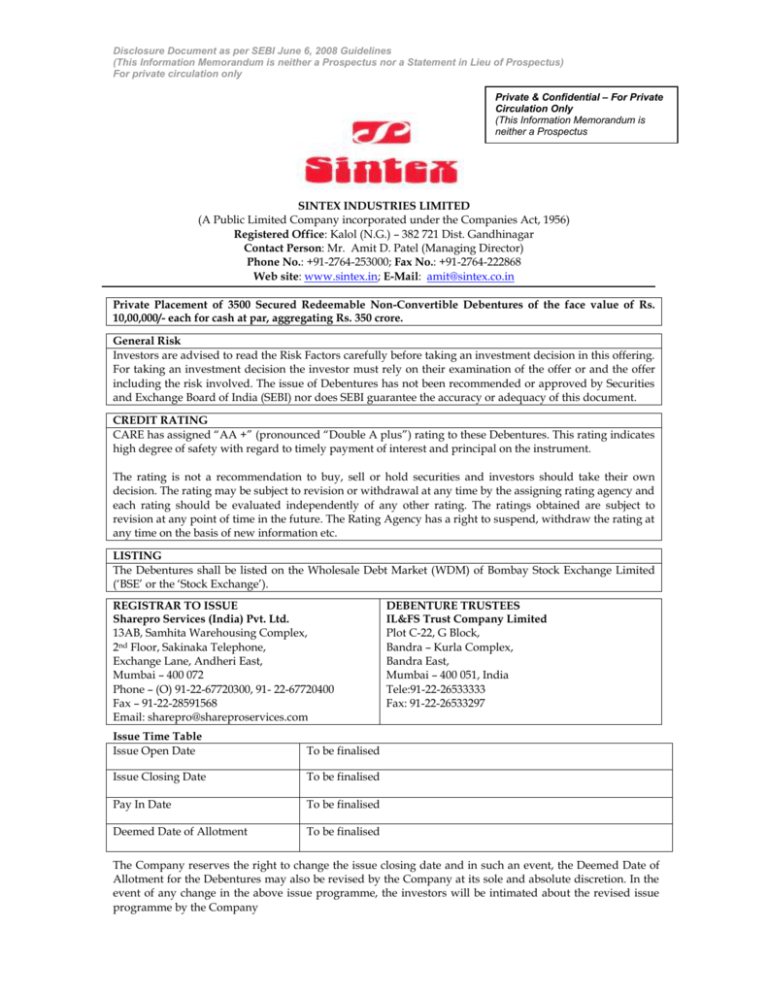

Recognition to SINTEX Brand

advertisement