Local Dedicated Sales Tax for Transit

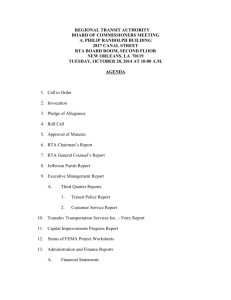

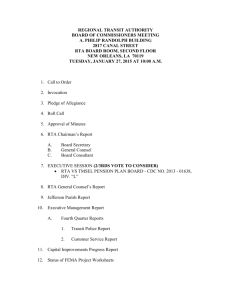

advertisement