ACT2291 Principles of Accounting I - the Sorrell College of Business

advertisement

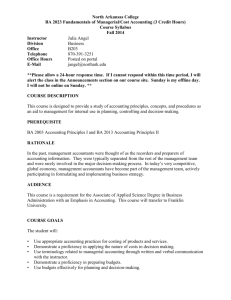

TROY UNIVERSITY SORRELL COLLEGE OF BUSINESS Principles of Accounting II ACT 2292 TBWA Summer 2011 Instructor: Dr. Eddy J. Burks, DBA, CPA Office Hours: Office Location: Office Phone #: Instructor Email: Classroom Location: Class Time: Prerequisites: M-TH 8:30-10:30 W 3:30-5:30 McCartha 201 334-670-3149 eburks@troy.edu GAB 101 MTWTH 10:30-12:50 ACT 2291 Description Modern financial accounting theory and practices applied to sole proprietorships, partnerships, and corporations. PurposeTo enhance understanding of how basic financial transactions are recorded and analyzed. This class is a core requirement for all undergraduate business programs. Objectives On completion of the course, the student should be able to: 1. Describe how accounting transactions are recorded. 2. Discuss the operating, financing, and investing activities of business entities. 3. Explain how accounting transactions flow through general-ledger accounts and financial statements. TEXTBOOK(S) AND/OR OTHER MATERIALS NEEDED You should already have a book that you used in ACT2291 principles of accounting. You may already have the access codes to CengageNow. Continue using them. ACT 2292 XTIH, Accounting (Custom Package), Warren, Carl S., 23RD 09, 0-538-77505-X, SouthWestern Publishing Co Here is the direct link for students to purchase their CengageNOW access code: Warren Accounting 23e: www.cengage.com/ichapters/tucnowbb2 Students can also go to www.ichapters.com CENGAGENOW online homework system for Blackboard is used in this course. You will need an access code. This access code is packaged with the textbook from Troy University Bookstore. Do not misplace this code. If you purchase a USED text you will need additional materials. Students who do not purchase the required bundle from MBS will be required to purchase the access code for CengageNOW separately. Students should have their textbook from the first week of class. Not having your textbook will not be an acceptable excuse for late work. Students who add this course late should refer to the “Late Registration” section for further guidance. Required: CengageNOW. 2 Grading Methods: Test 1 Test 2 100 points 100 COMP FINAL 200 90%-100% 80%-89% 70%-79% 60%-69% below 60% A B C D F QUIZZES 100 Homework100 Total 600 points Examinations: Tentative examination dates are indicated on the syllabus. More information on the content and format of the exams will be provided as the material is covered in class. The tentative format for each exam includes multiple-choice and problems. If an exam is missed a comprehensive final must be taken at the end of term. A grade of zero will be recorded for the second missed exam.. Programmable calculators (those that store text) are not permitted on the exams. Calculators without text storage capability are allowed. Homework: Complete homework in CengageNow. It is automatically graded. Class Procedure: Class will be a mixture of lecture and student discussion. Student participation in the class discussion is strongly recommended and encouraged as a vital part of the learning process. It is the instructor’s opinion and recommendation that students should spend at least 10-15 hours per week preparing for this class. Students should read the appropriate chapter prior to coming to class. Attendance Policy: In registering for classes at the University, undergraduate and graduate students accept responsibility for attending scheduled class meetings, completing assignments on time, and contributing to class discussion and exploration of ideas. If a student does not attend class during the first two weeks (first 14 calendar days) of the semester, and does not give prior notification to the instructor of reasons for absence and intent to attend the class, the student will be required to drop the course. It is the responsibility of the student to drop the course or to withdraw from the University according to University policy. A faculty member may excuse absences and allow students to make up work if the faculty member deems the absence legitimate. A faculty member is not expected to provide make-up opportunities for a student without a legitimate excuse. Official excuses are granted by the office of the Executive Vice Chancellor and Provost for authorized University activities, and must be honored by the faculty. Students receiving financial aid benefits are required to attend classes according to the regulations for financial aid benefits in addition to those regulations required for the course. (See the Oracle.) Inclement Weather and Emergency Situations: Both faculty and students are responsible for meeting all assigned classes. In the event of inclement weather, faculty and students will be expected to attend classes as usual as long as they may do so without risking peril to themselves or to others. During periods of inclement weather, faculty and students will not be penalized for 3 absences dictated by perilous conditions. In severe cases of inclement weather or other emergency conditions, the University will announce cancellation of classes through the local and regional media as well as through the University’s web site. The cancellation announcement may be specific to Alabama campuses or national or international sites across the University. Policies and Procedures for Disability Services Troy University supports Section 504 of the Rehabilitation Act of 1973 and the Americans with Disabilities Act of 1990, which insure that postsecondary students with disabilities have equal access to all academic programs, physical access to all buildings, facilities and events, and are not discriminated against on the basis of disability. Eligible students, with appropriate documentation, will be provided equal opportunity to demonstrate their academic skills and potential through the provision of academic adaptations and reasonable accommodations. Further information, including appropriate contact information, can be found at the link for Troy University’s Office of Human Resources at http://www.troy.edu/humanresources/index.html. Academic Misconduct/Plagiarism Statement: (taken from Oracle Student Handbook) By enrollment at the University, a student or organization neither relinquishes rights nor escapes responsibilities of local, state, or federal laws and regulations. The “STANDARDS OF CONDUCT” are applicable to behavior of students and organizations on and off the university campus if that behavior is deemed to be incompatible with the educational environment and mission of the university. A student or organization may be disciplined, up to and including suspension and expulsion, and is deemed in violation of the “STANDARDS OF CONDUCT”, for the commission of or the attempt to commit any of the following offenses: 1. Dishonesty, such as cheating, plagiarism or knowingly furnishing false information to the University, faculty or other officers or employees of the University. 2. Forgery, alteration or misuse of university documents, records or identification. For full list of offenses please see the Student Handbook (Oracle) Other Information: As deemed appropriate will be provided by the instructor. ACT 2292 Chapter 12 Chapter 13 Principles of Accounting II Course Outline Accounting for Partnerships and Limited Liability Companies self exam questions 1-5 Exercises: 1,3,5,10,12,16,17,19,21 Corporations: Organization, Capital Stock Transactions, and Dividends self exam questions 1-5 Exercises: 2,4,6,9,13,15,16,19,22,24,25 Chapter 14 Bonds Payable and Investments in Bonds self exam questions 1-5 Exercises: 1,3,4,5,8,10,12,15,19 Chapter 16 Statement of Cash Flows self exam questions 1-5 4 Exercises: Chapter 17 2,4,6,8,10,15,17,19,22 Financial Statement Analysis self exam questions 1-5 Exercises: 2,3,5,6,8,13,15,17,19,21 Chapter 18 Introduction to Managerial Accounting self exam questions 1-5 Exercises: 1,3,5,9,11,13,15,17 Chapter 19 Job Order Costing self exam questions 1-5 Exercises: 2,4,6,8,10,12,14,16 Chapter 20 Process Cost Systems self exam questions 1-5 Exercises: 5,7,8,10,12,14,16 Chapter 21 Cost Behavior and Cost-Volume-Profit Analysis self exam questions 1-5 Exercises: 1,2,5,6,7,10,11,13,15,24,25 Chapter 22 Budgeting self exam questions 1-5 Exercises: Chapter 23 2,3,5,7,9,11,14,15,17 Performance Evaluation Using Variances from Standard Costs self exam questions 1-5 Exercises: 1,3,5,7,12,13,15 Note: This outline is intended to be minimum coverage of concepts. Other concepts may be covered at the instructor’s discretion. Dates: June 22 first day of class June 29 Exam 1 chapters 12,13,14 July 14 Exam 2 chapters 16,17,18,19,20,21 July 20 June 22 23 27 28 29 Comprehensive Exam chapters 1 – 23 (last day of class) Chap 12 chap12/13 chap 13/14 chap 14 Exam1 5 July 5 chap 16 6 chap17 7 chap 18 11 chap 19 12 chap 20 13 chap 21 14 Exam 2 18 chap 22 19 chap 23 20 Comprehensive Final