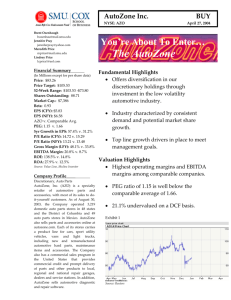

Autozone (AZO on NYSE)

advertisement

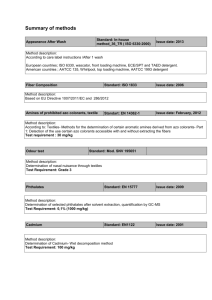

Five-Forces Model Analysis of Auto Parts Industry Spring 2007 Autozone (AZO on NYSE) From Yahoo Finance OP AUTO PARTS STORES COMPANIES BY MARKET CAP Company AutoZone Inc. Advance Auto Parts Inc. O'Reilly Automotive Inc. Pep Boys - Manny, Moe & Jack CSK Auto Corp. Tilden Associates Inc. Symbol Price Change Market Cap AZO 123.92 0.29% 8.76B AAP 36.79 1.27% 3.87B ORLY 32.71 0.28% 3.72B PBY 14.76 1.20% 802.86M CAO 17.03 0.18% 746.14M TLDN.OB 0.10 0.00% 1.14M P/E 15.96 16.90 21.17 N/A 27.25 33.33 Industry Leader AZO AZO Rank AZO VS. INDUSTRY LEADERS Statistic Market Capitalization AZO 8.76B P/E Ratio (ttm) CAO 27.25 15.96 4 / 7 PEG Ratio (ttm, 5 yr expected) - 1/7 1.08 N/A Revenue Growth (Qtrly YoY) ORLY 10.00% 4.10% 3 / 7 EPS Growth (Qtrly YoY) AZO Long-Term Growth Rate (5 yr) 16.40% - 1/7 N/A 13.0% N/A Return on Equity (ttm) AZO 109.30% - 1/7 Long-Term Debt/Equity (mrq) AZO 3.469 - 1/7 Dividend Yield (annual) PBY 1.80% N/A N/A BUSINESS SUMMARY AutoZone, Inc. operates as a specialty retailer of automotive parts and accessories. Its stores offer various products primarily to do-ityourself customers for use in cars, sport utility vehicles, vans, and light trucks, such as new and remanufactured automotive hard parts, maintenance items, and accessories and non-automotive products. http://edgarscan.pwcglobal.com/recruit/edu.html http://www.autozone.com/ -1- Five-Forces Model Analysis of Auto Parts Industry Spring 2007 Classifying Autozone’s Industry with 5-Forces Model in order to determine profit potential Industry: Retail Automotive Parts Competition Dimensions Actual Competitor Rivalry Actual Competitors (Per Yahoo Finance) Autozone Advance Auto Parts O’Reilly Automotive Pep boys CSK Auto Corp. NAPA WalMart ? K-Mart ? Look At Industry Sales Growth and Market Share per Financial Statements (spread sheet) Switching costs (can these firms easily enter another industry??) Are there Economies of Scale?? Does specialized industry based knowledge take place over time? Are the costs primarily fixed, variable or mixed?? Excess Capacity?? (look at same store sales) Is it difficult (legal or other reasons) to liquidate and leave business? Based on the above factors, do you see high or low degrees of competition between existing firms -2- Five-Forces Model Analysis of Auto Parts Industry Spring 2007 Threat of Potential Entrants or Competitors (“Force 2”) Economies of Scale Required to enter and effectively compete? First Mover Advantages (Brand identity or advantages)? Ease of Access to Supplier and Customer Distribution Networks? Necessity of Supplier or Customer Relationships to effectively compete? Existence of Legal Barriers to Entry? What type of competitor is WalMart?? (all or specific product lines and services?) Based on the above factors, do you see high or low degrees of competition between existing firms given the potential of new entrants into the industry? Threat of Substitute Products (“Force 3”) This could be substitute for retail car parts This could be due to changes in technology (can’t fix it now) This could be due to changes in distribution networks (internet, salvage yards, etc.) How does this affect current competitive pressures? Overall, is this a High, Low, or Mixed competition environment? -3- Five-Forces Model Analysis of Auto Parts Industry Spring 2007 Supplier and Customer Bargaining Power Ability to exert “power” dictates where pricing and cost flexibility lies for firm and industry. Bargaining Power of Buyers (Customers) If Firms in the Industry exert Power over the Buyers (customers), then Firms have the ability to maintain or increase prices. Otherwise, your product may be viewed as a commodity. In this case, you react to price changes of competition. Determining Factors: Switching Costs (Can Customers easily acquire product and service elsewhere?) Differentiation (Is this essentially a commodity product?) How critical is product to customers in terms of price (cost) and quality? Many small customers or just a few dominant customers? Do customers buy in bulk or small batches? Who do you think has the power in the retail auto parts industry (Customer or the Firm)? What does this do to profit potential? -4- Five-Forces Model Analysis of Auto Parts Industry Spring 2007 Bargaining Power of Suppliers (Firm is the Customer) If Firms in the Industry exert Power over the Suppliers (customers), then Firms have a greater ability to dictate their costs. Otherwise, your product suppliers may be more able to raise their prices. In this case, you react to price changes of competition. Determining Factors: Switching: Can suppliers easily find other customers? Can firms in the industry easily find other suppliers? Are the suppliers’ products commodities or specialty goods How important is the supplier cost and quality relationship to members in the industry? Are there few suppliers (dominance) and how much of your business requirements do they satisfy? Who do you think has the power in the retail auto parts industry (Suppliers or the Firms)? What does this do to profit potential? -5-