rivkin 2000, Loch et. al. 2001). A design space is the name given to

the abstract “territory” in which design search takes place. Speaking informally, a design space

includes all possible variants in the design of a class of artifact—like a rodeo kayak. The design of

a particular thing corresponds to a single point in a design space. As a trivial example, a red kayak

and a blue kayak with the same hull design are two points in the kayak design space. Their

designs differ on a single dimension—color. (Bell and Newell 1971, Shaw and Garlan 1996,

Baldwin and Clark 2000, Murmann and Frenken 2005.)

The following sequence of events takes place in a new design space. First, the new space

opens up. Then user-innovators search in this space for new and better designs. As they search,

the design space gets “mapped,” that is, the searchers come to understand the properties of a

large number of design alternatives. Eventually, the design space may be “mined out,” and

search in that space will stop. (Our assumption that the relevant design space is finite and so can

be mined out holds up well in the case of rodeo kayaking, as we will show below. Sometimes,

however, innovators exploring a design space may decide to alter or expand the space as they

explore. We will return to the issue of the limits of design spaces at the end of the paper.)

The Opening of a New Design Space

The “opening” of a new design space is often a datable event—like the time that Walt

Blackader first used a kayak to do tricks in the whitewater of a river. User-innovators may trigger

the opening by doing something in a new way. But researchers can also open up new design

spaces, as Shockley did with the invention of the transistor, and Kilby and Noyce with the

integrated circuit.

User-innovators are motivated to explore a design space because they believe that new

designs in the space can enhance the things they do. Thus no one has to pay users to search in the

design space. This is a critical property of user innovation in general: up to a certain point

(described below), design searches by user-innovators are motivated by the users’ own desires

for a better product. But, as we said, design searches are uncertain, hence there is no guarantee

that any given design search will be successful.

However, every new design is an option. Technically an option is “the right but not the

obligation” to take a particular action (Merton 1998). When a new design is created, users can

14

MIGRATION OF PRODUCTS

© C. Y. BALDWIN, C. HIENERTH AND E. VON HIPPEL

SEPTEMBER 5, 2005

accept it or reject it. They have “the right but not the obligation” to solve some problem in a new

way. Uncertainty combined with optionality justifies investment in multiple design searches, that

is, the prototyping and testing of many new designs. Uncertainty also results in a dispersion of

outcomes, but optionality implies that only the best of those results will survive (Baldwin and

Clark 2000).

Designs have one other important characteristic: the property of non-rivalry. The use of a

design by one person does not preclude another from using it too. Thus designs cannot be

“consumed” in the sense of being “used up.” 7

We are now ready to confront our designated actors—the user-innovators—with the

opportunity to search for new designs in an unexplored design space. We first consider the case

of isolated user-innovators and then the behavior of user-innovators in a community. We show

that user-innovators in a community are generally better off than their isolated counterparts

because they can avoid redundant over-searching and because a community makes the best

solutions—those discovered by the most highly motivated user-innovators—available to all.

Then we consider how the interarrival time of new designs changes as the design space is “mined

out.”

Search by Isolated User-Innovators

For simplicity, we assume that the designs in a particular space can be ranked, and that

all users will agree on the ranking. In that case, at any time, there will be one best design, and

everyone will agree on what it is. Let the quality of the best pre-existing design by user-innovator

i be ai . We can assume that all the ai s are zero when the new design space opens. Then, as the

innovators search, their designs will improve, and each innovator’s ai will get higher and higher.

By the optionality of designs, any innovator can always fall back on a previous design, thus ai

never decreases.

Innovators also have expectations about the qualityof the new designs they may find if

they make the effort to search. Design outcomes, we have said, are uncertain, hencethese beliefs

are probabilisitic. We model them as a random variable, X , whose support is a measure of design

quality or value. For simplicity, we assume that all innovators perceive X in the same way, and

that each new design search generates an independent draw from the distribution of X . (Our

qualitative results do not change if design searchoutcomes are correlated, although the notation

becomes more complicated.)

Each user-innovator also has a cost of search, di . This is his perception

of the time, effort

and money it will take to develop one new prototype for his own use. The innovator can compare

this number to the quality of prototypes already in existence and to his expectation of the quality

of future designs.

Suppose each user-innovator is completely isolated from all others. Each would then

have access to her own best previous design but no one else’s. We assume that the innovator

looks at her old design ( ai ); thinks about potential new designs ( X ); and the cost of her time and

effort ( di ). Investing time and effort in a new design is worthwhile if:

Pr( X

ai )[E(X | X ai ) ai ]

Reward conditional

on success of search

di

0

;

(1)

Cost of

Search

Property rights, e.g. patents or copyrights, can prevent others from using the design. However, property

rights are a feature of the institutional environment, not an intrinsic characteristic of designs. Property rights

can turn designs into rival goods. The effects of rivalry on user-innovators’ search behavior and

organization are discussed below.

7

15

MIGRATION OF PRODUCTS

© C. Y. BALDWIN, C. HIENERTH AND E. VON HIPPEL

SEPTEMBER 5, 2005

where:

Pr( X ai )

is the probability that the new (uncertain) design will be better

than the old one;

E(X | X ai ) ai

is the expected value of the new design, given that it is better,

minus the value of the old design.

The left-hand side of expression (1) is well-known in option theory: it is the expected

payoff (net of cost) to a call option. The “strike price” of this option is ai , the value of the best

pre-existing design. The cost of purchasing the option is di . It is well-known and intuitively

obvious that as ai increases, the value of the option declines. Thus for any innovator, as the value

of her best pre-existing design rises, the “net option value” ofsearch will decline. At some point,

the user-innovator will perceive the incrementalexpected benefit of further search to be less than

her opportunity

cost, and will stop trying to generate new designs.

Implicitly then there is a “threshold value,” ai *, that makes expression (1) equal to zero:

Pr( X ai *)[E(X | X ai *) ai *] di

0 .

(2)

Each user-innovator will continue to search until he finds a design that is better than his

threshold. In general, the threshold value ai * will differ from person to person, depending on

each person’s perceptions of the design space and his or her cost of search. Note also that the

innovators’ calculations do not have to be formal: they need only have a sense of the value of

their own time, the utility of their

own best pre-existing design, and the degree of difficulty of

design improvement.

Search in a Community of User-Innovators

The second event in the “user innovation track” of our model is the transition from

isolated user-innovators to a community of user-innovators who freely exchange information on

their designs in “real-time.” By “real-time,” we mean that designers learn of other designs in time

to influence their decisions to search or not on the next round.

Real-time communication coupled with free-revealing of new designs has been observed

in communities of sports enthusiasts (Franke and Shah 2003, Hienerth, 2004); in open source

development communities (Raymond 1999, Henkel, 2005), among firms using similar production

equipment and processes (Allen 1983, Nuvolari, 2004), and many other settings (Shah, in press).

In rodeo kayaking communities, for example, communication and free-revealing are achieved via

frequent joint excursions by members, during which the performance of any innovations can be

observed, and the innovations themselves are examined in detail by all who are interested.

More formally, let the previously isolated user-innovators form a community in which

they freely reveal their designs. Let a denote the value of the best of all pre-existing designs at a

given time: a max {ai }. We assume that any member of the community can use this design if he

i

or she wishes to do so. For the moment, assume that all members have the same search costs.

Each member’s expected benefit

from searching is then:

Pr( X a)[E(X | X a) a] d

(3)

This expression is identical in form to expression (1) above—it is the expected payoff to a call

option. The option price is the same, but the strike price is now a, the value of the community’s

16

MIGRATION OF PRODUCTS

© C. Y. BALDWIN, C. HIENERTH AND E. VON HIPPEL

SEPTEMBER 5, 2005

best pre-existing design, which is the maximum of all the individuals’ best designs.

The first result of the model is that search redundancy is reduced within communities.

Working separately, all user-innovators will get to designs with value above their personal ai *,

but they will do so redundantly. For example, suppose by luck one of the designers achieved a

design above everyone’s threshold on the first trial. If all the others knew about that new design

and could use it, they would stop searching. But, if they are isolated, they will keepon searching,

each on his or her own narrow trajectory.

Let us assume that there are K user-innovators in total and that all have the same

threshold value, a *. Let S * denote the average number of searches needed to surpass the

threshold. Then, in expectation, isolated user-innovators will conduct KS * searches, while userinnovators in the community

will conduct only S * searches.

The second

result of the model is that all community members will benefit from the

findings of those who search longest. To see this, suppose thecommunity is made up of

heterogeneous individuals. Some may have

higher or lower search costs; some may have

different perceptions of the probability of achieving a better design. As a result, the individual

user-innovators’ thresholds, ai *, will vary. Let a denote the maximum of all the individual

thresholds:

a max{ai *} .

i

(4)

Search in the community will continue until this threshold is surpassed.

To summarize, a community consisting of K user-innovators confers two benefits on its

members. First, any given threshold of performance can be attained at a search cost that is on

average 1/ K of the average search cost of individuals in isolation. Second, community search

will continue until the best design exceedsthe maximum threshold of all members. Thus, when

the search process ends, all members but one will have access to a design that is better than the

one they would have settled for had they been searching alone.

These results do not speak to the distribution of benefits and costs among members of the

community. One possible distribution is for one individual to do all the innovating, and for all

other members to free-ride. In this case, the lone innovator is no better off in the community than

if he were searching in isolation. But given any other distribution of search effort, all members of the

community are better off in it than outside of it (Baldwin and Clark forthcoming). A similar principle

applies to mergers of communities: as long as the distribution of effort is not one-sided, then

members of two smaller communities will always benefit by joining forces to form a larger

community.

The “pro-community” results of our model arise because of the non-rival property of

designs. If rivalry between user-innovators increases, the benefits of free-revealing and of

forming communities will go down. Rivalry can increase through several mechanisms. First, if

user-innovators become user-manufacturers and compete for the same customers, they will

perforce become rivals, and their incentives to share design information in a community will go

down. Thus if user-innovators become affiliated with manufacturing firms (as founders or

employees) and inter-firm competition is relatively fierce, a community of user-innovators who

freely share design information may not form or, if one exists, it may collapse. 8 Indeed free

revealing in the rodeo kayaking community has diminished markedly since user designs have

been commercialized. In effect, the larger innovative community has split up into a number of

sub-communities organized around commercial projects. There is essentially no information

Baldwin and Clark (in press); Henkel (2004) models the allocation of effort and “free-revealing” among

firms that design complementary goods but compete in their product markets. He derives the combination

of properties such that a community of user-innovators who are also rivals is an equilibrium outcome.

8

17

MIGRATION OF PRODUCTS

© C. Y. BALDWIN, C. HIENERTH AND E. VON HIPPEL

SEPTEMBER 5, 2005

sharing between subcommunities because of the commercially sensitive nature of the new

designs (Hienerth, 2004).

As another illustration of how commercial rivalry can diminish free revealing in a

community of user-innovators, consider the history of the Home Brew Computer Club. This club

was initially formed by hobbyists in the San Francisco Bay area who were interested in

developing and improving personal computers for their own use. It flourished for a number of

years as members developed and freely shared important advances in that field. Later, when

some club members formed companies (for example, Steven Jobs and Stephen Wozniak formed

Apple Computer), information flow among the membership decreased, and eventually the club

disbanded (Freiberger and Swaine 1999).

Organized competition in the form of games and tournaments can also increase rivalry

among user innovators. Indeed, Franke and Shah (2003) found that user-innovators who

participate in competitions are less likely to reveal their innovations than those who do not.

The Interarrival Time of Successful New Designs

One of the ways that user-innovation affects manufacturers’ profitability and investment

decisions is through the interarrival time of successful new designs. We define a successful new

design as one that is better than the best previous design. Thus if a is the community’s best

design so far, a successful new design is one whose realization a is greater than a.

Obviously, for a fixed random variable, X , the probability that the next design is better

than the best pre-existing design, a, is a weakly declining

function of a. Intuitively, as long as

the opportunity set does not change, the better the best

pre-existing

design,

the lower will be the

probability of surpassing it. This means

that, if the community of user-innovators conducts the

same number of searchesper period, the expected time between

successful new designs will tend

to increase over time. Indeed, the so-called “expected interarrival time” will go up each time a

successful new design is found.

Although the result is intuitive, we can formalize it as follows. Let k denote the number

of searches per period carried out by a community of users. Let T(a, k) denote the expected time

elapsed until a design better than a is discovered. Then we have:

Proposition 1. T(a, k) is increasing in a and decreasing in k .

Proof. See the Appendix.

We have already shown that a is (weakly) increasing in calendary time. It is likely,

although it cannot be guaranteed, that k will decrease over time as design searches become less

profitable.9 In this case, a corollary of Proposition 1 is that, as calendar time passes, the expected

interarrival time between successful

new designs will be increasing (as a step function). This fact

has important consequences for

the

evolution

of manufacturing, as we shall see below.

The “Mining Out” of a Design Space

When a design space approaches exhaustion there will be fewer and fewer performanceimproving innovations left to find. As a consequence, our model predicts that the rate of increase

in performance will drop off over time even given a constant level of search effort. In the case of

rodeo kayaking, the effects of design search and of “mining out” a design space can be seen by

plotting maximum scores attained by participants in rodeo kayak championships against time, as

k may respond to factors other than a, for example, the cost of design search, d , or the rules and rewards

of organized competition. Changes in these other factors may cause k to increase in the short run, although,

over longer horizons, k should decrease as the design space is mined out.

9

18

MIGRATION OF PRODUCTS

© C. Y. BALDWIN, C. HIENERTH AND E. VON HIPPEL

SEPTEMBER 5, 2005

shown in Figure 1. (Scoring methods for rodeo kayaking championships are established by the

International Freestyle Committee. They remained basically the same from 1985 to 2005, although

scores for new tricks were added as new techniques were invented. Thus the changes in

maximum scores reflect year-over-year improvements in the best techniques and equipment.)

Figure 1: Maximum performance scores by individual participants in rodeo

kayaking championships, 1985-2005

700

600

600

500

500

500

500

400

400

300

200

160

100

100

1

8

25

1985

1991

1993

50

0

1995

1997

1999

2001

2002

2003

2004

2005

From 1985 to 2002, as the figure shows, there were steady improvements in the

maximum scores. Until 1997, rodeo kayaking competition primarily involved tricks and moves

performed in whitewater “holes.” However in 1997, the solution space for performance in holes

was judged by most experts to be exhausted. 10 In order to make competition more challenging,

beginning in 1999, the Rodeo Kayaking World Championships were shifted to sites that offered

participants the chance to perform on standing waves as well as in holes. 11 This change of venue

opened up new scoring possibilities and, as the chart shows, maximum scores increased

dramatically in 1999, 2001 and 2002.

By 2002, however, standing wave possibilities were also exhausted: since then, maximum

scores have bounced around an average of about 500 points. In addition, competitors have begun

to “game” the scoring system, by, for example, performing many repetitions of certain moves. 12

In 2006, a new scoring system will be introduced, which does not reward repetitions.

A second prediction of our model is that, other things equal, total search effort by userinnovators will tend to decline over time. Intuitively, as each user-innovator crosses his

Interviews with professional athletes: Eric Jackson (May 2003), Stefan Steffel (May 2003), Arnd Schäftlein

(May 2003), Daniel Herzig (May 2003), Seppi Strohmeier (May 2003), Nico Langer (May 2003), Kennedy

Linyado (May 2003), Celliers Kruger (May 2003), Schorschi Schauf (May 2003)

10

Interviews with professional athletes: Eric Jackson (May 2003, October 2004), Stefan Steffel (May 2003),

Arnd Schäftlein (May 2003), Daniel Herzig (May 2003), Seppi Strohmeier (May 2003), Nico Langer (May

2003), Corran Addison (May 2003), Ken Mutton (May 2003), Lars Larsson (May 2003), Eric Martinsen (May

2003)

11

Interviews with professional athletes: Eric Jackson (April 2005), Ingrid Schlott (April 2005); and Inteview

with Robert Sommer (October 2004)

12

19

MIGRATION OF PRODUCTS

© C. Y. BALDWIN, C. HIENERTH AND E. VON HIPPEL

SEPTEMBER 5, 2005

performance threshold, ai *, the expected improvement in the design will no longer exceed that

person’s perceived value of time, effort and expense, and he or she will stop attempting to

innovate.

Although

data are sparse, some evidence of this pattern can be seen in rodeo kayaking.

In the early 1970s, around half of the approximately 6,000 units per year produced were

homemade (Taft, 2001, p. 165). For our purposes, each of these can be considered a separate

design. The high number of user-innovators at this time reflects the fact that users were

organized in small, local clubs. There were no national, much less international, communities. In

the late 1970s, with the introduction of molded plastic kayaks, the number of people actively

designing declined greatly even as the total number of users went up. Plastic kayaks did not have

to be repaired, thus were easier to maintain and to use. But they were very difficult to modify,

and thus a plastic kayak user faced an extraordinarily high design cost, di .

According to Jimi Snyder, a legendary squirt boat kayaker, from 1980 to 1985, people

started designing and building fiberglass squirt boats – first only a few, then increasing to a few

hundreds a year up to maybe 1,000 at around 1985.13 These boats

had to be customized to each

user, hence there was necessarily a lot of experimentation with design modifications.

However, with the introduction of center-buoyant, planing hull designs in the 1990s, the

number of people designing their own kayaks decreased again. According to Eric Jackson, a twotime world champion and founder of Jackson Kayaks, starting in the 1990s, the number of people

working on their own boats came down. By 2000, he estimated, there were only a few hundred

people actively working on new hull designs. 14 This is less than .1% of all users (estimated at 3.9

million in 200215). These active user-innovators typically work on designs at clubs, some for fun

and some in search of increased performance for high-level competition. About 400 people

compete at the world level every year. The theory of tournaments applied to design search

predicts that competitors may continue to search long after other users have stopped (Aoki 2001).

In sum, our theory views user-innovators as economic actors who perceive their time and

effort to be valuable and respond rationally to changing incentives. As the options in a given

design space are mined out, such user-innovators will be less inclined to search in that space.

Although we lack hard quantitative evidence, there is certainly a perception in the rodeo kayak

industry that user innovation (particularly in hull design) has declined over time, and that the

possibilities inherent in the design space have diminished. 16

6. Manufacturers’ Entry and Investment

The previous section showed that user innovation has its own organizational logic and

dynamic pattern. Users innovate to obtain the direct use value of a new design. Against the

expected value of a new design they offset the cost of their own time, effort and out-of-pocket

expenses. They benefit by freely revealing their designs in a community of like-minded people.

And over time, they will “mine out” a given design space: the interarrival time between

successful new designs will increase, and eventually search by users in the space will stop.

13

Interview with Jimi Snyder (April 2005).

14

Interview with Eric Jackson (April 2005).

15

Outdoor Industry Association, p. 213. The number refers to the total number of participants in the sport.

Design spaces to not have to remain fixed through time: they can be redefined in various ways or opened

up further by new knowledge. If the underlying design spaces are changing, search effort might not

decrease, and the interarrival time of successful new designs might not increase over time. We will revisit

the possibility of changing design spaces at the end of this paper.

16

20

MIGRATION OF PRODUCTS

© C. Y. BALDWIN, C. HIENERTH AND E. VON HIPPEL

SEPTEMBER 5, 2005

Where does manufacturing fit into this picture? In this section, we explore the behavior

of manufacturers with respect to a stream of user innovations in a particular design space. The

exposition proceeds as follows. First we characterize designs and manufacturing technologies

along five dimensions. We then construct a model of user-purchaser demand and profit

maximization by manufacturers. We derive a monopolist’s optimal price and scale as a function

of the five parameters and show how the resulting profit affects a firm’s decision to enter the

market. We go on to show how a market may be split between two products that differ on two

(or more) of the five dimensions.

Designs and Manufacturing Technologies

Designs and the technologies employed to maufacture them differ on thousands of

dimensions, but we will focus on just five, which we believe capture the first-order effects of

user-generated innovation on industry structure. The five dimensions are: (1) innovation cost, d ;

(2) design quality, a and $a ; (3) user cost, u ; (4) variable cost, c ; and (5) capital cost, C . The first

three properties are important to users and user-innovators; the last two are important to

manufacturers.

To build intuition, we will

discuss these properties

in relation to rodeo

kayaking.

However, we stress that the properties themselves are general. Any set of designs and

technologies can be categorized according to these five dimensions.

In the previous section, we said that innovation costs, d , are incurred when a userinnovator attempts to change a pre-existing design. Technologies differ in terms of the ease with

which a new design prototype can be constructed or an existing design modified. In the world of

rodeo kayaks, fiberglass hand lay-up techniques area low-innovation-cost (low- d ) technology,

and plastic injection molding is a high-innovation-cost (high d ) technology.

We have also already defined design quality, a , as it is perceived by user-innovators. This

parameter represents the functionality of the design to the most capable and

proficient users. Designs

a

that expert users deem to be “outstanding” have high

;

those

that

experts

consider to be inferior

have low a . (The next parameter, u , addresses

the

difference

between

expert

and non-expert

users.) In what follows, we assume that user-purchasers and user-innovators perceive design

quality in the same way: they agree on a . Butuser-purchasers must translate that perceived

quality

into a dollar figure,

denoted $a . This is the parameter that enters into the profit function

of manufacturers (see below). For simplicity, we assume that it is the same for all userpurchasers.

The design space ofrodeo kayaking teaches us that there are user costs, denoted u . In

general, designs and technologies that result in delicate, hard-to-handle, high-maintenance,

dangerous objects are high-u, while those that deliver robust, easy-to-handle, low-maintenance,

safe objects are low- u . In rodeo kayaking, fiberglass squirt boats were a high- udesign and

technology, while mass-produced plastic boats were a low- u design and technology.

Variable costs, c , are the per-unit cost of making an item. In our model, these include all

types of costs

administration,

borne by a producer: materials, labor, marketing, transportation,

management. Labor-intensive, low-capital technologies

have

high

variable

costs,

while highly

automated, high-capital

technologies have low variable costs. In rodeo kayaking, fiberglass is a

high- c technology, while plastic injection molding is a low- c technology.17

Capital costs, C , are the upfront costs needed to put a particular business model in place.

They include not only plant and equipment but also investments in inventory, trade credit,

branding, marketing, and process R&D. Inverting the

pattern of variable costs, in rodeo

Many costs borne by producers are semi-variable or fixed, that is, they do not vary with the volume of

goods produced. For simplicity, we have omitted such costs from our list. Including them complicates the

analysis but does not affect the conclusions in any significant way.

17

21

MIGRATION OF PRODUCTS

© C. Y. BALDWIN, C. HIENERTH AND E. VON HIPPEL

SEPTEMBER 5, 2005

kayaking, plastic injection molding, which involves large-scale equipment and special-purpose

dies, is a high- C technology. Fiberglass hand lay-up fabrication is a low- C technology.

Table 4 summarizes the dimensions of our model and shows how, in rodeo kayaking,

fiberglass squirt boat and plastic boat technologies differed on these dimensions.

Table 4

The Dimensions of Design and Technology

Dimension

Symbol

Squirt Boat

Standard

Plastic Boat

d

a, $a

u

c

C

Low

High

High

High

Low

High

Low

Low

Low

High

Innovation Cost

Design Quality

User Cost

Variable Cost

Capital Cost

User-Purchasers’ Willingness to Pay

User-purchasers, like user-innovators, value a design for its quality, a . Other things

equal, the higher the quality of the design, the more user-purchasers are willing to pay for it.

Design quality translated into willingness to pay is denoted $a .

Against this “pure” measure of quality or willingness-to-pay,

user-purchasers offset their

personal costs of ownership. Such costs take into account the time, effort and aggravation

involved in purchasing, handling and maintaining the

good. We assume that users differ from

one another in their perception of these costs. Specifically, for a given design, let users be arrayed

in order of their user costs from lowest to highest. We assume that the difference in user cost

between successive users is a constant, denoted u . Manufacturers then face a linear inverse

demand curve:

p(N ) $a uN

.

(5)

In words, the price needed to sell N units of a good with design quality a is $a uN . (The

reason to interpret the slope of the demand curve, u , in terms of user costs is to allow

technologies to differ along this dimension. Such differences have important consequences for

market structure and industry

evolution as we shall see.)

A Monopolist’s Optimal Price and Scale

In what follows, the behavior of a monopolist serves as a benchmark against which to

gauge the behavior of competitors. Thus the first step in our analysis is to derive the profitmaximizing strategy of a monopolist. Assume that a manufacturer makes a design using a

particular technology, described by the vector (d,$a,u , c, C) . How should this firm set prices and

production volumes?

In general, the manufacturer’s profits are given by: