notes on employees tax

advertisement

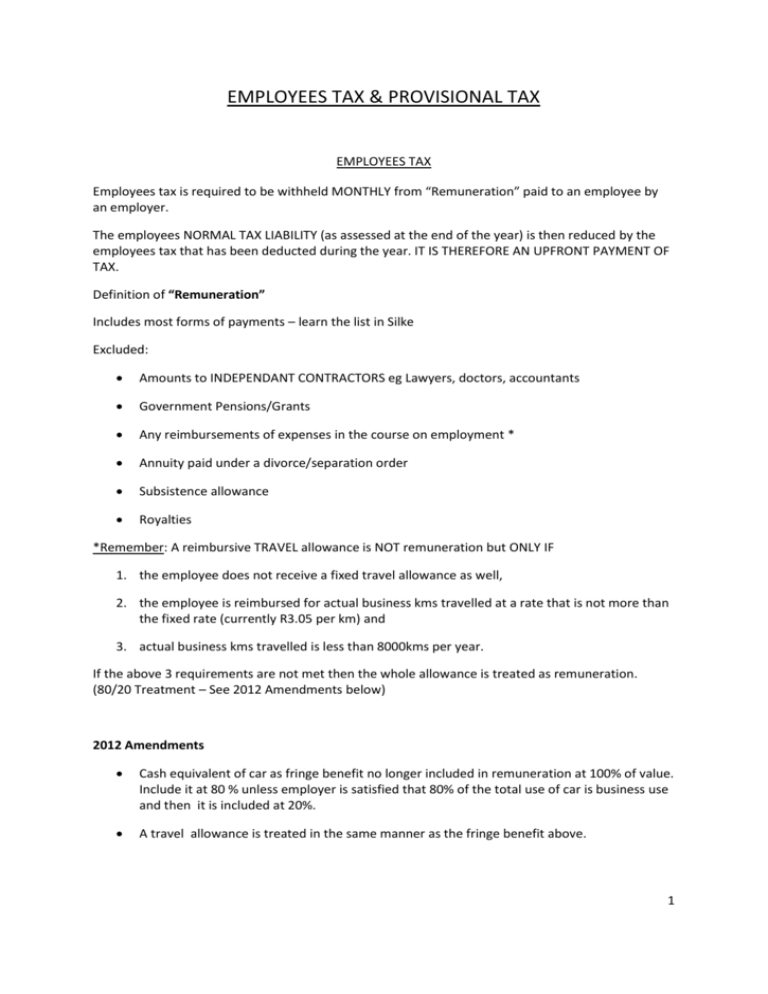

EMPLOYEES TAX & PROVISIONAL TAX EMPLOYEES TAX Employees tax is required to be withheld MONTHLY from “Remuneration” paid to an employee by an employer. The employees NORMAL TAX LIABILITY (as assessed at the end of the year) is then reduced by the employees tax that has been deducted during the year. IT IS THEREFORE AN UPFRONT PAYMENT OF TAX. Definition of “Remuneration” Includes most forms of payments – learn the list in Silke Excluded: Amounts to INDEPENDANT CONTRACTORS eg Lawyers, doctors, accountants Government Pensions/Grants Any reimbursements of expenses in the course on employment * Annuity paid under a divorce/separation order Subsistence allowance Royalties *Remember: A reimbursive TRAVEL allowance is NOT remuneration but ONLY IF 1. the employee does not receive a fixed travel allowance as well, 2. the employee is reimbursed for actual business kms travelled at a rate that is not more than the fixed rate (currently R3.05 per km) and 3. actual business kms travelled is less than 8000kms per year. If the above 3 requirements are not met then the whole allowance is treated as remuneration. (80/20 Treatment – See 2012 Amendments below) 2012 Amendments Cash equivalent of car as fringe benefit no longer included in remuneration at 100% of value. Include it at 80 % unless employer is satisfied that 80% of the total use of car is business use and then it is included at 20%. A travel allowance is treated in the same manner as the fringe benefit above. 1 If an amount is “remuneration” ANY PERSON paying such amount is defined as an employer and employees tax needs to be withheld by that person. Therefore in the case of an annuity, the institution paying the annuity has to withhold employees tax. If the employee received remuneration from more than one employer each employer does a separate calculation for employees tax. CALCULATION Employees tax is calculated on the BALANCE OF REMUNERATION i.e DEDUCT THE FOLLOWING FROM REMUNERATION: 1. Any pension fund contribution by employee limited to allowable deductions s 11(K) 2. Any RAF contributions in arrears limited to s 11(n) deductions 3. Any Employer contributions to pension fund as in (1) 4. Life insurance policy i.r.o. loss of income that is deductible i.t.o. ss11(a) 5. Medical aid contribution if younger than 65 limited i.t.o. s18(2)(c)(i) 6. Full medical aid contribution if older than 65 7. Any donation by employer to employee that does not exceed 5% of the balance of remuneration. Remember: Any rebates as well as the tax table are based on ANNUAL income – ADJUST! If remuneration for a particular month includes an ANNUAL payment like a bonus calculate it separately as it needs no adjustment. Part time/casual or temporary employees – no tax table – a flat 25% Personal Service Providers (companies/cc’s/trusts) – flat 28% (was 33%) unless can prove that 3 or more independent employees and not more than 80% of income form one client then NO EMPLOYEES TAX Independent Contractors (Drs, lawyers, accountants) – no employees tax Read Silke re Labour Brokers. 2 DIRECTORS FEES Part of remuneration but special rules apply only to directors NOT receiving fixed monthly payments of salary. If a director does NOT receive 75% or more of his balance of remuneration in the form of fixed monthly payments, the following applies: Employees tax is calculated on the GREATER of Remuneration actually accrued in the relevant month Deemed remuneration according to the formula below: Y = T/N Y = Deemed remuneration to be determined T= Balance of remuneration less any extraordinary items in the last year eg: lumo sums, S8A/B/C gains N= no of months in last year completed as director If NO last year as director – use actual balance of remuneration If an employee in last year – use the employees remuneration for deemed remuneration calculation. NOTE* If you are forced to use the remuneration of a year that is NOT the previous year of assessment e.g. when the bonus of the previous year was only finalised late in the current year ADD 20% on to your deemed remuneration calculation. 3 PROVISIONAL TAX NB: STUDY FLB SUMMARY Provisional tax is also a prepayment/upfront payment of tax due at the end of the tax year. Any taxpayer that does not receive remuneration EXCLUSIVELY from a salary and therefore has other income (not “remuneration”) accruing such as rental income etc. will be a provisional taxpayer. You can be a provisional taxpayer and also pay employees tax. BOTH AMOUNTS are subtracted off your assessed tax amount at the end of the year of assessment. PROVISIONAL TAXPAYERS MUST MAKE TWO OBLIGATORY PAYMENTS: First – on month 6 of year of assessment Second – on last day of year of assessment A THIRD, VOLUNTARY PAYMENT CAN BE MADE AS A ‘TOP UP’ to avoid any shortfall. This will be made by 7 months after a 28 Feb year end or by 6 months after any other date of year end. WHAT ARE THE ABOVE PAYMENTS BASED ON? During every period (6 months) that provisional tax is paid, an ESTIMATE of the taxable income for the year must be submitted. First payment: Based on the “BASIC AMOUNT” (see below) or an amount not less than this divided by 2 Second payment: Based on any estimate not less than the basic amount Third voluntary payment: Based on the ACTUAL AMOUNT of taxable income calculated by the taxpayer. CALCULATION: DEFINITION OF BASIC AMOUNT: The amount of taxable income as assessed by SARS in the last year of assessment less any extraordinary items (must only include regular items – SEE pg 404 Silke) If any you have to use a previous year of assessment’s amount ADD 8% PER YEAR. FOR THE FIRST PAYMENT The normal tax on the basic amount or estimate not less than basic amount ( LESS APPLICABLE REBATES) DIVIDED BY 2. Remember if it’s a company no rebates are applicable. LESS 1.Total amount of Employees Tax for Period 2. Certain Foreign taxes (s6quat) for period 4 FOR THE SECOND PAYMENT The normal tax on the basic amount or estimate not less than basic amount (LESS APPLICABLE REBATES) LESS 1.Total amount of Employees Tax for year 2. Certain Foreign taxes (s6quat) for year 3. First Provisional Tax Payment FOR THE THIRD VOLUNTARY PAYMENT The normal tax on the ACTUAL amount as calculated by the taxpayer for the year ( LESS APPLICABLE REBATES) LESS 1.Total amount of Employees Tax for year 2. Certain Foreign taxes (s6quat) for year 3. First Provisional Tax Payment 4. Second Provisional Tax Payment Because ACTUAL is used, extraordinary items like taxable capital gains will be included here – where it’s not included in the “BASIC AMOUNT” above. Learn Penalties and Interest in Silke 5