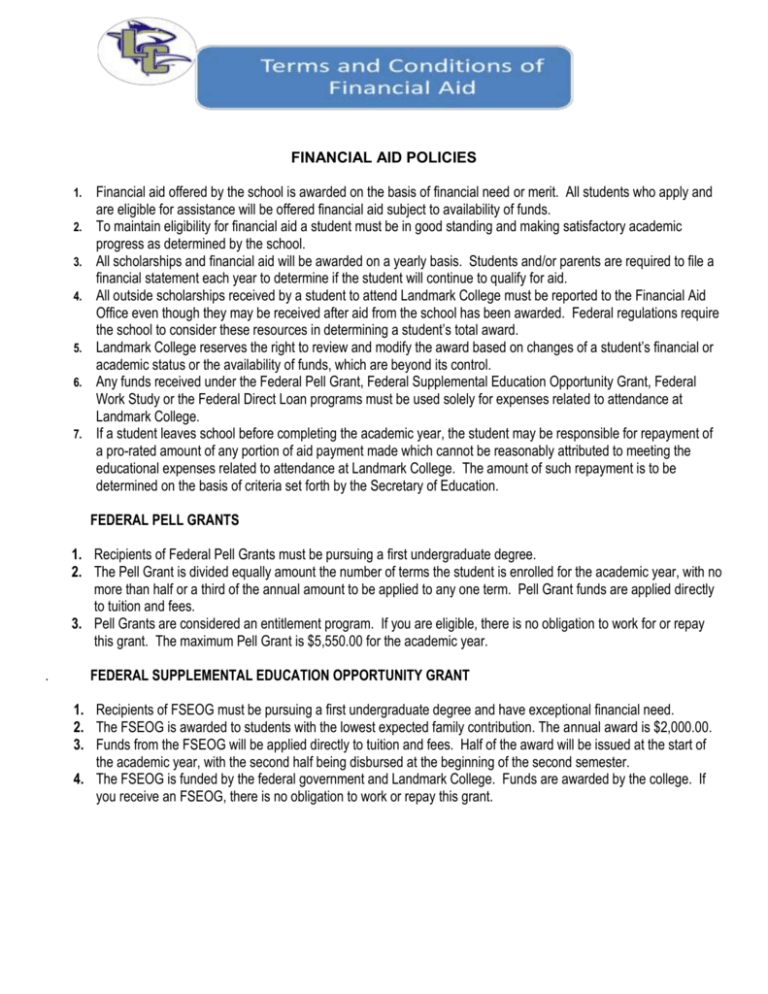

terms and conditions of fiancial aid

advertisement

FINANCIAL AID POLICIES 1. 2. 3. 4. 5. 6. 7. Financial aid offered by the school is awarded on the basis of financial need or merit. All students who apply and are eligible for assistance will be offered financial aid subject to availability of funds. To maintain eligibility for financial aid a student must be in good standing and making satisfactory academic progress as determined by the school. All scholarships and financial aid will be awarded on a yearly basis. Students and/or parents are required to file a financial statement each year to determine if the student will continue to qualify for aid. All outside scholarships received by a student to attend Landmark College must be reported to the Financial Aid Office even though they may be received after aid from the school has been awarded. Federal regulations require the school to consider these resources in determining a student’s total award. Landmark College reserves the right to review and modify the award based on changes of a student’s financial or academic status or the availability of funds, which are beyond its control. Any funds received under the Federal Pell Grant, Federal Supplemental Education Opportunity Grant, Federal Work Study or the Federal Direct Loan programs must be used solely for expenses related to attendance at Landmark College. If a student leaves school before completing the academic year, the student may be responsible for repayment of a pro-rated amount of any portion of aid payment made which cannot be reasonably attributed to meeting the educational expenses related to attendance at Landmark College. The amount of such repayment is to be determined on the basis of criteria set forth by the Secretary of Education. FEDERAL PELL GRANTS 1. Recipients of Federal Pell Grants must be pursuing a first undergraduate degree. 2. The Pell Grant is divided equally amount the number of terms the student is enrolled for the academic year, with no more than half or a third of the annual amount to be applied to any one term. Pell Grant funds are applied directly to tuition and fees. 3. Pell Grants are considered an entitlement program. If you are eligible, there is no obligation to work for or repay this grant. The maximum Pell Grant is $5,550.00 for the academic year. . FEDERAL SUPPLEMENTAL EDUCATION OPPORTUNITY GRANT 1. Recipients of FSEOG must be pursuing a first undergraduate degree and have exceptional financial need. 2. The FSEOG is awarded to students with the lowest expected family contribution. The annual award is $2,000.00. 3. Funds from the FSEOG will be applied directly to tuition and fees. Half of the award will be issued at the start of the academic year, with the second half being disbursed at the beginning of the second semester. 4. The FSEOG is funded by the federal government and Landmark College. Funds are awarded by the college. If you receive an FSEOG, there is no obligation to work or repay this grant. FEDERAL WORK STUDY 1. Work-study opportunities are available in a variety of locations on campus. A student is expected to complete a W4 and I-9 employment forms to be used for payroll and tax purposes. 2. There are no minimum hours; however, students should always consider their academic demands as a priority. Actual earning may very somewhat from the award as they are dependent upon the number of hours worked and the hourly rate of pay. 3. Federal Work Study grants are funded by the federal government and Landmark College. Funds are awarded by the college, with an average award of $1,000 for the academic year. FEDERAL DIRECT LOAN PROGRAM 1. Subsidized/Unsubsidized a. Loan proceeds will be received at the start of each academic term, and will be applied directly to tuition and fees, or used for off campus living expenses. b. Funds are disbursed by electronic means and will be applied directly to the student’s account. Students will be notified in writing within 30 days that the funds have been received. 2. Parent Plus Loan a. The maximum PLUS loan amount a parent may qualify for is the cost of attendance minus all other financial aid received. Interest begins accruing immediately upon disbursement, with repayment of the loan beginning within 60 days of the final disbursement. b. Loan proceeds will be received at the start of each academic term and applied directly to tuition and fees. Any credit balance can be refunded to the borrower and used for additional educational expenses. c. Funds disbursed by electronic means will be applied directly to the student’s account. Parents will be notified in writing within 30 days that the duns have been received. ESTIMATED OR ACTUAL VOCATION REHABILITATION GRANTS 1. All known or estimated funds from the Department of Vocational Rehabilitation will be included as a source of financial assistance. The final award may vary and adjustments will be made to the total award package if necessary. CREDIT AND NON-CREDIT COURSE WORK 1. Federal financial aid is based on a student’s enrollment status. Students are eligible to receive financial aid while enrolled in non-credit courses for up to 10 courses. 2. Students returning for a second or consecutive year must be enrolled in one, two or more credit courses to continue their eligibility. a. Federal PELL grants will be pro-rated according to the number of credit courses the student is enrolled in. b. FSEOG and Work Study are not pro-rated; the student may be enrolled in one, or more credit courses. c. Subsidized/Unsubsidized and PLUS loan eligibility requires the student to be enrolled in at least two credit courses. d. Landmark Scholarships, Vocational Rehabilitation Grants and most other private scholarships are usually not effected by the enrollment in credit or non-credit courses. Financial Aid office, River Road South, Putney VT 05346 (Fax) 802.387.6868 or e-mail to JenniferDesmarais@landmark.edu

![Bourse Loran Scholarship [formerly the CMSF National Award]](http://s3.studylib.net/store/data/008459991_1-b0aaf3db7ad79ae266d77380f9da023a-300x300.png)