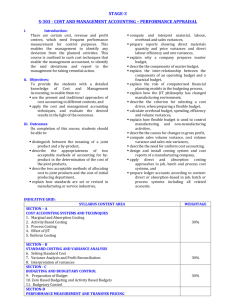

2015 Management Accounting 310 Course Outline

advertisement

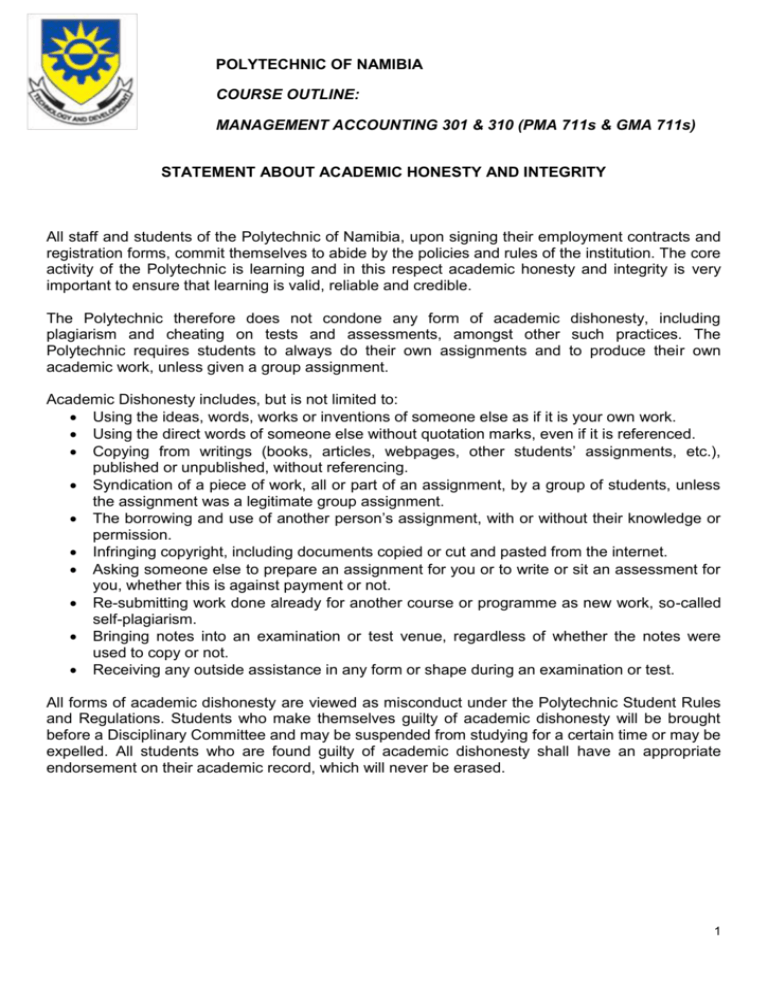

POLYTECHNIC OF NAMIBIA COURSE OUTLINE: MANAGEMENT ACCOUNTING 301 & 310 (PMA 711s & GMA 711s) STATEMENT ABOUT ACADEMIC HONESTY AND INTEGRITY All staff and students of the Polytechnic of Namibia, upon signing their employment contracts and registration forms, commit themselves to abide by the policies and rules of the institution. The core activity of the Polytechnic is learning and in this respect academic honesty and integrity is very important to ensure that learning is valid, reliable and credible. The Polytechnic therefore does not condone any form of academic dishonesty, including plagiarism and cheating on tests and assessments, amongst other such practices. The Polytechnic requires students to always do their own assignments and to produce their own academic work, unless given a group assignment. Academic Dishonesty includes, but is not limited to: Using the ideas, words, works or inventions of someone else as if it is your own work. Using the direct words of someone else without quotation marks, even if it is referenced. Copying from writings (books, articles, webpages, other students’ assignments, etc.), published or unpublished, without referencing. Syndication of a piece of work, all or part of an assignment, by a group of students, unless the assignment was a legitimate group assignment. The borrowing and use of another person’s assignment, with or without their knowledge or permission. Infringing copyright, including documents copied or cut and pasted from the internet. Asking someone else to prepare an assignment for you or to write or sit an assessment for you, whether this is against payment or not. Re-submitting work done already for another course or programme as new work, so-called self-plagiarism. Bringing notes into an examination or test venue, regardless of whether the notes were used to copy or not. Receiving any outside assistance in any form or shape during an examination or test. All forms of academic dishonesty are viewed as misconduct under the Polytechnic Student Rules and Regulations. Students who make themselves guilty of academic dishonesty will be brought before a Disciplinary Committee and may be suspended from studying for a certain time or may be expelled. All students who are found guilty of academic dishonesty shall have an appropriate endorsement on their academic record, which will never be erased. 1 Course Information Course Code and Title: PMA711s – Cost and Mgt Accounting 301 GMA711s – Cost and Mgt Accounting 310 Department: Accounting, Economics & Finance Programme: Bachelor of Accounting Contact Hours: 3 hours per week (Lectures) 1 hour per week (Tutorials/Assignments) NQF Level 7 Credit: 15 Course Description: This course focuses on the use of accounting information for planning and control of an organization. It emphasizes how mangers can use accounting information to control an organisation.In addition investment and appraisal techniques used in businesses are introduced. Pre-Requisites: Cost and Management Accounting 201 Cost and Management Accounting 202 Course Equivalencies: None Course Delivery Methods: The course will be offered on full time (FM), Part-time (PM) and Distance (DI) modes in terms of the prevailing Polytechnic of Namibia rules and regulations. The course will be facilitated through the following learning activities: 1. Presentation of materials in lectures 2. Presentation of materials by distance 3. Assigned readings and discussions 4. Guest lectures Tests and assignments The assessment for this course will be based on continuous assessment and end of semester examination (three-hour paper). The Continuous Assessment (CA) mark is made up of two class tests and/or assignments and contributes as follows to the Final Mark: Full-time and Part-time modes: Continuous assessment: 40% of the final mark Final examination: 60% of the final mark A candidate will gain admission to the examination by obtaining a continuous assessment/assignments mark of at least 40%. In order to pass the course, a student needs a final mark of at least 50%. A sub-minimum of 40% must be obtained in the examination. The examination shall consist of a single three hour paper. 2 The following communication tools may be used in this course: E-learning, Email, Discussion Board, Scheduled Chats, Unscheduled chats, Online content, facebook, etc Course Format: The course will be delivered through scheduled lecturers in accordance with the approved departmental time table. Effective Date: 4th February 2015 Course Coordinator A. Makosa Lecturer’s Information Lecturer’s name: Email: Office phone: Office location: Office hours: A. Makosa amakosa@polytechnic.edu.na +264 61 207 2816 Room 326, 3rd Floor, Office Building Monday to Friday 07h30 – 16h30 W. Dreyer wdreyer@polytechnic.edu.na +264 61 207 2102 Room 328, 3rd Floor, Office Building Monday to Friday 07h30 – 16h30 Consultation hours: All lecturers are available for consultation with students. Consultation times can be found on the doors of lecturers’ offices. Technology & Equipment Readiness: Students will be expected to possess basic computer skills to enable students to send emails and receive information online i.e. through email and e-learning. Student Commitments and Contact Times: It is a requirement that students attend all lectures as scheduled. Failure to fulfill this requirement may result in the student being unable to qualify for the examination should the attendance fall below the minimum of 80% as per the current regulations. Prescribed Reading: Bhimani, Horngren, Datar and Foster. (Latest). Management and Cost Accounting. Financial Times Press Recommended Reading: 1. Drury C. (Latest). Management and Cost Accounting. Cengage Learning 2. Lucey T. (Latest). Costing. Cengage Learning 3. Chadwick L. (Latest). Essence of Management Accounting. Financial Times Press 4. Correa, Langfiled-Smith, Thorne and Hilton. (Latest). Management Accounting. Mc Graw Hill Important websites www.accaglobal.com www.cimaglobal.com www.iplus.com www.ifac.org.uk www.pearsoned.com 3 Learning Outcomes: At the end of the course students will, through assessment activities, show evidence of their ability to: differentiate between budgeting and budgetary control compile various functional budgets and prepare a master budget prepare and appraise zero-based (ZB) budgeting analyse the behavioural implications of budgeting analyse operations in a standard costing system calculate and investigate variances discuss the significance of variances reconcile actual profit with budgeted profit Apply leaning curves to estimate time and cost for new products and services apply various appraisal techniques in evaluating the profitability of capital investments Course Schedule: Your prescribed book is: Bhimani, Horngren, Datar and Foster. (Latest). Management and Cost Accounting. Financial Times Press Year 2015 Semester 1 Topic Assumed knowledge Week 1-2 Budgeting - - Week 3-4 Purpose of budgets Approaches and administration of budgets Prepare operational budgets: sales budget; production budget; direct labour budget; factory overheads budget; selling and administration cost budget; Prepare departmental budgets; master budget; cash budget Budgeting - Fixed and flexible budgets Budget variance and analysis Causes of variances and remedies Journal entries for overhead costs and variances Monitoring and controlling performance Zero base budgeting Programme planning and budgeting systems Activity based budgeting Alternative to budgeting Behavioral aspects of budgeting: budgets vs motivation Cost assignment and cost behavior - - Text Book Reference Chapter 14 Page 453 493 Cost assignment Chapter 15 and cost Page 494 behavior. 526 High/low method 4 Week 5-7 Standard costing and variance analysis - Week 8-9 - Operating statements Variances in standard and marginal costing systems Working backwards approach to variance analysis Direct material mix and yield variances Direct labor mix and yield variances Sales mix and quantity variances Planning and operational variances Significance and interpretation of variances Week 10 Mid Semester Break Week 11-12 The learning curve theory - Week 13-14 Introduction to the learning curve theory The learning rate graph and formula When can the learning curve be used Types of cost affected by the learning curve Application of learning curve theory Limitations of the learning curve theory Capital budgeting - Cost behavior Chapter 16 Cost Assignment Page 527 562 - Cost behavior Product pricing Setting and updating standards Performance standard Budgets and standards compared Criticism of standard costing Variance analysis: Cost and sales variances Significance of variances Interpretation of variances investigation of variances Standard costing: further variances - - The process of investment decision making Post completion audit Decision making methods: Payback method Accounting rate of return method Net present value method Internal rate of return method NPV and IRR compared Discounted payback DCF: Additional points Chapter 17 Page 563 597 No classes - - Product costing Cost behavior and allocation Chapter 9 Page 281 284 Chapter 13 Page 409 450 5 Week 15 Capital budgeting - Use Chapter 13 Page 409 450 Allowing for inflation Allowing for taxation – Income Tax, VAT Mutually exclusive projects with unequal lives Asset replacement cycles Project abandonment Capital rationing Non-financial consideration in long-term projects. Important Dates: NOTE: The following dates are subject to change at the lecturer’s prerogative. Students will be notified ahead of time of any changes. Date Important Information 13 March 2015 Test 1 Aud 1 and 2 17h00 – 19h00 25 April 2015 Test 2 Aud 1 and 2 11h30 – 14h00 9 May 2015 Test 3 Aud 1 and 2 11h30 – 14h00 Examination see examination timetable Important: All Seventh Day Adventists students are requested to register themselves with the Head of Department, - Accounting, Economics and Finance. Tests 1 and 2 will cover all the work as scheduled up to the day for the test date while Test 3 will cover the entire course outline Course Policies All students will be required to write ONLY two tests. The third test is specifically for those students who may have missed either test one or two or have failed to qualify for examination admission. Those who have failed to qualify until with the 3 rd test will be limited to maximum mark of 40%. No other special tests will be set outside those tests scheduled in terms of this course outline. Assessment and Evaluation: Assessment Weight Continuous Assessment 40% Examination 60% Total: 100% 6 General Academic Policies: It is the student's responsibility to be familiar with and adhere to the Polytechnic’s policies. These Policies can be found in the Polytechnic Prospectus or online at www.polytechnic.edu.na/prospectus. Failure to Pay Fees: A student who fails to pay his/her fees may not be allowed to write the examination and if allowed, the results will be withheld until all outstanding fees are paid in full. Important Student Services at PoN There are a variety of services which you can use at the PoN. These services are to your advantage – Use them!!! They include the following: Student Counseling and Career Development - Dean of Students Office. Writing centre and student academic problems – Centre for Teaching & Learning (CTL) Campus Health and Wellness Centre (CHWC) - Dean of Student’s office/ PoN Clinic Authorization: This course is authorized for use by: ________________________________ P.N. Maliti Head of Department 04 February 2015 Date 7 ACKNOWLEDGEMENT BY STUDENT (To be completed by all students on the course, detached from the course outline and kept on record in the department) By inserting my Name, Student Number and Signature overleaf, hereby acknowledge that I have received the course outline for Cost and Management Accounting 301/310- PMA711s/GMA 711s, and that I have familiarized myself with its content, in particular the statement about academic honesty and integrity. I agree to abide by the Policies and arrangements spelt out in this course outline. Student Number Name Signature …………………. ………………………… …………………… 8