GRADE 11 WEEK 10 - LESSON 1 of 4 LESSON 33 INVENTORY

advertisement

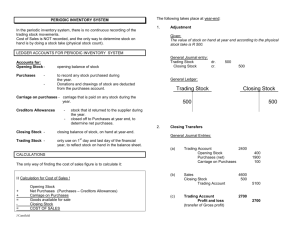

GRADE 11 LESSON WEEK 10 - LESSON 1 of 4 33 INVENTORY SYSTEMS Perpetual inventory system Periodic Inventory System The movement of stock is recorded on an ongoing or continuous basis. The exact quantities and types of stock items on hand are shown by the system at any point in time. Undertakings that are selling one type of commodity, like furniture, cars, or computers will make use of the perpetual stock method. The physical stocktaking is conducted to verify the stock on hand. There is no continuous recording of the movement of trading stock. The value of the trading stock on hand cannot be worked out during the financial year. It is used by businesses like supermarkets that sell large quantities of trading stock with low value. The value of the stock on hand at the financial year-end is calculated by doing a physical stocktaking. COMPARISON BETWEEN PERPETUAL AND PERIODIC INVENTORY SYSTEMS PERIODIC SYSTEM Stock purchases are recorded in the Purchases account – expense account Carriage on purchases/ custom duties are recorded directly in the Carriage on purchases / Custom duties account Returns on stock purchases are credited in the Purchases account Donations of stock are credited in the Purchases account Drawings of stock are credited in the purchases account A stock-take is conducted periodically to determine the amount of stock on hand There is no cost of sales account. A calculation is required to determine the cost of sales 33 - ACCOUNTING GRADE 11 - CAPS PERPETUAL SYSTEM Stock purchases are recorded in the trading stock account – asset account Carriage on purchases/ custom duties are recorded in the trading stock account Returns on stock purchases are credited in the trading stock account Donations of stock are credited in the trading stock account Drawings of stock are credited in the trading stock account The balance of the trading stock account is the amount of stock which should be on hand. A stock-take is conducted to verify this amount and determine stock losses / deficits The cost of sales is calculated on a continuous basis 1 IMPORTANT Perpetual stock system Periodic stock system The Trading stock account is The Purchases account is used used when goods are bought. when goods are bought When goods are returned the When goods are returned the Trading stock is credited. Purchases account is credited (recently changed) Cost of sales is calculated with every sale and returns. Cost of sales is not calculated with every sale or returns. In order to determine Cost of sales a calculation is required. Cost of sales is only determine at the end of the month or at the end of the financial year. PERIODIC SYSTEM means NEVER use the TRADING STOCK ACCOUNT (during the financial year) the use ALWAYS PERPETUAL SYSTEM means PERIODIC - ADVANTAGES It is cost effective as there is expensive equipment like bar codes and scanning equipment It is not necessary to calculate cost of sales on a continuous basis This system is suitable for businesses where it is difficult to determine the cost price of individual items PERIODIC - DISADVANTAGES Control over stock is not very effective Theft is not quickly detected – a stock-take is necessary to determine leakages or theft No trading stock deficit can be calculated – the business does not know how much stock they should have 33 - ACCOUNTING GRADE 11 - CAPS 2 PERIODIC INVENTORY CALCULATION OF COST OF SALES Opening stock Value of the stock at the beginning of the year Closing stock Value of stock at the end of the year obtained by conducting a physical stock taking. The closing stock at the end of the year becomes the opening stock at the beginning of the next year Purchases of trading stock (cash and credit) Purchases Creditors allowances Returns of goods to creditors Net purchases Net sales Purchases less creditors allowances less donations of stock less drawings of stock Sales less debtors allowances Gross profit Sales less cost of sales FORMULA TO CALCULATE COST OF SALES Opening stock Plus Purchases Carriage on purchases Other buying expenses Less Closing stock Cost of sales xxx xxx xxx xxx xxx (xx) xxx Other buying expenses custom duties freight costs import duties / taxes harbour / dock charges Remember Carriage on sales does not affect cost of sales – it goes to Profit and Loss account CALCULATING GROSS PROFIT Sales – Cost of sales = Gross profit % Gross profit on cost of sales = gross profit x 100 Cost of sales 1 % Gross profit on sales = gross profit x 100 sales 1 33 - ACCOUNTING GRADE 11 - CAPS 3 EXAMPLE Use the following information to calculate the cost of sales on the last day of the accounting period on 28 February 201 3 Stock – 1 March 2012 Purchases for the year Carriage on purchases Custom duty Stock 28 February 2013 R60 000 R450 000 R20 000 R5 000 R35 000 Answer Opening stock Plus Purchases Carriage on purchases Custom duty R 60 000 450 000 20 000 5 000 535 000 Less Closing stock Cost of sales 35 000 500 000 ACTIVITY 1 1.1 Use the following information to calculate the purchases for the year ended 28 February 2013 Credit sales Carriage on purchases Allowances to debtors Cost price of goods on 1 March 2012 Cost price of goods on 28 February 2013 Cost of sales ANSWER 33 - ACCOUNTING GRADE 11 - CAPS R90 000 R8 000 R5 500 R20 000 R40 000 R67 000 4 1.2 The following information was taken from the accounting records of three separate businesses. Calculate the unknown amounts and percentages on 29 February 2012 INFORMATION Balances on 29 February 2012 Opening Stock Purchases Carriage on purchases Cost of goods available for sales Less Closing stock Cost of sales Gross profit Sales Gross profit on cost of sales Gross profit on turnover Business A 60 000 A 8 000 198 000 55 000 B 71 500 214 500 C 33,33% Business B 56 000 120 000 7 500 D E 135 500 54 200 F 40% G ANSWER A B C D E F G H I J K L 33 - ACCOUNTING GRADE 11 - CAPS 5 Business C 48 000 115 000 H 169 000 I 130 000 J 208 000 K L ANSWERS LESSON 33 ACTIVITY 1. 1.1.Use the following information to calculate the purchases for the year ended 28 February 2013 Opening stock Purchases ??? Closing Stock Cost of sales 20 000 87 000 107 000 \ (40 000) 67 000 1.2 The following information was taken from the accounting records of three separate businesses. Calculate the unknown amounts and percentages on 29 February 2012 A 198 000 – (8 000 +60 000) = 130 000 B 198 000-55 000 = 143 000 D 56 000 + 120 000 + 7 500 =183 500 G Gross profit x 100 Sales 54 200 x 100 = 28.57% 189 700 J 208 000 -130 000 =78 000 E 183 500 – 135 500 = 48 000 H 169 000 – (48 000+115 000) = 6 000 K Gross profit x 100 Cost of sales 78 000 x 100 = 60% 130 000 33 - ACCOUNTING GRADE 11 - CAPS 6 C Gross profit x 100 Cost of sales 71 500 x 100 = 50% 143 000 F 135 500+ 54 200 =189 700 I 169 000 – 130 000 =39 000 L Gross profit x 100 Sales 78 000 x 100 = 37.5% 208 000