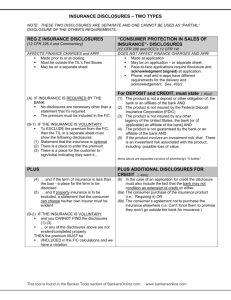

Reference for Disclosure in Annual Reports

advertisement