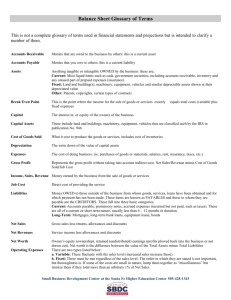

Glossary of Terms

advertisement

Glossary of Terms A Accounts Payable: Payments owed by a business to its vendors or suppliers for goods and services purchased. Accounts Receivable: Payments owed to a business by its customers for goods and services purchased. Accounts Receivable Collection Period: The average amount of time it takes to collect the money owed to a business from its customers. Accrued Expenses: Expenses that accumulate at regular intervals, such as each day, but which will be paid at a future date. Accumulated Depreciation: The cumulative amount of depreciation for the assets listed under property, plant, and equipment (PPE). Asset Intensity: The amount of assets required to generate an organization’s income. Assets: The items on a balance sheet showing the value of the property an organization owns that are expected to be used to generate future income. B Balance Sheet: A written statement of the financial condition of an organization at a specific point in time and specifying all of the organization’s assets and liabilities. Balanced Scorecard Movement: A management strategy pioneered by Robert Kaplan and David Norton designed to give a complete picture of an organization by focusing on finances, customers, internal processes, and learning and growth. Base Driver: A more detailed, lower-level performance measure on a financial value chain that is used to explain the movement in a higher, more broad financial measure. Benchmarking: The practice of comparing one’s own processes or services against the best practices of other highly regarded organizations with the goal of learning what others do that can be transferred into improving the processes of one’s own organization. Benefit-to-Cost Ratio: A ratio that shows how many dollars (or other monetary unit) of benefit were created for every one dollar of cost spent. Benefit-to-cost ratio is calculated by dividing the total gross benefits by the total costs of an intervention. Bottom Line: Gross sales minus cost of goods sold/cost of services, other sales-driven expenses, fixed expenses, taxes, interest, depreciation, and other one-time or special expenses. Also called net profit (or loss). C Calendar Year: A 12-month period beginning on January 1 and ending on December 31. May or may not correspond with the fiscal year. Capital: Funds, or other forms of assets and liabilities, used to generate income for an organization. Cash: An asset of an organization that is held in the form of coins, currency, checks, or money orders or the amount representing these items held in a bank account. Cash Flow Statement: A statement specifying sources and uses of cash over a particular period of time. Change Management: A proactive, systematic, and planned approach to changing an organization so that it will achieve its organizational vision and goals, with minimal disruption to the individuals within the organization and to the organization as a whole. Contribution Profit Margin: Equals the sales revenue minus cost of goods sold (COGS), revenue-driven expenses, and volume-driven expenses. Contribution Profit Margin Ratio: Ratio of contribution profit margin to sales revenue. Cost of Capital: The finance charges, or the cost of borrowing funds, to pay for an investment in a major new project for a business or to pay for other seasonal or extraordinary items. Cost of Goods Sold (COGS): The sum of material costs, labor costs, and direct overhead costs. Cost per Order Dollar (CPOD): Gross sales divided by sales-driven expenses. Provides a way to track if sales-driven expenses are dropping, holding steady, or rising to obtain the same level of gross revenue from customer orders. Current Assets: Assets that will be converted to cash within 1 year. Current Liabilities: Liabilities that will paid within 1 year. Current Ratio: Current assets divided by current liabilities. D Days Inventory Supply: The average number of days inventory is held before it is sold. Depreciation: The process of expensing the cost of a fixed asset over a useful life. The amount of the asset expensed is determined using one of several defined depreciation methods. E Earnings Before Income Taxes: Net sales (or revenue) minus all expenses except income taxes, specifically COGS, other revenue-driven expenses, fixed operating expenses, and interest expenses. Earnings Before Interest, Taxes, Depreciation, and Amortization (EBITDA): Calculated by looking at earnings after COGS, other sales-driven expenses, and fixed operating expenses have been removed from revenue, but before interest, taxes, depreciation, and amortization are taken into account. Effectiveness: Creating new or additional impact on an organization’s financial measures or financial statements such that the impact makes a significant or sizable difference to the success of the organization. Efficiency: Delivering the same level of benefit as before but at a lower intervention cost. F Financial Imperatives Scorecard: A format for tracking the benefits and costs of workplace learning and prevention interventions. Financial Metrics or Measures: Measures of value that are based strictly on financial or monetary considerations, such as COGS. Financial Ratios: Measures describing whether an organization is making enough return for its efforts. Ratios describe balance. Financial Statements: Written statements detailing an organization’s finances, including balance sheets, income statements, and cash flow statements. Together these statements give a presentation of the organization’s financial condition for a specific time period. Financial Value: The worth of a workplace learning and performance intervention as expressed in financial terms. Financial Value Chain: A cascading, linked set of measures where the leftmost measure is a broad, financially based measure of a Senior executive and the rightmost measure is a specific, performance-based measure of an Individual contributor. Financial Value Process: A process for connecting the merit or value of a workplace learning and performance intervention directly to the financial measures and goals of an organization. Financing Activities: A section on the cash flow statement that displays all of the changes in cash flow caused by management’s decisions to obtain or pay back debt. Transactions with owner’s equity, such as issuing or purchasing stock, also go in this section of the cash flow statement. Fiscal Year: A 12-month accounting period adopted by an organization starting on the first day of a specified month and ending on the last day of the twelfth month. May or may not correspond with the calendar year. Fixed Operating Expenses: Expenses that are incurred regardless of the level of production. An example would be the cost to pay a monthly lease on a building that houses a production plant. The monthly lease must be paid, even if the plant is shut down and not producing anything. Also referred to as fixed expenses. G Generally Accepted Accounting Principles (GAAP): In the United States, the Financial Accounting Standards Board (FASB) issues and regularly updates a huge set of statements that define acceptable accounting practices. Gross Profit: Net sales minus COGS. H Hoshin Process: A strategy based on identifying vital key issues in an organization and focusing on these issues at all levels of the organization. Human Performance Technology (HPT): A methodology that uses performance analysis, cause analysis, and intervention selection for solving problems or enabling new opportunities based on the improved performance of people. People may be classified in any combination of individuals, small groups, or large organizations. I Income Statement: A written financial statement showing details of revenues, costs, expenses, losses, and profits for a specific time period. Indicators: Measures where changes could imply that an intervention is or is not having the desired effect on the workplace. For example, if the goal of a stress management program is to reduce errors as a result of reduced stress, then a reduction in the error rate may mean that stress has indeed been reduced. Intervention: A systematic, planned response to an identified gap between current performance and desired performance. Can take many forms depending on the business conditions and allowable time frame for implementation. Also commonly referred to as programs, solutions, or strategies in workplace learning and performance literature. Inventory: The monetary value of the product a company has on hand but has not yet sold in the normal course of operating its business. Inventory may be referred to by its various states, such as raw materials, work in process, or finished goods. Investing Activities: A section on the cash flow statement that displays all of the changes in cash flow caused by investments made by the management of the organization. A common investment is the purchase of new property, plant, or equipment (PPE). J Just-in-Time (JIT) Inventory Management: A strategy in which raw materials and components that meet pre-specified quality levels are produced, or delivered from a supplier, immediately before they are needed in the manufacturing process. The underlying goal is to reduce waste from several areas of the production process such as waste from overproduction, transportation, processing methods, production defects, or production waiting or idle time. K Kano Model of Product Quality: A theory developed by Noriaki Kano describing levels of value perception. L Leverage: The amount of debt or borrowed money an organization is using to fund its operations. Leverage is not good or bad. If it is used wisely, it can have tax advantages or other beneficial impacts. Organizations that are highly leveraged (that is, carrying too much debt versus their assets) may be at great risk if any adverse business conditions arise that would cause them to be unable to pay their expenses. They may not be able to get any additional loans in an emergency. Such organizations may be forced into bankruptcy or driven out of business. Leverage Ratio: Total liabilities divided by owner’s equity. Liabilities: Debts and other financial obligations that an organization has at a particular point in time. Liquidity: A measure of the ease that a non-cash asset (such as real estate) can be converted into cash assets. Liquidity Ratio: See quick ratio. Long-Term Assets: Assets that will be held by an organization for more than 1 year from the date of the balance sheet. Long-Term Liabilities: Liabilities that will come due for an organization more than 1 year from the date of the balance sheet. M Managing Position: Maintaining the appropriate mix of the assets, liabilities, and owner’s equity of the organization. Market: A defined group of buying customers. Examples are: Eastern European small business owners, adults over age 50 in the United States, worldwide automobile consumers. Market Share: The percentage of sales for a type of product or service, made to a specific market, by a given company. For example, if Company X sold 15 percent of all scuba diving gear to consumers in Florida, Company X would have a 15 percent market share for this type of product, in this market. Material Costs: Also known as direct materials. Direct materials are all materials that become a part of the finished product of a manufacturing operation. Measures: See Financial Metrics or Measures; Performance Metrics or Measures. Metrics: See Financial Metrics or Measures; Performance Metrics or Measures. N Net Profit (or Loss): Gross sales minus cost of goods sold/cost of services, other sales-driven expenses, fixed expenses, taxes, interest, depreciation, and other one-time or special expenses. This is the proverbial bottom line. O Operating Activities: A section on the cash flow statement that displays all of the changes in cash flow caused by the normal day-to-day operation of the business. Increases or decreases in accounts receivable would be an example of changes from an operating activity. Operating Earnings: Contribution profit margin minus fixed expenses. Operating Expenses: See Fixed Operating Expenses. Operating Margin: The percentage difference between gross revenue (R) and operating costs (C), or . Operating Ratios: Measures of the relationships and balance between revenue and expenses and their corresponding assets and liabilities. Organizational Chain: The management structure of an organization expressed in broad layers or terms. Overhead: Costs that are not directly attributable to a specific product. Owner’s Equity: Total assets minus total liabilities. P Penetration: The total number of intervention attendees or intervention participants who successfully applied the intervention on the job. Performance Metrics or Measures: Measures of value that are based on an individual or organization’s performance, for example, an outstanding appraisal or the number of individuals trained in a particular area. Position: The financial condition of an organization. Positions can be fairly secure (healthy) or highly at risk (unhealthy) due to situations such as too much liabilities versus assets. Prepaid Expenses: Expenses that must be paid for before they are used. Profit: The amount of revenue or gain left over for a business after all expenses have been subtracted from revenue. Always a positive number. (The opposite of loss, which is always a negative number.) Profit and Loss Statement: Another name for income statement. Profit Line: One of several lines in an income statement detailing contribution profit margin, operating earnings, earnings before income tax, or net profit (or loss). Profit Ratio: The ratio of one of the profit lines to the net sales (revenue). Q Quick Ratio: Total amount of current assets less inventory, divided by current liabilities. R Ratio: The result of dividing one value by another. In financial terms, ratios are indicators of the amount of balance between different factors. Examples include the amount of assets versus liabilities or the amount of a line of profit versus revenue. Return-on-Assets (ROA): Net income divided by net operating assets, expressed as a percentage. Return-on-Equity (ROE): Net income divided by owner’s equity, expressed as a percentage. Return-on-Investment (ROI): Net return divided by investment, expressed as a percentage. The return may refer to earnings, income, profit, gain, or appreciation in value. Investment means the amount of capital used to generate the return. Frequently refers to the return gained and the investment made in a 1-year period. Specifically, ROI equals , where R is the total return and I is the total investment cost. Rework Rate: Percentage of goods or actions that are defective or of low quality that they must have additional work added to them before they can be sold or accepted. S Sales Mix: The balance of products and services sold as related to their price and volume. Seasonality: The naturally occurring cycles of variations in sales levels or other measures during the course of the year. Shareholder’s Equity: The equivalent of owner’s equity in a corporation. Source and Application of Funds: Another name for cash flow statement. Speed: How quickly the benefits of the intervention can be obtained. Statement of Operations: Another name for income statement. Statement of Utilization of Funds: Another name for cash flow statement. Succession Plans: Plans created within an organization to identify and then develop one or more potential successors for key positions within the organization. Sustainability: The length of time participants who apply the WLP intervention continue to do so. T Total Quality Management: An organizational management approach to managing the process, culture, innovation cycle, and customer satisfaction goals of an organization through a focus on continuous improvements in quality and value. V Value: The relative worth, importance, utility, or degree of excellence of something or someone. Value Add: A column on the financial imperatives scorecard describing the amount of financial change an intervention has, or is expected to create for an organization. Value Communication: Clearly and succinctly describing the value of your interventions in terms of the measures that your audience is judged by. Value Connection: The connection between the employee’s contribution and its benefit to his or her target audience. Value Lifecycle: A set of urgent and important activities corresponding to the annual budget and planning cycle, product development cycle, or seasonal sales cycle of an organization. Value Statement: A concise description of value that translates performance improvement into financial improvement relevant to the listener’s current priorities. The value is linked to a goal that the person making the statement would like to achieve next to add even more value to an organization. Value Theme: A statement of a specific intervention to an organizational problem or an activity that will have a positive effect on a financial measure, in terms of how and why that problem or measure will be affected. W White Paper: Documents of 10-20 pages that can be read in 30-60 minutes. White papers summarize the position, approach, framework, issues, strategies, trends, and/or conclusions about a particular topic from the group producing the white paper. White papers may be produced internally to an organization and remain confidential or may be publicly distributed by government agencies, special interest groups, marketing organizations, technology groups, or research committees. Workplace Learning and Performance (WLP): Professional activity focused on improving productivity in the workplace through learning, training, or other performance improvement processes, programs, and interventions.