Atlanta Area Realtors Pay $160,000 to Settle Claims of Housing

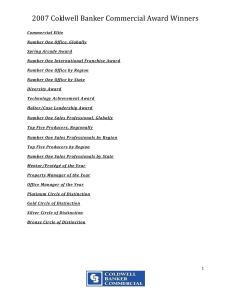

advertisement

For Immediate Release Contact: Deidre Swesnik, (202) 898-1661, dswesnik@nationalfairhousing.org COLDWELL BANKER COMPANY PAYS $160,000 TO RESOLVE HOUSING DISCRIMINATION LAWSUIT Department of Justice Filed Lawsuit after National Fair Housing Alliance Investigation Revealed Race Discrimination WASHINGTON – February 3, 2010 – Atlanta real estate firm Coldwell Banker Joe T. Lane Realty, Inc., its successor-owner Coldwell Banker Bullard Realty Company, Inc., and the companies’ former real estate agent Rodney Lee Foreman have agreed to pay $160,000 to settle a race discrimination lawsuit filed by the United States Department of Justice (DOJ) and the National Fair Housing Alliance (NFHA). The settlement, which awaits approval from a federal court in Atlanta, Ga., is believed to be the largest real estate sales discrimination settlement involving a single agent’s behavior in ten years. NFHA conducted a series of tests of Coldwell Banker Joe T. Lane from late 2003 into 2004 in which two testers posed as home seekers looking for properties in the same price range. NFHA sent one white tester (mystery shopper) and one African-American tester with slightly better financial qualifications to the real estate agency to document in which areas real estate agents would show and market homes. These testers had identical housing preferences. According to the NFHA and the United States’ complaints, testing revealed that Rodney Foreman discriminated on the basis of race. Foreman steered the white homeseekers away from interracial neighborhoods where African Americans lived and into white neighborhoods. He then steered African-American homeseekers away from white neighborhoods and into predominantly African-American neighborhoods. The lawsuit alleged that Foreman’s steering was conscious and deliberate. During one test, Foreman allegedly told a white tester that he had compiled two listings of homes to visit – one for an African-American buyer and one for a white buyer - because he could not determine the tester’s race over the telephone. Once Foreman saw the tester was white, he threw away one stack of listings. While taking the same tester to visit potential homes, he said, “Once Blacks move in then property values go down, it is impossible to sell your house…I want you to be able to re-sell your house.” NFHA presented this evidence to the U.S. Department of Housing and Urban Development (HUD) in the form of an administrative complaint in 2005. For unknown reasons it took HUD’s Office of Systemic Investigations three years to find probable cause and charge the complaint. NFHA elected to have the charge proceed in federal court, so the Justice Department filed suit on behalf of NFHA in the Northern District of Georgia in January 2009. NFHA subsequently intervened as a party in the Department of Justice lawsuit. “Five years after submitting this strong evidence of discrimination, we are pleased to see this matter finally resolved,” said NFHA President and CEO Shanna L. Smith. “Racial steering by real estate agents is a serious violation of the Fair Housing Act. It illegally limits housing choices for all homebuyers and perpetuates neighborhood segregation. Agents should understand that illegal steering practices will no longer go unchallenged. Congress intended the Fair Housing Act to eliminate discriminatory housing practices and promote residential diversity. Moving forward, NFHA will continue to test real estate companies for racial steering and bring actions against those that violate the law.” Under the Fair Housing Act it is illegal to discriminate on the basis of race, color, religion, national origin, gender, disability, or familial status. The Department of Justice and NFHA alleged that Coldwell Banker Bullard Realty was liable for Rodney Foreman and Coldwell Banker Joe T. Lane Realty’s violations because it purchased the assets of Joe T. Lane Realty in 2007. Defendants denied liability. This settlement follows a similar complaint NFHA filed involving a single agent working for Chicago-area real estate company Re/Max East-West. The Justice Department brought the case on behalf of NFHA and it settled for $120,000. Founded in 1988, the National Fair Housing Alliance (www.nationalfairhousing.org) is a consortium of more than 220 private, non-profit fair housing organizations, state and local civil rights agencies, and individuals from throughout the United States. Headquartered in Washington, DC, the National Fair Housing Alliance, through comprehensive education, advocacy and enforcement programs, provides equal access to apartments, houses, mortgage loans and insurance policies for all residents of the nation.