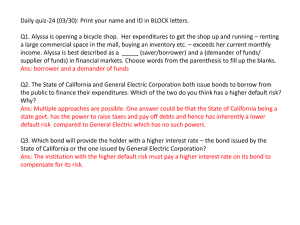

AC 116 MIDTERM QUESTIONS AND ANSWERS

advertisement

AC 116 MIDTERM QUESTIONS AND ANSWERS Chapter 8 1. A necessary element of internal control is a. database b. systems design c. systems analysis d. information and communication ANS: D 2. An example of a preventive control is a. the use of a bank account b. separation of the Purchasing Department and Accounting Department personnel c. bonding employees who handle cash d. accepting payment in currency only ANS: B 3. Under the voucher system, every transaction is recorded at the time of a. requisitioning b. ordering c. incurring d. paying ANS: C 4. A debit or credit memorandum describing entries in the depositor's bank account may be enclosed with the bank statement. An example of a credit memorandum is a. deposited checks returned for insufficient funds b. a promissory note left for collection c. a service charge d. notification that a customer's check for $375 was recorded by the depositor as $735 on the deposit ticket ANS: B 5. Journal entries based on the bank reconciliation are required in the depositor's accounts for a. outstanding checks b. deposits in transit c. bank errors d. book errors ANS: D 6. Accompanying the bank statement was a credit memorandum for a short-term note collected by the bank for the customer. What entry is required in the depositor's accounts? a. debit Notes Receivable; credit Cash b. debit Cash; credit Miscellaneous Income c. debit Cash; credit Notes Receivable d. debit Accounts Receivable; credit Cash ANS: C 7. Accompanying the bank statement was a debit memorandum for an NSF check received from a customer. What entry is required in the depositor's accounts? a. debit Other Income; credit Cash b. debit Cash; credit Other Income c. debit Cash; credit Accounts Receivable d. debit Accounts Receivable; credit Cash ANS: D 8. Which of the following would be subtracted from the balance per bank on a bank reconciliation? a. Outstanding checks b. Deposits in transit c. Notes collected by the bank d. Service charges ANS: A 9. Marcus Company developed the following reconciling information in preparing its September bank reconciliation: Cash balance per bank, 9/30 Note receivable collected by bank Outstanding checks Deposits-in-transit Bank service charge NSF $11,000 6,000 9,000 4,500 75 1,200 Using the above information, determine the cash balance per books (before adjustments) for the Marcus Company. a. $9,775 b. $15,725 c. $15,500 d. $1,775 ANS: D 10. A $100 petty cash fund contains $92 in petty cash receipts, and $6.50 in currency and coins. The journal entry to record the replenishment of the fund would include a a. credit to Petty Cash for $93.50 b. credit to Cash for $92 c. debit to Cash Short and Over for $1.50 d. credit to Cash Short and Over for $1.50 ANS: C 11. In the normal operation of business you receive a check from a customer and deposit it into your checking account. With your bank statement you are advised that this check for $450 is “NSF”. The bank also informs you that due to the amount of activity on your business account the monthly service charge is $40. During a bank reconciliation: a. subtract both values from balance according to bank. b. add both values from balance according to books. c. add both values from balance according to bank. d. subtract both values from balance according to books. ANS: D Chapter 9 12. The receivable that is usually evidenced by a formal instrument of credit is a(n) a. trade receivable. b. note receivable. c. accounts receivable. d. income tax receivable. ANS: B 13. The type of account and normal balance of Allowance for Doubtful Accounts is a. contra asset, credit b. asset, debit c. liability, credit d. expense, debit e. expense, credit ANS: A 14. If the direct write-off method of accounting for uncollectible receivables is used, what general ledger account is credited to write off a customer's account as uncollectible? a. Uncollectible Accounts Expense b. Accounts Receivable c. Allowance for Doubtful Accounts d. Interest Expense ANS: B 15. An estimate based on an analysis of receivables shows that $780 of accounts receivables are uncollectible. The Allowance for Doubtful Accounts has a debit balance of $110. After preparing the adjusting entry at the end of the year, the balance in the Allowance for Doubtful Accounts is a. $110 b. $780 c. $670 d. $890 ANS: D 16. If the allowance method of accounting for uncollectible receivables is used, what general ledger account is credited to write off a customer's account as uncollectible? a. Uncollectible Accounts Expense b. Accounts Receivable c. Allowance for Doubtful Accounts d. Interest Expense ANS: B 17. The balance in Allowance for Doubtful Accounts must be carefully considered prior to the end of the year adjustment when applying which method? a. direct write-off method b. estimate based on sales c. estimate based on an analysis of receivables d. both (b) and (c) ANS: C 18. An aging of a company's accounts receivable indicates that $3,000 are estimated to be uncollectible. If Allowance for Doubtful Accounts has a $1,200 credit balance, the adjustment to record bad debts for the period will require a a. debit to Bad Debt Expense for $4,200. b. debit to Bad Debts Expense for $3,000. c. debit to Bad Debts Expense for $1,800. d. credit to Allowance for Doubtful Accounts for $4,000. ANS: C 19. A 60-day, 10% note for $8,000, dated April 15, is received from a customer on account. The face value of the note is a. $8,600 b. $7,200 c. $8,800 d. $8,000 ANS: D 20. The journal entry to record a note received from a customer to apply on account is a. debit Notes Receivable; credit Accounts Receivable b. debit Accounts Receivable; credit Notes Receivable c. debit Cash; credit Notes Receivable d. debit Notes Receivable; credit Notes Payable ANS: A 21. Pane Company receives a $3,000, 3-month, 6% promissory note from Dag Company in settlement of an open accounts receivable. What entry will Pane Company make upon receiving the note? a. Notes Receivable 3,000 Accounts Receivable—Dag Company 3,000 b. Notes Receivable 3,045 Accounts Receivable—Dag Company 3,045 c. Notes Receivable 3,045 Accounts Receivable—Dag Company 3,000 Interest Revenue 45 d. Notes Receivable 3,000 Interest Receivable 45 Accounts Receivable—Dag Company 3,000 Interest Revenue 45 ANS: A 22. A 60-day, 12% note for $10,000, dated May 1, is received from a customer on account. If the note is discounted on May 21 at 15%, the proceeds are a. $170 b. $9,830 c. $10,000 d. $10,030 ANS: D Chapter 10 23. Land acquired so it can be resold in the future is listed in the balance sheet as a(n) a. fixed asset b. current asset c. investment d. intangible asset ANS: C 24. A used machine with a purchase price of $77,000, requiring an overhaul costing $8,000, installation costs of $5,000, and special acquisition fees of $2,000, would have a cost basis of a. $92,000 b. $91,000 c. $87,000 d. $86,000 ANS: A 25. In a lease contract, the party who legally owns the asset is the a. lessee b. lessor c. operator d. banker ANS: B 26. Equipment with a cost of $160,000 has an estimated residual value of $10,000 and an estimated life of 5 years or 12,000 hours. It is to be depreciated by the straight-line method. What is the amount of depreciation for the first full year, during which the equipment was used 3,300 hours? a. $30,000 b. $32,500 c. $34,000 d. $40,000 ANS: A 27. Equipment with a cost of $80,000, an estimated residual value of $5,000, and an estimated life of 15 years was depreciated by the straight-line method for 5 years. Due to obsolescence, it was determined that the useful life should be shortened by 5 years and the residual value changed to zero. The depreciation expense for the current and future years is a. $5,500 b. $11,000 c. $10,000 d. $5,000 ANS: B 28. The proper journal entry to purchase a computer on account to be utilized within the business would be: a. Jan 2 Office Supplies 1,250.00 Accounts Payable 1,250.00 b. Jan 2 Office Equipment 1,250.00 Accounts Payable 1,250.00 c. Jan 2 Office Supplies 1,250.00 Accounts Receivable 1,250.00 d. Jan 2 Office Equipment 1,250.00 Accounts Receivable 1,250.00 ANS: B 29. The calculation for annual depreciation using the units-of-production method is a. (initial cost/estimated output) * the actual yearly output b. (depreciable cost / yearly output) * estimated output c. depreciable cost / yearly output d. (depreciable cost / estimated output) * the actual yearly output ANS: D 30. A fixed asset with a cost of $42,000 and accumulated depreciation of $38,500 is traded for a similar asset priced at $60,000. Assuming a trade-in allowance of $5,000, the cost basis of the new asset is a. $58,000 b. $58,500 c. $60,000 d. $61,500 ANS: B 31. The Brock Company acquired new machinery with a price of $15,200 by trading in similar old machinery and paying $12,700. The old machinery originally cost $9,000 and had accumulated depreciation of $5,000. In recording this transaction, Brock Company should record a. the new machinery at $16,700 b. the new machinery at $12,700 c. a gain of $1,500 d. a loss of $1,500 ANS: D 32. On December 31, Reach It Batting Cages Company has decided to discard one of its batting cages. The initial cost of the equipment was $225,000 with an accumulated depreciation of $195,000. Depreciation has been taken up to the end of the year. The following will be included in the entry to record the disposal. a. Accumulated Depreciation Dr. $225,000 b. Loss on Disposal of Asset $195,000 c. Equipment Cr. $225,000 d. Gain on Disposal of Asset $30,000 ANS: C 33. Which intangible assets are amortized over their useful life? a. trademarks b. goodwill c. patents d. all of the above ANS: C Chapter 11 34. On June 8, Acme Co. issued an $80,000, 6%, 120-day note payable on an overdue account payable to Still Co. Assume that the fiscal year of Acme Co. ends June 30. Which of the following relationships is true? a. Acme is the creditor and credits Accounts Receivable b. Still is the creditor and debits Accounts Receivable c. Still is the borrower and credits Accounts Payable d. Acme is the borrower and debits Accounts Payable ANS: D 35. The maturity value of a $40,000, 90-day, 6% note payable is a. $40,600 b. $42,400 c. $600 d. $2,400 ANS: A 36. The journal entry a company uses to record the payment of a discounted note is a. debit Notes Payable and Interest Expense; credit Cash b. debit Notes Payable; credit Cash c. debit Cash; credit Notes Payable d. debit Accounts Payable; credit Cash ANS: B 37. Gray County Bank agrees to lend the Starkwood Building Company $100,000 on January 1. Starkwood Building Company signs a $100,000, 9%, 9-month note. What entry will Starkwood Building Company make to pay off the note and interest at maturity assuming that interest has been accrued to September 30? a. Notes Payable Cash b. Notes Payable Interest Payable Cash c. Interest Expense Notes Payable Cash d. Interest Payable Notes Payable Cash 106,750 106,750 100,000 6,750 106,750 6,750 100,000 106,750 9,000 100,000 109,000 ANS: B 38. The total payroll of a business is usually significant for all the reasons below except a. employees are sensitive to payroll errors and irregularities b. payroll is subject to various federal and state regulations c. businesses find it difficult to develop and maintain good internal controls on the payroll system d. payroll and related payroll taxes have a significant effect on the net income of most businesses ANS: C 39. Prior to the last weekly payroll period of the calendar year, the cumulative earnings of employees A and B are $99,350 and $91,000 respectively. Their earnings for the last completed payroll period of the year are $850 each. The amount of earnings subject to social security tax at 6% is $100,000. All earnings are subject to Medicare tax of 1.5%. Assuming that the payroll will be paid on December 29, what will be the employer's total FICA tax for this payroll period on the two salary amounts of $850 each? a. $127.50 b. $115.50 c. $112.50 d. $0 ANS: B 40. Manning Company has the following information for the pay period of December 15 - 31, 20xx. Gross payroll $15,000 Federal income tax withheld $3,000 Social security rate 6% Federal unemployment tax rate .8% Medicare rate 1.5% State unemployment tax rate 5.4% Salaries Payable would be recorded for a. $15,000 b. $11,100 c. $10,875 d. $9,945 ANS: C 41. The following totals for the month of June were taken from the payroll register of ABC Company: Salaries expense Social security and Medicare Taxes withheld Income Taxes withheld Retirement Savings $13,000 975 2,600 500 Salaries subject to federal and state unemployment taxes of 6.2 percent 4,000 The entry to record the accrual of employer’s payroll taxes would include a a. debit to Payroll Taxes Expense for $1,223 b. credit to Social Security and Medicare Tax Payable for $1,950 c. debit to Payroll Taxes Expense for $248 d. Debit to Payroll Tax Expense for $975 ANS: A 42. An aid in internal control over payrolls that indicates employee attendance is a. "clock card" b. voucher system c. payroll register d. employee's earnings record ANS: A 43. The journal entry a company uses to record pension rights that have not been funded for its salaried employees, at the end of the year is a. debit Salary Expense; credit Cash b. debit Pension Expense; credit Unfunded Pension Liability c. debit Pension Expense; credit Unfunded Pension Liability and Cash d. debit Pension Expense; credit Cash ANS: B 44. During June, CircuitSound sold 800 portable CD players for $50 each. Each CD player cost CircuitSound $25 to purchase and carried a one-year warranty. If 10 percent typically need to be replaced over the warranty period, what amount should CircuitSound debit Product Warranty Expense for in June? a. $4,000 b. $400 c. $2,000 d. $1,000 ANS: C Chapter 13 45. Under the corporate form of business organization a. ownership rights are easily transferred. b. a stockholder is personally liable for the debts of the corporation. c. stockholders’ acts can bind the corporation even though the stockholders have not been appointed as agents of the corporation. d. stockholders wishing to sell their corporation shares must get the approval of other stockholders. ANS: A 46. The two ways that a corporation can be classified by ownership are a. stock and non-stock. b. inside and outside. c. majority and minority. d. for profit or not-for-profit. ANS: D 47. The entry to record the issuance of 150 shares of $5 par common stock at par to an attorney in payment of legal fees for organizing the corporation includes a credit to a. Organizational Expenses b. Goodwill c. Common Stock d. Cash ANS: C 48. Alliance Corp. issues 1,000 shares of $10 par value common stock at $14 per share. When the transaction is recorded, credits are made to: a. Common Stock $14,000. b. Common Stock $10,000 and Paid-in Capital in Excess of Par Value $4,000. c. Common Stock $10,000 and Paid-in Capital in Excess of Stated Value $4,000. d. Common Stock $10,000 and Retained Earnings $4,000. ANS: B 49. The journal entry to issue 1,000,000 shares of $5 par common stock for $6.25 per share on January 2nd would be: a. Jan 2 Cash 6,250,000 Common Stock 5,000,000 Paid-In Capital in Excess of Par - C/S 1,250,000 b. Jan 2 Cash 5,000,000 Common Stock 5,000,000 c. Jan 2 Cash 5,000,000 Paid-In Capital in Excess of Par - C/S 1,250,000 Common Stock 6,250,000 d. Jan 2 Cash 1,000,000 Common Stock 1,000,000 ANS: A 50. Which of the following is not a prerequisite to paying a cash dividend? a. formal action by the board of directors b. market value in excess of par value per share c. sufficient cash d. sufficient retained earnings ANS: B 51. A corporation purchases 10,000 shares of its own $10 par common stock for $25 per share, recording it at cost. What will be the effect on total stockholders' equity? a. increase, $100,000 b. increase, $250,000 c. decrease, $100,000 d. decrease, $250,000 ANS: D 52. Retained earnings a. is the same as contributed capital b. cannot have a debit balance c. changes are summarized in the retained earnings statement d. over time will have a direct relationship with the amount of cash on hand if the corporation is profitable ANS: C 53. When a corporation completes a 3-for-1 stock split a. the ownership interest of current stockholders is decreased b. the market price per share of the stock is decreased c. the par value per share is decreased d. b and c ANS: D 54. If the board of directors authorizes a $100,000 restriction of retained earnings for a future plant expansion, the effect of this action is to a. decrease total assets and total stockholders’ equity. b. reduce the amount of retained earnings available for dividend declarations. c. increase stockholders’ equity and to decrease total liabilities. d. decrease total retained earnings and increase total liabilities. ANS: B Chapter 14 55. Which of the following is an example of a temporary difference between taxable income and reported income? a. using the installment method of determining revenue for taxable income and for income statement reporting b. using the straight-line depreciation method for income statement reporting and MACRS depreciation for taxable income c. using the straight-line depreciation method for some assets and MACRS depreciation for other assets d. including tax-exempt municipal bond interest in net income and not including any taxexempt municipal bond interest in taxable income ANS: B 56. Income tax allocation procedures are justified by what concept? a. Revenue recognition b. Matching c. Conservatism d. Cash basis accounting ANS: B 57. ABC Company has incurred a period income tax expense of $500,000. The tax accountants inform the financial accountants that 60% of this value will be paid on March 15th, 2 1/2 months away, while the balance will be paid in 14 1/2 months. The journal entry to recognize these obligations is: a. Dec 31 Income Tax Expense 300,000 Income Tax Payable 200,000 Cash 500,000 b. Dec 31 Income Tax Expense 500,000 Income Tax Payable - Current 300,000 Income Tax Payable - Non Current 200,000 c. Dec 31 Income Tax Expense 500,000 Cash 500,000 d. Dec 31 Income Tax Payable 500,000 Income Tax Expense 500,000 ANS: B 58. Which of the following items should be classified as an extraordinary item on a corporate income statement? a. Gain on the retirement of a bond payable b. Gain from land condemned for public use c. Loss due to an discontinued operation d. Selling treasury stock for more than the company paid for it ANS: B 59. For the year that just ended, a company reports net income of $3,200,000. There are 750,000 shares authorized, 600,000 shares issued, and 500,000 shares of common stock outstanding. What is the earnings per share? a. $6.40 b. $3.20 c. $5.33 d. $3.33 ANS: A 60. The Lange Company has a simple capital structure. The company has 20,000 shares of common stock outstanding. Net income for the year was $65,000. Lange declared and paid a preferred stock dividends of $4,000 during the year. Earnings per share for the year is: a. $3.25 b. $.125 c. $3.05 d. $3.45 ANS: C 61. Long-term investments are held for all of the listed reasons below except a. their income b. long-term gain potential c. influence over another business entity d. meet current cash needs ANS: D 62. Bean Corporation purchased 35% of the outstanding shares of common stock of Williams Corporation as a long-term investment. Subsequently, Williams Corporation reported net income and declared and paid cash dividends. What journal entry would Bean Corporation use to record its share of the earnings of Williams Corporation? a. debit Investment in Williams Corporation Stock; credit Cash b. debit Cash; credit Dividend Revenue c. debit Investment in Williams Corporation; credit Income of Williams Corporation d. debit Cash; credit Investment in Williams Corporation ANS: C 63. For 2008, net income is $240,000, shares outstanding are 80,000, and the market price is $24. What is the price-earnings ratio on common stock (round to one decimal point?) a. 8.0 b. 7.7 c. 10.0 d. 3.0 ANS: A 64. For accounting purposes, the method used to account for investments in common stock is determined by a. the amount paid for the stock by the investor. b. whether the acquisition of the stock by the investor was "friendly" or "hostile." c. the extent of an investor's influence over the operating and financial affairs of the investee. d. whether the stock has paid dividends in past years. ANS: C Chapter 15 65. A corporation would not be successfully trading on equity if it gathered funds by a. issuing common stock b. issuing preferred stock c. issuing notes d. issuing bonds ANS: A 66. When the market rate of interest on bonds is higher than the contract rate, the bonds will sell at a. a premium b. their face value c. their maturity value d. a discount ANS: D 67. If $3,000,000 of 10% bonds are issued at 97, the amount of cash received from the sale is a. $3,300,000 b. $3,000,000 c. $3,090,000 d. $2,910,000 ANS: D 68. When the market rate of interest was 11%, Waverly Corporation issued $1,000,000, 12%, 8-year bonds that pay interest semiannually. The selling price of this bond issue was a. $1,052,310 b. $1,154387 c. $1,000,000 d. $ 720,495 ANS: A 69. If the market rate of interest is greater than the contractual rate of interest, bonds will sell a. at a premium. b. at face value. c. at a discount. d. only after the stated rate of interest is increased. ANS: C 70. Bonds with a face amount $1,000,000, are sold at 97. The entry to record the issuance is a. Cash 1,000,000 Premium on Bonds Payable 30,000 Bonds Payable 970,000 b. Cash 970,000 Premium on Bonds Payable 30,000 Bonds Payable 1,000,000 c. Cash 970,000 Discount on Bonds Payable 30,000 Bonds Payable 1,000,000 d. Cash 970,000 Bonds Payable 970,000 ANS: C 71. Bonds Payable has a balance of $1,000,000 and Discount on Bonds Payable has a balance of $15,500. If the issuing corporation redeems the bonds at 99, what is the amount of gain or loss on redemption? a. $5,500 loss b. $15,500 loss c. $15,500 gain d. $5,500 gain ANS: A 72. The balance in Discount on Bonds Payable that is applicable to bonds due in 2015 would be reported on the balance sheet in the section entitled a. current liabilities b. long-term liabilities c. current assets d. intangible assets ANS: B 73. The Raymore Company issued 10-year bonds on January 1, 2007. The 15% bonds have a face value of $100,000 and pay interest every January 1 and July 1. The bonds were sold for $117,205 based on the market interest rate of 12%. Raymore uses the effective-interest method to amortize bond discounts and premiums. On July 1, 2007, Raymore should record interest expense (round to the nearest dollar) of a. $7,032 b. $7,500 c. $8,790 d. $14,065 ANS: A Chapter 16 74. Cash paid to purchase long-term investments would be reported in the statement of cash flows in a. the cash flows from operating activities section b. the cash flows from financing activities section c. the cash flows from investing activities section d. a separate schedule ANS: C 75. Cash paid for preferred stock dividends should be shown on the statement of cash flows under a. investing activities b. financing activities c. noncash investing and financing activities d. operating activities ANS: B 76. Investing activities include a. collecting cash on loans made. b. obtaining cash from creditors. c. obtaining capital from owners. d. repaying money previously borrowed. ANS: A 77. Accounts receivable arising from trade transactions amounted to $45,000 and $52,000 at the beginning and end of the year, respectively. Net income reported on the income statement for the year was $105,000. Exclusive of the effect of other adjustments, the cash flows from operating activities to be reported on the statement of cash flows prepared by the indirect method is a. $105,000 b. $112,000 c. $98,000 d. $140,000 ANS: C 78. Equipment with an original cost of $50,000 and accumulated depreciation of $20,000 was sold at a loss of $7,000. As a result of this transaction, cash would a. increase by $23,000 b. decrease by $7,000 c. increase by $43,000 d. decrease by $30,000 ANS: A 79. Which of the following should be deducted from net income in calculating net cash flow from operating activities using the indirect method? a. a decrease in inventory b. a decrease in accounts payable c. preferred dividends declared and paid d. a decrease in accounts receivable ANS: B 80. Mega Sales sells some used store fixtures. The acquisition cost of the fixtures is $12,500, the accumulated depreciation on these fixtures is $9,750 at the time of sale. The fixtures are sold for $3,000. The value of this transaction in the Investing section of the statement of cash flows is: a. $12,500 b. $3,000 c. $2,750 d. $250 ANS: B 81. Free cash flow is cash from operations, less cash for a. dividends and cash for fixed assets needed to maintain productivity b. dividends and cash to redeem bonds payable c. fixed assets needed to maintain productivity d. dividends, cash for fixed assets needed to maintain productivity, and cash to redeem bonds payable ANS: A