Gippsland Regional Growth Plan: Background Report (DOC, 5.6 MB

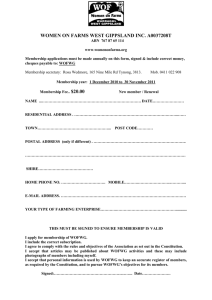

advertisement