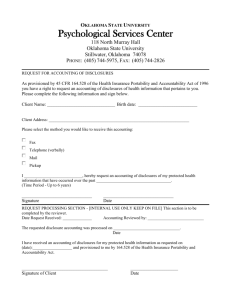

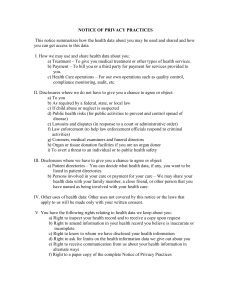

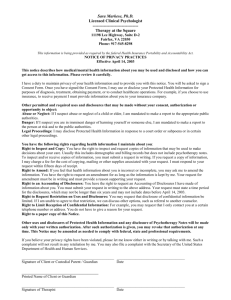

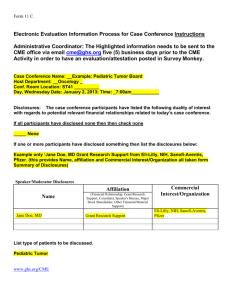

Reference for Disclosure in Annual Reports

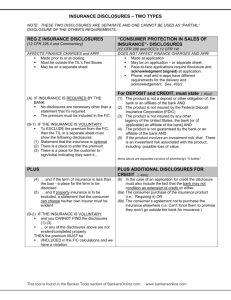

advertisement