Baruch MFE 这个项目的目标建立的目的是什么,要解决什么理论或实际的问

advertisement

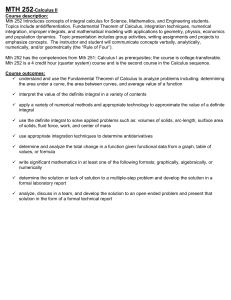

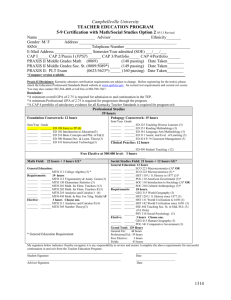

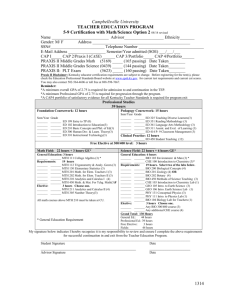

Baruch MFE 这个项目的目标建立的目的是什么,要解决什么理论或实际的问题?它的培养目标是什么? 越具体越好。 We offer a high quality education. Our graduates are very successful in the job market, even in the current market conditions. Fruitful ninja’s comment: 这看起来就是明确是职业培训所啊。。 学生被要求怎样学习,要完成些什么?有哪些课你感兴趣,为什么? Baruch MFE Curriculum The curriculum of the Baruch Financial Engineering program is designed to provide the students with the background required for modeling and solving problems that arise in the financial-service industry. Courses such as Object Oriented Programming for Financial Applications, Market and Credit Risk Management, Deal Theory and Structured Analysis, Commodities and Futures Trading, Time Series Analysis and Algorithmic Trading are taught by practitioners from the financial industry, enhancing the practical knowledge and the financial engineering skills of our students. Other courses, such as Interest Rate Models and Interest Rate Derivatives, Volatility Surface, and Market Microstructure Models, are taught by full-time faculty with many years of work experience in the financial industry. Fruitful ninja’s comment: 业界人士和教授一齐教课,这点还是比较吸引人的 Course Pages (NEW) Detailed information about selected courses in the Baruch MFE Program, beginning with the core required courses, will be posted here. Required Courses There are seven required courses: six Core Courses and a Capstone Project course. MTH 9814 A Quantitative Introduction to Pricing Financial Instruments MTH 9815 Object Oriented Programming for Financial Applications MTH 9821 Numerical Methods for Finance I MTH 9831 Probability and Stochastic Processes for Finance I MTH 9852 Numerical Methods for Finance II MTH 9862 Probability and Stochastic Processes for Finance II MTH 9903 Capstone Project and Presentation Elective Courses Students take elective courses in the mathematics department or in the Zicklin School of Business. MTH 9841 Statistics for Finance MTH 9842 Linear and Quadratic Optimization Techniques MTH 9845 Market and Credit Risk Management MTH 9848 Elements of Structured Finance MTH 9849 Deal Theory and Structured Analysis MTH 9865 Commodities and Futures Trading MTH 9867 Time Series Analysis and Algorithmic Trading MTH 9868 Advanced Risk and Portfolio Management MTH 9871 Advanced Computational Methods in Finance MTH 9873 Interest Rate Models and Interest Rate Derivatives MTH 9875 The Volatility Surface MTH 9879 Market Microstructure Models MTH 9881 Current Topics in Mathematical Finance FIN 9783 Investment Analysis FIN 9786 International Financial Markets FIN 9790 Seminar in Finance FIN 9793 Advanced Investment Analysis FIN 9797 Options Markets STA 9700 Modern Regression Analysis STA 9701 Time Series: Forecasting and Statistical Modeling ECO 82100 Financial Econometrics Suggested Curriculum for full-time students Fall semester, first year of study MTH 9814 A Quantitative Introduction to Pricing Financial Instruments MTH 9815 Object Oriented Programming for Financial Applications MTH 9821 Numerical Methods for Finance I MTH 9831 Probability and Stochastic Processes for Finance I Spring semester, first year of study MTH 9852 Numerical Methods for Finance II MTH 9862 Probability and Stochastic Processes for Finance II Two elective courses MTH elective courses offered in the Spring 2011 semester: MTH 9845 Market and Credit Risk Management MTH 9848 Elements of Structured Finance MTH 9867 Time Series Analysis and Algorithmic Trading MTH 9879 Market Microstructure Models Fall semester, second year of study MTH 9903 Capstone Project and Presentation Three elective courses MTH elective courses offered in the Fall 2010 semester: MTH 9849 Deal Theory and Structured Analysis MTH 9865 Commodities and Futures Trading MTH 9873 Interest Rate Models and Interest Rate Derivatives MTH 9875 The Volatility Surface Fruitful ninja’s comment: 随机过程和编程看来是这边特别重视的课程,其他的从名字上看起 来不会涉及特别深的数学好像。 学生毕业后的去向怎样?哪些职业选择你感兴趣,为什么? Employers Algorithmics Bank of America Merrill Lynch Bank of New York Mellon Barclays Capital Bloomberg Citigroup Deutsche Bank Ernst & Young Goldman Sachs HSBC JPMorgan Kepos Capital KPMG Morgan Stanley National Australia Bank Nomura Securities Numerix NuWave Investment Management Quantitative Brokers R & R Consulting RBC Capital Markets Royal Bank of Scotland Societe Generale Standish Mellon State Street SuperDerivatives UBS Vero Capital Positions Associate Advisor AVP – Risk Analytics & Modeling Commodities Trader Credit Risk Analyst Director of Research Financial Applications Engineer Financial Engineer Financial Engineer Associate Financial Software Developer Global Equities Analyst Interest Rates Trader Investment Banking Analyst Lead Financial Engineer Market Data Specialist Market Risk Analyst Quant Developer Quant Developer Associate Quant Research Associate Quantitative Analyst Quantitative Support Analyst Research Analyst Risk Analyst Senior Consultant Software Developer Fruitful ninja’s comment: 商行,四大,投行的天下。嗯,职位来说,我曾经试图去找出每一 个职位都是做什么的,但是各个公司可能叫法或者做的事情都不一样,让我比较难以决定。 另外我不是很确定 financial engineer 是一个大概念还是一个具体的职位。 这里的学生都是什么样的,有什么特点,请举例说明。 Bill Diomis holds a BS from New York University with majors in both Mathematics and Economics. He is a CFA Level II candidate, and prior to joining the Baruch MFE program, worked as a consultant at Burger Creations, Inc. He has been involved in many community service activities, volunteering in the Help Organization for International Students and Big Brothers Big Sisters. His interests include golf, table tennis, and motorcycling. Studying in the Baruch MFE Program will give me a good exposure to the structured finance world. Also, the commitment of Professor Stefanica in finding job opportunities for the program’s graduates, which I have personally observed during the past couple of months, has made my choice even easier. When I met the current students I realized that the small number of students admitted each year maximizes a strong collaboration among the students in their dedicated quantlab. Also, the faculty that I have met, such as Professor Stefanica and Professor Sherman Wong, are very helpful and open. The addition of Dr. Jim Gatheral to the faculty enhanced the extensive experience of the program it has accumulated during the past 8 years and increased my interest to the program. Fruitful ninja’s comment: 这家伙来之前有实业的经验,而且是数学和经济背景。事实上,大 部分的学生都是来自数学或者工程系。不过看出来,他的兴趣其实挺广的,高尔夫,乒乓球 和摩托车。另外他说了几个教授的名字,嗯,好资源。 gxue Li graduated in 2010 with a BS in Shanghai University of Finance & Economics where he was awarded numerous scholarships for his superior academic record. His experience includes an internship in the corporate banking division of the Bank of East Asia, where he focused on statistical methods. Additional work was performed in the risk group of China Construction Bank, where he performed on loan validation and distribution, and risk metrics. Yingxue also has published several papers, focusing on risk. Yingxue plans to pursue a career in quantitative analysis with a particular emphasis on fixed income and risk. I chose the Baruch MFE without any hesitation because that the class has a small size, the curriculum is very practical, the location cannot be better, some of the faculty are very famous. I firmly believe this elite program can help me realize my dreams. Fruitful ninja’s comment: 啊这是我们的校友啊,东亚银行实习,建行实习,发过论文。但他 写的 comment 明显看出来不是 bby 出去的,那么笼统。心里又来了点小希望。校友的力量 无穷啊,我要 CV 之。 有哪些教授、学生或其他的事情你觉得很有趣,希望多了解,为什么? http://mfe.baruch.cuny.edu/social/ Fruitful ninja’s comment: 课余活动蛮多嘛。。 。像这种借志愿者活动旅游神马的我最喜欢了。