File - Business Administration

advertisement

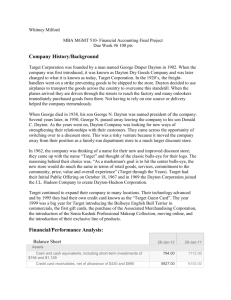

Running head: TARGET EXPANSION 1 Target: Expansion of 100 Stores Stanley J. Cochran MGMT510 – Financial Accounting February 15, 2014 Steve Adams Southwestern College Professional Studies TARGET EXPANSION OF 100 STORES 2 Abstract Target is a retail store that had over $72 billion dollars in revenue in 2013. Target sales several different types of merchandise and these consist of health and beauty products, clothes, food, and home furnishings. One of the future goals of Target is to expand and build and open 100 more stores. Target has been profitable for the past few years and they have continued to expand and grow in different markets. Target has set itself up and established its personality and differentiation by having value and a unique assortment of goods and the foundation of their “Expect More. Pay Less” brand promise (“Annual reports”, 2013). Target has been able to grow and keep customers returning by giving them a shopping experience different than the competition. From the beginning in 1881 to today Target has set itself differently from others by having a unique shopping experience that brings back retuning customers and has allowed them to grow the business. The main goal of expansion for Target is made difficult with retail market and many others like Penny’s having difficulties and struggling to remain in business making the decision to expand more difficult. Can growth continue and meet the expectations of the investors. TARGET EXPANSION OF 100 STORES 3 Target Founder George D. Dayton started in retail business in Minneapolis in 1881 and called the fist store the Dayton Dry Goods Company, today known as Target Corporation ("Target through the," 2014). It was 1962 before the first Target discount store opened and sold a variety of merchandise at a low price. Part of the Target experience is to have stores that presented itself as a high quality experience. The main goal of Target is in their mission statement and how they want to give the customer the best shopping experience at a price that makes the customer happy and builds a continuing relationship. Target’s mission statement is: Our mission is to make Target your preferred shopping destination in all channels by delivering outstanding value, continuous innovation and exceptional guest experiences by consistently fulfilling our “Expect More. Pay Less” brand promise ("Mission and goals," 2014). In the 1950’s Dayton’s began expanding into the suburbs and during this time opened one of the stores in what we call a shopping mall today where all the store fronts face the inside of a large building all under one roof. With the success of the stores in 1960 the company decided to expand into the mass market discount stores and in 1962 the idea became a reality and this is when the store name changed to Target and had the red bulls-eye as part of the trademark. As early as 1915 the Dayton family became known for their generosity and started giving back to the community. With each generation that took over after George Dayton this philosophy still stands and the Target Corporation continues to give back to the communities. The Dayton’s have even been recognized by President Reagan for its giving back to the communities. In 1997 Target is recognized by President Clinton for its good neighbor volunteer program. In 1979 Target had grown to 74 stores in 11 states and had reached the milestone of 1 billion dollars in annual sales per year ("Target through the," 2014). Target leadership has always been innovative in their approach to the business and was the first mass retailers to use the UPC bar codes. This system helped in inventory management and also led to shorter wait times in the check-out lines. In 1995 Target opened the first Super Target Store that included groceries with the idea it gave the customer the one stop shopping experience. The customer did not have to go to several stores to meet all the family’s needs. In 2005 Target reached more than 50 billion in annual sales. Today Target has more than 1700 stores with more than 70 billion in annual sales and is still growing. Financial Performance The Target Corporation in 2012 has more than $70 billion in annual sales, with close to $3 billion dollars in net earnings. George Steinhafel, Chairman, President and CEO, Target reported in 2012 that Target reached new highs of $72 billion in sales and diluted earnings of $4.52 per share, and the goal of opening more than 100 new stores in 2013 (“Annual reports”, 2013). The CEO wants to continue the growth of Target by adding stores and by creating a shopping experience that sets them apart from the competition. When you look at Appendix “A” you see where Target has grown the sales every year since 2011, $67M in 2011, $69 in 2012, $73 in 2013. When looking at several of the different ratios of financial performance Target has maintained or improved in all aspects of the business as you can see in table 1. Return on sales is stable at 4.0% average for years 2011 through 2013. The asset turnover ratio is holding stable for the last 3 years; return on assets has gone down slightly from 6.7% in 2011 to 6.2% in 2013, liquidity and solvency show improvement. Table 1 shows the numbers for the last 3 years giving us a picture of their performance. TARGET EXPANSION OF 100 STORES 4 Table 1: Ratio's Ratio ROS x Type Profitability Formula 2013 2012 2011 NI/ Revenue 4.0% 4.1% 4.0% Asset Turnover = Efficiency Revenue/ Total Assets 1.52 1.50 1.54 ROA Current Ratio Profitability Liquidity NI/ Current Assets/ Total Current Liabilities Assets 6.20% 6.30% 6.70% 1.17 1.15 1.71 Debt Ratio Solvency total Liabilities/ Total assets 65.6% 66.0% 64.5% Cochran. One important aspect of any company is the liquidity of current operations. Here we can see that the current ratio of current assets divided by current liabilities is above 1. This is considered healthy for liquidity (Schoenebeck & Holtzman, 2013, p. 39). The debt ratio gives us information about the company’s ability to pay debt over a long period. This gives us the information that 65% of debt is financed by debt and 35% is financed by stockholders’ equity. This is a lot of financed debt and must be considered when looking at the possibility of more debt. Can Target continue to make the needed payments if debt increases? One thing to consider is that Target has been growing and they have not increased the debt ratio much. The current trends for Target appear not to be out of control. In (Appendix B) the income statement we see that the return on sales and asset turnover are both steady. The return on assets gives us the info on how the assets are used to generate income. More information that we can gather from (Appendix B) is the gross profit margin. The gross profit margin equals gross profits divided by sales revenue. We can see that the gross profit margin can be seen in (Appendix C) of that each year was about 29% gross profits. Gross profit is very important to a business like Target where the smallest of increases means millions of dollars. With the customer base that Target is aiming to bring into their stores gives them a better chance to charge a little bit more for products with higher quality than the competition giving them a chance to increase their gross profit. The next aspect to consider is how is Target performing against the competition? In (Appendix E) we can see that Target’s performance is similar to Wal-Mart. We can see similarities in several aspects like; operating margins, gross margins and P/E which is current market price per share divided by earnings per share are all similar. Target’s performance is much like its competitors with nothing standing out that could lead to problems for growth. Target is in a very competitive business where you have to separate yourself from the competition and Target has set themselves apart from Wal-Mart and K-Mart with a different style that attracts a different customer base. Target has the customer base that is looking for a low price but is very interested in quality. Target gives the customer a more pleasant shopping experience. The competition is mostly interested in customers that are looking at low prices. TARGET EXPANSION OF 100 STORES 5 Industry Outlook The future for companies like Target is difficult to predict because of the fast changing aspects that attract customers. We are constantly hearing about large chains that are having financial difficulties like Penny’s, Sears, and K-mart. Penny’s recently closed several stores across the United States because of financial difficulties. For Target they are constantly changing in how they do business by adapting to customer expectations. Being able to purchase goods over the internet is causing many businesses to close due to lower sales. Target has adapted to this cycle by offering all their products they stock in stores and many they do not on the web site. No longer do certain retail chains hold the brands that consumers want, now they can go straight to the name brand manufacture to make their purchase (Hoium, 2012). Target must constantly adapt to consumer desires for shopping because most customers want to see what they are buying not just a picture on a web site. The advantage for online shopping is the price may be cheaper due to overhead costs like having stores all across the country. The future is hard to predict but companies have to be willing and able to change to meet customers’ demands and expectations. Before companies like Target can think about expanding it is important that they understand the outlook of the economy. 2013 had moderate growth for the year at around 3.7 percent. 2014 has as economic outlook of growth around 4.1 percent (Kleinhenz, 2014). 2013 was a difficult year for consumers with higher taxes, gas prices still climbing, and the government shutdown, consumer confidence was shaky. 2013 still showed growth and this gives us the hope that 2014 will finally support job growth and lead to growth for companies like Target. Growth In 2014 should Target continue to expand operations by opening 100 new stores? Target has continued to increase sales revenue each year and increased 2013 by almost $4 billion from the previous year. Stockholders’ Equity has grown by close to $1 billion in the last three years giving investors confidence that Target is moving in the right direction. There are many other aspects that need to be considered before making a large financial decision of adding 100 more stores to the Target Corporation. One aspect we need to consider is the long term debt of Target and can they continue to support more debt. The debt equity ratio of total liabilities divided by Stockholders’ Equity gives how the company is financing the debt. As seen in table 1 the debt ratio for the past 3 years has stayed around 65%. This is not bad considering that Target expanded stores the last couple of years and it continues to look at current stores by closing and relocating non-profitable stores. Overall long-term debt has decreased $1 billion since 2011. Target’s short-term debt seems to be stable the liquidity of Target and the ability to continue to pay short-term liabilities is stable which is 1.17% and is considered good for being able to repay short-term liabilities. The three year average has held steady at 1.3% as seen in table 1. How does Target compare to the competition in the same markets and same types of sales? When looking at (Appendix E) we can see that the major competition is Wal-Mart with others like K-mart (Pvt1) and Costco that are smaller than Target but have similar consumers. The main aspects to compare are gross margins, earnings per share, P/E, operating margin and net income. When you look at the gross margin of Target of .29 it compares to Wal-Mart of .25% and is better than the other competitors. The earnings per share is smaller compared to TARGET EXPANSION OF 100 STORES 6 Wal-Mart and Costco but is still considered good at 3.74. The P/E ratio for Target is 15.08 is close the major competitor in the market, Wal-Mart of 14.17, and this number is considered the target range for the P/E ratio. Target’s operating margin is higher than all the competitors at .07 and Target’s net income of 2.41 billion is good in comparison to total revenue of all the competition. Conclusion Target remains profitable and has been performing to stockholders’ expectations. The market that Target is in is very competitive and it is important to keep an identity that brings in the right customers. Target continues to remain competitive and has an identity that brings in the right type of consumers that helps them meet financial performance goals while expanding. The main question is can Target continue to grow and should they open 100 more stores. With the performance of the past three years and growing revenues and profits and the expected growth in the economy I would recommend that Target continue with the objects of growing and look for markets to place the expansion of the 100 stores. It will be important to not only look at expanding but to evaluate the current stores to make sure they should remain in business. The goal of opening 100 stores may not lead to the total growth of 100 more stores but it should lead to the growth of 100 more profitable stores. TARGET EXPANSION OF 100 STORES 7 References Annual reports. (2013). Retrieved from http://investors.target.com/phoenix.zhtml?c=65828&p=irol-reportsAnnual Hoium, T. (2012, December 28). What does the futer of retail look like? . Retrieved from http://www.dailyfinance.com/2012/12/28/what-does-the-future-of-retail-look-like/ Kleinhenz, J. (2014, February 6). Looking back looking forward: Stronger econmy points to a brighter outlook for retail. Retrieved from http://blog.nrf.com/2014/02/06/looking-backlooking-forward-stronger-economy-points-to-brighter-outlook-for-retail/ Libby, R., Libby, P., & Short, D. (2011). Financial accounting. (7th ed.). New York, NY: McGraw-Hill Irwin. Schoenebeck, K. P., & Holtzman, M. P. (2013). Interpreting ans analyzing financial statements: A project-based approach. (6th ed.). Upper Saddle River, New Jersey: Prentice Hall. Mission and goals. (2014). Retrieved from https://corporate.target.com/about/mission-values Target through the years. (2014). Retrieved from https://corporate.target.com/about/history/Target-through-the-years Yahoo finance: Competitors. (2014). Retrieved from http://finance.yahoo.com/q/co?s=TGT Competitors TARGET EXPANSION OF 100 STORES 8 Appendix “A” Income Statement Income Statement All numbers in thousands View: Annual Data | Quarterly Data Period Ending Feb 2, 2013 Jan 28, 2012 Jan 29, 2011 Total Revenue 73,301,000 69,865,000 67,390,000 Cost of Revenue 50,568,000 47,860,000 45,725,000 Gross Profit 22,733,000 22,005,000 21,665,000 Operating Expenses Research Development Selling General and Administrative Non Recurring Others Total Operating Expenses Operating Income or Loss - - - 15,220,000 14,552,000 14,329,000 - - - 2,142,000 2,131,000 2,084,000 - - - 5,371,000 5,322,000 5,252,000 Income from Continuing Operations Total Other Income/Expenses Net Earnings Before Interest And Taxes Interest Expense - - - 5,371,000 5,322,000 5,252,000 762,000 866,000 757,000 Income Before Tax 4,609,000 4,456,000 4,495,000 Income Tax Expense 1,610,000 1,527,000 1,575,000 - - - 2,999,000 2,929,000 2,920,000 Discontinued Operations - - - Extraordinary Items - - - Effect Of Accounting Changes - - - Other Items - - - 2,999,000 2,929,000 2,920,000 - - - 2,999,000 2,929,000 2,920,000 Minority Interest Net Income From Continuing Ops Non-recurring Events Net Income Preferred Stock And Other Adjustments Net Income Applicable To Common Shares TARGET EXPANSION OF 100 STORES 9 Appendix “B” Balance Sheet Balance Sheet All numbers in thousands View: Annual Data | Quarterly Data Period Ending Feb 2, 2013 Jan 28, 2012 Jan 29, 2011 784,000 794,000 1,712,000 - - - Net Receivables 5,841,000 5,927,000 6,153,000 Inventory 7,903,000 7,918,000 7,596,000 Other Current Assets 1,860,000 1,810,000 1,752,000 16,388,000 16,449,000 17,213,000 Assets Current Assets Cash And Cash Equivalents Short Term Investments Total Current Assets Long Term Investments - - - 30,653,000 29,149,000 25,493,000 Goodwill - - - Intangible Assets - - - Accumulated Amortization - - - 1,122,000 1,032,000 999,000 Property Plant and Equipment Other Assets Deferred Long Term Asset Charges - - - 48,163,000 46,630,000 43,705,000 11,037,000 10,501,000 9,951,000 2,994,000 3,786,000 119,000 - - - Total Current Liabilities 14,031,000 14,287,000 10,070,000 Long Term Debt 14,654,000 13,697,000 15,607,000 Other Liabilities 1,609,000 1,634,000 1,607,000 Deferred Long Term Liability Charges 1,311,000 1,191,000 934,000 Minority Interest - - - Negative Goodwill - - - 31,605,000 30,809,000 28,218,000 Misc Stocks Options Warrants - - - Redeemable Preferred Stock - - - Preferred Stock - - - Common Stock 54,000 56,000 59,000 12,698,000 Total Assets Liabilities Current Liabilities Accounts Payable Short/Current Long Term Debt Other Current Liabilities Total Liabilities Stockholders' Equity Retained Earnings 13,155,000 12,959,000 Treasury Stock - - - Capital Surplus 3,925,000 3,487,000 3,311,000 Other Stockholder Equity (576,000) (681,000) (581,000) Total Stockholder Equity 16,558,000 15,821,000 15,487,000 Net Tangible Assets 16,558,000 15,821,000 15,487,000 TARGET EXPANSION OF 100 STORES 10 Appendix “C” Debt ratio = total liabilities / Total assets Balance sheet Total Liabilities Total assets Debt Ratio Asset Turnover = Sales Revenue / total assets Income statement Sales revenue Total Assets Asset Turnover Return on sales = Net income / sales revenue Income statement Net income Sales revenue Return on sales Return on assets = Net income / total assets Income statement Net Income Total assets Return on assets Current ratio = current assets / current liab. Balance sheet Liquidity Current assets Gross profit margin = gross profits / sales rev. Income statement Gross Profits Current Liab. Current Ratio Sales revenue Gross Profit Mar. Cost of sales Stores opened closed relocated total 2012 31,605,000 48,163,000 0.656209123 2011 2010 30,809,000 28,218,000 46,630,000 43,705,000 0.660711988 0.645646951 65.6% 73,301,000 48,163,000 1.52 66.0% 69,865,000 46,630,000 1.50 64.5% 67,390,000 43,705,000 1.54 2,999,000 2,929,000 2,920,000 73,301,000 0.040913494 69,865,000 67,390,000 0.04192371 0.043329871 4% 2,999,000 48,163,000 0.062267716 4.10% 4% 2,929,000 2,920,000 46,630,000 43,705,000 0.062813639 0.066811578 6.20% 16,388,000 14,031,000 1.17 6.30% 16,449,000 14,287,000 1.15 6.70% 17,213,000 10,070,000 1.71 21,392,000 73,301,000 20,606,000 69,865,000 20,061,000 67,390,000 0.29 0.29 0.30 50,568,000 47,860,000 45,725,000 1,763 23 -5 -3 1,778 1,750 21 -3 -5 1,763 TARGET EXPANSION OF 100 STORES 11 Appendix “D” Outline 1. History of the company. a. Founded by and dates. b. How did the company grow? c. How was Target built and what was the mission statement? 2. Financial performance. a. Current CEO’s performance and expectations. b. List ratios of health. c. Chart of expectations. d. How does Target compare to the competition? 3. Industry growth. a. What are the future plans of Target’s growth? b. Will the economy support this growth? 4. Summary/conclusion a. Recommendation as to growing 100 stores. TARGET EXPANSION OF 100 STORES 12 Appendix E Performance Measures Against Competition. Competitors Direct Competitor Comparison TGT COST PVT1 WMT Industry Market Cap: 35.61B 50.15B N/A 238.64B N/A Employees: 361,000 103,000 N/A 2,200,000 N/A 0.02 0.06 N/A 0.02 0 1 474.88B N/A Qtrly Rev Growth (yoy): Revenue (ttm): 73.81B 106.46B Gross Margin (ttm): 0.29 0.13 N/A 0.25 0 EBITDA (ttm): 7.10B 4.05B N/A 36.98B N/A 0.07 0.03 N/A 0.06 0 1 17.20B N/A Operating Margin (ttm): Net Income (ttm): 15.28B 2.41B 2.05B EPS (ttm): -34.00M 3.74 4.64 N/A 5.2 N/A P/E (ttm): 15.08 24.59 N/A 14.17 N/A PEG (5 yr expected): 1.62 2.08 N/A 1.7 N/A P/S (ttm): 0.48 0.47 N/A 0.5 N/A COST = Costco Wholesale Corporation Pvt1 = Kmart Corporation (privately held) WMT = Wal-Mart Stores Inc. Industry = Discount, Variety Stores 1 = As of 2012 Yahoo finance: Competitors, (2014). http://finance.yahoo.com/q/co?s=TGT Competitors