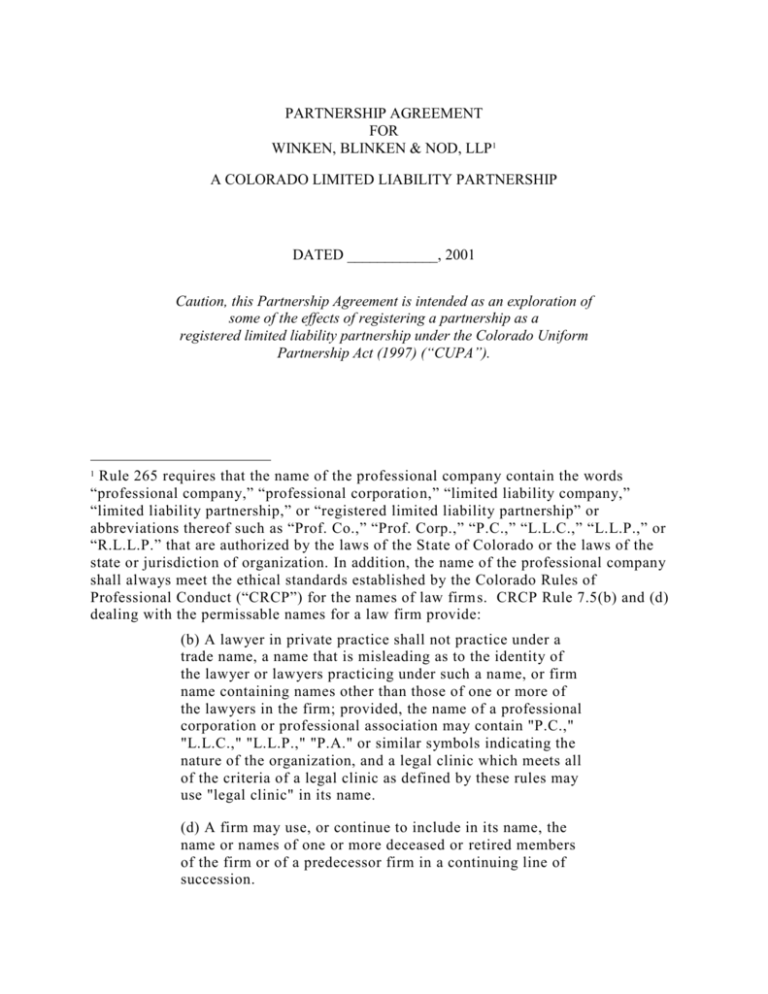

partnership agreement - Colorado Bar Association

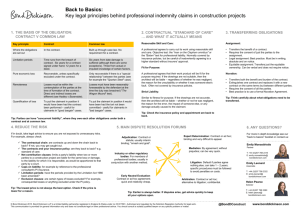

advertisement