It's working, different stock markets

advertisement

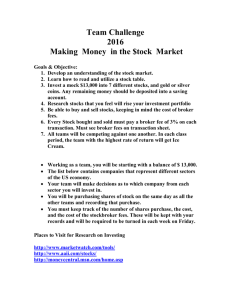

1. Background info - History, development, stock crashes Stock Market History Stock Market History. History of the Stock Market. Stock Market History The World's Market - Stock Market History When people talk about the Stock Market, it's no always immediatedly clear what they're referring to. Is the Stock Market a place? Or is it something different? To many people it is an abstract idea. They buy stocks in "the stock market" without ever leaving the comfort of their computer terminal. But the stock market is indeed a physical place with buildings and addresses, a place you can go visit. Wall Street is the Place Many folks think of Wall Street and the Stock Market as one in the same, and that view isn't really far from the truth. Wall Street is the place where it all started and where the world's largest financial market was born and prospered. From Wall Street sprang a new industry with it's own language and terminology. The History Wall Street can trace its name back to 1653. Originally it was set up for defense and not for commerce. Settlers of Dutch descent, who were always on the lookout from attacks by Native Americans and the British built a 12 foot stockade fence. Little did they know that this fence would go on to become the center of financial activity in the world. The wall lasted a good while, until 1685. At that point the wall was torn down and a new street was built. The British called it Wall Street. The Rise of the Stock Exchanges What helped Wall Street rise to pre-eminence was the emergence of two great Stock Exchanges, which gave order to the chaotic trading and gave birth to the financial markets as we know them today. The year was 1790. The place was Philadelphia. The occasion was the founding of the first stock exchange in America. Two years later a group of New York merchants met to discuss how to take command of the securities business. The merchants, a group of 24 men, founded what is now known as the New York Stock Exchange. But in early 1817, the merchant group from New York, distressed at the sorry state of their stock exchange, sent a representative to Philadelphia to observe how things were being done. Upon arriving with news about the robust exchange in Philadelphia, the New York Stock and Exchange Board was soon formally organized. The exchange opened up shop on Wall Street. As for the New York Stock Exchange, it has since moved past its humble beginnings to the point where its system now facilitates billions of dollars worth of trades each day. But there was a gradual build up to this sort of status. In the early 1900s massive amounts of money were made on Wall Street. But the boom period could not be sustained indefinitely. And in 1929 this principle came front and center as the stock market crash of 1929 seared the national.nay, global.psyche and triggered what was to be called the Great Depression. While many of the powers that be realized that the markets could not sustain a boom forever, very few publicized this view, choosing instead to let the market be its own judge, jury and executioner. As a result of the laissez-faire attitude, many people.rich and poor alike.lost a lot of money. But the stock market crash of 1929 was just the beginning of sorrows for Wall Street. For while the economy eventually recovered from its catastrophic losses, the market excesses that had factored into the crash in the late 1920s seeped back into the picture. The result was the stock market crash of 1987, which saw the Dow Jones suffer what was the largest single-day loss in the stock market.s history. Since then, the government and the industry have tried to put measures in place to curtail, if not entirely eliminate, the possibility of such a large-scale crash. The stock markets are now an integral part of the global economy, and so proper safeguards to reduce the risks of another disastrous crash are necessary. But while efforts have been made to reduce the risk, the possibility for another stock market crash can never be ruled out. Current Stock Market The current "stock market" is comprised of 300,000 computers situated on pro trader's desks. These computers are networked together using sophisticated protocols. This level of information sharing makes pricing an almost exact science. These 300,000 computers are further linked to another 26 million computers worldwide. These computers are located in banks, small businesses, and large corporations. These computers comprise the banking networks which make computerized transactions possible. Finally, these computers are connected to another 300 million+ computers which connect and disconnect from the financial markets daily. In New York City alone, these transactions amount to over $2.2 trillion dollars daily Right now, the New York Stock Exchange has billions of dollars changing hands every day, with thousands of companies being traded, and millions of people being affected. If we trace the roots of the New York Stock Exchange to its beginning, we would find that it started out as dirt path in front of Trinity Church in East Manhattan 200 years ago. At that time, there was no paper money changing hands, or even the idea of stocks. Rather, they traded silver for papers saying they owned shares in cargo, that was coming in on ships every day. The trade flourished. During the American Revolution, the Colonial Government needed money to fund its wartime operations. One way they did this was by selling bonds. Bonds are pieces of paper a person buys for a set price, knowing that after a certain period of time, they can exchange their bonds for a profit. Along with bonds, the first of the nation's banks started to sell parts or shares of their own companies to people in order to raise money. In essence they sold off part of the company to whomever wanted to buy it, which is the essence of the modern day stock market. Wall Street was becoming a major center of these transactions, and in 1792 twenty-four men signed an agreement that started the New York Stock Exchange (NYSE). They agreed to sell shares or parts of companies between themselves and charge people commissions, or fees, to buy and sell for them. They found a home at 40 Wall Street in New York City. As they grew they later moved into what is currently the New York Stock Exchange Building. The 1900s brought the Industrial Revolution, and along with it, a boom in Wall Street. Everybody wanted a piece of the action, and Wall Street grew. The New York Stock Exchange was not the only way to buy stocks at that time. Many stocks that were deemed not good enough for the NYSE, were traded outside on the curbs. This so called "curb trading," has now become the American Stock Exchange (AMEX). Today, the New York and the American Stock Exchanges, have been joined by the NASDAQ, and hundreds of local and international Stock Exchanges, that all play a part in the national and global economy. You were right to follow your hunch with McDonald's. Your 250 dollars has skyrocketed into 1000 dollars over a few years. Well, you've been checking the stock price recently and today, when you go get the newspaper, the headline reads "CRASH!". You read on and discover that the stock market has just dropped around 500 points, not to mention the fact that McDonald's stock value which has been slashed in half. You can't believe it- years of work, all gone, in one day. Sounds frustrating, but if you were investing in the late 1980s, 1987 to be exact, it would of been true. On October 19, 1987 the stock market plunged 508 points, or 22 percent of the total market value. It was the worst crash, since 1927 which signaled the Great Depression. What brought about this crash, why such a drop in such a little time? One major reason for the crash was fear. Fear of a correction. Fear of a drop. Fear of being to late to get out. The 1980s had brought large stock increases, people had been making fortunes on the huge surges in the stock market. People began to fear that the market wouldn't be able to go up forever, and eventually it would fall, and create what is called a correction. The fear began to accumulate around October 15th, when The Wall Street Journal published an article entitled, "Stocks May Face More than a Correction." It voiced fear that a correction would bring on a landslide. People began to listen, and big investment brokers began to worry. The SEC and NYSE listened too. They even talked about closing the market on the 19th when there was worry that the crash would come. Even though they decided to keep the market open, news of a potential collapse was the straw that broke the camel's back. The morning of 1987, began with a quick loss of around 150 points. Although, the market did rebound a little before noon, the landslide had begun, and the market was losing too fast to hold back. Many of the specialists, whose job it is to negotiate the trades between sellers and buyers, were going out of business, because the rules state that they must purchase stocks that cannot be sold. In the end, the market plunged, and after the closing bell rang in the NYSE, there was silence between the brokers. People were speechless, many broke. 2. Stock markets - It’s working, different stock markets Stock Basics: How Stocks Trade Most stocks are traded on exchanges, which are places where buyers and sellers meet and decide on a price. Some exchanges are physical locations where transactions are carried out on a trading floor. You've probably seen pictures of a trading floor, in which traders are wildly throwing their arms up, waving, yelling, and signaling to each other. The other type of exchange is a virtual kind, composed of a network of computers where trades are made electronically. The purpose of a stock market is to facilitate the exchange of securities between buyers and sellers, thus reducing the risks of investing. Just imagine how difficult it would be to sell shares if you had to call around the neighborhood trying to find a buyer. Really, a stock market is nothing more than a super-sophisticated farmers market linking buyers and sellers. Before we go on, we should distinguish between the "primary" market and the "secondary" market. The primary market is where securities are created (by means of an IPO) while, in the secondary market, investors trade previously-issued securities without the involvement of the issuing-companies. The secondary market is what people are referring to when they talk about "the stock market." It is important to understand that the trading of a company's stock does not directly involve that company. To learn more about this, see our article entitled "Where Securities Are Traded." The New York Stock Exchange The most prestigious exchange in the world is the New York Stock Exchange (NYSE). The "Big Board" was founded over 200 years ago in 1792 with the signing of the Buttonwood Agreement by 24 New York City stockbrokers and merchants. Currently the NYSE, with stocks like General Electric, McDonald's, Citigroup, Coca-Cola, Gillette, and Wal-mart, is the market of choice for the largest companies in America. The NYSE is the first type of exchange (as we referred to above), where much of the trading is done face-to-face on a trading floor. This is also referred to as a "listed" exchange. Orders come in through brokerage firms that are members of the exchange and flow down to floor brokers who go to a specific spot on the floor where the stock trades. At this location, known as the trading post, there is a specific person known as the "specialist" whose job is to match buyers and sellers. Prices are determined using an auction method: the current price is the highest amount any buyer is willing to pay and the lowest price at which someone is willing to sell. Once a trade has been made, the details are sent back to the The trading floor of the NYSE brokerage firm, who then notifies the investor who placed the order. Although there is human contact in this process, don't think that the NYSE is still in the Stone Age; computers do play a huge role in the process. The Nasdaq The second type of exchange is the virtual sort called an over-the-counter (OTC) market, of which the Nasdaq is the most popular. These markets have no central location or floor brokers whatsoever. Trading is done through a computer and telecommunications network of dealers. It used to be that the largest companies were listed only on the NYSE while all other "second tier" stocks traded on the other exchanges. The tech boom of the late 90s changed all this; now the Nasdaq is home to several big technology companies such as Microsoft, Cisco, Intel, Dell, and Oracle. This has resulted in the Nasdaq becoming a serious competitor to the NYSE. On the Nasdaq brokerages act as "market makers" for various stocks. A market maker provides continuous bid and ask prices within a prescribed percentage spread for shares for which they are designated to make a market. They may match up buyers and sellers directly but usually they will maintain an inventory of shares to meet demands of investors. We won't get into the process here since we cover this in detail in our tutorial entitled "Electronic Trading and Market Makers." The Nasdaq market site in Times Square Other Exchanges The third largest exchange in the U.S. is the American Stock Exchange (AMEX). The AMEX used to be an alternative to the NYSE, but that role has since been filled by the Nasdaq. In fact, the National Association of Securities Dealers (NASD), which is the parent of Nasdaq, bought the AMEX in 1998. Almost all trading now on the AMEX is in small-cap stocks and derivatives. There are many stock exchanges located in just about every country around the world. American markets are undoubtedly the largest and thus most important, but they still represent only a fraction of total investment around the globe. The two other main financial hubs are London, home of the London Stock Exchange, and Hong Kong, home of the Hong Kong Stock Exchange. We've got a complete list of exchanges from around the world here. The last place worth mentioning is the over-the-counter bulletin board (OTCBB). The Nasdaq technically is an over-the-counter market, but the term commonly refers to small public companies that don’t meet the listing requirements of any of the regulated markets, including the Nasdaq. The OTCBB is home to penny stocks because there is little to no regulation. This makes investing in an OTCBB stock very risky. You really need to know what you're doing here or you'll get burnt! Chances are, if you're reading this tutorial you don't want even to consider the OTCBB. Stock Basics: What Causes Prices To Change? Stock prices change everyday by market forces. By this we mean that share prices change because of supply and demand. If more people want to buy a stock (demand) than sell it (supply), then the price moves up. Conversely, if more people wanted to sell a stock than buy it, there would be greater supply than demand, and the price would fall. Understanding supply and demand is easy. What is difficult to comprehend is what makes people like a particular stock and dislike another stock. This comes down to figuring out what news is positive for a company and what news is negative. There are many answers to this problem and just about any investor you ask has their own ideas and strategies. That being said, the principal theory is that the price movement of a stock indicates what investors feel a company is worth. Don't equate a company's value with the stock price. The value of a company is its market capitalization, which is the stock price multiplied by the number of shares outstanding. For example, a company that trades at $100 per share and has 1,000,000 shares outstanding has a lesser value than a company that trades at $50 but has 5,000,000 shares outstanding ($100 x 1,000,000 = $100,000,000 while $50 x 5,000,000 = $250,000,000). To further complicate things, the price of a stock doesn't only reflect a company's current value--it also reflects the growth that investors expect in the future. The most important factor that affects the value of a company is its earnings. Earnings are the profit a company makes, and in the long run no company can survive without them. It makes sense when you think about it. If a company never makes money, they aren't going to stay in business. Public companies are required to report their earnings four times a year (once each quarter). Wall Street watches with rabid attention at these times, which are referred to as earnings seasons. The reason behind this is that analysts base their future value of a company on their earnings projection. If a company's results surprise (are better than expected), the price jumps up. If a company's results disappoint (are worse than expected), then the price will fall. Of course, it's not just earnings that can change the sentiment towards a stock (which, in turn, changes its price). It would be a rather simple world if this were the case! During the dot-com bubble, for example, dozens of Internet companies rose to have market capitalizations in the billions of dollars without ever making even the smallest profit. As we all know, these valuations did not hold, and most all Internet companies saw their values shrink to a fraction of their highs. Still, the fact that prices did move that much demonstrates that there are factors other than current earnings that influence stocks. Investors have developed literally hundreds of these variables, ratios and indicators. Some you may have already heard of, such as the P/E ratio, while others are extremely complicated and obscure with names like Chaikin Oscillator or Moving Average Convergence Divergence (MACD). So, why do stock prices change? The best answer is that nobody really knows for sure. Some believe that it isn't possible to predict how stocks will change in price while others think that by drawing charts and looking at past price movements, you can determine when to buy and sell. The only thing we do know as a certainty is that stocks are volatile and can change in price extremely rapidly. The important things to grasp about this subject are the following: 1. At the most fundamental level, supply and demand in the market determine stock price. 2. Price times the number of shares outstanding (market capitalization) is the value of a company. Comparing just the share price of two companies is meaningless. 3. Theoretically earnings are what affect investors' valuation of a company, but there are other indicators that investors use to predict stock price. Remember, it is investors' sentiments, attitudes, and expectations that ultimately affect stock prices. 4. There are many theories that try to explain the way stock prices move the way they do. Unfortunately, there is no one theory that can explain everything. ... Charles in return tells you, "Let's see, a share of McDonalds costs 20 dollars (Not the actual price), and I am going to charge you 50 dollars for my services, so you can buy 10 shares of McDonalds. " You then give Charles the money, and you get the stock. (They usually don't give you the paper stock certificates, but they transfer ownership over to you.) Voila, you have just bought stock in a company! Sounds simple enough, right? Actually it is not if you look at it from the broker's point of view. When you told the broker you wanted those 10 shares of stocks, he did not magically buy them for you, or already own them. Rather, he sent a message to another person who is working down on the floor of the New York Stock Exchange (or any other stock exchange). He tells this person to buy these stocks for you. This person is called a "Floor Broker." Now this person goes to the part of the Stock Exchange that is allotted to this particular stock. Here there are companies that specialize in this stock. This means that they will usually, if not always, buy and sell from people at the normal price. The floor broker then buys your ten shares from one of these people, reports his trade through the hundreds of computers on the floor, then reports to his colleagues back at the brokerage house that he bought the stock. The broker keeps a record that you own that stock, rather than sending you the actual paper stock certificates. If you ever want to sell them, your broker will sell them, deduct his commission, and then give you the money. Got all that? Well if you did not, here it is again using a simplified example. When you want a stock, you call a broker. The broker calls a person on the floor (usually an employee of the broker). This person runs to the space that is allotted to this stock. He then buys the amount of stock from the specialists, or companies, that are there to sell and buy on a regular basis. He then tells the firm he bought it, and then you have your stock. Well it was pretty easy to buy a few shares of McDonalds, but what if you are not sure about which stock you should buy? Maybe you would rather let a professional choose the stocks for you. Well, you are not alone. Millions of people turn over control of their finances to professionals by buying Mutual Funds. There are two types of mutual funds, open and closed. Open mutual funds, such as Fidelity Magellan, let people put their money in them, just like a bank. The difference is that banks take your money and lend it out, and then pay you interest on the money you gave it. This is static, in that it does not change. When you put your money in, the bank usually says we will give you 3 percent interest. When you put your money in a mutual fund, they take that money, along with that of millions of other people who are investing, and buy stocks and bonds with it. They then take out part of the profits for themselves, a commission, and give you your share. Closed end mutual funds, are similar to their open counterparts in that you turn over control of your money to professionals but, rather than putting money in them like a bank, you buy shares like a stock. This means that a closed end mutual fund acts just like any other stock on the Stock Exchange, they have Ticker Symbols, and are traded. The difference is that these mutual funds, instead of making burgers, or creating airplanes, take the money they have, invest it, and return the profits to the share holders. Well, we have now learned how to hand over money to people, in exchange for stocks, but what is to stop them from cheating you, or from running off to Mexico with your hard earned 250 dollars that was supposed to go to McDonalds? Well to keep brokers honest, the government has put into place many commissions, and organizations. Of these organizations the major player is the Securities Exchange Commission (SEC). The SEC is a government agency whose purpose is to regulate the securities industry (the stock markets). It was created after the Great Depression when Congress passed the Securities Exchange Act of 1934. This agency decides what is legal, and prosecutes those who break the rules, along with setting many standards for brokers and investors alike. All companies traded on the many stock exchanges across America have to be registered with the SEC. Each must follow rules about what they can do with their stock, how they can advertise, and much more. Most of the rules placed on companies are to prevent the owners and employees from using insider information. Insider information is information that a person obtains about a company that is not available to the rest of the public, that can be used to their advantage while buying stocks. For example, lets say you are the CEO of company XYZ, and company ABC is now in negotiations with you to merge, and create a much larger company called GHI Inc. Now, usually mergers cause stock prices to go up, so if you, knowing that a merger is going to take place, go out and buy a lot of stock from both company ABC, and XYZ, you are using insider information, and are breaking the law. SEC rules and regulations not only pertain to companies on the Exchange, but to the brokers that trade, and to you, the investor. As an investor, you too, cannot buy stocks knowing information about a company that know one else knows. Brokers get the heaviest burden of rules and regulations from the SEC. Most of these rules are to protect you, the investor. An example of one of these rules is that when a floor broker goes to buy a stock on your behalf , he must buy from the lowest priced bidder, and when he is selling, he must sell it to the highest price bidder. Sounds like common sense, but in fact it is not. Floor brokers, could easily sell your stock really low to another broker, in exchange for them selling you a different stock really cheap, to give a better customer a better price. This would not be fair to you, being sacrificed to give another person a better price. Why does the stock market go up and down? Theses fluctuations occur partly because companies make money, or lose money, but it is much more involved than that. A stock is only worth what someone will pay for it. Usually, if a company makes a lot of money, its value rises, because people are willing to pay more for a company's stock if the company is doing well. There are many other factors that affect the value of stocks. One example is interest rates, or the amount of money you have to pay a bank to loan money, or how much it has to pay you to keep your money in their bank. If interest rates are high, stock prices generally go down, because if people can make a decent amount of money, by keeping their money in banks, or buying bonds, they feel like they should not take the risk in the stock market. Many other factors have an effect on the stock market- for example, the state of the economy. If there is more money floating around, there is more flowing into companies making their prices rise. Yet another factor is time of year, and publicity. Many stocks are seasonal, meaning they do well during certain parts of the year, and worse during others. An example is an ice company, the ones that package ice that you buy at the supermarket. During the summer, with picnics, and sweltering heat, their product sells well, and thus their stock price goes up; But during the winter, when people are not as interested in a picnic with 20 below temperatures, their price goes down. Publicity has an effect on stock prices. If an article comes out saying that company ABC, has just invented this new type of ice that will revolutionize the industry, odds are their price will increase. Conversely, if an article comes out saying that company ABC's president is a crook, and stole the pension funds, it is a good bet that the price will go down. The three most developed stock markets are in Japan, the United Kingdom, and the United States, and the most underdeveloped markets are in Colombia, Nigeria, Venezuela, and Zimbabwe. Markets tend to be more developed in richer countries, but some markets commonly labeled "emerging" (for example, in Malaysia, the Republic of Korea, and Thailand) are systematically more developed than some markets commonly labeled "developed" (for example, in Australia, Canada, and many European countries). World stock markets are booming. Between 1982 and 1993, stock market capitalization grew from $2 trillion to $10 trillion, an average 15 percent a year. A disproportionate amount of this growth was in emerging stock markets, which rose from 3 percent of world stock market capitalization to 14 percent in the same period. Yet there is little empirical evidence about how important stock markets are to long-term economic development. Economists have neither a common concept nor a common measure of stock market development, so we know little about how stock market development affects the rest of the financial system or how corporations finance themselves. Demirguc-Kunt and Levine collected and compared many different indicators of stock market development using data on 41 countries from 1986 to 1993. Each indicator has statistical and conceptual shortcomings, so they used different measures of stock market size, liquidity, concentration, and volatility, of institutional development, and of international integration. Their goal: to summarize information about a variety of indicators for stock market development, in order to facilitate research into the links between stock markets, economic development, and corporate financing decisions. They highlight certain important correlations: In the 41 countries they studied, there are enormous cross-country differences in the level of stock market development for each indicator. The ratio of market capitalization to GDP, for example, is greater than 1 in five countries and less than 0.10 in five others. There are intuitively appealing correlations among indicators. For example, big markets tend to be less volatile, more liquid, and less concentrated in a few stocks. Internationally integrated markets tend to be less volatile. And institutionally developed markets tend to be large and liquid. The three most developed markets are in Japan, the United Kingdom, and the United States. The most underdeveloped markets are in Colombia, Nigeria, Venezuela, and Zimbabwe. Malaysia, the Republic of Korea, and Switzerland seem to have highly developed stock markets, whereas Argentina, Greece, Pakistan, and Turkey have underdeveloped markets. Markets tend to be more developed in richer countries, but many markets commonly labeled "emerging" (for example, in Korea, Malaysia, and Thailand) are systematically more developed than markets commonly labeled "developed" (for example, in Australia, Canada, and many European countries). Between 1986 and 1993, some markets developed rapidly in size, liquidity, and international integration. Indonesia, Portugal, Turkey, and Venezuela experienced explosive development, for example. Case studies on the reasons for (and economic consequences of) this rapid development could yield valuable insights. The level of stock market development is highly correlated with the development of banks, non bank financial institutions (finance companies, mutual funds, brokerage houses), insurance companies, and private pension funds. This paper --- a product of the Finance and Private Sector Development Division, Policy Research Department --- is part of a larger effort in the department to study stock market development. The study was funded by the Bank's Research Support Budget under the research project "Stock Market Development and Financial Intermediary Growth" (RPO 67837). Copies of the paper are available free from the World Bank, 1818 H Street NW, Washington, DC 20433. Please contact Paulina Sintim Aboagye, room N9057, extension 38526 (58 pages) The full report is available on the World Bank FTP server Stock Basics: Conclusion and Resources Let's recap what we've learned in this tutorial: Stock means ownership. As an owner, you have a claim on the assets and earnings of a company as well as voting rights with your shares. Stock is equity, bonds are debt. Bondholders are guaranteed a return on their investment and have a higher claim than shareholders. This is generally why stocks are considered riskier investments and require a higher rate of return. You can lose all of your investment with stocks. The flip-side of this is you can make a lot of money if you invest in the right company. The two main types of stock are common and preferred. It is also possible for a company to create different classes of stock. Stock markets are places where buyers and sellers of stock meet to trade. The NYSE and the Nasdaq are the most important exchanges in the United States. Stock prices change according to supply and demand. There are many factors influencing prices, the most important being earnings. There is no consensus as to why stock prices move the way they do. To buy stocks you can either use a brokerage or a dividend reinvestment plan (DRIP). Stock tables/quotes actually aren't that hard to read once you know what everything stands for! Bulls make money, Bears make money, but Pigs get slaughtered! Whew! Seems like we covered a lot. We hope that this tutorial has given you a good idea of what stocks are and how the stock market works. Also: 1. If you think we missed something and have a question, tell us about it. 2. If you enjoyed this tutorial, make sure to Tell a Friend! 3. If you still aren't on our newsletter, why not? We must emphasize that this tutorial is meant to provide a basic foundation for understanding. There is plenty more to learn in the days, weeks, and years ahead. Check out the links below for more tutorials that build on your newfound knowledge. Quiz Yourself Finally, if you think you know this stuff now we challenge you to take the quiz and Test Your Stocks Knowledge. Related Tutorials We hinted a few times in this tutorial that there are many strategies for finding a good stock. For more on this, check out our stock picking tutorial. There are also other ways to trade stocks that we didn't cover because we've got entire tutorials devoted to the subjects. See our sections on short selling and buying on margin. We touch on debt a little bit on this tutorial, but there is much more to learn in our tutorial on Bond Basics. You might have also already heard of mutual funds. These are basically big baskets of stocks managed by a professional. Mutuals can be a great way for beginners to get involved in the market; learn more in our tutorial on Mutual Fund Basics. Picking stocks can be a daunting task. Fear not! There is also a way to invest in the entire market by using something called a stock index. We talk more about this in our tutorial on Index Basics. We mentioned that you need a broker to trade stocks. This topic is covered in detail in our tutorial on Broker Basics. 3. Shares / stocks - What they are, different kinds of shares, who buys shares Stock Basics: What Are Stocks? The Definition of a Stock Plain and simple, stock is a share in the ownership of a company. Stock represents a claim on the company's assets and earnings. As you acquire more stock, your ownership stake in the company becomes greater. Whether you say shares, equity, or stock, it all means the same thing. Being an Owner Holding a company's stock means that you are one of the many owners (shareholders) of a company, and, as such, you have a claim (albeit usually very small) to everything the company owns. Yes, this means that technically you own a tiny sliver of every piece of furniture, every trademark, and every contract of the company. As an owner, you are entitled to your share of the company's earnings as well as any voting rights attached to the stock. A stock is represented by a stock certificate. This is a fancy piece of paper that is proof of your ownership. In today's computer age, you won't actually get to see this document because your brokerage keeps these records electronically, which is also known as holding shares "in street name." This is done to make the shares easier to trade. In the past when a person wanted to sell his or her shares, that person physically took the certificates down to the brokerage. Now, trading with a click of the mouse or a phone call makes life easier for everybody. Example stock certificate (Click to enlarge) Being a shareholder of a public company does not mean you have a say in the dayto-day running of the business. Instead, one vote per share to elect the board of directors at annual meetings is the extent to which you have a say in the company. For instance, being a Microsoft shareholder doesn't mean you can call up Bill Gates and tell him how you think the company should be run. In the same line of thinking, being a shareholder of Anheuser Busch doesn't mean you can walk into the factory and grab a free case of Bud Light! The management of the company is supposed to increase the value of the firm for shareholders. If this doesn't happen, the shareholders can vote to have the management removed--well, this is the theory anyway. In reality, individual investors like you and I don't own enough shares to have a material influence on the company. It's really the big boys like large institutional investors and billionaire entrepreneurs who make the decisions. It isn't too big a deal that the shareholders are not the ones managing the company. After all, the idea is that you don't want to have to work to make money, right? The importance of being a shareholder is that you are entitled to a portion of the company’s profits and have a claim on assets. Profits are sometimes paid out in the form of dividends. The more shares you own, the larger the portion of the profits you get. Your claim on assets is only relevant if a company goes bankrupt. In case of liquidation, you'll receive what's left after all the creditors have been paid. This last point is worth repeating: the importance of stock ownership is your claim on assets and earnings. Without this, the stock wouldn't be worth the paper it's printed on. Another extremely important feature of stock is its limited liability, which means that, as an owner of a stock, you are not personally liable if the company is not able to pay its debts. Other companies such as partnerships are set up so that if the partnership goes bankrupt the creditors can come after the partners (shareholders) personally and sell off their house, car, furniture, etc. Owning stock means that, no matter what, the maximum value you can lose is the value of your investment. Even if a company of which you are a shareholder goes bankrupt, you can never lose your personal assets. Debt vs. Equity Why does a company issue stock? Why would the founders share the profits with thousands of people when they could keep profits to themselves? The reason is that at some point every company needs to raise money. To do this, companies can either borrow it from somebody or raise it by selling part of the company, which is known as issuing stock. A company can borrow by taking a loan from a bank or by issuing bonds. Both methods fit under the umbrella of "debt financing." On the other hand, issuing stock is called "equity financing." Issuing stock is advantageous for the company because it does not require the company to pay back the money or make interest payments along the way. All that the shareholders get in return for their money is the hope that the shares will some day be worth more. The first sale of a stock, which is issued by the private company itself, is called the initial public offering (IPO). If you want to know more about how stocks are created, check out our IPO tutorial. It is important that you understand the distinction between a company financing through debt and financing through equity. When you buy a debt investment such as a bond, you are guaranteed the return of your money (the principal) along with promised interest payments. This isn't the case with an equity investment. By becoming an owner, you assume the risk of the company not being successful. Just as a small business owner isn't guaranteed a return, neither is a shareholder. As an owner your claim on assets is lesser than that of creditors. This means that if a company goes bankrupt and liquidates, you, as a shareholder, don't get any money until the banks and bondholders have been paid out; we call this absolute priority. Shareholders earn a lot if a company is successful, but they also stand to lose their entire investment if the company isn't successful. Risk It must be emphasized that there are no guarantees when it comes to individual stocks. Some companies pay out dividends, but many others do not. And there is no obligation to pay out dividends even for those firms that have traditionally given them. Without dividends an investor can make money on a stock only through its appreciation in the open market. On the downside, any stock may go bankrupt, in which case your investment is worth nothing. Although risk might sound all negative, there is also a bright side. Taking-on greater risk demands a greater return on your investment. This is the reason why stocks have historically outperformed other investments such as bonds or savings accounts. Over the long term, an investment in stocks has historically had an average return of around 10%-12%. A great proof of the power of owning equities is General Electric. Stock Basics: Different Types of Stock There are two main types of stocks: common stock and preferred stock. Common Stock Common stock is, well, common. When people talk about stocks in general they are most likely referring to this type. In fact, the majority of stock issued is in this form. We basically went over features of common stock in the last section. Common shares represent ownership in a company and a claim (dividends) on a portion of profits. Investors get one vote per share to elect the board members, who oversee the major decisions made by management. Over the long term, common stock, by means of capital growth, yields higher returns than almost every other investment. This higher return comes at a cost since common stocks entail the most risk. If a company goes bankrupt and liquidates, the common shareholders will not receive money until the creditors, bondholders, and preferred shareholders are paid. Preferred Stock Preferred stock represents some degree of ownership in a company but usually doesn't come with the same voting rights. (This may vary depending on the company.) With preferred shares investors are usually guaranteed a fixed dividend forever. This is different than common stock, which has variable dividends that are never guaranteed. Another advantage is that in the event of liquidation preferred shareholders are paid off before the common shareholder (but still after debt holders). Preferred stock may also be callable, meaning that the company has the option to purchase the shares from shareholders at anytime for any reason (usually for a premium). Some people consider preferred stock to be more like debt than equity. A good way to think of these kinds of shares is to see them as being in between bonds and common shares. (If you don't understand bonds make sure also to check out our bond tutorial.) Different Classes of Stock Common and preferred are the two main forms of stock; however, it's also possible for companies to customize different classes of stock in any way they want. The most common reason for this is the company wanting the voting power to remain with a certain group; hence, different classes of shares are given different voting rights. For example, one class of shares would be held by a select group who are given ten votes per share while a second class would be issued to the majority of investors who are given one vote per share. When there is more than one class of stock, the classes are traditionally designated as Class A and Class B. Berkshire Hathaway (ticker: BRK), the company of Warren Buffett (one of the greatest investors of all time), has two classes of stock. The different forms are represented by placing the letter behind the ticker symbol in a form like this: "BRKa, BRKb" or "BRK.A, BRK.B". Blue chip, secondary issues, growth stock, and penny stock corporations can issue different types of stock. The basic two types of stock are common stock and preferred stock. Both types of stock have their pros and cons, so before buying a corporations stock, you must decide which one pleases you most. A common stock is the basic stock a corporation issues. It just shows that you own a fraction of the company. The common stocks are directly influenced by failures and successes of the company. Common stocks are more of a gamble. Since there is a higher chance of making profit, common stock owners are issued their dividends or profits after the preferred stock. After all the common stock has been issued, companies begin to distribute preferred stock. The preferred stock owners are given their dividends before the common stock owners are. Also, if the company goes out of business, and liquidates, the preferred stock owners are paid back the money they invested before the common stockholders are reimbursed. The main drawback of preferred stocks is that they cannot benefit as much from company profits because they are only paid a fixed dividend payment. There are also classes of preferred stock. These different classes are often labelled A,B,C and so on. The different classes usually have different market prices, restrictions, and dividend payments. When no one is buying a stock because of a high price, companies will often issue a stock split. When they issue a stock split, a company gives you more stock for your money. They simply distribute more stocks, and decrease the price for a stock. This just allows someone who doesn't have as much money to invest in a company. If you own stock in a company that splits two for one, you would get twice the amount of stocks that you had before, but each stock will have decreased in value by fifty percent. Stocks can split into any number, but they can also reverse split which means that the stocks double in value, but you only get to keep half the stocks you had before. In either split, you do not lose any money. It is just like trading in two five dollar bills for one ten dollar bill, or vice versa. There are more than 6,000 stocks to choose from, so investors usually like to put stocks into different categories. You can slice and dice the stock market into all sorts of different groups, but the most common ways are by size, style, and sector. By size When talking about a company's size, we're referring to its market capitalization, the current share price times the total number of shares outstanding. It's how much investors think the whole company is worth. Ford Motor, for example, has 1.8 billion shares outstanding, and in December 2004, each share was trading for $14, for a total market capitalization of about $25 billion. (Technically, if you had an extra $25 billion lying around, you could buy each share of stock, and own the whole company.) Is $25 billion a lot or a little? No official rules govern these distinctions, but below are some useful guidelines for assessing size. Large-cap companies tend to be established and stable, but because of their size, they have lower growth potential than small caps. General Electric, one of the most highly valued companies in the world with a market cap of more than $350 billion, has posted steady long-term returns, but don't expect it to double anytime soon. Over the long run, small-cap stocks have tended to rise at a faster pace. It's much easier to expand revenues and earnings quickly when you start at, say, $10 million than $10 billion. When profitability rises, stock prices follow. There is a trade-off, though. With less developed management structures, small caps are more likely to run into troubles as they grow -- expanding into new areas and beefing up staff are examples of potential pitfalls. (Of course, even corporate titans get into trouble. Witness the stock-price collapse of Merck in 2004.) By style A "growth" company is one that is expanding at an above-average rate. Cisco, for instance, increased its earnings nearly 40 percent a year in the late 1990s -- the average tends to run around 10 percent. Catch a successful growth stock early on, and the ride can be spectacular. But again, the greater the potential, the bigger the risk. Growth stocks race higher when times are good, but as soon as growth slows, those stocks tank. If you'd picked up 100 shares of Cisco in 1995, your stake would have cost you a little more than $3,000. By early 2001, that investment grew to $68,400. Cisco fell from grace, however. If you were unlucky enough to have purchased Cisco shares at their absolute peak price, you would have lost nearly 90 percent of your money by September 2002, when the stock was trading below $9. (It has recovered some ground since then, trading at about $20 in late 2004.) The opposite of growth is "value." There is no one definition of a value stock, but in general, it trades at a lower than average earnings multiple than the overall market. Maybe the company has messed up, causing the stock to plummet -- a value investor might think the underlying business is still sound and its true worth not reflected in the depressed stock price. A "cyclical" company makes something that isn't in constant demand throughout the business cycle. For example, steel makers see sales rise when the economy heats up, spurring builders to put up new skyscrapers and consumers to buy new cars. But when the economy slows, their sales lag too. U.S. Steel, the largest steel maker, lost money during the recession of 2001. Cyclical stocks bounce around a lot as investors try to guess when the next upturn and downturn will come. By sector Standard & Poor's breaks stocks into 10 sectors, and dozens of industries. Generally speaking, different sectors are affected by different things. So at any given time, some are doing well while others are not. In most cases, finance, health care, and technology tend to be the fastest growing sectors, while consumer staples and utilities offer stability with moderate growth. The other sectors tend to be cyclical, expanding quickly in good times and contracting during recessions. Sizing Up A Stock Category Market Cap Micro-cap Small-cap Mid-cap Large-cap Mega-cap less than $500 million $500 million to $2 billion $2 billion to $10 billion $10 billion to $100 billion $100 billion or more Sector Watch Sector Basic Materials Capital Goods Communication services Consumer cyclicals Consumer staples Energy Financial Health care Technology Utilities 4. Stock brokers Example Nucor (steel); International Paper (paper) Caterpillar (earth moving equipment); Boeing (aircraft) Verizon (local phone); Sprint (long distance) Goodyear (tires); Sony (electronics) Anheuser-Busch (beverages); Procter & Gamble (household products) Exxon/Mobil (petroleum); Schlumberger (oilfield equipment) Citigroup (banking); Wells Fargo (banking) Pfizer (drugs) Cisco Systems (Internet infrastructure); Nokia (cell phones) Southern Company (electric)