Reverse Time-Inconsistency

advertisement

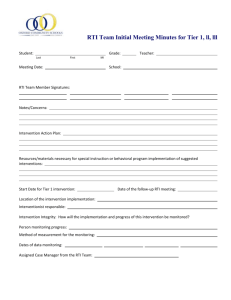

Reverse Time-Inconsistency Serdar Sayman Ayşe Öncüler April 2006 _____________________________________________________________________________ Serdar Sayman Assistant Professor of Marketing Koç University Rumeli Feneri Yolu, Istanbul, 34450, Turkey Phone: +90 (212) 338 1616 Fax: +90 (212) 338 1653 E-mail: ssayman@ku.edu.tr Ayşe Öncüler Assistant Professor of Decision Sciences INSEAD Boulevard de Constance, Fontainebleau, 77305, France Phone: +33 (0) 1 60 724511 Fax: +33 (0) 1 60 746716 E-mail: ayse.onculer@insead.edu This research is supported by funds from Koç University, INSEAD, and KÜMPEM. Authors thank seminar participants at the Marketing Science Conference 2005 Atlanta, ESA 2005 Montreal and SPUDM 2005 Stockholm for their comments, and Demir Çilingir for his contributions at various stages of this research. Abstract Individuals preferring a particular future option may change their preference in favor of another one as time progresses -- a behavior referred to as dynamic or time-inconsistency. Previous empirical findings on time-inconsistent preferences consistently points to the case where decision-makers prefer a later (and superior / larger) future prospect over an earlier (and inferior / smaller) one at the outset, but switch their choice to the smaller prospect when the options become more imminent. In this paper, we provide evidence for time-inconsistency in the other direction: preferring a smaller-earlier temporal payoff over a larger-later one at the beginning, but choosing to wait for the latter as both payoffs draw nearer. We use the term reverse time inconsistency to designate this behavior. This intertemporal preference pattern, to our knowledge, has not been explicitly identified before. Our findings from a number of empirical studies suggest that reverse time-inconsistency occurs in a variety of contexts. The results show that the extent of reverse time-inconsistency depends on payoff sizes and delay times. Furthermore, we also provide some evidence on gender differences. Key Words: Time Inconsistency, Dynamic Inconsistency, Time Preference 1 Introduction Individuals preferring a particular future option may change their preference in favor of another option as time progresses (e.g. Hoch and Loewenstein 1991, Loewenstein 1996). For instance, a prospective dieter may decide to eat a chocolate bar (possibly with a feeling of guilt) even though she had earlier decided to go on a diet. There has been an extensive investigation of time-inconsistent preferences in the behavioral literature (see Frederick et al. 2002 for a comprehensive review). Empirical evidence regarding such time-inconsistent preferences consistently points to the case where decision-makers prefer a later (and superior / larger) future prospect over an earlier (and inferior / smaller) one at the outset, but switch their choice to the smaller prospect when the options become more imminent. In this paper, we provide evidence for time-inconsistency in the other direction: preferring a smaller-earlier temporal payoff over a larger-later one at the beginning, but choosing to wait for the latter as both payoffs draw nearer. This intertemporal preference pattern, to our knowledge, has not been explicitly identified before. We will use the term “reverse time-inconsistency” to denote this behavior. Our findings from four empirical studies suggest that reverse time-inconsistency, like timeinconsistency, is indeed a common behavior under various contexts. Our studies involve: (i) both hypothetical and real payoffs; and (ii) cases where participants spend effort for the payoffs (loyalty programs) and cases with effortless payoffs. The results show that the extent of reverse timeinconsistency depends on payoff sizes and delay times. Furthermore, we also provide some evidence on gender differences. The paper is planned as follows: The next section involves a brief discussion of the background research on time-inconsistent preferences. We then present our findings from four empirical studies followed by a discussion of possible causes or explanations for reverse time-inconsistency. The paper ends with a summary and concluding remarks. Background Time-inconsistency (or dynamic inconsistency), a concept first introduced by Strotz (1955), falls 2 under the broader line of preference reversal research and it implies non-stationarity of preferences. For example, one may prefer $12 in 31 days over $10 in 30 days; but $10 today is preferred over $12 tomorrow. Discounted Utility Theory (DUT), the standard economic model of choice over time, assumes that preferences between two temporal payoffs do not depend on the point of time the evaluation is made (Samuelson 1937; Koopmans 1960; Fishburn and Rubinstein 1982). In other words, if payoffs are delayed by the same amount of time, the preference ordering should not be affected. This discounting behavior is modeled by an exponential function, where the discount rate does not change with delay time. However, this framework has been systematically challenged as a descriptive model. Studies such as Thaler (1981) and Benzion et al. (1989) suggest that although individuals prefer an earlier payoff to a delayed one, sensitivity to time delay progressively decreases; that is, the discount rate is not constant. Hyperbolic discounting has been proposed and modeled in the literature (e.g. Ainslie 1975; Mazur 1987; Hernnstein 1981; Loewenstein and Prelec 1992) as a discount function that can capture time-inconsistent preferences. Under hyperbolic discounting, the discounted value of a temporal payoff falls sharply for small delays but then it flattens out. In other words, there is less discounting (a higher discount factor, or a lower discount rate per period) for a given time interval if the interval is temporally remote. Hence, in the above example, hyperbolic discounting can account for the shift in the preferences because the per-period discount rate moving from 30 days to 31 days is smaller than the rate moving from today to tomorrow. There are a few explanations for the decreasing sensitivity towards time delay. One possibility is that a time interval, if it is evaluated relatively, would be perceived as smaller when it is temporally further away. Hence, the difference between 30 and 31 days would be perceived as smaller than the difference between today and tomorrow. This is related to the Weber’s law, or psychophysics of time (see Keren and Roelofsma 1995). Another explanation is that discounting reflects the implicit uncertainty in obtaining the payoff in the future (Keren and Roelofsma 1995). This uncertainty increases rapidly for the near future, and then the rate of increase diminishes. A third possibility is impulsive decision-making and lack of self-control (Ainslie 1975; Rachlin and Green 1972; Green et al. 1981). If impulsivity plays a role 3 in preference or choice, one would overweigh a smaller-imminent payoff relative to a larger-later one, even though she had planned to wait for the latter earlier on. Emotions and visceral factors such as cravings may also play a role in triggering such impulsive or myopic decisions (Loewenstein 1996). It has been argued that even exponential discounting could account for time-inconsistency if discounting is not independent of the payoff size (see Green et al. 1981; Kirby and Marakovic 1996; Kirby 1997). These studies involve exponential discounting, as suggested by DUT, but smaller amounts are discounted more than larger amounts.1 Such a discounting implies that when both small and large payoffs are brought forward, the small payoff would become relatively more attractive. With this background in mind, we hope to contribute to the literature by providing evidence for a time-inconsistency of a different direction. Previous literature on time- inconsistency focuses mainly on one direction: preferring a larger-later reward to a smaller-sooner one when both outcomes are in distant future, but then switching to the smaller-sooner reward when the outcomes become less remote (e.g. Green et al. 1981, Green et al. 1994, Kirby and Hernnstein 1995). Our experimental results indicate that there exists some situations where a smaller-earlier temporal payoff may be preferred over a larger-later one at the outset, but the larger payoff becomes more attractive as both payoffs draw nearer. We designate this behavior as reverse time-inconsistency. In the next section we present our empirical findings on this phenomenon. We conducted four studies: Studies 1 and 3 involve payoffs within the context of loyalty programs, and Studies 2 and 4 use neutral monetary payoffs. Studies 1 and 2 employ cross-sectional designs; Studies 3 and 4 use longitudinal data with real payoffs. The design specifics of the four studies are summarized in Figure 1. ----- Insert Figure 1 about here ---- 1 This may be explained by the psychophysics of the waiting effort -- for smaller amounts, the return has to be substantial to make the wait attractive (Thaler 1981). 4 Empirical Studies Study 1 Method. Our first study involves two choice experiments with 97 and 100 student participants from INSEAD and Koç University, respectively. Participants answered questions regarding rewards offered by hypothetical loyalty programs. The rewards were based on accumulated purchases; hence, the payoffs required (hypothetical) effort. In exchange for participation we offered students in INSEAD and Koç University a chance to win $100 and $70 gift checks respectively. There were additional sections, unrelated to our study, in the survey booklets. Design and Stimuli. We will only describe the details of the session run at INSEAD because the two sessions are almost identical in structure and stimulus. The experiment involves two hypothetical loyalty program vignettes: (a) Local supermarket Porcupine offers a $10 check if the buyer makes $100 worth of purchases. The reward is $25 for a cumulative purchase of $200. Gift checks can be used at any Porcupine store. (b) Subjects’ favorite movie theater offers one free ticket after purchasing three tickets; or two free tickets after five tickets. The order of the vignettes is counter-balanced across subjects. There is no time limit for either of the loyalty programs, and a shopper receiving a reward can pursue additional reward(s) afterwards. Furthermore, purchases can be recorded by using the student ID (smart) cards, and there is no additional effort or cost associated with the programs. Our experimental manipulation is the timing of the reward choice: (i) Students in the “distant” condition are told that the loyalty program starts today. They are then asked to indicate whether they would prefer to receive the $10 check or the $25 check after the corresponding purchase volume. Similarly, for the movie theater vignette, they indicate their choices between one and two free tickets. (ii) Students in the “immediate” condition are told to assume that the program started a few weeks ago, and the sales clerk informs them that they have completed $100 worth of purchases. They are asked whether they would prefer to receive the $10 check immediately, or wait for the $25 check after completing a total of $200 purchases. For the movie theater loyalty program, they are told to assume that they are buying their third ticket today, and that they have a choice between receiving a free ticket today or two free 5 tickets later. Reward choice timing is a between-subjects manipulation. In addition to the choice questions, we also asked the gender of the participants in both groups. There were 47 participants, with 25 females and 22 males, in the “distant” condition, compared to 50 participants, with 30 females and 20 males, in the “immediate” condition. Regarding the session run at Koç University, the supermarket vignette was slightly different: the local supermarket Migros offers a $3 check if consumer spends a total of $30, and $7.5 if spending reaches $60.2 There were 50 participants (26 females and 24 males) in the “distant” condition; and 50 (28 females and 22 males) in the “immediate” case. Results and Discussion. Before presenting our findings, we note that prior research suggests that there may be gender differences in time preferences. Although studies such as Kirby and Marakovic (1995) and Harrison et al. (2002) report no gender differences in discounting behavior, others indicate a gender difference albeit small and domain specific (Bjorklund and Kipp 1996; Silverman 2003). For instance, Kirby and Marakovic (1996) find that females discount future payoffs less than males do, suggesting that women are generally better in delaying gratification and resisting temptation or impulsivity. In a recent study, McLeish and Oxoby (2005) report that males switch to smaller-immediate payoff faster than females. Hence, there may be some gender differences in time-inconsistency. We will consider gender as a factor in our analysis of the empirical data regarding reverse time-inconsistency (RTI hereafter), or time-inconsistency (TI hereafter) thereof. ---- Insert Table 1a and Table 1b about here ---- Table 1a and 1b present the findings from the two experimental sessions. For brevity purposes, the tables only describe the options SS (smaller-sooner reward) and LL (larger-later reward) in the 2 The figures were stated in local currency terms; at the time of the experiment, one US Dollar was about 1.35 New Turkish Lira. 6 “distant” rewards condition. In the corresponding “immediate” case, subjects have already spent $100 and they are to choose between receiving $10 (SS option) or receiving $25 after spending $100 more (LL option). For instance, the upper panel of Table 1a indicates that 48% of the female participants in the “distant” supermarket rewards condition preferred to wait for the larger-later reward LL, compared to 20% in the “immediate” case. Hence, a smaller ratio of female subjects preferred to wait when the rewards were closer in time, indicating a TI behavior. The difference is significant with p 0.05 (2 test, df = 1). For the movie theater loyalty program presented in the lower panel, 72% of females chose to wait when both rewards were distant, but only 50% did so when the smaller reward was immediate. This again indicates TI (p 0.10). For the male participants, on the other hand, there is strong evidence of RTI in the case of supermarket loyalty program: 32% of males preferred to wait when rewards were distant, 85% chose to wait when the smaller reward was immediate (difference significant with p 0.01). In the movie theater scenario, the percentages directionally indicate RTI even though the difference is not statistically significant. When we look at the aggregate data over all subjects, the corresponding percentages are not significantly different from each other-- that is, neither TI nor RTI is evident on average. Our findings from the session at Koç University, presented in Table 1b, are directionally similar to the above; however, none of the differences between the corresponding percentages is significant. Hence, there is no statistical evidence of TI or RTI. Taken together, Table 1a and 1b indicate that the incidence of RTI or TI may depend on the context (type of program, size of the rewards, cultural setting) and on the individual (gender differences). There is one issue worth noting: In this particular design, rewards are based on consumer effort or spending. Hence, what we are measuring may not be time preference per se. Study 2 presented below focuses on (neutral) monetary payoffs to be received over time, without requiring any effort or spending. Study 2 Method. There were three experimental sessions in Study 2. Two of these were conducted at Koç University and the third one at INSEAD, with 130, 116, and 67 subjects in each session respectively. 7 Subjects answered choice questions regarding hypothetical monetary payoffs. We varied the relative sizes of the payoffs across the experimental sessions and the payoff-delay time combinations within a session. Participants from Koç University were offered a chance to win a $50 gift check of a department store; in INSEAD the survey was part of a larger survey and the prize was an MP3 player. Design and Stimuli. The introduction of the survey stated that the questions were intended to measure the individual preferences for payoffs over time. Participants then answered eight questions involving choices between two temporal payoffs (details can be seen in Tables 2a, 2b, and 2c below). Similar to our first study, we used a between-subjects design. For instance, subjects in the “distant” condition were asked to indicate their preference between receiving “$7 in 1 day” versus “$10 in 3 days”; whereas in the corresponding “immediate” case, the choice was between “$7 today” versus “$10 in 2 days”. In both conditions, the order of the questions was randomized -- picked from one of the predetermined versions. We also noted in the introduction that there were no right or wrong answers, and each question should be considered independently. After the choice questions, we also asked the gender of the participants. ---- Insert Table 2a, Table 2b, and Table 2c about here ---- Results and Discussion. As in the first study, the tables describe the options SS and LL for the “distant” rewards condition; in the corresponding “immediate” condition, SS is immediate and LL is brought forward. Study 2a, conducted at Koç University, involved 70 subjects in the “distant” rewards condition (32 female and 38 male), and 60 subjects in the “immediate” condition (29 female and 31 male). The results were quite robust in the direction of RTI for both payoff pairs. Except for the pairs where SS was to be received in two weeks and LL in four weeks, we observed RTI in all cases (p values are given in Table 2a). This finding holds for both genders and for the overall subject group. Study 2b was also run at Koç University. The relative sizes of payoffs were modified in order to provide further evidence on the range of payoff-delay combinations for which RTI or TI is pertinent. 8 There were 59 subjects in the “distant” condition (26 female and 33 male) and 57 subjects in the “immediate” case (26 female and 31 male). We again observed a strong evidence for RTI, as given in Table 2b, for all three subject groups. A third session (Study 2c) was run at INSEAD. The size of the SS and LL rewards were modified further in this treatment. We had 33 subjects in the “distant” condition (16 female and 17 male) and 34 subjects in the “immediate” condition (15 female and 19 male). Although the number of subjects in each experimental cell was not large, we still obtained significant differences between the corresponding percentages (see Table 2c). In general, women exhibited RTI, while men behaved predominantly in the other direction. All subjects taken together, for smaller payoffs with short delays, evidence is in the direction of RTI, but not significant; for larger payoffs and / or long delays there is evidence for TI. Study 3 Most of the empirical work in intertemporal choice involves cross-sectional designs (rather than longitudinal), where the front-end delay in attaining a reward is manipulated in a single session to demonstrate time inconsistency (see Read 2004 for a comparative analysis of the two methods). Longitudinal studies, which elicit preferences in a real-time setting, are quite scarce in the literature. Harrison et al. (2002) conducted a large-scale field experiment in Denmark over several months in order to elicit discount rates at different points in time. They report no evidence for TI, except for a particular segment of the general subject pool (students). In another recent study that compares longitudinal to cross-sectional designs, Airoldi et al. (2005) found that cross-sectional design overestimates dynamic inconsistency. Another experimental design issue is the use of real versus hypothetical payoffs. Most intertemporal choice experiments use hypothetical rewards for practical reasons-- to have flexibility over the magnitude of payoffs and over the time horizon. Bohm (1994) provides evidence that an incentivecompatible design can reduce the extent of preference reversal. Evidence in intertemporal choice literature is mixed: Some studies report no significant difference in discounting behavior with respect to 9 hypothetical and real rewards (Johnson and Bickel 2002; Read et al. 2005), whereas some others show that real rewards are discounted more heavily than hypothetical ones (Kirby 1997). Study 1 and 2 presented above involve cross-sectional designs and hypothetical payments, without any incentive-compatible payment structure. In order to examine whether these design issues would indeed influence the extent of RTI and/or TI, we conducted two additional studies, Study 3 and 4, which induce incentive compatibility through real payments. In addition, both are longitudinal studies conducted with respective subject panels. Method. Study 3 is a within-subject field experiment conducted on INSEAD campus. In association with the campus café, a loyalty program was initiated. 47 customers were willing to join the loyalty program (20 female and 27 male). At the outset, each customer was asked to state their preference between two rewards offered by the program; later preferences were elicited from actual reward redemptions. Contrary to Study 1, data is obtained from individuals who actually chose to participate in the program.3 Design and Stimuli. The café offered a two-level reward program: customers could receive a free croissant when they bought 10 croissants or two free croissants after 15 croissants. At the beginning of the experiment, the participating customers were given patronage cards, bearing ID numbers and were asked to indicate their preference between the two promotion levels. During the following few weeks, they showed these cards when making a croissant purchase, and the purchases were recorded on the card by means of a stamp. A research assistant at the café counter kept track of the participating customers’ purchase times on a half-hour basis. The experiment lasted 6 weeks, and once the free croissant(s) were given, the program ended for that customer.4 3 Dhar and Simonson (2003) provide evidence that choice proportions of two options may differ when subjects are provided with a “no-choice” option. 4 None of the subjects bought more than one croissant at a time. Individual purchase dates and times can be obtained from the authors. 10 ---- Insert Table 3 about here ---- We note that because the measurements are from the same set of subjects, we use the McNemar’s 2 test (Siegal and Castellan 1998). The results in Table 3 show that the majority of the female participants exhibit RTI. Although men show a tendency for TI, the difference is not significant. At the aggregate level, there is evidence for RTI: 51% of the participants indicated a preference for LL at the outset, compared to 72% when SS became imminent. When we analyze the data at the individual level, there were 9 customers (all male) who preferred LL at the beginning but then received the SS when they could, indicating TI. There were 19 customers who exhibited RTI behavior, of which 14 are female and 5 are male. The remaining 19 customers, 6 females and 13 males, were time consistent (either chose SS or LL at the beginning, and received the corresponding reward later on). Study 4 Method. In Study 4, as in the previous study, we employed a within-subject longitudinal design with real payments. The experiment was conducted at INSEAD. 38 student participants (17 female, 21 male) stated their preferences between different pairs of temporal monetary payoffs. When the smaller-earlier payoff was due, they were asked to state their choices again. The questionnaire was similar to the one in Study 2 but with an addition of incentive compatibility condition since all payments were done in real. Design and Stimuli. Subjects were students of a negotiations analysis course at INSEAD. The first phase of the longitudinal study was conducted in a class meeting. During this first meeting, participants answered 6 choice questions (vignettes) with monetary payoffs. The six temporal payoffs are presented in Table 4. The choice pairs were the same ones as in Study 2, except for the 2 weeks-4 weeks case.5 The subjects were told that one payoff level (€7 - €10 or €20 - €25) would be chosen randomly, and each of the three delay scenarios would be played out for real. When the SS option in each delay scenario became imminent, subjects were asked to indicate their preference between SS and LL again. In order to minimize 5 Because of practical limitations, we were not able to employ the 2 weeks-4 weeks case. 11 any concerns of consistency on the part of the subjects, they were told that the previous records were not taken into consideration. After the subjects indicated their choice between SS and LL, payments were made, if applicable. This was repeated for all three scenarios on the respective days, starting from the initial experimental day. ---- Insert Table 4 about here ---- Results and Discussion. As in Study 1 and 2, Table 4 only describes the option pairs for when the payoffs were “distant”. For the payoff pair €7- €10, there is evidence for RTI at the aggregate level in the first two delay scenarios: 29% of the subjects preferred LL in the “distant” conditions, compared to 71% and 58% in the “immediate” conditions. Females and males have similar tendencies; however the evidence is weak for males. Another observation is that the proportion of subjects preferring to wait for LL in the “immediate” condition decreases as the interval between SS and LL increases. For the payoff pair €20€25, we observe RTI for all subjects group when the delay interval is two days. For longer delays, there is no evidence in either direction of time inconsistency. Looking at individual data, 32% of the subjects were consistently showing RTI for both payoff pairs and for all three delay options; 18% were constantly exhibiting TI, and 21% of the subjects were time-consistent in all of their choices. The remaining 29% exhibited different behaviors in different payoff-delay conditions. General Discussion for Studies 1 - 4 Although Studies 1 through 4 provide substantial evidence for RTI, a simple generalization regarding the incidence of RTI or TI does not seem to avail itself. Rather, our results suggest that the extent of time-inconsistency in either direction depends on the context and the decision makers’ characteristics. More specifically, delay times of the payoffs, type and size of the payoffs, and gender altogether influence the direction of time inconsistency: 12 When payoffs are framed as loyalty program rewards (hence requiring effort), gender, type and size of the rewards, and incentive compatibility affect the extent of TI or RTI. Male participants are inclined to exhibit RTI and females exhibit TI when loyalty rewards are hypothetical (Study 1). However, in the case of real rewards (Study 3), RTI seems to be more relevant for females and TI for males. We should note that Study 3 differs from Study 1 both in terms of incentive compatibility and the nature of the reward (croissants versus supermarket coupons/movie tickets); hence, this interpretation is not without reservation. Nevertheless, one key finding from Studies 1 and 3 is that even though RTI / TI is exhibited by males and/or females, it may be overlooked when only the aggregate data is considered in the data analysis. Studies 2 and 4 indicate that, in the case of neutral monetary rewards (requiring no effort per se), the relative size of SS and LL payoffs and the time interval between them affect the degree of RTI and TI. When the size of the payoffs in options SS and LL are relatively close to one another (e.g. $7-$10 or $20-$25, as opposed to $4-$10 or $10-$25), RTI is more likely to occur, especially when the payoff is hypothetical. When the SS reward is relatively smaller than the LL reward, there is a lower tendency for RTI. The main conclusion suggested by these findings is that intertemporal preferences are richer than previously recognized in the literature. In particular, some individuals may exhibit RTI (or TI) in a variety of settings, but we fail to notice this behavior while examining only the (sample) averages. As a next step we will discuss some possible explanations that may account for our findings regarding RTI. 1. Utility from Delayed Consumption. One related issue is the additional utility derived from savoring (Loewenstein 1987). It is possible that savoring about a payoff or a consumption experience may lead individuals to defer the consumption when it is imminent. There are no clear guidelines as to what type of products or payoffs are likely to yield such a utility; in our case, croissants may be such a product. However, this account fails to explain why individuals do not prefer (derive additional utility from savoring) the larger-later payoff to begin with. 13 2. Effort Uncertainty. A second possible account is that at the outset some individuals may not be sure whether they could exert the effort or patience for the larger-later payoff, and hence, smaller-earlier payoff seems more feasible. However, when the smaller-earlier payoff is due, the extra effort required for the larger-later payoff appears to be more reasonable, compared to what it has taken until then. For instance, after having bought 10 croissants and qualifying for a free one, the additional 5 croissant purchases needed for two free croissants may be perceived as easily doable. Our empirical work above provides two pieces of evidence against the effort explanation. For one, subjects exhibited RTI for effortless payoffs as well (Studies 2 and 4). Yet, one can still argue that the passage of time per se triggers some form of mental effort or cost at the outset, which may be disregarded later on (similar to the lack of a sunk time cost effect, as discussed in Soman 2003). Second, we observed RTI for hypothetical payoffs in cross-sectional designs (Studies 1 and 2). However, even for hypothetical payoffs, there may be some perceived or imagined effort linked to temporal investments (Soman 2004). Hence, our empirical analysis does not quite rule out the effort explanation altogether. A further examination of this problem should measure the perceived / imagined effort (or any mental cost of waiting). 3. Affect. A third possible explanation is that our findings may reflect affective responses rather than deliberate or analytical responses. That is, RTI may occur due to the relative affective salience (evaluability) of information and individual characteristics (see Slovic et al. 2002a, 2002b for a discussion of affective decision making). It is possible that a payoff may be weakly evaluable when it is immediate, making it less attractive compared to a very close, but not immediate, payoff. Slovic et al. (2002a) report a study where a simple gamble with only one possible gain was rated as less attractive than the same gamble with an additional small loss. A similar finding was reported in Fetherstonhaugh et al. (1997): a life saving equipment was rated higher when subjects were told that it could save 98% of the passengers than the case of saving all passengers. The relevance of such an affective mechanism in intertemporal choice could be examined by looking at the condition where the delay time for the smaller payoff is very short, for instance one day, rather than immediate. We ran a follow-up study at INSEAD to examine the role of affect in RTI behavior (Study 5). 14 Participating students received a flat payment. We used $20-$25 as the payoff pair and three delay time pairs (3 days-1 week, 1 week-2 weeks, and 2 weeks-4 weeks) from Study 2a. In addition to the “distant” and “immediate” conditions, a “tomorrow” condition is included where SS payoff is to be received in one day. The “tomorrow” condition involves 1 day-5 days, 1 day-8 days, and 1 day-15 days as the delay times -- that correspond to the respective cases in the “immediate” and “distant” conditions. 81 subjects answered all nine choice questions. ---- Insert Table 5 about here ---- If difficulty of evaluating immediacy plays a role in RTI, then the preference for the LL option should be larger for the case of “immediate” SS condition than for the “tomorrow” and “distant” SS conditions -- preference for LL in the tomorrow and distant conditions may possibly be similar. The results are summarized in Table 5. Percentages for “immediate” are larger than those for “tomorrow” across all groups and delay times, but in only two cases the differences are significant. In addition, percentages are significantly larger for the “tomorrow” condition than for the “distant” condition in six cases. Therefore, affect seems have some role in the RTI behavior, but it is limited. We note that our within-subjects design is a stronger test; a between-subjects design may offer further evidence. 4. Form of Discounting. Finally, RTI may be associated with a discounting function of a particular characteristic. We noted earlier that TI behavior can be captured by a hyperbolic discount function. Hyperbolic discounting is characterized by heavier discounting of outcomes that are temporally close to the current period, compared to distant ones. In contrast, RTI indicates a lower discounting for temporally close outcomes. The intuition is as follows: In RTI, the smaller payoff is preferred when it is temporally close to the current period (compared to the distant larger payoff); but as the smaller payoff becomes immediate and the larger payoff becomes close, the larger payoff is preferred. Lower discounting of outcomes that are close to the present indicates a discount function that has a smaller slope at first than later, and then presumably the slope decreases again. A reverse-S form has these characteristics; it is 15 illustrated in Figure 2 below vis-à-vis hyperbolic and exponential forms. In the Appendix we show that a reverse-S shape discounting function can accommodate RTI. ---- Insert Figure 2 about here ---- It has been long known that the inferred shape of the discount function varies with the elicitation technique (e.g. Ainslie 1975). In order to further investigate the reverse-S form discounting suggested by the choice tasks in Studies 1-4, we elicited individual discount functions also by using valuation / matching tasks. In two studies run at Koç University, presented below, subjects reported the future values for which they were indifferent with the corresponding present values. The first study, based on hypothetical payments, was part of a booklet of surveys. There were 120 student participants. Unfortunately we do not have data regarding the gender of the subjects, because the survey was part of a project unrelated to the current paper. We asked subjects to state future amounts that would be as attractive as $10 today.6 The time delays used were 1 week, 2 weeks, 4 weeks, and 6 months. Corresponding discount factors were plotted as a graph, and we examined each subject’s discount function visually. For benchmarking purposes, we also included exponential discounting curves (for a few discount factors), as well as an exponential curve fitted to the subject’s discounting data, on the graph. From the 120 discounting curves, 18 resemble reverse-S shape, 77 hyperbolic, and 9 exponential. 16 subjects had discounting curves that were difficult to label or data was not usable (missing data, valuations less than $10 etc.). The second study uses an incentive compatible scheme. 60 student subjects (38 female, 22 male) received a monetary payment at the end of the experiment. The study involves a web-based interface, and data was collected in one session in a computer lab. Subjects were asked to provide the smallest future 6 Our decision to use “delayed value of an immediate reward” rather than “immediate value of a delayed reward” was based on a pretest; in a paper-pencil test, we had found that the latter led to much unusable data. 16 amounts they would accept in the future, instead of receiving a set of present amounts. There were 21 valuation questions using combinations of three present payoffs ($6, $13, and $21) and seven delay times (1 day, 2 days, 3 days, 4 days, 1 week, 2 weeks, and 4 weeks). We used an incentive-compatibility scheme adapted from Kirby and Marakovic (1995). At the end of experiment, subjects were paid either their stated future valuation or the present payoff for one of the questions chosen randomly. Whether the particular subject received the future or present amount was determined through an auction -- in order to eliminate the temptation to state large future figures. Participants’ stated future valuations were entered as bids to an auction. The participant who stated the smallest future amount was to receive that amount in due time, and the other participants received the present amount.7 After the valuation questions, subjects completed an unrelated survey. This second part provided us the additional time needed for all subjects to finish our main study before any of them claimed the payoff. Payments were made for “present payoff $6 - future payoff in 1 week” combination.8 In terms of data analysis, as in the hypothetical payments study, we examined the discount functions of each subject for each payoff separately. For $6, 8 out of 60 subjects had a reverse-S shape discount function. There were 19 functions that resembled hyperbolic, and 8 resembled exponential curves. Data from 25 subjects was either not useful (valuations less than $6, etc.) or could not be categorized. There were a number of curves with significant ups and downs. This may be due to the fact that the question order was randomized; and unlike the previous hypothetical payments survey, subjects were not able to see and adjust their valuations for different future times. For $13, there were 13 subjects with reverse-S discounting, 15 with hyperbolic, and 9 with exponential forms. Data from 23 subjects was 7 Theoretically, revealing true preferences is the optimal strategy in the second-price auction. The reason for using a first-price auction is that it is easier to explain to the participants. In any case, efficiency loss compared to secondprice auction is small when number of participants is high, and we are interested in the shape of the discount function (relative valuations of future payoffs). 8 We actually paid a round figure (in local currency terms) higher than $6. 17 not useful or not categorized. For $21, there were 10 reverse-S, 14 hyperbolic, and 8 exponential discount functions; and data from 28 subjects was not useful or not categorized. Over all the payoffs ($6, $13, and $21), the proportion of females with reverse-S-like discounting was slightly higher, but not significantly different, than of the corresponding males.9 To summarize, our incentive compatible study also provides evidence that a portion of individuals do exhibit reverse-S discounting. To summarize the discussion on possible explanations for RTI, we observed that reverse-Sshaped discounting is not an exception and can potentially explain the observed RTI behavior. In addition, affect seems to have some role in RTI, but the evidence limited. Finally, effort uncertainty as an explanation needs further investigation. Conclusion The main contribution of the current paper is that it is the first study that defines reverse timeinconsistency explicitly as a new anomaly in intertemporal choice. Sholten and Read (2005) observed this behavior in a subset of their participants, and classified it as an anomalous inconsistency pattern. Airoldi et al (2005) report that, if anything, people become more impatient over time (a behavior that we label as the RTI behavior) rather than becoming patient (implying TI). In a recent elicitation study which introduces time-tradeoff sequences as a new method to measure intertemporal preferences (that does not require any knowledge about the utility function), Attema et al. (2006) observed increasing impatience initially and then constant discounting. In our study, we provide extensive empirical evidence that RTI is indeed a robust phenomenon, rather than a one-time experimental artifact. We also explored possible explanations for this behavior; affect and reverse-S shape discounting seem to contribute to RTI -- and there is evidence that individual discount functions are in fact quite diverse. Our findings have potential implications for decision makers. For instance, a bank may allow 9 When we look at the aggregate of all subjects, hyperbolic discounting seems to prevail for each payoff, and the overall level of discounting seems to decrease with increasing payoff size. No difference was observed between females and males. 18 (and offer incentives when profitable) its customers to extend the term of a deposit account when the original due time approaches. For loyalty programs with multiple reward levels, changing preferences when consumers qualify for smaller rewards may have implications for planning the reward redemption process or program profitability. In terms of future research directions, more evidence on RTI would be much insightful; in particular, regarding the context where it is more or less likely to be observed. For instance, gender differences in temporal preferences seem to require further research. In addition, we did a preliminary of investigation of whether RTI can be explained by the shape of the discounting function. Future research may consider a more detailed measurement of discount function (with more time points), and a comparison of discounting forms elicited by different methods from the same subjects -- although such an approach may have practical difficulties. Finally, future research may examine other possible explanations of the RTI behavior. 19 Table 1a Results from Study 1a - INSEAD Percent preferring to wait for LL in “distant” vs. “immediate” conditions Females Option pairs (for “distant”) N=25 Males n=30 n=22 n=20 Total n=47 n=50 SS: $10 after spending $100 LL: $25 after spending $200 48% 20% b 32% 85% a 40% 46% SS: 1 ticket after 3 tickets LL: 2 tickets after 5 tickets 72% 50% c 32% 51% 48% NOTE: 45% a: difference is significant with p < 0.01; b: with p < 0.05; c: with p < 0.10. Table 1b Results from Study 1b - Koç University Percent preferring to wait for LL in “distant” vs. “immediate” conditions Females Males Total Option pairs (for “distant”) N=26 n=28 SS: $3 after spending $30 LL: $7.5 after spending $60 50% 46% 37% 45% 44% 46% SS: 1 ticket after 3 tickets LL: 2 tickets after 5 tickets 42% 43% 50% 59% 46% 50% NOTE: None of the pairwise differences is significant. n=24 n=22 n=50 n=50 20 Table 2a Results from Study 2a - Koç University Percent preferring to wait for LL in “distant” vs. “immediate” conditions Option pairs (for “distant”) Females Males Total n=32 n=29 n=38 n=31 n=70 n=60 SS: $7 in 1 day LL: $10 in 3 days 38% 72% a 32% 81% a 34% 77% a SS: $7 in 3 days LL: $10 in 1 week 19% 45% b 18% 42% b 19% 43% a SS: $7 in 1 week LL: $10 in 2 weeks 3% 28% a 11% 26% c 7% 27% a SS: $7 in 2 weeks LL: $10 in 4 weeks 6% 11% 9% SS: $20 in 1 day LL: $25 in 3 days 44% 72% b 26% 84% a 34% 78% a SS: $20 in 3 days LL: $25 in 1 week 19% 52% a 16% 71% a 17% 62% a SS: $20 in 1 week LL: $25 in 2 weeks 6% 38% a 8% 29% b 7% 33% a 3% 5% 4% 13% c SS: $20 in 2 weeks LL: $25 in 4 weeks NOTE: 14% 14% a: difference is significant with p < 0.01; b: with p < 0.05; c: with p < 0.10. 10% 13% 12% 21 Table 2b Results from Study 2b - Koç University Percent preferring to wait for LL in “distant” vs. “immediate” conditions Option pairs (for “distant”) Females Males Total n=26 n=26 n=33 n=31 n=59 n=57 SS: $6 in 1 day LL: $10 in 3 days 38% 96% a 48% 100% a 44% 98% a SS: $6 in 3 days LL: $10 in 1 week 46% 69% c 48% 84% a 47% 77% a SS: $6 in 1 week LL: $10 in 2 weeks 27% 62% b 18% 65% a 22% 63% a SS: $6 in 2 weeks LL: $10 in 4 weeks 15% 18% 35% c 17% 35% c SS: $20 in 1 day LL: $30 in 3 days 50% 92% a 67% 97% a 59% 95% a SS: $20 in 3 days LL: $30 in 1 week 52% 88% a 52% 81% b 47% 84% a SS: $20 in 1 week LL: $30 in 2 weeks 31% 81% a 39% 94% a 36% 88% a SS: $20 in 2 weeks LL: $30 in 4 weeks 23% 62% a 21% 68% a 22% 65% a NOTE: 35% a: difference is significant with p < 0.01; b: with p < 0.05; c: with p < 0.10. 22 Table 2c Results from Study 2c - INSEAD Percent preferring to wait for LL in “distant” vs. “immediate” conditions Females Males Total Option pairs (for “distant”) n=16 n=15 n=17 n=19 n=33 n=34 SS: $4 in 3 days LL: $10 in 1 week 63% 100% a 82% 73% 79% SS: $4 in 1 week LL: $10 in 2 weeks 38% 87% a 76% 47% c 58% 65% SS: $4 in 2 weeks LL: $10 in 1 month 6% 60% a 71% 37% b 39% 47% SS: $4 in 1 month LL: $10 in 2 months 6% 33% c 76% 11% a 42% 21% c SS: $10 in 3 days LL: $25 in 1 week 81% 93% 94% 63% b 88% SS: $10 in 1 week LL: $25 in 2 weeks 63% 80% 94% 37% a 79% 56% b SS: $10 in 2 week LL: $25 in 1 month 44% 73% c 82% 16% a 64% 41% c 6% 53% a 76% 5% a 42% SS: $10 in 1 month LL: $25 in 2 months NOTE: a: difference is significant with p < 0.01; b: with p < 0.05; c: with p < 0.10. 63% 76% 26% 23 Table 3 Results from Study 3 Percent preferring LL (2 croissants) when: “joining the program” vs. “completing 10 purchases” Females Males Total n=20 n=27 n=47 25% 95% a NOTE: 70% 56% a: difference is significant with p < 0.01; c: with p < 0.10. 51% 72% c 24 Table 4 Results from Study 4 Percent preferring to wait for LL in “distant” vs. “immediate” conditions Option pairs (for “distant”) Females Males Total n=17 n=21 n=38 SS: €7 in 1 day LL: €10 in 3 days 24% 76% b 33% 67% c 29% 71% a SS: €7 in 3 days LL: €10 in 1 week 18% 59% b 38% 57% 29% 58% b SS: €7 in 1 week LL: €10 in 2 weeks 18% 29% 38% 43% 29% SS: €20 in 1 day LL: €25 in 3 days 41% 59% 29% 57% 34% 58% c SS: €20 in 3 days LL: €25 in 1 week 35% 29% 29% 33% 32% 32% SS: €20 in 1 week LL: €25 in 2 weeks 29% 18% 29% 29% 29% 24% NOTE: a: difference is significant with p < 0.01; b: with p < 0.05; c: with p < 0.10. 37% 25 Table 5 Results from Follow-Up Study 5 Percent preferring to wait for LL in “distant” vs. “tomorrow” vs. “immediate” conditions Option pairs (for “distant”) Females Males Total n=34 n=47 n=81 SS: €20 in 3 days LL: €25 in 1 week 24% 32% 41% 23% a 51% b 64% 23% a 43% a 54% SS: €20 in 1 week LL: €25 in 2 weeks 6% b 26% 32% 11% b 26% 9% a 26% 32% SS: €20 in 2 weeks LL: €25 in 4 weeks 3% 18% 6% 5% b 13% 17% NOTE: 12% a: difference is significant with p < 0.01; b: with p < 0.05. 15% 32% 17% 26 Figure 1 Overview of Experimental Designs Cross-Sectional Longitudinal Loyalty Program Study 1 Study 3 Neutral Payoff Study 2 Study 4 Figure 2 Illustrative Discount Functions discounted 1 reverse-S w exponential hyperbolic 0 delay period 27 Appendix Consider a decision maker who faces a choice between receiving a payoff R1 in period t1 and payoff R2 in period t2, where R1 R2. Figure A1 RTI and Reverse-S Discounting (t2 t1) (t1) (t2) t2 t1 0 t1 t2 t Assume that the discounting function (t) is such that in period t = 0 she prefers to receive R1: U(R1) (t1) U(R2) (t2) U(R1) U(R2) (t2) / (t1) (A1) When R1 is immediate, that is t = t1, she would compare: U(R1) and U(R2) (t2 t1) She may change here preference to receiving R2 in t2 t1 periods from that time point only if (t2) / (t1) (t2 t1) If the reverse-S discounting function is such that (t) is steeper in [t1, t2] than in [0, t1], then (t2) / (t1) could be notably less than 1, and (t2 t1) could be close to 1. In other words, (t2) / (t1) (t2 t1) could be satisfied. 28 References Ainslie, G., (1975), “Specious Reward: A Behavioral Theory of Impulsiveness and Impulse Control,” Psychological Bulletin, 82(4), p. 463-496. Airoldi, M., Read D., and Frederick, S., (2005), “Longitudinal Dynamic Inconsistency”, Oral Presentation at SPUDM 20, Stockholm, Sweden. Attema, A.E., Bleichrodt, H., Rohde, K.I.M, Wakker, P.P., (2006), “Time-Tradeoff Sequences for Quantifying and Visualising the Degree of Time Inconsistency, Using only Pencil and Paper,” Working Paper, Erasmus University. Benzion, U., Rapoport, A., and Yagil, J., (1989), “Discount Rates Inferred from Decisions: An Experimental Study,” Management Science, 35(3), p. 270-284. Bohm, P., (1994), “Time Preference and Preference Reversal among Experienced Subjects: The Effect of Real Payments”, Economic Journal, 104(427), p. 1370-1378. Bjorklund, D.F., and Kipp, K., (1996), “Parental Investment Theory and Gender Differences in the Evolution of Inhibition Mechanisms,” Psychological Bulletin, 120(2), p. 163-188. Dhar, R., and Simonson, I., (2003), “The Effect of Forced Choice on Choice,” Journal of Marketing Research, 40(2), p. 146-160. Fetherstonhaugh, D., Slovic, P., Johnson, S.M., and Friedrich, J., (1997), “Insensitivity to the Value of Human Life: A Study of Psychophysical Numbing,” Journal of Risk & Uncertainty, 14(3), p.283300. Fishburn, P.C., and Rubinstein, A., (1982), “Time Preference,” International Economic Review, 23(3), p. 677-694. Frederick, S., Loewenstein, G.F., and O’Donoghue, T., (2002), “Time Discounting and Time Preference: A Critical Review,” Journal of Economic Literature, 40(2), p. 351-401. Green, L., Fisher, E.B., Perlow, S., and Sherman, L., (1981), “Preference Reversal and Self Control: Choice as a Function of Reward Amount and Delay,” Behaviour Analysis Letters, 1(1), p. 43-51. 29 Green, L., Fry, A.F., Myerson, J., (1994), “Discounting of Delayed Rewards: A Life-Span Comparison,” Psychological Science, 5(1), p. 33-36. Harrison, G.W., Lau, M.I., and Williams, M.B., (2002), “Estimating Individual Discount Rates in Denmark: A Field Experiment,” The American Economic Review, 92(5), p. 1606-1617. Herrnstein, R.J., (1981), “Self-Control as Response Strength”, in C.M. Bradshaw, E. Szabadi and C.F. Lowe, eds. Quantification of Steady-State Operant Behavior, Elsevier/North-Holland, Amsterdam. Hoch, S.J., Loewenstein, G.F., (1991), “Time-Inconsistent Preferences and Consumer Self-Control,” Journal of Consumer Research, 17(4), p. 492-507. Johnson, M.W., and Bickel, W.K., (2002), “Within-Subject Comparison of Real and Hypothetical Money Rewards in Delay Discounting,” Journal of the Experimental Analysis of Behavior, 77(2), p. 129146. Keren, G., and Roelofsma, P., (1995), “Immediacy and Certainty in Intertemporal Choice,” Organizational Behavior and Human Decision Processes, 63(3), p.287-297. Kirby, K.N., (1997), “Bidding on the Future: Evidence against Normative Discounting of Delayed Rewards,” Journal of Experimental Psychology: General, 126(1) March, p. 54-70. Kirby, K.N. and Herrnstein, R.J., (1995), “Preference Reversals Due to Myopic Discounting of Delayed Reward,” Psychological Science, 6(2), p.83-89. Kirby, K.N., and Marakovic, N.N., (1995), “Modeling Myopic Decisions: Evidence for Hyperbolic Delay-Discounting within Subjects and Amounts,” Organizational Behavior & Human Decision Processes, 64(1), p. 22-30. Kirby, K.N., and Marakovic, N.N., (1996), “Delay-Discounting Probabilistic Rewards: Rates Decrease as Amounts Increase,” Psychonomic Bulletin & Review, 3(1), p.100-104. Koopmans, T.C., (1960), “Stationary Ordinal Utility and Impatience,” Econometrica, 28(2), p. 287-309. Loewenstein, G.F., (1987), “Anticipation and the Valuation of Delayed Consumption,” Economic Journal, 97(387), p. 666-684. 30 Loewenstein, G.F., (1996), “Out of Control: Visceral Influences on Behavior,” Organizational Behavior and Human Decision Processes, 65(3), p. 272-292. Loewenstein, G.F., and Prelec, D., (1992), “Anomalies in Intertemporal Choice: Evidence and an Interpretation,” Quarterly Journal of Economics, 107(2), p. 573-597. Mazur, J.E., (1987), “An Adjusting Procedure for Studying Delayed Reinforcement,” in M.L. Commons, J.E. Mazur, J.A. Nevin, and H. Rachlin, eds. Quantitative Analyses of Behavior: The Effect of Delay and Intervening Events on Reinforcement Value, v5, p. 55-73, Lawrence Erlbaum Assoc., New Jersey. McLeish, K.N., and Oxoby R.J., (2005), “Gender, Affect and Intertemporal Consistency: An Experimental Approach,” Working Paper, University of Calgary. Rachlin, H., and Green, L., (1972), “Commitment, Choice and Self-Control,” Journal of the Experimental Analysis of Behavior, 17(1), p. 15-22. Read, D., (2004), “Intertemporal Choice,” in D. Koehler and N. Harvey, eds. The Blackwell Handbook of Judgment and Decision Making, Blackwell, Oxford. Read, D., Frederick, S., Orsel, B., and Rahman, J., (2005), “Four Score and Seven Years from Now: The Date/Delay Effect in Temporal Discounting,” Management Science, 51(9), p. 1326-1335. Samuelson, P.A., (1937), “A Note on Measurement of Utility,” Review of Economic Studies, 4(2), p. 155161. Scholten, M., and Read, D., (2005), “Discounting by Intervals: A Generalized Model of Intertemporal Choice,” Working Paper, Instituto Superior de Psicologia Aplicada. Siegal, S., and Castellan, N.J., (1998), Nonparametric Statistics for the Behavioral Sciences, McGrawHill, New York. Silverman, I.W., (2003), “Gender Differences in Delay of Gratification: A Meta-Analysis,” Sex Roles, 49(9/10), p. 451-463. 31 Slovic, P., Finucane, M., Peters, E., and MacGregor, D.G., (2002a), “The Affect Heuristic,” in T. Gilovich, D. Griffin, Dale, and D. Kahneman eds. Heuristics and Biases: The Psychology of Intuitive Judgment, Cambridge University Press, New York. Slovic, P., Finucane, M., Peters, E., and MacGregor, D.G., (2002b), “Rational Actors or Rational Fools: Implications of the Affect Heuristic for Behavioral Economics,” Journal of Socio-Economics, 31(4), p. 329-342. Soman, D., (2003), “Prospective and Retrospective Evaluations of Experiences: How You Evaluate an Experience Depends on When You Evaluate It,” Journal of Behavioral Decision Making, 16(1), p. 35-52. Soman, D., (2004), “The Effect of Time Delay on Multi-Attribute Choice,” Journal of Economic Psychology, 25(2), p. 153-175. Strotz, R.H., (1955), “Myopia and Inconsistency in Dynamic Utility Maximization,” Review of Economic Studies, 23(3), p. 165-180. Thaler, R., (1981), “Some Empirical Evidence on Dynamic Inconsistency,” Economics Letters, 8(3), p. 201-207.