1 - Hong Kong Bar Association

advertisement

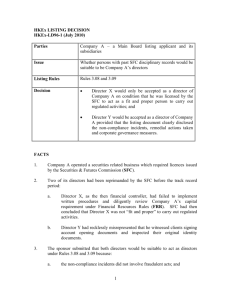

HONG KONG BAR ASSOCIATION'S COMMENTS ON SFC’S DRAFT DISCIPLINARY FINING GUIDELINES INTRODUCTION 1. The Draft SFC Disciplinary Fining Guidelines (“the Fining Guidelines”) are made pursuant to Clause 187(7) of the Securities and Futures Bill (“the Bill”). By way of the Fining Guidelines, the SFC seeks to set out the considerations which are relevant to the determination of the level of fine that it should impose on a regulated person guilty of misconduct in the context of Clause 187(2) of the Bill. FINE AS INTERMEDIARY SANCTION 2. The SFC regards a fine as an intermediary sanction between a reprimand and a suspension/revocation of a licence. However, such categorisation of a fine does not appear to be reflected in Clause 187 of the Bill because of the following reasons:(1) Clause 187(1) only deals with revocation/suspension of a licence, reprimand and prohibition regarding future application for licence whilst “pecuniary penalty” is mentioned in Clause 187(2). Different kinds of penalty are not ranked in accordance with the severity they are supposed to carry in the Bill. (2) Further, in respect of all kinds of penalty for a regulated person guilty of misconduct, the overriding consideration for the SFC as stated in the Bill is the same i.e. whether, in the opinion of the SFC, the regulated person is not a fit and proper person to be or to remain licensed, or to be or to remain a responsible officer, or a person involved in the management of the business, of a licensed person. NO FINE IF ANOTHER PENALTY WARRANTED 3. As specifically stated in the Preamble of the Fining Guidelines, the SFC will not impose a fine if only a private or public reprimand is warranted in view of the circumstances of the case. What should naturally follow is that the SFC will not revoke or suspend a licence if only a fine is warranted in a particular case. The corollary is that a fine and another kind of penalty imposed under Clause 187(1) of the Bill are mutually exclusive. However, such mutual exclusivity appears to be inconsistent with Clause 187(2) of the Bill which states that the SFC may “separately or in addition to any power exercisable under subsection (1), order the regulated person to pay a pecuniary penalty”. In other words, a fine may be the only penalty or one of the penalties to be imposed. GENERAL CONSIDERATIONS 4. The first part of the Fining Guidelines deals with “general considerations” which are intended to make a distinction between:(1) conduct which should be regarded as more serious and thus deserving a higher level of fine (for example, conduct which is intentional or conduct which damages the market integrity or causes loss to others); and (2) 5. conduct which should be regarded as less serious and thus deserving a lower level of fine (for example, negligent conduct or conduct which causes little damage to market integrity or little cost on others). It is submitted that the general considerations will not serve any useful purpose in determining the level of fine because of the following reasons:(1) The general considerations only provide an artificial difference between more serious conduct and less serious conduct. It is difficult to evaluate the seriousness of conduct by simply resorting to the general considerations. For example, if some conduct is intentional but causes little adverse effect on the market integrity, it is unclear whether such conduct should be regarded as more serious or less serious. On the contrary, if some inadvertent or negligent conduct causes substantial impact on the market integrity or loss to other parties, one can hardly determine how to categorise such conduct in the light of the general considerations. (2) In any event, all the factors stated under general considerations are contained in part 2 of the Fining Guidelines i.e. specific considerations. This gives rise to the question whether it is necessary to have a distinction between “general considerations” and “specific considerations” in the Fining Guidelines. It is suggested that all factors be placed under the heading of “relevant considerations”. SPECIFIC CONSIDERATIONS 6. Part 2 of the Fining Guidelines, namely, “Specific considerations”, consists of four sections:(1) The nature and seriousness of the conduct (“Section A”). (2) The amount of profits accrued or loss avoided (“Section B”). (3) The size, financial resources and other circumstances of the firm or individual (“Section C”). (4) Other relevant factors (Section D”). SECTION A 7. The third factor under Section A is whether the conduct was intentional or reckless, including whether prior advice was sought. However, before looking at whether prior advice was sought, it is more important to first examine whether in the light of the conduct/practice involved, it was reasonable for the regulated person to obtain advice. 8. The fifth factor under Section A is whether the conduct is widespread in the relevant industry. In this regard, it is believed that one relevant question which could be specifically set out is how long such conduct/practice has been in place in the relevant industry. 9. The seventh factor under Section A concerns whether a breach of fiduciary duty was involved. However, the mere existence of a breach of fiduciary duty may be 2 neither here nor there. The crucial factors are always those regarding the nature and the effect of the conduct, which are already contained in the Fining Guidelines. 10. The final factor in this section deals with whether the conduct reveals serious or systematic weakness in a firm’s system. What can be further considered is whether the firm, with reasonable efforts, should have been able to identify the risk in the system and eliminate the same. SECTION B 11. It is submitted that it is not necessary to have a separate Section B under the heading of “The amount of profits accrued or loss avoided” because:(1) The factor regarding the loss to other people caused by the conduct is dealt with in Section A i.e. “The nature and seriousness of the conduct”. The question whether a firm or individual and related parties benefit from the conduct which is associated with the loss factor, should be considered in Section A. (2) The second point of Section B simply states that a fine should have deterrent effect. It has nothing to do with the amount of profits accrued or loss avoided. 12. In view of the points raised in paragraph 11 above, it is suggested that Section B be deleted and the first point under Section B should be placed under Section A. Further, as stated in Clause 187(2) of the Bill, the fine should not exceed HK$10,000,000 or 3 times the amount of the profit secured or loss avoided, whichever is greater. In the circumstances, the Fining Guidelines should stipulate whether in a case which involves profit gained or loss avoided by the regulated person, the level of fine should automatically be based on the amount of such profit or loss. This may give rise to the following questions:(1) A substantial profit may be obtained by simply a negligent act or a technical breach. In this case, the level of a fine, if based on the amount of profit, may not reflect the degree of seriousness of the conduct. (2) On the contrary, certain conduct may lead only to little or no profit gained by the regulated person but a substantial loss to its clients. In that case, the level of fine, if based on the amount of the profit, again may not be commensurate with the impact of such conduct. 13. Given the deterrence value of a fine, it is necessary to consider the prevalence of the conduct in question or similar conduct in Hong Kong while determining the level of fine in a particular case. SECTION C 14. The first point of Section C apparently concerns the effect of a fine on a firm or individual. Obviously, a most relevant factor in this regard is the financial situation of a firm or individual. However, it is interesting to note that an example of a firm or individual taking deliberate steps to dissipate assets is 3 mentioned. It is unclear why this particular example is raised whilst the financial situation of a firm or individual is not mentioned at all under Section C. It is suggested that the first sentence of the first point of Section C should be sufficient. 15. As to the second point of Section C, it is submitted that the way in which the conduct is identified and brought to the SFC’s attention is of significance. There should be a material difference between a matter reported by the firm or individual in question and that reported by a third party. SECTION D 16. The first point in this section is whether the SFC has issued any guidance in relation to the conduct in question. Apparently, if guidance has been issued, this may help consider whether the conduct in question was engaged in in disregard of the SFC guidance. This factor hence is relevant to the assessment of the seriousness of the conduct and should therefore be placed under Section A. 17. It is the SFC’s intention to keep a database of all the fining decisions which will serve as a sentencing guide. However, it will take time to develop certain tariffs from the decisions. It is believed that the fining decisions on other types of misconduct in the context of securities may act as a good starting reference. It can be stated in the Fining Guidelines that the SFC can refer to the fining decisions on, for example, insider dealing as a starting point bearing in mind the difference between the two types of conduct. 18. The last point in Section D states that the result of any civil action taken should be considered. It is believed that this would give rise to the following questions:(1) It is doubtful why the outcome in a civil action should affect the level of the fine imposed. It is important to note that in nature, the former is compensatory whilst the latter is punitive. (2) If no civil action is taken at the time when the SFC is considering the level of the fine, it is impossible to predict whether and when a civil action will be commenced. In the circumstances, there is no basis on which the SFC, at the time when the level of a fine is considered, can ascertain the likelihood of any third party taking civil action, let alone the likely result of such action. (3) The level of fine may, to a certain extent, depend on whether a third party brings a civil action promptly or not. This may be fortuitous or unfair to the regulated person in question. Dated: 25th May 2001 4