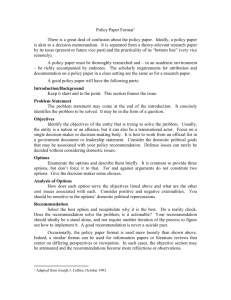

Document Retention Policy and Guidelines

advertisement

L A W O F F IC E S HOWE & HUTTON, LTD. S T . L O U IS O F F IC E : 2 0 N O R T H W AC KE R D R IV E W A S H IN G T O N , D C O F F IC E : 1421 BUCKHURST COURT C H IC A G O , ILLINOIS 60606-9833 1901 PENNSYLVANIA AVENUE, N.W. BALLWIN, MISSOURI TELEPHONE 63021 (636) 256-3351 FAX (636) 256-3727 TELEPHONE (312) 263–3001 FAX (312) 372–6685 SUITE 1007 WASHINGTON, DC TELEPHONE __________ 20006 (202) 466-7252 FAX (202) 466-5829 hh@howehutton.com Document Retention Policy and Guidelines Document retention is a critical but often overlooked assignment for associations and their member companies. The recent Enron bankruptcy and the controversy over that company’s and its auditor’s destruction of documents has demonstrated the need for a carefully planned, uniform record retention and destruction practice. The proliferation of forms and records over the last decade has left many associations and businesses with file boxes and drawers of paper, back-up tapes, and electronic messages and other media. The retention of documents not otherwise necessary to conduct business is both expensive and inefficient. It could leave the association or member company open to potential legal challenges on grounds based on outdated and irrelevant material. To minimize these costs and risks, your organization should review and update its record (also called document) retention program for the systematic retention and destruction of documents based on statutory or regulatory recordkeeping requirements and practical business needs. A document retention and destruction policy should ensure that documents are retained only so long as they are (1) necessary to the conduct of the organization's business; (2) required to be kept by statute or government regulation; or (3) relevant to pending or foreseeable investigations or litigation. Currently relevant documents should be filed systematically and accessibly. Documents that must be maintained permanently can be catalogued and, if possible, reduced to some secure form of electronic record for storage and easy access when needed. To achieve these objectives, procedures should be established so that documents are filed in the appropriate place, the number of copies is catalogued, and documents are retrieved and destroyed on pre-established "pull" dates. One individual should have overall responsibility for initial implementation and yearly review of compliance with the program. The program itself should be reviewed every few years to ensure governmental requirements are being met, business needs are satisfied, and changes in hardware and software do not prevent access to stored electronic records. Retention periods are based primarily on current federal record-keeping requirements and state statutes of limitation (these may vary from state to state). Meeting Professionals International, for example, is incorporated in the State of Illinois which has adopted the Uniform Preservation of Private Copyright Howe & Hutton, Ltd. 2004. Copying permissible with attribution to Copyright Owners 726836189 Business Records Act (“UPPBRA”). The Act defines records as “books of account, vouchers, documents, cancelled checks, payrolls, correspondence, records of sales, personnel, equipment and production, reports relating to any or all of such records, and other business papers.” The Act allows for (but does not require) destruction of these documents three (3) years from the date they are produced. Associations and member companies are also subject to criminal penalties under provisions of the Sarbanes-Oxley Act of 2002 passed in connection with the securities fraud scandals of recent years, and which prohibits corruptly tampering, altering, destroying or concealing records in an effort to prevent their availability for use in an “official proceeding.” The following schedule highlights suggested retention periods for some of the major categories of documents for the Meeting Professionals International and its members. MPI members are urged to consider their own document retention and orderly destruction policies. In addition to the illustrated categories, the document retention policy should cover accounting, insurance, personnel, real estate, and tax records. While the policy behind retention of certain records is prescribed by statute, at other times the policy comes from practical business experience and judgments. You may also choose to adopt more conservative retention periods for certain types of documents. The terms below are considered minimums, after which destruction is permitted, though not required. Each organization should develop its own detailed program, of course, depending on its specific needs. A good record retention policy should minimize both the legal risks flowing from hastily drafted or misleading documents and the adverse inferences that may arise from the selective destruction of documents in the absence of such a policy. Moreover, the expense of storing obsolete documents as well as the cost of retrieving documents in response to business requests, government investigations or litigation should be reduced. The following schedule sets forth guidance for the Meeting Professionals International. Members may adapt the schedule for their own needs. Type of Record Retention Period (years) Law/Policy (source) ACCOUNTING Auditors' reports P CCH recommendation Budgets 7 CCH recommendation Cancelled checks, generally 3 UPPBRA Depreciation records P CCH recommendation Officer, director and employee expense reports 3 UPPBRA Employee payroll records (W-2, W-4) annual earnings records, etc.) 3 FLSA, UPPBRA Inventory lists 7 CCH recommendation 2 Invoices 7 CCH recommendation Payroll journal 3 FLSA, UPPBRA Petty cash vouchers 3 UPPBRA Subsidiary ledgers (accounts receivable, accounts payable, etc.) 7 CCH recommendation Annual reports P CCH recommendation Authorizations and appropriations for expenditures 7 CCH recommendation Contracts, generally Expiration +7 CCH recommendation Contracts, government Expiration +7 CCH recommendation Contracts, sales (UCC) 7 CCH recommendation Notes (internal reports, memos, etc.) 3 UPPBRA 3 UPPBRA Accident reports 7 CCH recommendation Insurance policies P Practical experience P (See below 1) 1 Title VII, ADA CORPORATE RECORDS CORRESPONDENCE General, routine INSURANCE LEGAL Claims and litigation files PERSONNEL Applications 1 Company copies of all pleadings, key briefs and motions, court orders and opinions of record on dispositive motions and hearings, any attorney-client confidential privileged communications, all original witness statements and affidavits, exhibits, and settlement agreements/contracts need to be kept permanently. Mere drafts of various and routine pleadings, motions, and briefs, as well as multiple copies of original business documents need not be retained. 3 Employee earnings/payroll records 3 FLSA Employee files 4 SSA, FLSA, ERISA, ADEA, Equal Pay Act Employment contracts Expiration + 3 FLSA Form I-9 3 Immigration Reform & Control Act Garnishments 7 FLSA Medical or exposure to toxic substances records 30 OSHA Pension documents/profit sharing plans 6 ERISA Government reports 5 CCH recommendation Employee pension records, including service, eligibility, personal information, pensions paid 6 ERISA, ESA Time cards/sheets 3 FLSA Leases Expiration + 7 CCH recommendation Deeds P CCH recommendation Mortgages P CCH recommendation Income tax returns and cancelled checks (federal, state and local) 6 IRS Code Payroll tax returns 4 IRS Code Property tax returns P CCH recommendation Sales and use tax returns 4 IL Use & Occupation Tax Act REAL ESTATE TAXES 4